Economic Growth

Economic Growth

Growth Facts

Solow Growth Model

Optimal Growth

Endogenous Growth

Readings

• Williamson, Ch 6, p 200-222 (Solow Growth)

• Williamson, Ch 7 (Endogenous Growth)

Table 6.1

Economic Growth in

Eight Major Countries, 1870 –2005

Growth Facts

• Before Industrial Revolution (1800) standards of living was very similar across countries .

• Large differences in per-capita incomes across countries appeared after IR.

• Positive correlation between per capita output and per capital investment.

• Negative correlation between per capita output and population growth .

• Rich countries: Convergence

• Poorest countries: No Convergence

Figure 6.2 Output per Worker vs.

Investment Rate

Figure 6.3 Output per Worker vs. the

Population Growth Rate

Figure 6.5 Convergence

Among the Richest Countries

Figure 6.6 No Convergence

Among the Poorest Countries

• Questions:

(1) What explains differences in economic growth and standard of living among countries?

(2) How do factors like saving, population, and technology affect economic growth and productivity?

(3) What does CE model say about optimal growth?

(4) How does the accumulation of “human capital” contribute to economic growth?

(4) Policy implications?

• Two key variables of interest:

(1) y t

= Y t

/N t

= output per person or average labor productivity. Also can measure standard of living .

(2) ΔY/Y = growth rate of Y.

Solow Growth Model

• Robert Solow (MIT) – 1989 Nobel Winner

• A constant returns to scale production function says

F(xK,xN) = xF(K,N)

• Notice that from CRTS production function we can write y t

Y

N t t

t

( ) where k t

= K t

/N t

.

• Per-capita GDP (y) depends only on the capital– labor ratio (k).

• Competitive Market-Clearing:

Y t

= C t

+ I t

• Assume proportional aggregate savinginvestment rate:

(Y t

- C t

)= I t

= sY t

• Population grows at rate n:

N t+1

= (1+n)N t

• Population = Labor Force = N t

• Definition of (Net) Investment:

I t

K t

1

( 1

) K t k t

1

( 1

n )

sz t f ( k t

)

( 1

) k t

k t

1

k t

sz t f ( k t

)

( n

) k t

k t

• A steady state equilibrium is where k and y are constant

(no pressure to change): k t

1

k t

k* or

k

0

szf ( k *)

( n

) k *

• In the steady state k = K/N and y = Y/N are constant. Therefore

*

y =

k = 0

*

Y

Y

K

K

N

N

n

• Saving Rate (s)

Increase s increases k* and y*

(i) Permanent increase in standard of living (y*)

(ii) Temporary increase in economic growth.

• Productivity/Technology (z)

Increase z increases k* and y*

(i) Perm increase in standard of living

(ii) One time inc. in z temp increase in economic growth.

(iii) Sustained inc. in z perm inc. in growth

Figure 6.15

Effect of an Increase in the

Savings Rate on the Steady State Quantity of

Capital per Worker

6-16

Figure 6.16

Effect of an Increase in the Savings Rate at Time

T

6-17

Figure 6.23 Natural Log of the Solow

Residual, 1948 –2001

• Population growth (n) increase n decreases k* and y*

(i) Permanent decrease in standard of living

(ii) Permanent increase in economic growth

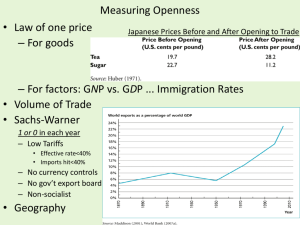

• Application – The convergence hypothesis :

Economic growth and output per person in countries with similar levels of technology, savings and population growth should converge.

• Application/Evidence

* Growth convergence among developed countries.

* Japanese/German “miracle” after WWII

* Non-convergence among poor countries

Explanation: Barriers to Technological

Adoption.

(i) Trade Restrictions

(ii) Intellectual Property Rights /

Monopolies

Figure 7.2 Convergence in Income per

Worker Across Countries in the Solow

Growth Model

Figure 7.3 Convergence in Aggregate

Output Across Countries in the Solow

Growth Model

Productivity Levels in Selected Countries

Country GDP/ Labor 1973

(% of US)

GDP/Labor 1998

(% of US)

Growth Rate

US

France

UK

Germany

Ireland

Argentina

Mexico

Peru

Brazil

100

62

41

76

67

26

24

45

38

100

77

78

98

79

15

23

39

29

1.5%

2.5%

2.2%

2.4%

4.1%

0.9%

0.5%

-0.7%

1.2%

Figure 6.4 No Convergence

Among All Countries

Figure 7.4 Differences in Total Factor

Productivity

Optimal Growth

• How much should a growing economy consume and save?

(i) What’s the “best” s?

(ii) What’s the “best” k*?

• Two Responses:

(1) Maximize Steady State Consumption

(Solow Model)

(2) Maximize PDV of discounted household utility. (Optimal Growth Model)

Solow - The Golden Rule

• Steady-state per capita consumption:

C t

N t

c *

Y t

N t

S

N t t

Y t

N t

sY t

N t

( 1

s ) y *

OR c *

zf ( k *)

( n

) k *

• Golden-Rule: The optimal k

GR

* maximizes c*

“treat others (future generations) as you would like to be treated”:

FOC zf ' ( k

GR

*)

n

Figure 6.17

Steady State

Consumption per Worker

6-28

Policy

• Public policies to increase saving rate (s)

(1) Reduce budget deficit (government spending)

(2) Encourage private saving (IRA accounts,

Social Security reform)

• Public policies to increase productivity (z)

(1) Infrastructure

(2) Human capital (R&D)

(3) Industrial policies

The Optimal Growth Model –

Modified Golden Rule

• Optimal Growth Model Basic CE model w/

* exogenous/inelastic labor supply

* representative consumer so all variables are already in per-capita terms.

• The saving rate (s) is endogenous in Optimal

Growth Model.

• Recall that CE Model Pareto Optimal

• Social Planner’s Objective: subject to c t

I t

I t

k t

1

y t

zf

( 1

max

( k t

) t

1

) k t

t

1 u ( c t

)

• State Variable:

• Control Variable: k t c t

• Bellman Equation: subject to

V ( k t

) k t

1

z t

Max c t

u ( c t

)

V ( k t

1

)

f ( k t

)

( 1

) k t

c t

• First Order Condition: u ' ( c t

)

u ' ( c t

1

)

zf ' ( k t

1

)

( 1

)

• Steady State (Modified Golden Rule): zf ' ( k

*

MGR

)

( 1 /

1 )

where

1/(1r) and r is rate of time preference.

• Is this level of capital k*

MGR socially optimal?

accumulation

• Social Efficiency (Solow Growth): zf ' ( k

GR

*)

n

• Individual Efficiency (Optimal Growth): zf ' ( k

*

MGR

)

r as steady state implies r* = rate of time preference = r.

(i) n = r = r k

GR

= k

MGG

(ii) n > r =

(iii) n < r = r k

GR r k

GR

< k

MGR

> k

MGR

over accumulation

Dynamic Efficiency under accumulation

Endogenous Growth

• Solow Model can only explain non-convergence via barriers to technological adoption.

• In Solow Model sustained growth is due to exogenous forces. Does not explain where growth comes from.

• Endogenous growth models attempt to explain economic growth from society’s choice of human capital accumulation:

Human Capital = Stock of Knowledge and Skills

A Simple Example

• Definitions:

Labor Supply

Education

Human Capital Stock

Efficiency Units of Labor

Real Wage per Efficiency Unit

• Budget Constraint for t = 1,2: c t

w t u t

H t

t

= u t

= (1-u t

)

= H t

= u t

H t

= w t

(BC)

• Investment in Human Capital:

H t

1

b ( 1

u t

) H t

• Production Function:

Y

t z ( u t

H t

)

(HC)

• Representative Household: Given H

1 and w t

, max U(c

1

,c

2

, …) subject to (BC) and (HC).

• Representative Firm: Maximize t

• Market-Clearing: Y t

= c t

= Y t

– w t u t

H t.

• General Case: In a steady state equilibrium where u t u t+1

= u,

Y t

1

Y t

zu t

1 b ( 1 zu t

H t u t

) H t

b ( 1

u )

H t

1

H t

=

Output Growth = Consumption Growth

= Human Capital Growth = b(1-u) – 1 > 0 if b(1-u) > 1.

Implications

• Sustained economic growth can be explained by endogenously by human capital accumulation.

• Higher rates of growth can be attained by

(i) Greater time allocation to education (1-u)

(ii) More efficient educational systems (b)

• Countries with identical u and b will experience same growth rate but levels of output and standard of living may never converge .

Figure 7.9 Growth and

Education

Figure 7.10 Income per

Worker and Education

Figure 7.8 No Convergence in the Endogenous Growth

Model

• Policy Implications:

(i) There is a potential role for governments to subsidize education/worker retraining or encourage efficiency (increasing b / decreasing u).

(ii) There are externalities to human capital accumulation too little private investment .

Private Marginal benefit = MC

< Society Marginal Benefit

• (iii) Optimal Human Capital Accumulation:

* Social MB = MC

* Short-Run Marginal Cost of Lost

Consumption = Long Run MB of increased future consumption.

Figure 7.7 Effect of a Decrease in u on the

Consumption Path in the Endogenous Growth

Model