Global

advertisement

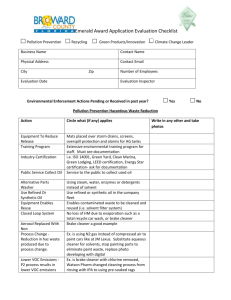

SUSTAINABILITY, PART 2 SO WHAT DO WE DO NOW? Dr. Ron Lembke WHAT IS “SUSTAINABILIT Y?” The ability to keep doing something for the indefinite future If it’s not profitable, it’s not sustainable What allows a company to survive? Meeting customer demands Developing new products Keeping costs low DIFFERENT METRICS Dimensions of Environmental Sustainability: Carbon: energy burned by us, by our suppliers Water: water used The Carbon Paper and corrugated used Solid waste generated Footprint of Costs and Revenues: Lower electricity, gas and water bills Lower garbage hauling costs Better public relations a plastic bag is 1/1000 that of the food in it! How much do customers care? If it makes them feel closer, there’s likely monetary value? How much is your competition doing? Watch out for GREENWASHING!!!! Trivial gestures: attention misdirection – ski passes, plastic bags MORE EFFICIENT CARS Aka Suzuki Swift, Cultus EPA 55/60 mpg 2011 EPA MILEAGE CHAMP TOYOTA PRIUS MRSP $23,810 Hybrid MPG Gas Fuel/yr Fuel/mo Fuel Price / gallon 33 454.5 $1,591 $133 $3.50 Regular Hybrid MPG 26 33 Gas 576.9 454.5 Cost $2,019 $1,591 $ saved $428 % fuel reduction 21% Base MSRP 20,580 Breakeven years Fuel Price / gallon 27,435 16.0 $3.50 Jan 17, 2011 Oct 17, 2010 Jul 17, 2010 Apr 17, 2010 Jan 17, 2010 Oct 17, 2009 Jul 17, 2009 Apr 17, 2009 Jan 17, 2009 Oct 17, 2008 Jul 17, 2008 Apr 17, 2008 Jan 17, 2008 Oct 17, 2007 Jul 17, 2007 4 Apr 17, 2007 Jan 17, 2007 Oct 17, 2006 Jul 17, 2006 Apr 17, 2006 Jan 17, 2006 Oct 17, 2005 Jul 17, 2005 Apr 17, 2005 Jan 17, 2005 4.5 Avg US Retail Gas Price CAMRY HYBRID 3.5 3 2.5 2 1.5 1 0.5 0 GREEN SUVS? ISN’T THAT AN OXYMORON? Regular Hybrid MPG 17 21 Gas 882.4 714.3 Cost $3,088 $2,500 $ saved $588 % fuel reduction 19% Base MSRP 42,580 Breakeven years Fuel Price / gallon 54,490 20.2 $3.50 2011 MSRP Info from cars.com Regular Hybrid MPG 14 21 Gas 1071.4 714.3 Cost $3,750 $2,500 $ saved $1,250 % fuel reduction 33% Base MSRP 32,515 Breakeven years Fuel Price / gallon 38,340 4.7 $3.50 HOW HAVE WE FIXED THINGS BEFORE? IF CARS ARE THE PROBLEM… LET’S GO BACK TO HORSES! Feeding: 1.4 tons of oats, 2.4 tons of hay per year 5 acres per horse 15 million acres: West Virginia 1 ,000 lb horse: 50 lbs/day, 10 tons/year, quart of urine “Crossing Sweepers” 1898 first urban planning conference: horse manure 1894 Times of London: 9ft deep by 1950 Conference quit after 3 days, not 10 Henry Ford saved us? DDT DichloroDiphenylTrichloroe thane Mosquitoes-malaria Lice-typhus Nobel Prize, 1948 Rachel Carson Silent Spring, 1962 EDF, 1964 Banned, 1972 Granny’s garage, 2005 OZONE HOLE Return to 1980 levels by 2068 Photo: NASA http://www.nasa.gov/vision/earth/lookingatearth/ozone_record.html CFCS Chlorofluorocarbons Break down, release chlorine Chlorine destroys ozone UV rays reach Earth’s surface CFCs banned- Montreal Protocol, 1986 LEADED GAS 1930s: Octane in 30s Add Lead: 87! Protected Valve seats Catalytic converter problems 1996 banned US $10,000 fine , Feb 2, 1962 ad in Life magazine Humble merged with Standard to become Exxon SO WHO IS GOING TO DO SOMETHING? CAP AND TRADE VS CARBON TAX Cap and Trade Amount of carbon is fixed, costs to companies are known Complicated: Permits are issued, based on past emissions, go down each year If you reduce emissions and don’t need them all, sell them If you don’t want to reduce, buy more from somebody else Carbon Tax Price is fixed each year, amount of carbon varies Costs are known, it’s simpler, but it’s (gasp) a “TAX!” Martin Feldstein, Reagan’s chief economic advisor – 20 years Almost replaced Greenspan, but on board of AIG Monies Raised help people af fected by Climate Change ACID RAIN Sulfur Dioxide SO2 and nitrogen oxides NOx react 1990 Clean Air Act US coal plants cut sulfur emissions in half Permits issued, reduce or trade Emissions monitored THE PRICE OF CARBON (and everything else) Markets need a price signal Right now, it’s an “Externality.” You can’t MANAGE what you don’t _______? And by the way, who testified before Congress in FAVOR of cap and trade? CAP AND TRADE IS DEAD American Clean Energy and Security Act Waxman-Markey Passed house 219-212 6/29/09 Died in Senate Environmentalists divided: Too weak Fuel MPG targets too low Restricted EPA’s ability to regulate CO 2 If the politicians won’t save us… who will? SO WHO IS DOING ANYTHING? THE SEC? Risks to a company must be disclosed Guidance about reporting Climate -change related risks 2008 E&Y study listed climate change as #1 threat to insurance industry MAYBE WAL-MART WILL? 65% improvement fleet efficiency 2010 vs ‘05 Power Units – idling Truck skirts 2010 – 57m more cases, 49m fewer miles Better load planning 7,600 cars off the road World’s Largest Company $419b ending Jan, 2010 Told Congress to pass Cap and Trade No fish left to sell? Largest organic cotton buyer, overnight. CERTIFICATION EFFORTS Seafood Paper Wood SUSTAINABILIT Y INDEX 1 . 15 questions for suppliers, Oct 2009 2. Lifecycle Analysis Database Sustainability Consortium, ASU, U of Arkansas 3. Simple Tool for Customers Maybe rating 1-100 on Carbon Emissions Energy use Water conservation Deforestation Scan QR codes for more info? Nobody wants a red score SUSTAINABILIT Y INDEX? Red, Yellow and Green labels on the shelves? Relative to what? Industry? Other alternative products? Plasma TVs vs. CRTs vs. LEDs vs. OLED Scan barcode or QR code with smartphone? Set up your own criteria I care more about: water usage, child labor, sweatshops, chemical usage, pesticide usage, etc., etc. Using ratings from Earthster? Whatever Walmart wants may become a global standard SUSTAINABILIT Y INITIATIVE Not developing a consumer standard Sustainability Measurement and Reporting Standards What mfg should measure, and how Report to common database Common database used for indices Wait, what? No Index or label? Kicking the can down the road? MAYBE WALL STREET WILL? “Carbon is a financial risk” Single reporting entity 551 Institutional Investors $71 Trillion in assets Launched 2000 Largest 2,500 corporations = 2025% GHG By supply chain, not by country > 50% carbon emissions outside the four walls Maybe 80% 600% expected increase in carbon consulting and software Dan Olson 11/3/11 CDP SUPPLY CHAIN 55 companies “greater realization that carbon management presents a wider cost and revenue opportunity rather than being a pure risk mitigation activity.” 90% members committed to reductions 3.4% annual goals, up from 2.2% Increased insight into baseline emissions Growing expertise regarding reducing their emissions Global 3.9% per year needed for 80% by 2050 ONLY 1/3 of suppliers have targets IMPORTANCE OF CARBON IN SOURCING DECISIONS CARBON FOOTPRINTS CO 2 E The amount of CO 2 that would have the same global warming potential (GWP). CO 2 , by definition has GWP = 1 .0 Gas Lifetime (years) Methane GWP 20yrs GWP 100 yrs GWP 500 yrs 12 72 25 7.6 Nitrous Oxide 114 289 298 153 HFC-23 270 12000 14,800 12,200 14 3,830 1,430 435 3,200 16,300 22,800 32,600 HFC-134a Sulfur hexafluoride IPCC AR4 p. 212 SF 6 - 8,000 tons produced per year 6,000 in electrical industry, inert gas for casting magnesium Inert filling for insulated glazing windows 0.2% of GHG emissions CF PER UNIT + + = Add up total Carbon Footprint of all activities and inputs, divide by the number of units sold PATAGONIA – 15 PRODUCTS CARBON FOOTPRINT AS MULTIPLE OF PRODUCT WEIGHT Product Shoes Shirts Jackets/vests Sweaters/sweatshirts Shorts Bottoms Dresses Luggage Average 40 29.7 23 46.7 8.5 18 46 8 Original data from Patagonia World Resources Institute Gustave Speth, “Bridge at the End of the World” Natural Resources Defense Council World Business Council for Sustainable Development CEO led, 200+ companies Stephan Schmidheiny 1992 Rio Earth Summit “The mission of the GHG Initiative is to develop internationally accepted GHG accounting and reporting standards and tools, and promote their adoption in order to achieve a low emissions economy worldwide” Direct vs. indirect GHG emissions? Direct: sources that are owned or controlled Indirect: result of activities, but at sources owned or controlled by another entity. Scope: 1. 2. 3. Direct GHG emissions GHG from purchased electricity, heat, or steam Extraction and production of purchased materials and fuels, transport-related activities in vehicles not owned or controlled by the reporting entity, electricity -related activities (e.g. T&D losses) not covered in Scope 2, outsourced activities, waste disposal, etc. SCOPE 1,2,3 OLD PICTURE GHG PROTOCOL 2,487 respondents for CDP 85% used GHG Protocol Standard “Often, majority of emissions come from Scope 3 sources, which means many companies have been missing out on significant sources of improvement.” Kraft Foods found 90% from value chain GHG Protocol Factsheet INDIRECT EMISSIONS 2010 VS. 2011 2010 2011 50% outside four walls 80%? 90%? REVISED PICTURE, OCT 2011 Inherent DoubleCounting CORPORATE PERSPECTIVE Supplier Retailer LIFECYCLE ANALYSIS Production Distribution Usage End Of Life DOUBLE BILLING MFG AND RETAILER BOTH RESPONSIBLE Production Distribution Usage MANUFACTURER’S FOOTPRINT RETAILER’S FOOTPRINT EOL EMBODIED CARBON Supplier Retailer Scope 3 supply chain reporting is growing Still lags far behind other scopes SCOPE 3 GUIDELINES Upstream Downstream 1. Purchased Goods and Services 2. Capital Goods 3. Fuel and Energy -Related Activities 4. Upstream Transportation & Distribution 5. Waste Generated in Operations 6. Business Travel 7. Employee Commuting 8. Upstream Leased Assets 9. Downstream Transportation & Distribution 10. Processing of Sold Products 11. Use of Sold Products 12. End-of-life treatment of Sold Products 13. Downstream leased assets 14. Franchises 15. Investments “Guidance for Calculating Scope 3 Emissions,” Aug. 2011 CARBON FOOTPRINT VISIBILIT Y Wal-Mart Sustainability initiative Carbon Trust Labeled £2 billion last year Patagonia Footprint chronicles TESCO (UK) LABELED 500 ITEMS Carbon-label.co.uk Carbon Trust APPLE CARBON FOOTPRINT FRUSTRATION-FREE PACKAGING Easier to open Less materials Ship in same box Cheaper to pack No twist-ties No theft concerns No display concerns WAL-MART WAL-MART “These are not complicated questions, but we have never systematically asked for this kind of information before ” Mike Duke WAL-MART CFLS Sell 100 MILLION CFLS in a year! Save customers $3b in electricity 20 millions metric tons of CO2 Save $40 over life of bulb WAL-MART KID CONNECTION Reduced packaging 497 fewer containers per year $2.4m shipping costs Straight to bottom line 4,000 trees saved 1,000,000 barrels of oil $60m sales needed for that much profit Why didn’t we do this sooner? $2.4 million straight to the bottom line WAL-MART DAIRY Don’t make the farmers to bad guy Look at whole supply chain Grow the crops to feed the cows Methane from the cows and their manure On-site power generation Transport milk to process Process milk into sour cream Haul sour cream to Distribution Centers (DCs) CARBON TRUST Measuring and Reducing GHG WAL-MART 10% of impact is from stores, trucks, etc. 90% of its impact is from the Supply Chain Fortune 1= 900 lb gorilla Take the water out of Tide ¼ the packaging, shipping cost, shelf space 95 million lbs plastic resin saved 400 m gallons of water 125 m lbs cardboard 500,000 gallons of diesel = 11m lbs CO2 WAL-MART LAUNDRY SOAP 128 facings of Tide brand products 13 facings of Coldwater products = 10% of slots NW Reno Wal-Mart, Jan. 2012 TESCO DROPPING ITS LABELS? STATUS OF WAL-MART’S INITIATIVE 2005 – 8% of shoppers left, unfavorable views went from 38% down to 20% in 2012. Require top 200 Chinese suppliers to cut electricity by 20% It’s still sold 35% more stuf f in the US from 2005 to 2011 . Index will NOT account for durability Carbon footprint per year, assuming it lasts 3 vs 5 years? Index a Long way of f Why? Nobody cares about carbon Why? Because there is no price on it SO WHAT MAKES SENSE? WHY WORRY ABOUT CARBON? Carbon = Energy = Money MCKINSEY STUDY http://www.mckinsey.com/Client_Service/Electric_Power_and_Natural_Gas/Latest_thin king/Unlocking_energy_efficiency_in_the_US_economy TOOLS FOR FINDING CARBON? Look for energy usage What appliances use the most? LIFECYCLE ANALYSIS Input-Output Total inputs and outputs of system, industry wide Micro approach – look at each input KWh used Gallons of water, etc. CF OF TOMATOES, ETC. 1kg of Tomatoes 0.4 kg organic loose tomatoes, grown locally in July 9.1 kg (20 lbs) average 50 kg (1110 lbs) organic, “on the vine” cherry tomatoes, grown in Ohio, in March Flights, bread, wine – Ca vs. France Bags vs food? Attention Misdirection Carbon Footprint of a plastic bag? Recyclable ski passes Recycled paper Feels like something is being done COMPOSTABLES Great Basin Brewing Company Compostable napkins, straws, silverware, boxes, etc. Slightly higher cost Vendors not even aware of their own products Project lead by UNR MBA graduate Waste hauled by Castaway Trash Hauling Commercial composting Landfills emit methane, a bad GHG, and usually don’t capture it Composting emits less methane 30-70% less KILL-A-WATT COMMERCIAL COMPOSTING Look up impact of things DISCOVERING OPPORTUNITIES IMPACTS ALONG VALUE CHAIN LIFECYCLE ANALYSIS LEED: LEADERSHIP IN ENERGY AND ENVIRONMENTAL DESIGN US Green Building Council Points system Start with an architect that specializes in LEED True believers who really know how to find cost-effective methods BOOKS TO CONSIDER Ecological Intelligence: The Hidden Impacts of What We Buy, Daniel Goleman Force of Nature: The Unlikely Story of Wal -Mart’s Green Revolution, Edward Humes How Bad Are Bananas? The Carbon Impact of Almost Everything, Mike Berners-Lee Hot Flat and Crowded: Why We Need a Green Revolution – And How it Can Renew America, Thomas L. Friedman