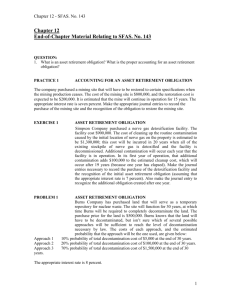

Chapter 18A

advertisement

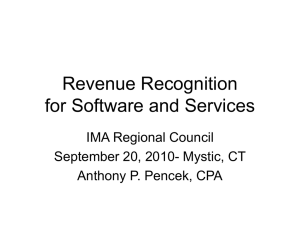

Chapter 18 Revenue Recognition ACCT-3030 1 1. Revenue Recognition Basic Concepts Revenue recognition ◦ most difficult issue facing accounting ◦ most prevalent reason for accounting restatements ◦ most common way financial statements are fraudulently presented ◦ revenue is one of most important measures used by inventors to assess a company’s performance ◦ revenue recognition is the cornerstone of accrual accounting ACCT-3030 2 1. Revenue Recognition Basic Concepts Definition of revenue (SFAC 6) ◦ Inflows or other enhancements of assets or settlement of liabilities during a period from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations. General recognition criteria (SFAC 5) ◦ ◦ ◦ ◦ meets definition of an element measurability relevance faithful representation ACCT-3030 3 1a. Revenue Recognition Basic Concepts APB Statement 4 ◦ Revenue is recognized when the earnings process is complete or virtually complete an exchange has taken place Realization principle (SFAC 5) ◦ Revenue is recognized when the earnings process is judged to be complete or virtually complete there is reasonable certainty as to the collectability of the asset to be received ACCT-3030 4 1a. Revenue Recognition Basic Concepts SEC SAB No. 101 ◦ persuasive evidence of an arrangement exists ◦ delivery has occurred or services have been rendered ◦ the seller’s price to the buyer is fixed or determinable ◦ collectability is reasonably assured ACCT-3030 5 1b. Revenue from Contracts with Customers New standard adopted by FASB and IASB ◦ issued May 28, 2014 ◦ entities required to apply the new standard for reporting periods beginning on or after Jan. 1, 2017 ◦ the issuing boards agreed that this unusual length of time is appropriate because of the impact of this project ◦ this gives entities time to update their software systems and processes in order to capture data for comparatives ◦ the boards tentatively stated that entities could use an alternative transition method that would recognize the cumulative effect of initially applying the new standard ACCT-3030 6 1b. Revenue from Contracts with Customers New standard adopts an asset-liability approach to revenue recognition ◦ companies account for revenue based on the asset or liability arising from contracts with customers New revenue recognition principle: ◦ revenue is recognized when the performance obligation is satisfied Follows a five-step process ACCT-3030 7 1b. Revenue from Contracts with Customers The five steps of revenue recognition are: 1. Identify the contract with customers. 2. Identify the separate performance obligations in the contract. 3. Determine the transaction price. 4. Allocate the transaction price to the separate performance obligations. 5. Recognize revenue when each performance obligation is satisfied. ACCT-3030 8 1b. Revenue from Contracts with Customers 1. Identifying the Contract with Customers ◦ a contract is an agreement between two or more parties that creates enforceable rights or obligations ◦ requirements for a contract the contract has commercial substance (future cash flows change as a result of the contract) the parties to the contract have approved the contract and are committed to perform their respective obligations. the company can identify each party’s rights regarding the goods or services to be provided, and the company can identify the payment terms for the goods and services to be transferred. ACCT-3030 9 1b. Revenue from Contracts with Customers 1. Identifying the Contract with Customers ◦ Revenue from a contract with a customer cannot be recognized until a contract exists. ◦ Do not recognize contract assets or liabilities until one or both parties to the contract perform. ACCT-3030 10 1b. Revenue from Contracts with Customers 1. Identifying the Contract with Customers ◦ Contract modification - determine if a new contract and performance obligation results or whether it is a modification of the existing contract Treated as a new contract if both of the following conditions are met: the promised goods or services are distinct, and the company has the right to receive an amount of consideration that reflects the standalone selling price of the promised goods or services If either or both of the above conditions not met, account for modification using a prospective approach under this approach, revenue is recognized using a blended price ACCT-3030 11 1b. Revenue from Contracts with Customers Identify the separate performance obligations in the contract. 2. A company must provide a distinct product or service for a performance obligation to exist. If a single product or service is provided there is only one performance obligation. If multiple products/services are provided and they are interdependent and interrelated, they are combined and reported as a single performance obligation. If the products/services are not highly dependent or interrelated with other promises, then each performance obligation should be accounted for separately. ACCT-3030 12 1b. Revenue from Contracts with Customers 3. Determine the transaction price. ◦ Transaction price is amount company expects to receive from a customer in exchange for transferring goods/services ◦ In some contracts, may need to consider: variable consideration (such as discounts, rebates, bonuses, royalties) use expected value (if more than two possible outcomes) or, most likely amount (if only two possible outcomes) time value of money m/b used if contract has significant financing component and time period greater than one year noncash consideration measure as fair value of what received consideration paid or payable to the customer items that will reduce the consideration received (e.g., free products, volume discounts) ACCT-3030 13 1b. Revenue from Contracts with Customers 4. Allocate the transaction price to the separate performance obligations. ◦ If more than one performance obligation exists, an allocation of the transaction price should be based on the relative fair values of the various performance obligations ◦ When a bundle of goods/services is sold, the bundle’s selling price may be less than the sum of the individual standalone prices. If so the discount should be allocated to the product(s) causing the discount, not to the entire bundle ACCT-3030 14 1b. Revenue from Contracts with Customers 5. Recognize revenue when each performance obligation is satisfied. ◦ A company satisfies its performance obligation when the customer obtains control of the good/service. ◦ Performance obligations may be satisfied at a point in time or over a period of time. ◦ Companies recognize revenue over a period of time if: the customer controls the asset as it is created or the company does not have an alternative use for the asset, and the company has a right to payment. ACCT-3030 15 2. General Rule When applying Revenue from Contracts with Customers, revenue usually recognized at the point of sale Activity Revenue recognized when Selling products Point of sale (date of delivery; when title passes) Providing services Services have been performed and amounts are billable Permitting others to use the firm’s assets As time passes Disposing of assets Date of sale ACCT-3030 16 3. Possible Points to Recognize Revenue Most significant event Recognition before point of sale ◦ prior to starting production customer advances ◦ during production long-term construction contracts ◦ at completion of production precious metals, ag products Recognition at point of sale ◦ but if right of return exists or sale with buyback Recognition after point of sale ◦ cash collection methods installment sales, cost recovery basis ◦ consignments ACCT-3030 17 4. Expense Recognition Expense – expired economic benefits Outflows or other using up of assets or incurrence of liabilities during a period from delivering or producing goods, rendering services, or other activities that constitute the entity’s ongoing major or central operations. (SFAC 6) Expenses to be recognized can be identified by ◦ matching ◦ direct expensing (period costs) ◦ systematic allocation ACCT-3030 18 5. Revenue Frauds Obvious accounting violations ◦ Fictitious sales or fake customers ◦ Premature recording of sales ◦ Inflated sales Transactions sometimes lacking integrity ◦ ◦ ◦ ◦ ◦ ◦ Roundtrip transactions Channel stuffing and trade loading Bill and hold transactions Repurchase agreements Related party transactions Principle-agent (grossing up revenue) Contracts, agreements and side letters ACCT-3030 19 6. Long-term Construction Contracts Percentage of completion method ◦ revenue recognized each period based on progress of construction ◦ this method required if company’s performance creates or enhances an asset that the customer controls, or company’s performance does not create an asset with an alternate use, and costs to complete and extent of progress toward completion are reasonably dependable If criteria not met use completed contract method ACCT-3030 20 6a. Long-term Construction Contracts Methods to estimate percentage of completion ◦ cost-to-cost method (input method) costs to date ÷ total estimated costs to complete most common method ◦ ◦ ◦ ◦ machine hours or labor hours (input measure) project milestones (output method) units of production (output method) engineer’s or architect’s estimates ACCT-3030 21 6b. Long-term Construction Contracts Revenue and GP recognized per period ◦ percentage completed this period x total revenue or GP ◦ new accounts construction in progress (inventory account) progress billings (contra acct to CIP) ◦ financial statement presentation net both accounts – could be debit or credit balance ◦ example ACCT-3030 22 7. Completed contract method Revenues and gross profit recognized when project finished Entries ◦ same entries to record costs and billings ◦ do not recognize revenue and gross profit each year The two methods are not acceptable alternatives Example ACCT-3030 23 8. Right of Return Only recognize revenue if all of following are met sellers price is fixed ◦ buyer has paid or is obligated to pay ◦ buyer’s obligation would not be changed by the theft or destruction of the product ◦ buyer has economic substance apart from that provided by the seller ◦ seller doesn’t have future significant obligations ◦ amount of future returns can be reasonably estimated ACCT-3030 24