Unit #7 - Posting to the Ledger

advertisement

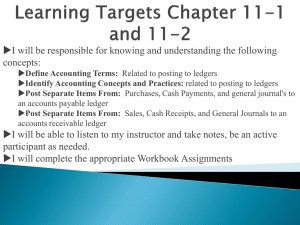

Unit 7 – Posting to the Ledger Posting to the Ledger Business Transactions Journal (Journalizing) Ledger (Posting) ** The General Journal does not provide the balance for each account. This information is found in the accounts in the general ledger. *** Transfer information from the journal to the ledger by a process called posting. Balance-Column Ledger Account “three-column account” • The most widely used form of account that provides a running balance on each line. • “T-accounts introduced in Chapter 2, ideal for learning rules, but not very practical for use in business. Ex: Cash T-Account Cash Nov. 1 3 5 2 000 75 100 2 175 Balance 1 825 Nov. 3 6 150 200 350 Ex: Three-Column Account General Ledger Account Cash Date Particulars P.R. 20_ Nov. 1 3 3 5 6 No. 100 J1 J1 J1 J2 J3 Debit 200000 7500 10000 Journal Page number is shown. Each entry has its own line. Credit DR. CR. DR. DR. 15000 DR. DR. 20000 DR. Balance 200000 207500 192500 202500 182500 Indicates whether the account balance is a debit or a credit. Chart of Accounts • Is a list of the names and account numbers of all of the accounts in a ledger. • Each account in a ledger – Has a title and a number – Placed in numerical sequence – located quickly • Use – Which accounts to journalize – Locating accounts • Accounts in ledger numbered in the same order as they appear on the balance sheet and income statement. Rainbow Painting Contractors Chart of Accounts Assets 100 101 102 131 141 142 Cash Accounts Recievable/A.Baker Accounts Recievable/L.Carter Painting Supplies Equipment Truck Liabilities 200 201 221 Accounts Payable/International Paints Accounts Payable/Hardware Supply Corp. Bank Loan Owner’s Equity 300 301 K. Schmidt, Capital K. Schmidt, Drawings Revenue 400 Sales Expenses 500 501 502 503 Advertising Expense Rent Expense Salaries Expense Utilities Expense - In large companies with a large number of accounts, a four-digit series of numbers may be required to cover all of the accounts. - Ex: Assets (1000-1999) Liabilities (2000-2999) - Computer Accounting - The accounting number becomes a numeric code for finding account names and information faster. Steps – Posting to a Balance-Column Form of Ledger accounts • See Figure 4.6 – Page 117 Step 1: Locate the account and current balance Step 2: Record the date Step 3: Enter the amount – Debit or credit? Step 4: Calculate the New Balance Step 5: Complete the Ledger Posting Reference Column – Journal Page number from which the amount was posted. Step 6: Complete the Journal Posting Reference Column – Copy account number from the ledger account into the P.R. column of the general journal. Example. Example Continued… Example Continued… Posting References • Numbers in posting reference columns serve an important purpose. • Cross-references that link particular journal entries to corresponding postings to the ledger accounts. • Journal Page in Ledger – Where to find more info about transaction. • Ledger Acct. # in Journal – indicates that the amount has been posted, and tells accounting clerk where they left off in posting to the ledger. Audits • An audit is a systematic check of accounting records and procedures by an accountant. • Periodically, all companies have their records audited. • Purpose: – Use the cross-references to check the accuracy of the journalizing and posting of transactions. – P.R. numbers allow the transactions to be traced from the journal to the ledger and vice versa. Posting Example • Page 120-121 (Textbook) Opening Entry • Records the assets, liabilities, and owner’s equity when a business first begins operations. • To ‘open the books’, the general journal is set up and the business’ assets, liabilities, & owner’s equity are recorded. • After the opening entry is journalized, the daily entries of the business can be recorded. Example – Page 122 • Compound Entry: – Has more than one debit or more than one credit. – All entries, including compound ones, must have equal debit and credit amounts. Page 123 – Figure 4.11 Opening Ledger Accounts (first time) 1. Account name (“Cash”) 2. Account number (“100”) 3. Date 4. Opening Entry (in particulars column) 5. P.R. of J1 (General Journal page 1) 6. Amount (in debit or credit) 7. Enter the opening balance 8. DR. or CR. (depending on balance) 9. Ledger account number in P.R. of Journal Entry 10.Insert the account in numerical sequence in the ledger. Page 124 – Figures 4.12-13 Forwarding Procedure • Happens when an account page is filled – a new page must then be opened using the following procedure: 1) 2) 3) New Page: Same Header (Same Acct Name & #) Write Forwarded – Last line of old page in the particulars column New Page: - First line: Date (yr, month, day) Forwarded (Particulars column) Balance (Balance column) Check mark in P.R. ** Particulars column is seldom used. (Exception: Opening Entry and Forwarded notations)…use P.R. numbers to trace back for more detailed information. Review Trial Balance Trial balance – is proof of the mathematical accuracy of the ledger. See Page 125 Trial balance includes Acct. number column. Forms of the Trial balance • Formal Trial balance (previous slide) • List form Trial balance (Total list of debits = Total list of credits) • Machine tape form Trial balance (Debit balances – Credit balances = 0) Types of Trial balances List form Machine tape form Rainbow Painting Contractors Trial Balance November 30, 20__ DEBIT $ 3 515 295 1 200 5 000 20 000 $30 010 Rainbow Painting Contractors Trial Balance November 30, 20__ CREDIT $ 695 315 15 000 14 000 ______ $30 010 0 3 515+ 295+ 1 200+ 5 000+ 20 000+ 69531515 00014 0000* Possible Posting Errors • Not posting an entire transaction • Not posting either the debit or credit part of a transaction • Posting to the correct side but to the wrong account • Posting to the wrong side of an account • Calculating the balance incorrectly • Transposing figures (posting 86 instead of 68) How to locate Trial Balance Errors 1) Determine the difference (Debit-Credit) 2) Difference (1,10,100) – (+ or – error?) 3) Acct. in ledger with balance = difference? (possible omission from trial balance) 4) Divide difference by 2 (amount may have been placed in the wrong column of the trial balance) 5) Difference divisible by 9? (Transposition error) How to locate Trial Balance Errors Cont. 6) If divisible by 9 and the difference is 2 (18/9) (The numbers that were transposed have a difference of 2) ex: 57 to 75 7) Amount not posted from journal? 8) Check each balance in each account of ledger Check P.R. column for unposted items Re-check each posting. Examples. 1. Transposition Error (Page 127) 2. Correcting Errors (Page 127) - Rule out mistake, and re-write. (some want initials) 3. Correcting Journal Entries (Page 128) - Cancel entry by performing the opposite transaction 4. Checking for accuracy (Page 128-29) 5. Checking accounts - Calculator - Calculator with sub-total method The Accounting Cycle • Is the set of accounting procedures performed in each accounting period. New Accounting Period Begins Business Transactions Journalizing Journal Financial Statements Posting Trial Balance Ledger Proof Preparing Financial Statements