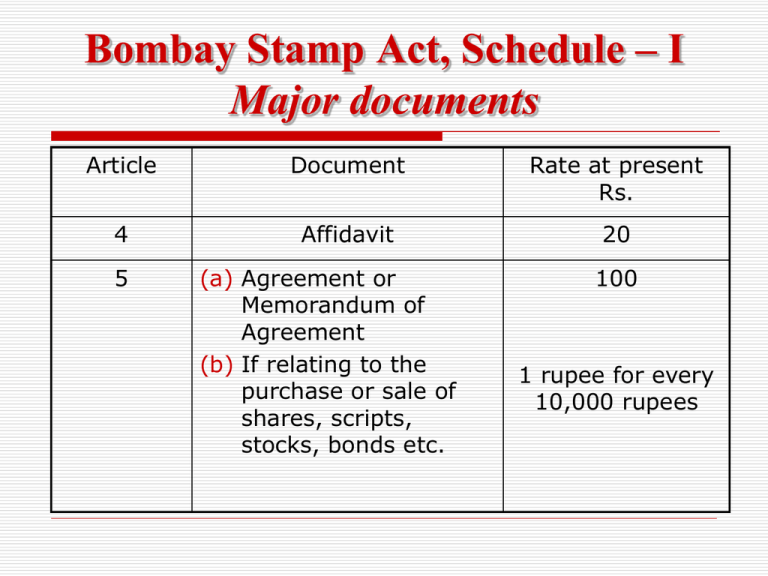

Bombay Stamp Act, Schedule – I Major documents

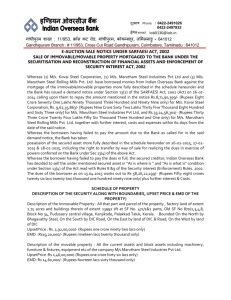

advertisement

Bombay Stamp Act, Schedule – I Major documents Article Document Rate at present Rs. 4 Affidavit 20 5 (a) Agreement or Memorandum of Agreement (b) If relating to the purchase or sale of shares, scripts, stocks, bonds etc. 100 1 rupee for every 10,000 rupees Bombay Stamp Act, Schedule – I Major documents 6 Agreement or (a) Loan amount up to 10 Memorandum of Cr., 0.25 paisa for Agreement every hundred rupees relating to Deposit or part thereof i.e. of Title Deeds, Maximum goes up to Pawn, Pledge or Rs. 2.50 lacs Hypothecation (If repayable not more than three months, half the duty under sub. (a) or (b), as the case may be.) (b) Loan amount above 10 Cr. Subject to maximum of Rs. 8 Lacs, 0.50 paisa for every hundred rupees or part thereof Bombay Stamp Act, Schedule – I Major documents 11 12 Apprenticeship Deed 100 Articles of Association of Company having Share Capital Subject to maximum of Rs. 5 Lacs, 0.50 paisa for every hundred rupees Bombay Stamp Act, Schedule – I Major documents 14 Bond (a) Loan amount up to 10 Cr., 0.25 paisa for every hundred rupees. (b) Loan amount above 10 Cr. Subject to maximum of Rs. 8 Lacs, 0.50 paisa for every hundred rupees or part thereof Bombay Stamp Act, Schedule – I Major documents 18 Certificate or other documents 20 Conveyance 1 rupee for every 1 thousand rupees or part thereof of the value(incl. premium)of the share, scrip or stock. (a) Immovable property 3.50% plus 40% surcharge so, overall 4.90% (b) Movable property 2% Bombay Stamp Act, Schedule – I Major documents (c) Amalgamation / Demerger / Reconstruction order (max. Rs. 25 Cr) 1% of true market value of Immovable property 1% of value shares to be issued as a result of Amalgamation (If listed, price on Stock Exchange is taken as base otherwise face value of shares to be taken) Bombay Stamp Act, Schedule – I Major documents 23 Custom Bond or Excise Bond Rs. 100 28 Gift Stamp duty as on conveyance as per Article-20 30 Lease Various rates starting from 1% to 3.50% depending upon the period of Lease and average annual rent payable Bombay Stamp Act, Schedule – I Major documents 35 Memorandum of Association Rs. 100 36 Mortgage Deed (a) Loan amount up to 10 Cr., 0.25 paisa for every hundred rupees. (b) Loan amount above 10 Cr. Subject to maximum of Rs. 8 Lacs, 0.50 paisa for every hundred rupees + 40% Surcharge on both (a) and (b) (0.35%) (0.70%) Bombay Stamp Act, Schedule – I Major documents 44 Partnership Deed Subject to maximum 10,000 Rs., 1 rupee for every hundred rupees of partnership capital 45 Power of Attorney 100 Rs. 58 Trust 100 Rs. Indian Stamp Act, Schedule – I Major documents 27 Debenture (whether a mortgage debenture or 0.05% per not) being marketable security transferable – year of the face value (a) by endorsement or by a separate of the instrument of transfer debenture, (b) by delivery subject to maximum Exemption: of 0.25% A debenture in terms of registered mortgage or deed duly stamped in respect of the full Rs. 25 amount of debentures to be issued there Lacs under, whereby the Company or body whichever borrowing makes over, in whole or in part, is lower their property to trustees for the benefit of the debenture holders. Indian Stamp Act, Schedule – I Major documents 52 Proxy empowering a person to vote at the meeting of members 62 Transfer Fifteen paise (a) of Shares in an incorporated Twenty five paise Company or other body for every corporate hundred rupees or part thereof the value of the Shares (b) of Debentures One half of the duty payable on a conveyance