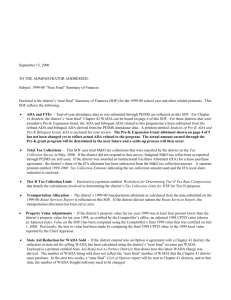

SCHOOL FINANCE 101

advertisement

SCHOOL FINANCE FUNDAMENTALS An overview that determines the state and local revenue of a typical small/rural school 1 Texas Association Of Rural Schools Student Information Required 1. 2. 3. 4. 5. 6. 7. 8. 2 Total Refined ADA Sp Ed FTE Sp Ed WFTE Career & Technology FTE Comp Ed Students Biling/ESL ADA Gifted Ed ADA Regular ADA (1-2&4 above) 295.000 3.860 12.240 10.260 108.000 2.930 14.750 280.880 Texas Association Of Rural Schools STATE ALLOTMENT CALCULATIONS 3 The first calculation is the Cost of Education Index (CEI). The CEI adjusts the Basic Allotment, a per pupil cost as set by the state, to account for personnel cost due to the cost of doing business in any given school district. In our example the district has an index of 1.04 (a 4% add on) that is applied to 71% of the BA. It’s estimated that 71% of a district’s cost is for salaries. Let’s see how the formula works ! Texas Association Of Rural Schools THE ADJUSTED BASIC ALLOTMENT Basic Allotment @$4,765 ABA = ((BA *.71) * CEI) + (BA *.29) ABA = (($4,765 *.71) * 1.04) + ($4,765 *.29) ABA = ($3,383 * 1.04) + $1,382 ABA = $3,518 + $1,382 ABA = $4,900 This represents an increase of $135 per pupil over the original Basic Allotment. 4 Texas Association Of Rural Schools State Allotment Calculations (Continued) 5 The next step is the Small or Mid-size school calculation. This adjustment recognizes the high cost of small classes. The mid-size adjustment is for districts under 5000 pupils and the small adjustment is for districts under 1600 pupils. Both work the same way. The small district adjustment has two factors: .0004 for districts over 300 sq miles and .00025 for districts under 300 sq miles and presumed to be small by choice. Mid-Size uses .000025. In our next example we will assume our typical small school has less than 300 sq miles. Texas Association Of Rural Schools THE ADJUSTED ALLOTMENT The Adjusted Basic Allotment@ $4,900 AA = (1+((1600-ADA)*.00025)) * ABA AA = (1+((1600-280.88)*.00025)) * $4,900 AA = (1+(1319.12*.00025)) * $4,900 AA = (1 + .32978) * $4,900 AA = I.32978 * $4,900 AA = $6,516 This represents an $1,616 per pupil increase over the original Adjusted Basic Allotment and $1,761 per pupil over the original Basic Allotment. 6 Texas Association Of Rural Schools STATE ALLOTMENT CALCULATION (Continued) 7 We are now ready to calculate the Foundation School Program cost for our typical small school. The pupil or student counts from our first slide x their appropriate weights x the Adjusted Allotment of $6,516. Texas Association Of Rural Schools FOUNDATION PROGRAM COST Typical Small / Rural School Reg. Program (280.88 X $6,516) $1,830,214 Sp Ed (12.240 X $6,516) 79,756 Career& Tech (10.26 X1 .35 X $6,516) 90,253 Comp Ed (108 X .20 X $6.516) 140,746 Biling/ESL (2.930 X .10 X $6,516) 1,909 Gifted (14.75 X .12 X $6,516) 11,533 Transportation (Separate Calculation) 31,597 New Facilities Allotment (Campus ADA X $250) 0 High School Allotment (80 ADA x $275) 22,000 Total FSP Cost $2,208,008 8 Texas Association Of Rural Schools FOUNDATION SCHOOL PROGRAM Local Share Calculation Our District Has a Wealth of $28,529,448 State Requires an $1.00 per $100 Local Share Therefore The local Share is: $28,529,448 X .0100 = $285,294 Now let’s summarize where we are… 9 Texas Association Of Rural Schools A SUMMARY OF STATE AID TO THIS POINT ALSO CALLED TIER 1 Reg program $1,830,214 Sp Ed 79,765 Career & Tech 90,253 Comp Ed 140,746 Biling/ESL 1,909 Gifted 11,533 Transportation 31,597 New Facilities 0 High School_____________________22,000 Total FSP $2,208,008 Less LFA - 285,294 Net State (Tier 1) $1,922,714 10 Texas Association Of Rural Schools STATE ALLOTMENT CALCULATIONS CON’T Guaranteed Yield Allotment( GYA) A district’s GYA is partly based on Weighted ADA so we must calculate the district WADA. WADA equals the Total FSP less the transportation, the new facilities and high school allottments divided by the original BA less one half the effect of the ABA. Thus : WADA = ( FSP – TRANS, FAC ,HS ) / ((( ABA – BA ) *.5 ) + BA ) WADA = (2,208,008- 53,597 ) / ((( 4,900 – 4,765 ) *.5 ) + 4,765 ) WADA = 2,154,411 / (( 135 *.5 ) + 4,765 ) WADA = 2,154411/ ( 67.5 + 4,765 ) WADA = 2,154,411 / 4,832.5 WADA = 445.82 Remember Refined ADA for the district was 280.88,therefore the use of WADA becomes an extreme issue for small/rural schools. 11 Texas Association Of Rural Schools GUARANTEED ALLOTMENT GYA (Continued) The GYA or Tier 2 (The Golden Pennies) is calculated using the following: 1. WADA ( Calculated @ 445.82 ) 2. District Wealth ( $ 28,529,448 ) 3. District M&O Tax Rate above the Local Share of Tier 1(DTR) The Total M&O Tax Rate ($1.00), plus the GYA Pennies currently aloud by the State is $.06 ; therefore the DTR is $.06 4. Local Revenue (LR) is the amount raised by the DTR times District Wealth, therefore LR is $17,118 ($28,529,448*.0006) 5.State Guaranteed Level of wealth (GL) of $590,200 per WADA (Austin ISD) is stated as $59.02 per $.01 of tax effort The GYA formula is as follows: GYA = ( G L * WADA * ( DTR * 100 ) – LR 12 We will examine the formula on the next slide Texas Association Of Rural Schools CALCULATING THE GYA 13 GYA = (GL * WADA * (DTR * 100) – LR GYA = ($59.02 * 445.82 * ($.06*100)) - $17,118) GYA = ($59.02 * 445.82 * 6) - $17,118) GYA = $157,874 - $17,118 GYA = $140,756 Therefore the 2nd Tier (The Discretionary Tier) revenue for our typical small district is $ 140,756. Now we will Summarize Tier 1 and Tier 2. Texas Association Of Rural Schools A SUMMARY OF REVENUE TYPICAL ISD LOCAL REVENUE Tier 1 Local Share Tier 2 Local Share TOTAL LOCAL GRAND TOTAL 14 TIER 1 (FSP) Less Local Share Net Tier 1 TIER 2 (GYA Discretionary Tier) Technology @ $30 per ADA TOTAL STATE AID $2,208,008 - 285,294 1,922,714 140,756 8,850 $2,072,320 $ 285,294 17,118 $ 302,412 $ 2,072,320 $ 302,412 $ 2,374,732 Texas Association Of Rural Schools