Accounting for Stock

advertisement

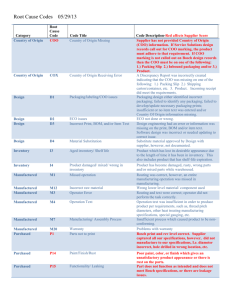

Accounting for Stock Chapter 8 Stock Stock – goods purchased by a trading firm for the purpose of resale at a profit. Note - shelving, business vehicles and office equipment, would not normally be considered as stock. (This is not to say that these items will never be sold, but the intention behind their purchase was use, not resale, so they are not stock.) This potential for resale – at a profit – some time in the future means that stock represents a future economic benefit, and because the stock is under the control of the trading firm, stock fits perfectly the definition of an asset. And given that the firm’s intention would be to resell the stock within the next 12 months, it means that stock is a current asset. Stock Stock is not only one of the most important assets for a trading firm, but also one of the most vulnerable. Stock is susceptible to damage, spoilage, theft and even changes in tastes and fashions, each of which can undermine its value. Given its importance and vulnerability, it is vital that the accounting system is able to provide accurate information about stock. The Stock Control Account All movements of stock are summarised in the Stock Control account, with stock ‘in’ (primarily through purchases) recorded on the debit side, and stock ‘out’ (mainly through sales) recorded on the credit side. The Stock Control account thus shows a summary of total cash and credit purchases on the debit side, with total cash and credit sales (recorded at cost price) and any stock withdrawals by the owner recorded on the credit side. The balance of the Stock Control account represents the total value of all stock on hand. Exam tips COMPLETE the account. This means to balance it, but it does not need to be brought down for the new period. Students who bring the balance down for the next period would not be penalised. PD’s have talked about this - and my understanding was that the wording to be used is something like "preparing the ledger account for the next period" which means then to bring the balance down. Some teachers tell their students to always bring it down it helps them to work out if it is a debit or credit balance. Stock Cards Although the Stock Control account in the General Ledger provides an important summary of all movements of stock in and out of the firm, this account alone will not provide sufficient information to manage stock effectively. Most trading firms will carry a number of different lines of stock – different items, different colours, different sizes. It is vital that the owner has detailed information relating to each line of stock, from basics such as its description, location in the warehouse and supplier; to financial information such as the cost price of each unit, the number of units purchased and sold, and the number of units on hand at any point during the period. Information relating to individual lines of stock – including details of stock transactions – recorded in stock cards. A trading firm will only ever have one Stock Control account in the General Ledger, but could have a huge number of stock cards, with one stock card for every different line of stock. Stock Cards Review Questions 8.3 All q’s. My dog (just thought you should know)! Recording Transactions in Stock Cards Remember that GST does not affect the valuation of stock (nor the revenue earned from its sale). Where cost prices are constant (see p. 168) Purchases: means stock is coming in to the business. Sales: means stock is moving out of the business. Remember the stock card shows the cost price. The amount recorded in the OUT value column is the Cost of Sales figure for this transaction. Recording Transactions in Stock Cards Where cost prices are changing. Frequently, the cost price charged by the supplier will change during the Reporting period. That is, the items on hand may have the exact same selling price and be identical in the eyes of the customer, but may have different cost prices. These differing cost prices must be recorded in the stock cards. See example: 7 were purchased for $60 each, while the 8 new pots were purchased for $70 each – they must be listed separately in the Balance column of the stock card. Recording Transactions in Stock Cards Unless stock is marked or identified in some way, it is not possible to identify whether the customer bought pots worth $60 per unit or $70 per unit. For this reason we must assume that the stock which was purchased first will be sold first. This is known as the First-in, first-out (FIFO) assumption. In the example provided, it means we will assume that the 7 pots valued at $60 each will be sold first, with the remaining 3 pots (to make up the 10 pots sold) assumed to be from the $70 batch. FIFO must be applied to all transactions recorded in the OUT column, including sales, drawings and stock losses, but it is an assumption only; it may not match the actual flow of goods (i.e. customers may buy the pots which were purchased more recently, rather than those which were first in). You! Review Questions 8.4. Q’s 1, 3. Stock Cards & Journals Earlier, we noted that the price on the source document will be the selling price, because the cost price of the stock is not revealed to the customer. But when cash sales are recorded in the Cash Receipts Journal, and credit sales are recorded in the Sales Journal, we must identify both the selling price and the cost price. This makes the stock cards a vital source of information when transactions are recorded in the journals, because it is the stock cards that will determine the cost price of each sale. Stock Cards & Journals See example pp. 171, 172. The Physical Stocktake Because the stock cards are updated after every transaction, they provide a continuous (or perpetual) record of stock on hand. That is, at any stage, the number of units shown in the Balance column should reflect the actual quantity of stock on hand in the shop, showroom or warehouse. However, just because the stock card says there should be a certain number of items on hand does not mean this will be the case. Therefore, the number of units on hand should be checked periodically by conducting a physical stocktake. A stocktake involves a physical count of the number of units of each line of stock on hand. This count can then be compared against the balances in the stock cards to not only check their accuracy, but also detect any stock losses or gains. If the stocktake and stock cards differ, assume the stocktake is correct. Stock Losses Losses may occur for a number of reasons: Theft damage/breakages undersupply from a supplier – a supplier has delivered less stock than has been charged for oversupply to a customer – stock to customers has been supplied in excess of what they have been charged for. Recording a Stock Loss A stock loss means that there is less stock available for sale than is currently shown in the stock card and Stock Control account, so the quantity missing (or lost) must be recorded in the OUT column of the stock card, and as a credit in the Stock Control account. In addition, the stock loss itself is an expense – an outflow of an economic benefit in the form of a decrease in assets (stock on hand), leading to a decrease in owner’s equity – and this must also be shown in the ledger. See Figures 8.2 & 8.3. Note the reliance on Memo. Note the Stock Loss expense account. Stock Gains Stock gains may be due to: oversupply from a supplier – a supplier has sent us stock for which we have not been charged undersupply to a customer – we have charged a customer for stock which we have not delivered (and the customer has not realised!). Stock gain is a good reminder that revenue does not need to be cash; in this case stock is the asset that has increased, with no effect on cash whatsoever. Recording a Stock Gain The quantity gained must be recorded in the IN column of the stock card, and as a debit in the Stock Control account. In addition, the stock gain itself is a revenue item – an inflow of an economic benefit in the form of an increase in assets (stock on hand), leading to an increase in owner’s equity, and this must also be shown in the ledger. You! Copy Stock & Information Flows p. 180, 181. Reporting for Stock Balance Sheet Relevance says there is not much point identifying the quantity of every line of stock in the Balance Sheet. The only item that must be reported here is Stock Control (current asset). Reporting for Stock Income Statement Sales of stock will be the main source of revenue for a trading firm. It is important to note that Sales Revenue must be reported separately to Other Revenues, such as Discount Revenue, which do not relate directly to stock. Note Cost of Sales may be only one of a number of expenses related to stock. The term Cost of Goods Sold (COGS) is used to describe all costs incurred in getting goods into a condition and location ready for sale. Note expenses such as Customs Duty and Freight for example. Reporting for Stock Income Statement (cont.) Gross Profit is the difference between Sales Revenue and COGS. It is important for it to have its own heading as owners need to judge the adequacy of mark ups. Adjusted Gross Profit is used to notify of stock gain or loss. Benefits of Perpetual System Perpetual means continuous. A continuous system of recording allows an owner to know if stock needs to be reordered at any time (not just the end of a period). Fast and slow moving stock can be more easily identified. You! Read ‘Where Have We Been?’