Monetary Policy Part 1

advertisement

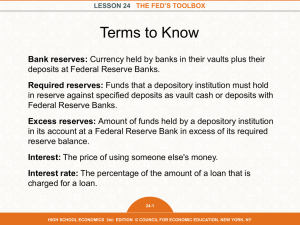

CHAPTER 15 MONETARY POLICY Overview and Tool #1 Monetary Policy Consists of: Deliberate change in the money supply to influence interest rates and thus the total level of spending in the economy. The Goals of Monetary Policy Maintain Price-level stability (control inflation) Full employment Economic Growth The Balance Sheet of the Federal Reserve Chapter 15 focuses on the following two components of the Balance Sheet: Assets Liabilities Assets of the Federal Reserve Securities (Government Bonds) Treasury Bills (Short-term)- Treasury Notes (Mid-term) Maturing in 1-10 years Treasury Bonds (Long-term) maturing in less than 1 year Maturing in more than 10 years Loans to Commercial Banks Federal Reserve Securities Bought from the Treasury Acquired from Commercial Banks and the Public Mainly bought and sold to influence the size of Commercial Bank reserves and therefore, the ability of banks to create money by lending. Loans to Commercial Banks Commercial Banks occasionally borrow from the Federal Reserve. This is an Asset for the Fed and a Liability for the Commercial Bank. By borrowing in this way, Commercial Banks increase their reserves. Liabilities of the Federal Reserve Reserves Treasury Deposits Federal Reserve Notes Reserves of Commercial Banks Commercial Banks are required to hold reserves, and these reserves are held by the Federal Reserve Banks. This is a liability for the Fed and an Asset to the Commercial Bank Treasury Deposits of the Federal The U.S. Treasury keeps its deposits in the Federal Reserve Banks and writes checks to pay its obligations. These treasury deposits are Assets to the Treasury and Liabilities to the Federal Reserve Banks Treasury deposits are replenished by depositing tax receipts and money borrowed from the public or from Commercial Banks through the sale of Bonds. Federal Reserve Notes Consists of the supply of paper money in circulation. It constitutes claims against the assets of the Federal Reserve Banks. The Fed thus treats these notes as a Liability Monetary Policy Goal: To understand how the Fed can influence the money creating abilities of the Commercial Banking System Tools of Monetary Policy The Fed has three tools of Monetary Control that it can use to alter the reserves of Commercial Banks: Open-Market Operations The Reserve Ratio The Discount Rate 1st Tool: Open-Market Operations Buying Government Bonds from Commercial Banks and the general public. Selling Government Bonds to Commercial Banks and the general public. The Fed’s most important instrument for influencing the money supply. Open-Market Operations: Buying Securities When the Fed Buys Securities (from Commercial Banks or the Public) the reserves of the Commercial Banks will increase. Open-Market Operations: Buying Securities The Fed buying Securities from Commercial Banks: Commercial Bank gives up Government Bonds to the Fed. Fed pays for those Bonds and thus increases the reserves of the Commercial Bank by the amount of the purchase. This increases the Lending Ability of the Commercial Banks Open-Market Operations: Buying Securities The Fed buying Securities from the Public: Impact on the Commercial Bank reserves is much the same as when the Fed buys from the Commercial Bank. Increases the reserves of the Commercial Bank, therefore lending ability of the Commercial Bank increases. Example: Company owns Government Bonds Company sales Bonds to the Federal Reserve Company gets check drawn on the Federal Reserve Bank Company deposits the check in its own Commercial Bank Commercial Bank sends check to Federal Reserve for collection and receives the funds from the Federal Reserve Banks Reserves have increased Open-Market Operations: Buying Securities When the Fed purchases government bonds from the public, the supply of money is increased directly, because of an increased amount of “checkable” deposits in the economy. This also increases the Lending ability of the Commercial Banking System Open-Market Operations: Buying Securities When the Fed purchases securities from Commercial Banks, it increases the actual reserves and the excess reserves of Commercial Banks by the entire amount of the Bond purchase. When the Fed purchases Bonds from the public, it increases actual reserves but also increases checkable deposits when the seller places the Fed’s check into their personal checking account. Example: Purchase from Public Fed purchases a $1000 bond from the public Increases checkable deposits by $1000, and hence, the actual reserves of the banking system Assume a 20% reserve ratio The excess reserves would be $800 $200 would have to be held as reserves Key Points: When the Federal Reserve Banks buy securities in the Open-Market, Commercial Banks reserves are increased. When banks lend out their excess reserves, the nation’s money supply will rise. When the Fed buys $1000 bond, this results in $5000 in additional money whether purchased from commercial bank or the public. FEDERAL RESERVE PURCHASE OF BONDS Purchase of a $1000 bond from a bank... New reserves $800 Excess Reserves $4000 Bank System Lending $200 Required reserves $1000 Initial Deposit Total Increase in Money Supply ($5000) Open-Market Operations: Fed Selling Securities Selling Securities to Commercial Banks Selling Securities to the Public Open-Market Operations: Fed Selling Securities Selling to Commercial Banks Fed gives up securities The commercial banks acquire the securities Commercial bank pays for the securities with checks drawn against their deposits (their reserves held by Federal Reserve Banks) Fed “collects” those checks by reducing the commercial banks reserves Open-Market Operations: Fed Selling Securities Selling securities to the public: Consider a company that wants to buy a government bond. The company buys the bond from the Fed and pays with a check drawn on its commercial bank account. The Fed clears this check by reducing the commercial bank’s reserves The commercial bank returns the canceled check to the company, the company’s checkable deposit is reduced. Open-Market Operations: Summary The sale of $1000 bond to a commercial bank reduces the system’s actual and excess reserves by $1000. Fed’s sale of $1000 to the public, reduces bank’s excess reserves by $800 because checkable-deposit money is reduced by $1000 - - The commercial bank deposits are reduced by $1000. Hence, the bank has to keep $200 less in reserves (assuming 20% reserve ratio). Key Points: When the Federal Reserve Bank sells securities in the Open-Market, commercial bank reserves are reduced. If all excess reserves are already lent out, this decline in commercial bank reserves produces a decline in the nation’s money supply. Key Points: What makes commercial banks or the public want to buy government securities? Price of the bond and their interest rate When the Fed buys bonds, the demand for them increases (bond price goes up), and interest rate on the bond declines High bond prices and low interest rates prompt banks and individuals to sell the bonds. Conversely: When the Fed sales bonds, results in lower bond prices and higher interest rates.