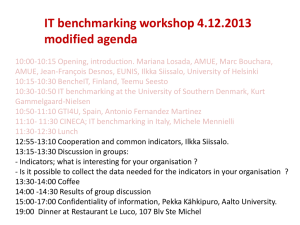

FMV_Physician_Compensation

advertisement

Fair Market Value of Physician Compensation Appraisal Theory and Applications Presented by: Randy Biernat, CPA/ABV 1 Introduction • • • • Assumed Knowledge Level Types of Arrangements to be Discussed Detail Level of Presentation Disclaimer 2 Healthcare Market Overview • Consolidation • Integration • Healthcare Reform 3 Hospital-Physician Arrangements • Common Hospital Motivations • • • • • • • Create or Expand Access to Services Continuity/Coordination of Care Market Share / ACO Positioning Enhance Patient Experience Achieve Efficiencies Expanded Clinical Expertise / Branding EMTALA or Other Compliance Requirements 4 Hospital-Physician Arrangements • Common Physician Motivations • • • • • • • Opportunity for Profit / Income Stability Control or a Voice in Decision Making ACO Positioning Access to Capital Market Positioning Co-Branding Personal Prestige 5 Arrangements Discussed Today • • • • Medical Direction Call Coverage Professional Service Arrangements (Leases) Co-management Arrangements 6 Appraisal Overview 1. Determine and Document FMV Requirements, including Jurisdictional Exceptions 2. Identify Parties to Agreement 3. Document Purpose of Arrangement 4. Identify Method of Compensation 5. Consider and Select Valuation Methodology 6. Evaluate Transaction from the Perspective of Each Party. 7 Appraisal Overview 7. Reconcile FMV Findings 8. Provide Conclusion of FMV Range of Compensation The availability of information may limit the appraiser’s ability to complete each of the above steps 8 Information Required • Term Sheet / Draft Contract • Written Summary of Benefits accrued to Facility • Representations on Relevant Facts Related to the Arrangement • Financial Impact of Arrangement to Both Parties 9 General Guidance • To the extent possible, both parties should sign off jointly on major assumptions • Trade offs in quality, timeliness, and believability will dictate whether or not an appraisal can be delivered • Working closely with qualified counsel will help ensure you are making assumptions and using data consistent with the legal opinion 10 Standard of Value • From R.R. 59-60 to “Healthcare FMV” • Entity to Compensation Valuation • Implications to Appraisers 11 Fair Market Value (R.R. 59-60) The typical standard of value is classically defined by Revenue Ruling 59-60: “The price at which property would change hands between a willing buyer and willing seller, neither party being under any compulsion to buy or sell, and both having reasonable knowledge of all relevant facts, with equity to both.” 12 Fair Market Value (Stark) “…the value in an arm’s length transactions, consistent with the general market value. ‘General market value’ means the price that an asset would bring, as the result of a bona fide bargaining between well-informed buyers and sellers who are not otherwise in a position to generate business for the other party….” (Stark regulations at 42 CFR § 351) 13 Fair Market Value in Management Services Arrangements • Same standard of value as entity valuation • “Ultimately, fair market value is determined based on facts and circumstances. The appropriate method will depend on the nature of the transaction, its location, and other factors.” (Federal Register, Vol. 72, No. 171, CMS, 42 CFR Parts 411 and 424) 14 Implications of Stark Standard of Value • Avoid “investment value” • • • • No consideration of downstream referrals No consideration of hospital rates No consideration of specific economies of scale Limitations on use of opportunity cost • Deal must make sense between purely arms’length players 15 Valuation Methodologies • Survey Benchmarking • Cost Mark-up • Management Company Fee Benchmarking 16 Methodologies: Survey Benchmarking Description – Survey benchmarking captures the range of compensation paid for labor and other goods and services in the marketplace. Application – By benchmarking the subject arrangement to market pricing, one can infer fair market value (especially if benchmark data is not referral based). 17 Methodologies: Survey Benchmarking Limitations – Survey data may not capture entity risk and is not available for certain goods and services. Cautions – Careful matching of service type to survey data may call for adjustments to make an appropriate comparison (independent contractor status, etc.). 18 Methodologies: Survey Benchmarking General Guidelines • Compensation commensurate with productivity • Consider isolating clinical and non-clinical sources of income • Be cautious with utilizing compensation per WRVU survey data 19 Methodologies: Survey Benchmarking General Guidelines, cont. • Signing & Retention bonuses • Student loan repayments • Malpractice insurance tail coverage • Outside income • Multiple contractual arrangements 20 Methodologies: Survey Benchmarking Sources of Data • MGMA • Sullivan Cotter • Watson Wyatt • IHS Survey • Many others 21 Methodologies: Cost Mark-up Description – Cost mark-up approaches seek to determine and apply a profit to the costs of the goods and services to be provided on a risk adjusted basis. Application – Discrete cost pools must be determined by type and care must be taken that mark-ups appropriately match services. 22 Methodologies: Cost Mark-up Limitations – Ascribing value to costs may create an incentive to increase costs and the methodology may fail to recognize the value of efficiencies. Cautions – Markups should be applied to discrete pools of costs to avoid double dipping. 23 Methodologies: Cost Mark-up Guidelines • What is really being received by the purchaser? • Confusing cost of capital and acceptable rate of return • Adjusting for risk 24 Methodologies: Cost Mark-up Sources of Data • Publicly-traded companies • Private transaction data • Freestanding surveys, such as MGMA’s ASC Survey • Risk Management Association 25 Methodologies: Management Fee Benchmarking Description – A percentage of facility revenues is used for a fee to be paid for a contractual bundle of goods and services. Application – A determination is made that the services under consideration for FMV has a sufficient match to market data that a pricing inference can be drawn and relied upon. 26 Methodologies: Management Fee Benchmarking Limitations – Benchmark data is typically unclear as to what goods and services are included in an arrangement, which can create matching issues. Cautions – Assumptions utilized in drawing comparisons on rates will need to be reasonable in order to support this approach. 27 Methodologies: Management Fee Benchmarking Guidelines • Traditional management companies typically exclude medical director fees • Not all fees necessarily tie to specific costs • • Base fee – tied to hours worked Incentive fee – based on good results 28 Methodologies: Management Fee Benchmarking Sources of Data • Ancillary business survey data (such as surgery center or imaging center cost data) • Perform survey of management company fees • Private transaction database(s) 29 Comparison of Approaches Primary Method Secondary Method Commercial Reasonableness Survey Benchmarking Yes Yes Yes Cost Mark-up Yes Yes Yes Before & After Analysis No No Yes Management Co. Benchmarking Yes Yes Yes Methodology 30 Framework for Valuation • • • • Medical Direction On-Call Arrangements Professional Services Agreements Co-Management Arrangements 31 Medical Direction Overview • Hospital engages a physician to provide unique clinical insight necessary for hospital operations, accreditation, management, etc. Typical Valuation Methodologies • Survey Benchmarking • Sullivan Cotter, HIS, MGMA, etc. 32 Medical Direction Going One Level Deeper • Look for a good understanding of duties to determine what data should be used • Executive Services versus Traditional Directorships Signs of a Bad Deal • Numerous directorships with apparent overlap • Services provided are unnecessary/undocumented 33 On-Call Arrangements Overview • Hospital engages a physician or physician group to provide guaranteed clinical coverage at its facility(s) Typical Valuation Methodologies • Survey Benchmarking • • Sullivan Cotter MGMA 34 On-Call Arrangements Going One Level Deeper • Unrestricted versus Restricted • Call Burden / Trauma Designation of Facility • Uncompensated Care Signs of a Bad Deal • Services are not exclusive (stacked services) • Services to be provided are unnecessary • Fees are based on clinical opportunity cost 35 Professional Services Agreements Overview • Hospital engages a physician or physician group to provide clinical services on its behalf while physician remains an independent contractor Typical Valuation Methodologies • Survey Benchmarking • Compensation surveys (Sullivan Cotter, MGMA, etc.) • Cost Mark-up 36 Professional Services Agreements Going One Level Deeper • What else is included besides physician services? • Exclusion of Designated Health Services • Use of physician extenders Signs of a Bad Deal • The payment rate is not reconciled properly to services included in the arrangement • Fees based on practice overhead 37 Co-Management Arrangements Overview • Hospital engages a physician-owned entity to provide management services on its behalf for some component of its inpatient or outpatient services Typical Valuation Methodologies • Cost Mark-up (primary) • Survey Benchmarking (primary) • Profit Margin Analysis & Before and After (secondary) 38 Co-Management Arrangements Going One Level Deeper • Breakdown of the Technical Component is Crucial • Consideration of Provider-based Rules • Bona Fide Services Signs of a Bad Deal • Looks like a billing under arrangement • Fees are based entirely on a percentage of revenue 39 Case Studies • Co-management Arrangement • On-call Coverage Arrangement 40 Co-Mgmt. Case Study - Facts • Hospital seeks to align with a group of orthopedic surgeons to develop a Spine Institute (SI). • Hospital believes the development of a SI will greatly increase patient access and improve care coordination with its substantial employed primary care physician group. • Hospital has a not for profit tax status. 41 Co-Mgmt. Case Study - Facts • Hospital believes the involvement of community physicians in the development of its SI is critical to the clinical success of the program and in its marketing efforts to the community. • Therefore, Hospital proposes a comanagement arrangement with a small group of spine surgeons. 42 Co-Mgmt. Case Study – Facts • Hospital proposes the Management Company to provide the following: – Executive Medical Direction (250 hours per year) – Traditional Medical Direction (Clinical Protocol Development, Implementation, Staff Orientation, Management, Training, Program Development and Community Outreach (400 hours per year) – Non-Physician Executive Director 43 Co-Mgmt. Case Study – FMV Analysis Survey Method Executive Administrative M.D. Hours Executive Administrative M.D. Hourly Rate Total Executive M.D. Compensation 250 300 75,000 Traditional Administrative M.D. Hours Traditional Administrative M.D. Hourly Rate Total Administrative M.D. Compensation 400 175 70,000 Non-Physician Service Line Director Total Management Company Compensation 155,000 $ 300,000 44 Co-Mgmt. Case Study – FMV Analysis Mark-up Method Allocated M.D. Cost (650 hours @ $200) Executive Director Cost Labor Cost Pool FMV Labor Mark-up Factor (35% gross margin) Total Management Company Compensation 130,000 130,000 260,000 1.54 400,000 Mgmt Co. Profit Gross Profit Margin 140,000 35% 45 Co-Mgmt. Case Study – FMV Analysis Management Company Benchmarking Management Fee as a % of Normalized Revenue Pricing for Non-MD Management Companies Private Transaction Database Pricing 4.5% 2.5% - 6.5% 3.5% - 8.5% 46 Co-Mgmt. Case Study – Conclusion Summary of FMV Results Proposed Compensation $ 400,000 or 4.5% of collections Survey Method 300,000 consistent with FMV Mark-up Method 400,000 consistent with FMV 2.5% - 8.5% consistent with FMV Mgmt Co. Fee Benchmarking Overall Arrangement is Fair Market Value 47 On-Call Coverage Case Study – Facts • Hospital has an identified need to provide more consistent general surgery trauma coverage as its recent ER expansion has yielded more acute cases than anticipated. • Hospital does not employ any general surgeons trained to treat trauma cases and cannot otherwise convince qualified surgeons to volunteer to provider necessary coverage. 48 On-Call Coverage Case Study – Facts • Hospital believes the engagement of qualified trauma surgeons will improve patient outcomes and enhance its reputation in the community. • Therefore, hospital agrees to pay a pool of five local general surgeons qualified in trauma surgery a fair market value rate for 24/7/365 coverage of its emergency department. 49 On-Call Coverage Case Study - Facts • Hospital proposes the physicians to provide the following services: – Unrestricted (“beeper”) call with a phone response time of 10 minutes and on-site consultation within 30 minutes, as necessary, and a named back-up – Other terms include a penalty for failure to respond, a fmv re-evaluation provision, an evergreen clause, a statement of the physicians’ right to bill for services rendered while on call, etc. 50 On-Call Case Study – FMV Analysis Facts and Circumstances Matrix Applicable Facts FMV Impact M.D. Supply and Demand Area has limited trauma surgeons ↑ Frequency of Call Low call volume expected in yr. 1 ↓ Expected to be low ↑ ED has poor payor mix ↑ Currently applying for level two status -- 1 in 5 -- Hospital is in a high crime urban area ↑ Category Use of Backup Payor Mix of Patient Seen Facility Trauma Designation Depth of Call Rotation Other Facts 51 On-Call Case Study – FMV Analysis Survey Method Trauma Surgery Daily Rate Market Method Local Market Deal A Local Market Deal B Regional Market Deal C 25th $ 575 Rate $ 600 $ 800 $ 1,100 50th $ 950 75th $ 1,200 Facts and Circumstances Comparison similar in scope and intensity Subject agmt is less intense Subject agmt is less intense 52 On-Call Case Study – FMV Analysis Synthesis of Methods Published Survey Data Low High $ 500 - $ 1,000 Proposed Daily Rate $ 650 Overall Arrangement is Fair Market Value 53 Questions & Answers Contact Information Randy Biernat, CPA/ABV BKD, LLP Direct: 317-383-4271 Email: rbiernat@bkd.com 54