PresentationAGM09 - Hinduja Ventures

advertisement

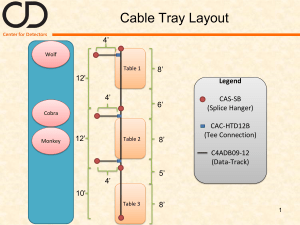

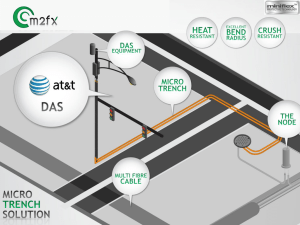

WELCOMES SHAREHOLDERS 27th Annual General Meeting August 9, 2012 Presentation to Shareholders HVL- CONSOLIDATED FINANCIAL OVERVIEW SNAPSHOT OVER THE YEARS FYE-2010 FYE-2011 FYE-20122 FYE-2010 FYE-2011 FYE-20122 Rupees in Millions 5,630.46 1,004.64 4,752.92 865.72 4,017.11 605.78 Profit After Minority Interest Total Income 2 Private & Confidential Hinduja Ventures Limited Incubating arm of New Business Ventures • Media Investments - Cable Distribution (IndusInd Media & Communication Limited) • Power Investments - Thermal Based Power (Hinduja National Power Corporation Limited) • Leasing and Finance Investments- Automotive & Equipment Finance (Hinduja Leyland Finance Limited) • Real Estate - Bengaluru & Hyderabad Properties MEDIAIndusInd Media & Communications Ltd. MEDIA- INDUSIND MEDIA & COMMUNICATIONS LTD(IMCL) INTRODUCTION Background Shareholding Pattern IndusInd Bank, 5.53% • IMCL is a pioneer and leading Multi System Operator in India with a presence across 34 cities including 18 key cities and metros Kudelski, 2.26% ICL/ICHL Mauritius (Hinduja Group), 26.20% • Reaching ~8.5 Mn households offering both digital and analog Cable services • The Company is the first ISO 9001:2000 Cable TV services company in the country. It has over 2,700 affiliated LCOs and is leading the digital Cable charge with around 1 Mn STBs already installed Hinduja Ventures (includes Grant Investrade), 65.79% • Business presence in Cable, Commerce and Internet/ VoIP offering a compelling ‘triple play’ proposition to consumers *IndusInd Communication Ltd/ IndusInd Channel Ltd (Hinduja Group) 5 Private & Confidential IMCL- FINANCIAL OVERVIEW SNAPSHOT OVER THE YEARS Rupees in Millions REVENUE EBIDTA PAT 4814 4099 3312 2966 1629 1976 1580.45 383 135 504 284 FYE -2007 FYE -2008 FYE -2009 707 333 FYE -2010 1211 671 1468 638 FYE -2011 FYE-2012 CAGR from 2007 to 2012: •Revenue: 24.2% •EBIDTA: 56.2% 6 Private & Confidential The Indian TV Market Today India Has a Large Television Market, Dominated by Cable Great Service at Nominal Cost Millions of Homes Served • 148 million TV Households • 93 million Cable TV + Homes • 33 million DTH Homes.(Net) A Thriving Consumer Driven Market Over 800 TV Channels + Average payments per household: Rs. 150 to 180/- Cable likely to grow over 110 million homes by 2014 Digital Opportunity- Digital Cable • Hybrid Digital STBs for Cable and Internet, HD TV services Digitalisation Timelines • E Learning • Exclusive Content and Channel distribution for server based Channels • Events and localized content in Digital Cable • Localized E Commerce/Teleshopping • Triple Play , with PPV and NVOD services • IMCL will cover about 70% of its subscriber base by Phase 2 Phase 1 4 Metro’s 31st October , 2012 Phase 2 Phase 3 All One Million Plus Cities 31st March 2013 by 31 March, 2013 All Municipalities by Sept 2014 byb333CorporationsbyRest Of India2014 September 31 December ,2014 30 September , 2014 Phase 4 IMCL- NETWORK AND REACH Kurukshetr Kaithal a Bhiwani Overall reach: Cities: 34 Subscribers: 8.5 Mn+ Delhi/ Noida/ Faridabad Udaipur Surat Mumbai/ Thane/ Navi Mumbai/ Kalyan Digital Cable reach: Cities: 21 Subscribers: 1.0 Mn+ •Kolkata Ahmadabad Indore Vadodara Broadband reach: Cities: 12 Subscribers: 30,000+ Nagpur Nasik Ahmednagar Solapur Sangli Hyderabad Kolhapur Gulbarga Belgaum Goa Mysore Substantial reach in high ARPU in key locations such as Mumbai , Delhi & Kolkata in phase-I Sufficient presence in other key Tier I cities & towns in Phase-II & Phase-III Bangalore Allepey 9 Private & Confidential Hinduja National Power Corporation Limited Strictly Private & Confidential Hinduja National Power Corporation Ltd. – Project Highlights Hinduja Group has plans to reach ~10,000 MW power generation capacity in ~6-8 years at an expected investment of $12 billion. First Greenfield Project 1040 MW (2 x 520 MW) Domestic Coal Based Thermal Power Plant is being set up in Visakhapatnam (A.P.) Land to the extent of 1123 acres + additional 301 acres has been acquired and land titles transferred to HNPCL Project Cost ~ INR 55,450 Mn. Project Financing – Financial Closure: Achieved; Loan documentation signed with a consortium of 14 banks Statutory Clearances – The project has been granted requisite statutory clearances & other approvals. Commissioning Date : 2013. Vizag Power Project | Site Photographs Main Power Block Boiler drum for Unit-1 lifted on 10.01.2012 Boiler drum for Unit-2 lifted on 18.04.2012 EOT Crane erection completed for both units 12 Vizag Power Project | Site Photographs Coal Handling Plant Track Hopper RCC Work In progress Excavation work for Wagon tippler in progress Structural Erection in progress 13 Vizag Power Project | Site Photographs SWEET WATER RESERVOIR: Clay Layer work in progress HDPE Lining & Pre-cast tiles laying in progress Ash Dyke Piling works completed for Ash Silos and Fly Ash Evacuation towers. Central bund filling in progress 14 Vizag Power Project | Site Photographs Switchyard Tower erection started on 14 May 2012 Equipment foundations in progress. Sea Water Intake/Outfall System Engineering in progress Soil investigations completed Excavation for laying of CW piping In progress 15 (HLF) About HLF Received RBI license in April 2010 Commenced Operations in May 2010 Disbursements cross Rs 10,000 mn by March 2011 Credit Rating upgraded from “Care A” to “Care A+” in November 2011 Disbursement crosses Rs 30,000 mn by March 2012 Achieved PAT of Rs 836 mn in second year of operations (March 2012) AUM cross over Rs 25,000 mn by March 2012 Total Number of Locations are 440 spread across 19 States pan-India as of March 2012 17 Performance Indicators - 2011 -12 Manpower Profit After Tax (Rs. Cr) 1199 84 588 2010-2011 440 2011-2012 28 259 94 Business Locations (No) 169 Leased offices Employees (No) 2010-11 Gross Receivables (AUM) (Rs. Cr) 2530 1300 2010-2011 2011-2012 2011-12 Portfolio Spread (2011-2012) Thank You www.hindujaventures.com