HowToDealWithPayerRecoupmentIssues

advertisement

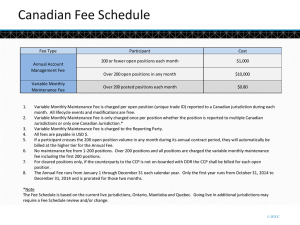

Can They Really Do That? Top 5 Questions Posed to the Health Systems Committee • #1 – Can insurance plans have different fee schedules for different types of providers? • #2 – Can insurance plans sell my participating provider contract without my notification? • #3 – Can insurance plans outsource or exclude me from performing certain procedures allowed by my scope of practice? Top 5 Questions Posed to the Health Systems Committee • #4 – Can insurance plans ask for money back on previous paid claims, and if you don’t comply, can they take money out of a future claim payment? • #5 – How can I fight back? Strategy Basics • Research the issue – understand the scope of the problem and avoid jumping to conclusions • Determine your legal rights with regard to the issue • Working with the plan – develop a strategy that appeals to what plans care about • Communicate with the correct people at the plan • If you escalate to policymakers, cast the issue in terms of public policy #1 – Different Fee Schedules? The Basics: What Law Applies and Who Regulates the Plan? 59.3 60 50 40 30 Government Direct Purchase 27.8 Not Covered Employer Based 20 10 0 15.3 9.1 #1 – Can Insurance Plans Have Different Fee Schedules for Different Types of Providers? • Applicable Laws – Medicaid – State/Federal – Medicare – Federal – Military – Federal – Direct Purchase – State – Uninsured – State #1 – Different Fee Schedules? • Employer Plans – ERISA – Insured are regulated by state and federal law – if it is in the insurance code, it probably applies – Self-insured are regulated by federal law 100% 80% 55 60% 40% 20% Self Insured Insured 45 0% 1st Qtr #1 – Different Fee Schedules? • What to Know and Do About Employer Sponsored Plans – In firms with 5,000 or more employees, 89% of workers were covered by self-insured arrangements in 2006 – Does the insurance card have the employer logo? – Call the plan administrator – Always pre-certify your patients so you know the “paying" field #1 – Different Fee Schedules? • What If I Don’t Like the Fee Schedule? – Renegotiate your contract – See chapter 2 in the Private Insurance Resource Guide (PIRG) – Evaluate your current office profit/loss ratio for the particular insurance plan • Survive without it • Need it to survive #2 – “Sell” My Contract ? • Yes, look at the original contract for language such as “deemed” provider or the definition of payer • Very common if you signed up with multiple PPO contracts in the late 80s or early 90s that have merged over the years (Ex. Multiplan) • A review of your state laws may be help #3 - Exclude Me from Certain Procedures? • Review your contract thoroughly – Example: Orthonet • Definition of experimental or investigational – Insurance plans typically exclude coverage for services that are “experimental, investigational and/or unproven.” – Confusion sometimes arises because plans may be imprecise in how they categorize denials based on such exclusions. • Within the range of covered services, private plans typically cover only items and services that are medically necessary and appropriate. #4 - Ask for Money Back? • Review the insurance company’s specific claim that states you owe them money – if not, ask for additional information. • Review your contract to see what your rights are for these type of claims – Did they reserve the right to do recoupments? – Do they have the right to offset the amount against future payments? – Is there an appeal mechanism specified, and if so, does it include timelines? #4 - Ask for Money Back? • Recoupment Reasons – Overpayment – Retroactive denial – Individual was not eligible – Service was not covered – Miscoordination of benefits – it was subsequently determined that another payer was responsible #4 - Ask for Money Back? • More Recoupment Reasons – If the recoupment is due to the beneficiary not being “eligible” for coverage, you can bill the beneficiary. – If the recoupment is the result of a payer coordination issue, is it timely enough that you can receive the funds from the other payer? – Does the recoupment affect the amount you should have received as patient cost sharing? #4 - Ask for Money Back? • If there is an available appeal process, file an appeal – Write a detailed appeal letter about the claim in question. – Cite any contractual provisions and laws that you believe are violated by the recoupment. – If the recoupment changes the amount you should have collected in cost sharing, note your intent to collect the additional funds. #4 - Ask for Money Back? • Appeal Process – continued – Call the plan and ask to discuss the issue with either the head of claims or provider relations. – Using a multi-pronged approach to increase the chances that your concerns will reach someone who cares and someone in a position to address the situation. – Keep records of your correspondence and the people you talk to. #4 - Ask for Money Back? • Applicable laws regulating recoupments – Determine what law is applicable (e.g., federal, state, program-specific law). – Laws regarding retroactive denials and other recoupments are frequently found in the section of the state code that sets forth prompt-payment laws, laws concerning unfair (or fair) insurance practices, or claims settlement rules. #5 - How Can I Fight Back? • Review chapters of PIRG regarding appeals process-different for ERISA vs. Non-ERISA plans • Review and know your state laws - Chapter 9 • Review and utilize sample letters - Chapter 12 Visit http://www.apma.org/privateguide #5 - How Can I Fight Back? • Contact the agency in charge of enforcing the relevant law if no agreement is reached – Provide concise facts regarding the issue – Provide history of your efforts to resolve it – To the extent possible, cast the issue in terms of public policy #5 - How Can I Fight Back? • Issues commonly addressed by the law – Prohibition on retroactive denials for preauthorized services – Timelines for recoupments or retroactive denials – The information that a health plan must furnish if it requests a recoupment – Whether an offset is allowed and/or whether an appeal must be allowed – In general, if the applicable law offers more protection than appears in the contract, the law will apply #5 - How Can I Fight Back? • Sponsor Legislation – In 2009, APMA’s State Advocacy Committee and Health Systems Committee initiated the Model Law Project to protect podiatric physicians and surgeons from discriminatory and unreasonable practices by payers. – Next Model Law Project: Retroactive Recoupment Model Law – This model law is intended to address deficiencies in state law that allow payers to recoup payment in an unreasonable manner. – A model retroactive recoupment law will be available later this. Model Legislation • Model Fee Parity Project – Section One: Understanding Fee Discrimination Laws. – Section Two: Obtaining Enforcement of Existing Law – Section Three: Introducing Fee Parity Legislation – Section Four: Resources for State Advocates – Available at: www.apma.org/modellaws Model Legislation • Model Anti-Fee Discrimination and Fee Parity Act – Payment may be based on several factors including market power, geographic location, or need to include a physician specialty – Model Law prohibits fee discrimination when the difference in amount of payment is based solely on the fact that the physician is a DPM rather than an MD or DO. Questions?