Presentation

advertisement

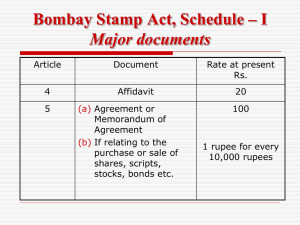

C.J.S NANDA CHARTERED ACCOUNTANT BUDGET AT GLANCE A lot has happened since the new government has taken charge and understandably, expectations are getting built-up in the run-up to the budget. The reform measures undertaken so far are nothing less than transformational. One has to only look at the gamut of sectors touched by the government initiatives to get an idea of the potential cascading impact the steps can have on our economy. FACESAVER AT CLOSE • Volatility kept the market company on budget day as investors frowned upon the absence of "big-bang" measures but gave a token thumbs-up to the proposed cut in corporate tax and the deferral of the dreaded General Anti-Avoidance Rules (GAAR). • The upshot was the BSE sensex ended the day with a gain of 141.38 points after a roller-coaster ride - the first rise on a budget day in four years.The benchmark index opened on a promising note at 29411.33 and made steady gains as the finance minister talked about implementing the goods and services tax from April 2016. • The stocks then softened as the budget speech spoke of several social initiatives and the fiscal deficit road map. • The markets whooped as the finance minister announced a staggered cut in corporate taxes to 25 per cent although the fine print suggested that the effective gains need not be as high as initially expected. • The deferment of the GAAR by two years took the 30-share index to the day's peak of 29560.32 - a gain of 340 points. However, the joy was short-lived and stocks came back to negative territory as Jaitley finished his budget speech. • Although it saw an abrupt drop of more than 200 points at one stage, the index managed to recover the ground lost since this morning. • The reason behind the drop during intra-day trades was the hike in excise duties on cigarettes. The shares of the cigarette major ITC, which have a huge weightage in the sensex, tanked by 8.27 per cent after the budget raised excise duties by 25 per cent on cigarettes up to 65mm in length. MARKET REFORMS • Propose to merge commodities regulator with SEBI • To bring a new bankruptcy code • To set up public debt management agency • Proposes to introduce a public contract resolution of disputes bill • To establish an autonomous bank board bureau to improve management of public sector banks POLICY REFORMS • To enact a comprehensive new law on black money • Propose to create a universal social security system for all Indians • To launch a national skills mission soon to enhance employability of rural youth • To raise visa-on-arrival facility to 150 countries from 43 • Allocates 346.99 billion rupees for rural employment guarantee scheme • Raises threshold for application of transfer pricing rules to 200 million rupees from current 50 million rupees MARKET REACTION • BSE index gains 0.48 percent; NSE index up 0.65 percent • ITC slumps after budget hikes excise duty on cigarette STOCKS NEGATIVELY IMPACTED • Media companies: Companies in the media space could be affected by the change in service tax rules. Now, the entertainment sector would be brought under the service tax net. Earlier, these services were exempted from service tax. The tax would push up prices of services like theatre tickets or cable television. As a result, it could discourage customers and affect demand. • Metal and mining stocks: The Budget announced two measures that could directly impact metals and mining companies, the increase in clean energy cess on coal to Rs 200/tonne from Rs 100/tonne, and the hike in basic custom duty on metallurgical coke to 5% from 2.5% earlier. Coal and metallurgical coke are key raw materials. The increase in clean energy cess on coal could also impact power companies like NTPC, Tata Power and CESC, which depend on coal to produce energy. However, the impact would be limited. • PSU banks: The Budget announced that the government will infuse Rs 7940 crore in PSU banks in the next fiscal. “However, this is a meager amount in comparison with the humongous capital requirements by the PSU banks over next few years to meet BASEL III norms,” a report by Kotak Securities said. This is why the Budget has negative impact on the banks mentioned above • Tobacco Companies: The government usually reduces taxes for essential goods and increases tax burden on goods which are not essential and/or harmful. One such product which sees high taxation is cigarettes. The Budget further increased tax burden by hiking excise duty in certain cigarette products by 25% and 15%. This would make your cigarettes costlier from April 2015. Any rise in price negatively impacts demand and thus corporate profits. • Consumer durables: The consumer durables company is in the plastic product-making business. The government wants to deter plastic consumption to reduce its harmful effects on the environment. For this reason, the Budget increased excise duty from 12% to 18% on plastic products (polymers). This would make plastic products costly. BORROWING • Gross market borrowing seen at 6 trillion rupees • Net market borrowing seen at 4.56 trillion rupees TAXATION • To abolish wealth tax • Replaces wealth tax with additional 2 pct surcharge on super rich • Proposes to cut to 25 percent corporate tax over next four years • Corporate tax of 30 percent is uncompetitive • Net gain from tax proposals seen at 150.68 billion rupees • Extends withholding tax concession on foreign debt purchases by two years • Expects to implement goods and services tax by April 2016 • To reduce custom duty on 22 items • Basic custom duty on commercial vehicle doubled to 20 percent • Proposes to increase service tax rate and education cess to 14 percent from 12.36 percent PERSONAL INCOME TAX • No revision of income tax brackets • Limit of deduction of health insurance premium increased to 25,000 rupees from 15,000 rupees; limit increased to 30,000 rupees from 20,000 rupees for the elderly • People aged above 80 and not covered by health insurance to be allowed deduction of 30,000 rupees for medical expenses • Additional deduction of 25,000 rupees for the disabled • Limit on deduction for contributions to pension fund and new pension scheme increased to 150,000 rupees from 100,000 rupees • Additional deduction of 50,000 rupees for contribution to new pension scheme under section 80CCD • Monthly transport allowance exemption doubled to 1,600 rupees • Plans to introduce direct tax regime that is internationally competitive on rates without exemptions • Exemptions for individual tax payers to continue • To enact tough penalties for tax evasion in new bill • Tax dept to clarify indirect transfer of assets and dividend paid by foreign firms INFRASTRUCTURE • Investment in infrastructure will go up by 700 bln rupees in 2015/16 over last year • Plans to set up national investment infrastructure fund • Proposes tax-free infrastructure bonds for projects in roads, rail and irrigation projects • Proposes 5 "ultra mega" power projects for 4,000 MW each • Second unit of Kudankulam nuclear power station to be commissioned • Ports in public sector will be encouraged to corporatize under Companies Act INVESTMENT • Government to provide 79.4 billion rupees capital infusion to state-run banks • Propose to do away with different types of foreign investment caps and replace them with composite caps • To allow foreign investment in alternative investment funds • Public investment needed to catalyse investment SUBSIDIES • • • • Food subsidy seen at 1.24 trillion rupees Fertiliser subsidy seen at 729.69 billion rupees Fuel subsidy seen at 300 billion rupees Major subsidies estimated at 2.27 trillion rupees CIGRATTES • Raises excise duty on cigarettes by 25 percent for cigarettes of length not exceeding 65 mm • Raises excise duty by 15 percent for cigarettes of other lengths GOLD • To launch gold deposit accounts and sovereign bond • Import duty stays at 10 percent; disappoints jewelers • To work on Indian-made gold coin to cut imports INFLATION • Expects consumer inflation to remain close to 5 percent by March, opening room for more monetary policy easing • Monetary policy framework agreement with the RBI clearly states objective of keeping inflation below 6 percent • One of the achievements of my government has been to conquer inflation. This decline in my view represents a structural shift