Volunteer Basic Training 2

advertisement

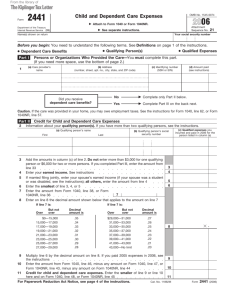

BASIC WORKSHOP 2 VOLUNTEER INCOME TAX ASSISTANCE (VITA) TRAINING 11/17/14 REV RECAP What we covered last week • • • • • • CAP Riverside/VITA History Volunteer Process Standards of Conduct Interview/Intake Process Exemptions, Standard, or Itemized deductions Tax Preparation, inputting income TOPICS FOR TODAY We will cover remaining basic concepts: • Inputting Income • • Social Security • Distributions from IRA or Retirement Plans • Gambling Income • Other Income • Alimony Schedule C • Schedule A Itemizations • Education expenses • • Student Loan Interest • Tuition and Fees • American Opportunity and Lifetime Learning Credits Dependent Care Expenses • Earned Income Tax Credit • Child Tax Credit • CA State • ACA TAX PREPARATION This is a social security annual benefit statement. The important numbers are in box 5 and 6. You will need to know Medicare part B payments as well, especially if taxpayer is itemizing. TAX PREPARATION Social Security Income • Remember to input Medicare payments and Federal withheld TAX PREPARATION TAX PREPARATION Check for address on 1099-R Input required fields, skip Name Code, input Payer’s Name and Address as well as Zip code. Don’t forget Lines 1, 2, 4, and 7. These are very important in this form. CA information, if available, input on Lines 12 and 13. TAX PREPARATION General rule for Gambling, anything over $1,999 must be claimed as income. TAX PREPARATION Specific Gambling Rules • Bingo or slot machine $1,200 • Keno Machine $1,500 • Poker Tournament $5,000 TAX PREPARATION Input information according to the form TAX PREPARATION Schedule C Income Compensation not subject to SS wages Move out incentives Day Care subsidy Honorariums and Executor Fees Box 3 Always in box 7 Contract employees to avoid employment HR issues Some Stipends Remember use Schedule C 1099, and not one associated with 1040 Line 21 TAX PREPARATION Business Expenses (add cash via scratchpad) TAX PREPARATION Schedule A – Inputting Itemizations TAX PREPARATION Schedule A Detail– Inputting Itemizations Input qualifying Medical expenses here TAX PREPARATION Schedule A Detail – Inputting Itemizations Qualifying donations to qualified organizations TAX PREPARATION Schedule A – Inputting Itemizations TAX PREPARATION Education Expenses/Credits Student loan interest deduction • You may be able to deduct interest you pay on a qualified student loan. Generally, the amount you may deduct is the lesser of $2,500 or the amount of interest you actually paid. The deduction is claimed as an adjustment to income so you do not need to itemize your deductions on Form 1040, Schedule A You can claim the deduction if all of the following apply: • You paid interest on a qualified student loan in tax year 2013 • You are legally obligated to pay interest on a qualified student loan • Your filing status is not married filing separately • Your modified adjusted gross income is less than a specified amount which is set annually, and • You and your spouse, if filing jointly, cannot be claimed as dependents on someone else's return TAX PREPARATION Education Expenses/Credits Tuition and fees deduction Generally, you can claim the tuition and fees deduction if all three of the following requirements are met. • You pay qualified education expenses of higher education. • You pay the education expenses for an eligible student. • The eligible student is yourself, your spouse, or your dependent for whom you claim an exemption on your tax return. • The tuition and fees deduction can reduce the amount of your income subject to tax by up to $4,000. • This deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A (Form 1040). This deduction may be beneficial to you if you do not qualify for the American opportunity or lifetime learning credits. TAX PREPARATION Education Expenses/Credits American Opportunity Credit Added required course materials to the list of qualifying expenses and allows the credit to be claimed for four post-secondary education years instead of two. Many of those eligible will qualify for the maximum annual credit of $2,500 per student. $1,000 of credit is refundable. The full credit is available to individuals whose modified adjusted gross income is $80,000 or less, or $160,000 or less for married couples filing a joint return. The credit is phased out for taxpayers with incomes above these levels. TAX PREPARATION Education Expenses/Credits American Opportunity Credit you may be able to claim a lifetime learning credit of up to $2,000 for qualified education expenses paid for all eligible students. There is no limit on the number of years the lifetime learning credit can be claimed for each student. A tax credit reduces the amount of income tax you may have to pay. Unlike a deduction, which reduces the amount of income subject to tax, a credit directly reduces the tax itself. The lifetime learning credit is a nonrefundable credit. This means that it can reduce your tax to zero, but if the credit is more than your tax the excess will not be refunded to you. Your allowable lifetime learning credit may be limited by the amount of your income and the amount of your tax. TAX PREPARATION Education Expenses/Credits Tips A taxpayer has to choose one of the 3 options when it comes to Tuition and Fees deduction, American Opportunity Credit, or Lifetime Learning Credit. Cannot claim any two, only one. In some cases, the taxpayer must see which is most beneficial. Tuition and Fees is an adjustment to income, which can reduce tax liability, while American Opportunity Credit is only available in first 4 years of post-secondary. Lifetime learning has a different focus, targeting courses to acquire or improve job skills, while being limited to amounts paid for required books that must be paid to the educational instituion. TAX PREPARATION Student Loan Interest and Tuition and Fees deduction TAX PREPARATION Student Loan Interest and Tuition and Fees deduction TAX PREPARATION American Opportunity Credit and Lifetime Learning Credit (1040 Pg. 2) TAX PREPARATION American Opportunity Credit and Lifetime Learning Credit TAX PREPARATION American Opportunity Credit and Lifetime Learning Credit TAX PREPARATION Dependent Care Expenses To be able to claim the credit for child and dependent care expenses, you must file Form 1040, Form 1040A, or Form 1040NR, not Form 1040EZ or Form 1040NR-EZ, and meet all the following tests. The care must be for one or more qualifying persons who are identified on Form 2441. (See Qualifying Person Test.) You (and your spouse if filing jointly) must have earned income during the year. (However, see Rule for student-spouse or spouse not able to care for self under Earned Income Test, later.) You must pay child and dependent care expenses so you (and your spouse if filing jointly) can work or look for work. (See Work-Related Expense Test, later.) You must make payments for child and dependent care to someone you (and your spouse) cannot claim as a dependent. If you make payments to your child, he or she cannot be your dependent and must be age 19 or older by the end of the year. You cannot make payments to: Your spouse, or The parent of your qualifying person if your qualifying person is your child and under age 13. See Payments to Relatives or Dependents under Work-Related Expense Test, later. Your filing status may be single, head of household, or qualifying widow(er) with dependent child. If you are married, you must file a joint return, unless an exception applies to you. See Joint Return Test, later. You must identify the care provider on your tax return. (See Provider Identification Test, later.) If you exclude or deduct dependent care benefits provided by a dependent care benefit plan, the total amount you exclude or deduct must be less than the dollar limit for qualifying expenses (generally, $3,000 if one qualifying person was cared for or $6,000 if two or more qualifying persons were cared for). (If two or more qualifying persons were cared for, the amount you exclude or deduct will always be less than the dollar limit, since the total amount you can exclude or deduct is limited to $5,000. See Reduced Dollar Limitunder How To Figure the Credit, later.) TAX PREPARATION Dependent Care Expenses (1040 Pg. 2) TAX PREPARATION Dependent Care Expenses Input information of care provider, SSN or Employer Identification can be used, and place full amount paid for care. TAX PREPARATION Dependent Care Expenses List expenses per each qualifying child with qualifying expenses. TAX PREPARATION Earned Income Tax Credit To qualify for Earned Income Tax Credit or EITC, you, and your spouse if married and filing a joint return, must meet all of the following rules: Have a Social Security Number that is valid for employment Have earned income from working for someone, running or owning a business or farm or another source Cannot file as married filing separate Must be: • a U.S. citizen or resident alien all year or • a nonresident alien married to a U.S. citizen or resident alien, file a joint return and choose to be treated as a resident alien (for more information on making this choice, see Publication 519, U.S. Tax Guide for Aliens) Cannot be the qualifying child of another person Cannot file Form 2555 or 2555-EZ (related to foreign earned income) Your Adjusted Gross Income and earned income must meet the limits shown on the Income Limits, Maximum Credit Amounts and Tax Law Updates Page Your investment income must meet or be less than the amount listed on the Income Limits, Maximum Credit Amounts and Tax Law Updates Page TAX PREPARATION Earned Income Tax Credit Earned Income and adjusted gross income (AGI) must each be less than: • $46,227 ($51,567 married filing jointly) with three or more qualifying children • $43,038 ($48,378 married filing jointly) with two qualifying children • $37,870 ($43,210 married filing jointly) with one qualifying child • $14,340 ($19,680 married filing jointly) with no qualifying children Tax Year 2013 maximum credit: • $6,044 with three or more qualifying children • $5,372 with two qualifying children • $3,250 with one qualifying child • $487 with no qualifying children TAX PREPARATION Earned Income Tax Credit Test 1. 2. A taxpayer has interest income of $3,500. His job pays him $7,000 annually. He is 30, single, has a valid social security number and is not the qualifying child of anyone else, does he qualify? Starting in February of the tax year, Sam has cared for Lisa in his home. She is the 10 year old daughter of his stepson who also lives with him and is unemployed. Does Lisa meet the EITC requirements for a qualifying child? TAX PREPARATION Earned Income Tax Credit Read the directions, if you answer 4a with a yes, then move to Line 5. TAX PREPARATION Earned Income Tax Credit • Answer each question carefully and accurately. TAX PREPARATION Earned Income Tax Credit This is the tricky portion to the EIC worksheet, be sure to read each line and answer accordingly. Complete each column where a qualifying child is listed. TAX PREPARATION Earned Income Tax Credit Ask taxpayer if they have ever been disallowed for the tax credit. Most questions are prefilled, but Question 13 asks about residency. If taxpayer has lived in United States for more than half the year, answer, Yes. TAX PREPARATION The Child Tax Credit is a credit that may reduce your tax by as much as $1,000 for each of your qualifying children. The additional child tax credit is a credit you may be able to take if you are not able to claim the full amount of the child tax credit. A qualifying child for purposes of the child tax credit is a child who: • Is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them (for example, your grandchild, niece, or nephew), • Was under age 17 at the end of 2013, • Did not provide over half of his or her own support for 2013, • Lived with you for more than half of 2013 (see Exceptions to time lived with you , later), • Is claimed as a dependent on your return, Does not file a joint return for the year (or files it only as a claim for refund), and • Was a U.S. citizen, a U.S. national, or a resident of the United States. If the child was adopted, see Adopted child , later. For each qualifying child you must check the box on Form 1040 or Form 1040A, line 6c. TAX PREPARATION CA State Forms Most common issue seen is filling in the Deceased Taxpayer or Spouse Information. Follow the form. TAX PREPARATION Taxpayers with multiple Federal W2, will need to have multiple CA W2 • This is completed by putting the cursor over the W2 and clicking the “+” sign. You will press this sign as many times as needed. You will then verify the amounts as shown above. TAX PREPARATION Custom er needs landlord info. or cannot claim AFFORDABLE CARE ACT The individual shared responsibility provision of the Health Care Law requires you and each member of your family to: • have qualified health insurance, also called minimum essential coverage, • have an exemption, or • make a shared responsibility payment when filing your federal income tax return. Many people already have qualifying health insurance coverage and don’t need to do anything more than maintain that coverage. AFFORDABLE CARE ACT Exemptions and Where to Request: • Members of Certain Religious sects – Marketplace • Short Coverage Gap – IRS • Certain Noncitizens – IRS • Coverage is Considered Unaffordable – IRS • Household Income Below the Return Filing Threshold – IRS • Members of Federally-recognized Indian Tribes Marketplace or IRS • Members of Health Care Sharing Ministries Marketplace or IRS • Incarceration Marketplace or IRS • Hardships Marketplace or IRS - depending which hardship exemption you claim EXIT INTERVIEW Meet with taxpayer Taxpayer should verify all information • Social Security (ALL), Name Spelling, Address, etc. Review refund or amount owed with taxpayer • Instruct on what credits they’re receiving • Instruct on why they owe • Failure to pay Federal Witholding (W9) • Self Employment tax if they’re self-employed Taxpayer must sign 1040 PG 2 Return ALL documents to taxpayer Taxpayer complete online survey either at site or at home • Available on CAP Riverside webpage EXIT INTERVIEW Now that you’ve received your return, have you thought about savings? • Bank Accounts • Savings • IDA (Individual Development Account) • CAP Riverside • Match Savings Program • Workshops RECAP Don’t prepare returns beyond your level Due Diligence W-2’s must match SSN (not ITIN) Driver License Don’t prepare fraudulent returns • Watch for fake SSN • Last Names are important • ITIN • Used in lieu of Social Security number for filing taxes • Must paper file to get one Confidentiality is a MUST RECAP Personal Exemption • Unless claimed as a dependent by another • Teens and college students Head of Household • Tricky, use 4012 • Assess situation, do not use previous filing status Widow(er) with Dependent – 2 tax years after Enjoy the rewards of volunteering! WHAT’S NEXT? Certify/Live Scan by January 24th, 2014 • Once certified, print three (3) Volunteer Agreement and sign • Give one to Site Coordinator, Submit one to Program Manager via e-mail, keep one for yourself Software Training • Visit capriverside.org for training schedule • You may sign-up for as many software trainings as necessary