05

Market Failures: Public Goods and

Externalities

McGraw-Hill/Irwin

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Market Failures

• Market fails to produce the right

•

LO1

amount of the product

Resources may be:

• Over-allocated

• Under-allocated

5-2

Demand-Side Failures

• Impossible to charge consumers

what they are willing to pay for the

product

• Some can enjoy benefits without

paying

LO1

5-3

Supply-Side Failures

• Occurs when a firm

does not pay the full

cost of producing its

output

• External costs of

producing the good

are not reflected in

supply

LO1

5-4

Efficiently Functioning Markets

• Demand curve must reflect the

•

LO1

consumers full willingness to pay

Supply curve must reflect all the costs

of production

5-5

Consumer Surplus

• Difference between what a consumer

•

LO2

is willing to pay for a good and what

the consumer actually pays

Extra benefit from paying less than

the maximum price

5-6

Consumer Surplus

Consumer Surplus

(2)

Maximum

Price Willing

to Pay

(3)

Actual Price

(Equilibrium

Price)

Bob

$13

$8

$5 (=$13-$8)

Barb

12

8

4 (=$12-$8)

Bill

11

8

3 (=$11-$8)

Bart

10

8

2 (=$10-$8)

Brent

9

8

1 (= $9-$8)

Betty

8

8

0 (= $8-$8)

(1)

Person

LO2

(4)

Consumer

Surplus

5-7

Price (per bag)

Consumer Surplus

Consumer

Surplus

Equilibrium

Price

P1

D

Q1

Quantity (bags)

LO2

5-8

Producer Surplus

• Difference between the actual price a

•

LO2

producer receives and the minimum

price they would accept

Extra benefit from receiving a higher

price

5-9

Producer Surplus

Producer Surplus

(2)

Minimum

Acceptable

Price

(3)

Actual Price

(Equilibrium

Price)

Carlos

$3

$8

$5 (=$8-$3)

Courtney

4

8

4 (=$8-$4)

Chuck

5

8

3 (=$8-$5)

Cindy

6

8

2 (=$8-$6)

Craig

7

8

1 (=$8-$7)

Chad

8

8

0 (=$8-$8)

(1)

Person

LO2

(4)

Producer

Surplus

5-10

Price (per bag)

Producer Surplus

Producer

surplus

S

P1

Equilibrium

price

Q1

Quantity (bags)

LO2

5-11

Efficiency Revisited

Price (per bag)

Consumer

surplus

S

P1

Producer

surplus

D

Q1

Quantity (bags)

LO2

5-12

Efficiency Losses

Price (per bag)

a

Efficiency loss

from underproduction

S

d

b

e

D

c

Q2 Q 1

Quantity (bags)

LO2

5-13

Efficiency Losses

Price (per bag)

a

Efficiency loss

from overproduction

S

f

b

g

D

c

Q1 Q 3

Quantity (bags)

LO2

5-14

Private Goods

• Produced in the market by firms

• Offered for sale

• Characteristics

• Rivalry

• Excludability

LO3

5-15

Public Goods

• Provided by government

• Offered for free

• Characteristics

• Nonrivalry

• Nonexcludability

• Free-rider problem

LO3

5-16

Demand for Public Goods

Demand for a Public Good, Two Individuals

(1)

Quantity

of Public

Good

(2)

Adams’ Willingness

to Pay (Price)

1

$4

+

$5

=

$9

2

3

+

4

=

7

3

2

+

3

=

5

4

1

+

2

=

3

5

0

+

1

=

1

LO3

(3)

Benson’s

Willingness to

Pay (Price)

(4)

Collective

Willingness

to Pay (Price)

5-17

Demand for Public Goods

Benson’s Demand

$4 for 2 Items

$2 for 4 Items

P

$6

5

4

3

2

1

0

D2

1

2

3

4

Q

5

Benson

Adams’ Demand

$3 for 2 Items

$1 for 4 Items

P

$6

5

4

3

2

1

0

D1

1

2

3

4

Q

5

Adams

P

Collective Demand

$7 for 2 Items

$3 for 4 Items

S

$9

Optimal

Quantity

7

5

Collective

Willingness

To Pay

3

Connect the Dots

DC

1

0

1

2

3

4

5

Q

Collective Demand and Supply

LO3

5-18

Cost-Benefit Analysis

• Cost

• Resources diverted from private

•

LO3

good production

• Private goods that will not be

produced

Benefit

• The extra satisfaction from the

output of more public goods

5-19

Cost-Benefit Analysis

Cost-Benefit Analysis for a National Highway Construction Project

(in Billions)

(1)

Plan

(2)

Total Cost

of Project

(3)

Marginal

Cost

(4)

Total

Benefit

(5)

Marginal

Benefit

(6)

Net Benefit

(4) – (2)

No new construction

$0

A: Widen existing highways

4

$4

5

$5

1

B: New 2-lane highways

10

6

13

8

3

C: New 4-lane highways

18

8

22

10

5

D: New 6-lane highways

28

10

26

3

-2

LO3

$0

$0

5-20

Quasi-Public Goods

• Could be provided through the market

•

•

LO3

system

Because of positive externalities the

government provides them

Examples: education, streets,

libraries

5-21

The Reallocation Process

• Government

• Taxes individuals and businesses

• Takes the money and spends on

production of public goods

LO3

5-22

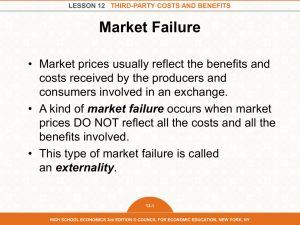

Externalities

• A cost or benefit accruing to a third

•

•

LO4

party external to the transaction

Positive externalities

• Too little is produced

• Demand-side market failures

Negative externalities

• Too much is produced

• Supply side market failures

5-23

Externalities

P

Negative

Externalities

a

P

St

b

St

y

z

S

Positive

Externalities

Dt

x

c

D

D

Overallocation

0

Qo

Qe

(a)

Negative externalities

LO4

Underallocation

0

Q

Qe

Qo

Q

(b)

Positive externalities

5-24

Government Intervention

• Correct negative externalities

• Direct controls

• Specific taxes

• Correct positive externalities

• Subsidies and government

provision

LO4

5-25

Government Intervention

P

Negative

Externalities

a

b

P

St

St

a

S

T

c

0

LO4

S

D

Overallocation

Qo Qe

Q

D

0

Qo Qe

Q

(a)

(b)

Negative Externalities

Correct externality with

tax

5-26

Government Intervention

y

St

z

St

St

Subsidy

S't

Positive

Externalities

x

Dt

Subsidy Dt

D

D

U

D

Underallocation

0

Qe

Qo

(a)

Positive Externalities

LO4

0

Qe

Qo

(b)

Correcting via a subsidy

to consumers

0

Qe

Qo

(c)

Correcting via a subsidy

to producers

5-27

Government Intervention

Methods for Dealing with Externalities

Problem

Resource Allocation

Outcome

Ways to Correct

Negative externalities

(spillover costs)

Overproduction of output

and therefore

overallocation of

resources

1.

2.

3.

4.

5.

Private bargaining

Liability rules and lawsuits

Tax on producers

Direct controls

Market for externality rights

Positive externalities

(spillover benefits)

Underproduction of output

and therefore

underallocation of

resources

1.

2.

3.

4.

Private bargaining

Subsidy to consumers

Subsidy to producers

Government provision

LO4

5-28

Society’s Marginal Benefit and Marginal

Cost of Pollution Abatement (Dollars)

Society’s Optimal Amounts

MC

Socially

Optimal Amount

Of Pollution

Abatement

MB

0

LO5

Q1

5-29

Government’s Role in the Economy

• Government can have a role in

•

•

LO5

correcting externalities

Officials must correctly identify the

existence and cause

Has to be done in the context of

politics

5-30

Controlling Carbon Dioxide Emissions

• Cap and trade

• Sets a cap for the total amount of

•

emissions

• Assigns property rights to pollute

• Rights can then be bought and sold

Carbon tax

• Raises cost of polluting

• Easier to enforce

5-31