2010 Medicaid Update CLTC May 26, 2010

advertisement

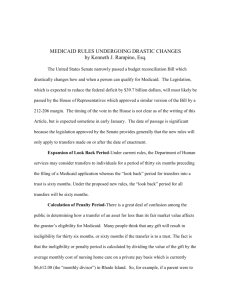

2010 Medicaid Update CLTC May 26, 2010 Harry S. Margolis, Esq. Margolis & Bloom, LLP Boston, Dedham, Framingham & Woburn www.ElderLawAnswers.com The Big Picture State budgets under incredible pressure No comprehensive long-term care policy Mix of Medicare, Medicaid and long-term care insurance Most nursing home care paid for by Medicaid Basic Medicaid Rules Limited to $2,000 in “countable” assets “Community” spouse limited to about $110,000 House not counted if spouse (or dependent child) is living in it or equity value is under $500,000 ($750,000 in some states) But beware liens and estate recovery Can't give away assets to get under the limits Transfer Rules One month of ineligibility for every $8,120 transferred Different in each state Transfer of $81,000 causes 10 months of ineligibility ($81,000 / $8,120 = 10) DRA changes Penalty period begins when “otherwise eligible” for benefits – spent down to $2,000 Five-year lookback period Transfers Mr. Gates transfers $81,000 to his son and daughter on April 1, 2009 He enters a nursing home on April 1, 2010 He spends down his remaining assets on April 1, 2011 He will be eligible for MassHealth on February 1, 2012 10 months after he runs out of money 34 months after the transfer Transfer Exceptions To spouse To disabled child To trust for “sole benefit” of disabled individual under age 65 House To “caretaker” child To sibling with equity interest Home Equity House worth $600,000 Options Sell and spend down Borrow $100,000 on the house Argue that the valuation is wrong Do deal with nursing home – in effect a loan Annuities for Community Spouses Mr. Gates moves to nursing home Mrs. Gates remains at home They have $310,000 in countable assets Since Mrs. Gates can keep $110,000, they have $200,000 in excess assets Mrs. Gates can pay this towards her husband's cost of care at $10,000 a month, or Protecting the Community Spouse Purchase an immediate annuity Transforms excess resource to income stream No limit on community spouse's income nor requirement of contribution Annuity must be “actuarially sound”, and Include repayment provision Purchase short-term annuities Big Issues in Post-DRA World New versions of “half-a-loaf” Penalty period start date Promissory notes Personal care contracts The New “Half-a-Loaf” The old half-a-loaf John moves to nursing home with $200,000 in savings He gives half to his children, causing one year of ineligibility starting immediately He uses the remaining $100,000 and his income to pay for his care for that year Doesn't work post-DRA because penalty period won't begin until he uses up the remaining $100,000 The New “Half-a-Loaf” Gift and gift back John gives entire $200,000 to children They “cure” by paying for nursing home care, shortening penalty period with each payment Gift and promissory note John gives $100,000 and loans them $100,000 to be paid back over the year, so John can pay the nursing home The New “Half-a-Loaf” Gift and annuity Same as promissory note, except payments coming back come from annuity Must be short term and “actuarially sound” Different solutions in different states None works in Massachusetts Penalty Period Start Date When “otherwise eligible” for benefits Massachusetts approach: only when there's no other source of payment for the nursing home Penalty Period Start Date Marino v. Velez (U.S. Dist. Ct., Dist. N.J., No. 10911 (JAP), May 4, 2010). Mrs. Marino transferred $192,000 in February 2009 Her children returned $89,000, shortening the penalty period New Jersey says that penalty period would not begin until $89,000 was spent down in April 2010 Federal District Court agrees Personal Care Contracts Agreement with family member to be paid to provide care Lump sum vs. ongoing payment Challenged as not arms length or adequately monitored Stronger if taxes, FICA, workers comp paid Can't go back if no agreement in place Promissory Notes Intra-family loans can be seen as unenforceable Cases are fact specific, depending on timing and terms of loan Transfers: Intentions and Hardship No penalty is to be applied when Purpose of transfer is exclusively other than to qualify for Medicaid benefits, or Hardship would result Very few successful claims Successful cases are very fact specific Transfer Exceptions Or not, V.S. v. Division of Medical Assistance and Health Services (N.J. Super. Ct. App. Div., No. A-473508T2, April 22, 2010). Son supports mother for years, including repairs to house Mother executes promissory notes Ultimately transfers house to son Medicaid agency imposes transfer Tough Court Court agrees with state agency: "the Director's findings of fact are supported by the record . . . that the debt enumerated in the various promissory notes did not match the funds purportedly contributed and expended for V.S.'s support and comfort . . . [and] that the various renovations and upgrades could just as easily been expended to ready the house for sale at an advantageous price as to accommodate the home for V.S.'s disability." Promissory Note Wesner v. Velez (D. N.J., No. 10-308 (JAP), April 19, 2010). Applicant seeks injunction in support of authenticity of promissory note Court refuses, stating that the circumstances of the note combined with the acknowledgement that the note was part of a Medicaid planning technique place the bona fides of the note in question. Penalty Period Begins on Application Matter of Baker v. Mahon (N.Y. App. Div. 2d. Dept., No. 2009-03242, April 13, 2010). Mother in nursing home transferred $292,680 to son Son paid $153,122 to nursing home Then applied for Medicaid for mother Medicaid agency determines that that's when 15-month penalty period begins because mother was not “otherwise eligible” until she applied for benefits Court upholds state decision But Not in New Jersey Frugard v. Velez (U.S. Dist. Ct., D. N.J., No. 085119 (GEB), April 8, 2010) New Jersey residents transferred assets while in the community and were eligible for community based waiver services, but did not apply Federal Court disagrees: “Defendants' position is plainly an incorrect reading of the statute. Defendants ignore the language 'and would otherwise be' in the statute and incorrectly replace it with the word 'is,' to require the applicant to actually be receiving community-based waiver services before the penalty period can begin. This is an improper and incorrect reading of the plain language of the statute.” Spousal Annuity Protected J.P. v. Missouri State Family Support Div. (Mo. Ct. App., No. WD 70994, April 20, 2010). State rules that income from spouse's annuity is available to the nursing home resident Court disagrees, finding that that under federal Medicaid law the community spouse's income is not deemed available to the institutionalized spouse and the requirement under the DRA that the state be named a primary beneficiary means only that the annuity could not pay out to another heir in the event of the community spouse's death Georgia Court Permits NonAssigned Annuity Harbin v. Meadows (Ga. Sup. Ct., No. 2009-CV0643-LA, Dec. 1, 2009) 94-year-old woman pays $83,500 for actuariallysound annuity Georgia Medicaid agency demands that it be named the remainder beneficiary Woman refuses and Georgia court agrees with her interpretation of the DRA If finds that federal law requires it to be actuarially sound for its purchase not to be a transfer of assets; nothing else is required Lump Sum Life Care Contract Disallowed E.S. v. Division of Medical Assistance and Health Services (N.J. Super. Ct., App. Div., No. A-256408T2, March 26, 2010) Life care contract between nursing home resident and daughter Lump sum for the future provision of personal care services Court determines mom did not receive fair market value because contract is non-assignable and nonenforceable Margolis & Bloom, LLP Offices in Boston, Dedham, Framingham & Woburn 617-267-9700 hsm@margolis.com www.margolis.com www.elderlawanswers.com