Read - Cashmere Iron

advertisement

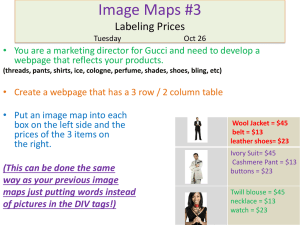

CASHMERE IRON One of Australia's Premium undeveloped Magnetite and DSO Hematite iron ore deposits 2014 AGM Disclaimer CASHMERE IRON Cashmere Iron Ltd (“Cashmere”) has prepared this presentation (the “Presentation”) solely for the benefit of the Recipient. This Presentation is provided solely for the purpose of assisting the Recipient in its evaluation of Cashmere and its iron ore development project. The Presentation has been released to the Recipient on the express understanding that the contents will be regarded and treated as strictly confidential. The Presentation is solely for the benefit of the recipient and may not be reproduced or used, in whole or in part, or given to any other person for any purpose without the prior consent of Cashmere. The Presentation is designed solely for information purposes. The information contained herein has been prepared to assist the Recipient in evaluating Cashmere, but does not purport to be all-inclusive or to contain all of the information that the Recipient may require to evaluate Cashmere and its business. In all cases, the Recipient should conduct its own investigation and analysis of Cashmere and its business and the information set forth in the Presentation. While all reasonable care has been taken to ensure that the facts stated herein are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Cashmere does not make any representation or warranty as to the accuracy or completeness of the information in the Presentation and shall not have any liability for any information or representations (express or implied) contained in, or for any omissions from, the Presentation or any other written or oral communications transmitted to a Recipient in the course of its evaluation of the Proposal. In no case shall any of Cashmere’s advisers, or any of their respective directors, officers or employees, be in any way responsible for, or have any liability in respect of, the contents hereof (or any omissions here from), and no reliance should be placed on the accuracy, fairness or completeness of the information contained in this Presentation. All projections, forecasts and forward-looking statements and calculations in the Presentation are for illustrative purposes only using assumptions described herein. The calculations are based on certain assumptions, which may not be realised. In addition, such forward-looking statements involve a number of risks and uncertainties. Actual results may be materially affected by changes in economic, taxation and other circumstances. Cashmere disclaims any responsibility for any errors or omissions in the financial calculations set forth in the Presentation and make no representations or warranties as to the accuracy of the assumptions on which they are based. The reliance that the Recipient places upon the projections, forecasts, calculations and forward-looking statements of the Presentation is a matter for its own commercial judgment. No representation or warranty is made that any projection, forecast, calculation, forward-looking statement, assumption or estimate contained in the Presentation should or will be achieved. Cashmere assumes no responsibility to update the Presentation in any respect. Neither this Presentation nor any copy of it may be taken or transmitted into or distributed in the United States. Any failure to comply with this restriction may constitute a violation of US securities laws, as applicable. The distribution of this Presentation in other jurisdictions may also be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. This Presentation does not constitute or form part of, and should not be construed as, an offer or invitation to purchase or subscribe for any securities, and neither this Presentation nor anything contained herein shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. By accepting this Presentation the Recipient agrees to be bound by the foregoing limitations. •The information in this report that relates to Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Allen J. Maynard and Brian J. Varndell, both of whom are members of the Australasian Institute of Mining and Metallurgy and is employed by AM&A. Allen Maynard and Brian Varndell both have sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as a Competent Person as defined in the JORC Code. Allen Maynard and Brian Varndell consent to the inclusion in this report this information in the form and context in which it appears. 2 Executive Summary CASHMERE IRON • Public company, formed in 2007 to explore and develop the Cashmere Downs Iron Ore Project. • 50,000 metres drilled • Hematite JORC resource complete • Magnetite JORC resource complete • Mine development model based on early stage Hematite production funding future phases of development: Stage 1 at 5 million Tonne Per annum increasing to a potential 20 million tonne per annum. • Port capacity reservation deed for the Esperance Port for 5Mt/pa from the new facility. The YES consortium awarded development approval by Western Australian Government 2014. • Highly experienced leadership team with proven track record in project delivery Ore Body definition CASHMERE IRON • In excess of 50,000 metres of drilling completed covering 600 holes • 6000 DTR tests at 38 µm grind size. • Final Magnetite Product 68% fe. with less than 4.5%SiO2 • Hematite/Detrital JORC resources 47.5 million tonnes • JORC resource of over 1 billion tonne combine Magnetite and Hematite of which 928 million tonne is in measured and indicated categories. • An additional 7 Billion tonne inferred potential • Stage 1 Hematite Detrital studies complete (Jan 2012) • Metallurgical test work complete on each stage of the Project • Exploration to date of 14% of the BIF ridges, which has defined significant Hematite and Magnetite JORC resources in excess of 1BT. Significant Project Milestones CASHMERE IRON • Aboriginal Heritage agreements signed (with Mabrouk Minerals) • 3 Mining Leases granted • Level 2 Spring and Autumn Environmental survey complete • No significant Flora types identified • Fauna assessment recognised Mallee fowl present • Capacity reservation Deed with Esperance Port • Purchase Agreements in place with Pastoral lease holders Completed Stages. CASHMERE IRON • Due Diligence by Chinese Party completed 2013 Complete • Project Definition Study Complete • Magnetite JORC Resource 1 billion tonne Complete • Hematite/Detrital JORC resources 47.5 Million Tonne Complete • Pastoral lease agreement Complete • Native Tittle agreements Complete • Level 2 Environmental surveys Complete • Port Definitive Feasibility Study Complete • Port capacity reservation deed Complete • Detrital Hematite Desk top study Complete • DSO Scoping Study Complete • BFO Pre Feasibility Study Complete • Magnetite Scoping Study Complete CASHMERE IRON JORC Resources Resource Description Detrital Hematite >30% Fe* DSO Hematite* BIF >40.0% fe BIF Hematite >20% Fe BIF Magnetite >20% Fe* Resource Description BIF Hematite >20% Fe JORC Classification Indicated Indicated Indicated Measured Indicated Inferred Measured Indicated Inferred Measured & Indicated Inferred JORC Classification Reserves Tonnage Mt Fe % SiO2% Al2O3% 42 5.5 3.7 42 137 13 160 597 65 37.8 58.1 40.27 33.5 32.9 31.3 33.4 32.5 31 33.8 9.39 28.14 48.5 49.3 51.2 48.3 49.4 51.1 6.6 4.92 6.11 0.6 0.6 0.8 0.4 0.5 0.5 982.8 78 33 31.1 48.5 51.1 0.8 0.6 Tonnage Mt Fe % SiO2% Al2O3% 166 33.8 48.1 0.6 *Detrital Hematite requires downstream wet processing similar to the FMG process plants used in the Pilbara *DSO Hematite is a typical Crush and screen lump and fines product *Magnetite requires Wet magnetic separation and is processed using the same methods as Savage River iron and Karara mining Project Location • Mid-West region of Western Australia • 700km North-East of Perth • 180km from Menzies on existing road • Government owned, commercially operated, open access rail from Menzies to Esperance (526km) • Esperance deep water port, open access, multi-user, with advanced expansion plans with development Proponents to be announced Q2 2014 – (Capacity reservation deed signed Dec11) CASHMERE IRON Geology and prospectivity (project area) JORC Resource 1Bt Potential Magnetite target of 8.6Bt Magnetite/ Hematite mineralisation CASHMERE IRON • 201km2 over 5 tenements at Cashmere Downs • 52km outcropping Banded Iron Formation (BIF) identified • Exploration potential of 8.6Bt1 calculated from 37km of the 52km outcropping BIF • +1Bt JORC resource from 7.5km of 52km of BIF • 42Mt Hematite Detrital Iron ‘DSO’ JORC Resource • 5.5 Mt DSO Hematite JORC Resource • 14% of BIF ridges has been drilled to JORC status • • Independent geologist report, (Mackay and Schnellman 2010) Details of the individual categories of the resource are set out on page 9. CASHMERE IRON Developments in last 12 months • Continued discussions and Due Diligence with “YES” consortium • Discussions with State Development • Discussions with Department of Transport • Cost reductions and Efficiency's • Area 8 JORC Resources (inferred) 4.5m/t • Independent Technical Valuation Latest Exploration Results AREA 6 CASHMERE IRON • 3 PARALLEL BIF RIDGES STRIKE NORTHNORTH WEST FOR APPROX 2.5KM EACH GIVING A TOTAL OF 7.5KM OF BIF AVERAGEING 20 METERES IN WIDTH. • ROCKCHIP SAMPLES A6BIF1-14 WERE TAKEN ALONG THE CENTRAL BIF SEQUENCES. THE ENCOURAGEING RESULTS WERE OBTAINED FROM HEMATITE ENRICHED BANDED IRON AND ALTERED MASSIVE MAGNETITE UNITS. • CONCEPTUAL DSO ORE TONNAGES FROM AREA 6 COULD BE 15 MILLION TONNES. • • • • • • • • • • • ASSAY RESLUTS A6BIF-1 A6BIF-2 A6BIF1-3 A6BIF1-4 A6BIF1-5 A6BIF1-6 A6BIF1-7 A6BIF1-12 A6BIF1-13 A6BIF1-14 CaFe 62.7% CaFe 62.93% CaFE 62.19% CaFE 64.02% CaFe 61.26% CaFe 65.03% CaFe 65.83% CaFe 65.93% CaFe 53.80% CaFe 61.06% DSO economics CAPEX breakdown CASHMERE IRON Mining and Processing model is built around a full Contract mine and crush typical of the current market operators minimising upfront Capital costs FOB Cost fro DSO Hematite Mining Capex 2.5mtpa Capex 5mtpa A$M A$M Mobilisation $1.33 Establishment $1.23 Preliminary site works $5.00 Power supply $1.24 Utilities / water $1.50 Processing Contractor Processing Mobile Plant $2.24 Accommodation $4.80 Road Upgrade $15.20 Rail Haulage $3.84 Total Capital Cost $36.38M Contractor Contract Processing $4.80 $4.80M DSO Stage 1. economics CASHMERE IRON MACA mining Operations using the Proposed DSO modular plant. OPEX FOB 2.5Mtpa Admin $1.00 Mining $7.98 Processing $6.95 Haulage (road & rail) $44.0 Port loading $5.00 Contingency $4.00 TOTAL FOB (ex Royalties) $68.93/t Pipeline To Oakajee CASHMERE IRON Mt Magnet Oakajee Port Yalgoo Cashmere Iron 265km Pipeline to Golden Grove Pump Booster Station 235km Pipeline Golden Grove to Oakajee Port 550mm Diameter Slurry pipeline 650mm Diameter return Water pipeline. 34 Mw Total Power requirement Estimated Transport Cost Mine to Port $5.30 Per Tonne BFO Hematite – economics CASHMERE IRON Cashmere Iron ran a pre-feasibility study into the development of a process that would produce a saleable product from the Hematite cap that spans the Biff ridge system. The outcome was that a process similar in principal to the Magnetite methodology would produce a 65% fe material at a rate of 5mtpa, through a process of Crushing, milling, magnetic separation and filtering. This plant has the option of upgrading the circuit to a full scale Magnetite process once the ore body beneath the cap is exposed thus capitalising on a material that would traditionally be pre-striped and stored as Waste. The operating costs have been developed using pipeline logistics options which significantly reduced the FOB cost. Stage 3 BFO Hematite Summary Process Plant Capex Annualised tonnage FOB cost A$ tonne Revenue Expenditure Earnings (EBITDAR) $1,374.95 M 5 million pa $51.69 $471.00 M p/a $258.00 M p/a $213.00 M p/a Based on Iron Price of US$80.00 tonne and exchange rate of 0.85 Magnetite Process Economics CASHMERE IRON The Magnetite Processing consists of three stage crushing to achieve a >6mm particle size which feeds a 2 stage grinding circuit at this point the material is reduced to =< 35 µm, The plant feed then passes through several stages of magnetic separation and flotation and is finally filtered to give a high grade filter cake product of 68% fe with a >4.5% silica and extremely low contaminant. The final product is held at an optimum 9% moisture content to allow effective material handling process and the loading of a product that attracts a premium price in the market. Stage 4 Magnetite Pipeline Summary Process Plant Capex Annualised tonnage FOB cost A$ tonne Revenue Expenditure Earnings (EBITDAR) $1,413.30 M 10 million pa $47.48 $1,082.35 M p/a $474.81 M p/a $607.54 M p/a Magnetite values Represent Transport to port via pipeline Based on Iron Price of US$80.00 tonne plus 15% bonus for High Grade clean Magnetite ore at an exchange rate of 0.85 CASHMERE IRON