View Marcia Wagner`s PowerPoint presentation, with notes, here

advertisement

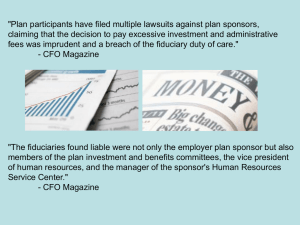

The Politics of Retirement A Washington Update Marcia S. Wagner, Esq. 1 Not FDIC Insured • Not Bank Guaranteed • May Lose Value Introduction – Impending Retirement Plan Crisis • Social Security • Employer-Sponsored Plans • Private Savings – Current Private Pension System • Half of workers have no plan. • Plans have low saving rates and hidden costs. • Fewer than half of workers will have adequate retirement income. – Role of Policymakers 2 1. Increasing Savings 2. Protecting Returns 3. Decumulation Planning 4. Tax Reform 5. Industry Groups 3 Increasing Savings Thru Automatic Features – Pension Protection Act of 2006 • Auto-Enrollment • Auto-Escalation – Plan Sponsor and Advisor Initiatives • Re-Enrollment • Re-Allocation – Automatic IRAs 4 Automatic Enrollment and Escalation – Negative Elections • IRS issued guidance in late 1990’s. • Pension Protection Act of 2006 expands IRS guidance and offers fiduciary protection. – Problems • Most plans set auto-contribution rates at 3%. • 6% safe harbor rate provides “free pass” from discrimination testing. • But few plans use safe harbor or auto-escalation. – Automatic enrollment can significantly increase savings. 5 Emerging Initiatives and Practices – Re-Enrollment Program • Auto-enrollment and auto-escalation typically apply to new employees, not incumbent employees. • Consider re-enrolling all employees with low contribution rates to default rate (e.g., 6%). • May be implemented on ad hoc basis. – Re-Allocation Program • Consider re-allocating participant accounts and new contributions to QDIA (unless they opt out). • May be implemented at re-enrollment or ad hoc basis whenever elections become stale. 6 Automatic IRAs – Legislative History • Auto IRAs proposal appears to be partisan. • But had bi-partisan support in prior years. • Increasing retirement plan coverage is shared policy goal. – Three Key Features • Default contribution rate set at 3%. • Post-tax Roth IRA would be default, but employee could choose pre-tax Traditional IRA. • Multiple alternatives available for selecting Auto IRA provider. 7 Prospects for Auto IRAs – Objections to Auto IRAs • Burdensome mandate for small businesses with more than ten employees. • Federal government control overs assets. • Role of private sector. – Partisan politics will continue in short term. • But bipartisanship support typically emerges on retirement issues. 8 Summing Up – Push for auto investments expected to continue. – Auto IRA legislation unlikely in current form. – But some reform can be expected in future. • Retirement needs of aging middle class will force lawmakers to act. • $5,000 cap on Auto IRA contributions would not discourage formation of qualified plans. • Auto IRAs would help close retirement gap. 9 1. Increasing Savings 2. Protecting Returns 3. Decumulation Planning 4. Tax Reform 5. Industry Groups 10 Introduction – Policymakers focusing on protection for investment returns. • Disclosing hidden fees. • Meaningful information for participants. – Regulatory Agenda • Improving fee transparency. • Encouraging participant-level advice. • Broadening “fiduciary” definition. 11 Fee Transparency – Policymakers want plans to get fair price for services. – Plan Sponsor-Level Disclosure Regs • Effective July 1, 2012. • Service providers must disclose direct and indirect (“hidden”) compensation. – Participant-Level Disclosure Regs • Effective August 30, 2012 (for calendar year plans). • Must compare investment options and provide quarterly fee disclosures. – Disclosures are expected to drive down fees. 12 Fee Litigation and Case Law – 2006 Wave of 401(k) Fee Litigation • Alleged breach of fiduciary duty to monitor indirect compensation. • Trial courts cautious and did not dismiss lawsuits. – Hecker v. Deere • Case dismissed on “efficient markets” theory. – 408(b)(2) Fee Disclosures • May support new theories of 401(k) litigation. • Monetary settlements to date have been significant. 13 Encouraging Participant Advice – Many participants unwilling or unable to make investment decisions. • Advisors receiving variable fees (e.g., 12b-1) generally cannot provide fiduciary advice. – DOL provides fiduciary relief. • Advice based on computer model. • Level fee for affiliate providing advice. – Fiduciary relieve unhelpful to many advisors. – DOL expected to work with private sector. 14 Proposal to Broaden “Fiduciary” Definition – ERISA’s Functional Definition • If fiduciary advice provided, fiduciary status arises. • It is fiduciary advice only if it is primary basis for plan decisions and given on regular basis. • Ellis v. Rycenga Homes – DOL’s Initial Proposal • It is fiduciary advice if it may be considered for plan decision. • One-time, casual advice may trigger fiduciary status. • Re-proposed definition pending. 15 Emerging Practices and Levelizing Fees – Fiduciaries must not receive variable fees. • Non-fiduciary advisors may receive 12b-1 fees. • DOL proposal to broaden “fiduciary” definition would stop receipt of variable fees. – Plan Expense Accounts • Typically, funded by recordkeeper’s indirect compensation for gross-to-net pricing. • May be used to levelize advisor’s compensation. 16 Summing Up – Administration has launched initiatives. • Fee disclosures for plan sponsors and participants. • Tried to encourage participant-level advice. • Pushing boundaries of fiduciary status. – Pressure on Fees • Interest in levelized fee arrangements. • Downward pressure on 401(k) pricing . 17 1. Increasing Savings 2. Protecting Returns 3. Decumulation Planning 4. Tax Reform 5. Industry Groups 18 Administration’s Goals – Help retirees take plan distributions without outliving them. • Motivate retirees to annuitize accounts. • Retirement paycheck for life. – Encourage plan sponsors to voluntarily offer annuity options. • Permit longevity annuities. • Remove regulatory hurdles. • Facilitate default annuities. • Promote education and disclosures. 19 Longevity Annuities – IRS proposal would relax required minimum distribution (RMD) rules for plans. – Longevity annuities provide income stream for later in life. • But RMD rules mandate start at age 70 ½. – Proposed Regulations • Exception from RMD rules for longevity annuity investments. • Limit investment to $100,000 or 25% of account. • Must start no later than age 85. 20 New Tax Rules Favoring Annuities – Rollovers to DB Plans • Rev. Rul. 2012-4 • 401(k) accounts may be rolled over and converted to DB plan annuity benefits. • Provides favorable annuity rates for participants. – Relief for DC Plans With Deferred Annuities • Rev. Rul. 2012-3 • 401(k) plans typically exempt from onerous death benefit rules. • Ruling confirms that 401(k) plans with deferred annuities can still avoid them. 21 Default Annuities – Should annuity option be default for plan? – Possible Approach: Amend QDIA Rules • Permit annuity option to qualify as QDIA. • Critics argue annuities not appropriate for all. • Default annuity investments not easily reversed. – Possible Approach: 2-Year Trial Period • Retirees receive annuity during trial period (unless they opt out). 22 Education and Disclosures for Participants – GAO Recommendations • Update DOL’s “investment education” guidance to cover decumulation. • But DOL is concerned about conflicts. • Guidance likely to restrict sales pitches. – Lifetime Income Disclosure Act • Would require plan to show account balances as if converted into guaranteed monthly payments. • Would also encourage participants to think about retirement paycheck for life. 23 Summing Up – Consensus emerging on lifetime income options. • Proposal for longevity annuities to be finalized in near future. • Recent IRS annuity rulings are plan-friendly. • Guidance on decumulation education expected from DOL. • But debate on use of annuities as QDIA likely to follow. 24 1. Increasing Savings 2. Protecting Returns 3. Decumulation Planning 4. Tax Reform 5. Industry Groups 25 Tax Reform – Impact of Plan Contributions on Federal Deficit • $70.2 Billion Annually. • $361 Billion 2011 – 2015. – Plan Limitations That Can Be Reduced to Lessen Deficit • Annual Additions from All Sources - $50,000. • Elective Deferrals - $17,000. • Plan Sponsor Deduction – 25% Compensation of All Participants. • Compensation Counted to Determine Benefits/Contributions - $250,000. 26 Tax Reform – National Commission on Fiscal Responsibility (20/20 Cap) – Lesser of $20,000 of 20% Compensation. – Brookings Institution • Make All Employer and Employee Contributions Taxable. • Refundable Tax Credit Deposited to Retirement Savings Acct. – Obama Administration – 7% on Employer and Employee Tax Contributions for High Earners Only. 27 State-Sponsored Plans for Private-Sector – Secure Plan Proposal. • Proposed by National Conference on Public Employee Retirement Systems. • Provide coverage for employees of small employers. • Seeks to benefit from economies of scale. • Cash balance plan: 6% annual credits; minimum 3% interest credits. • Funding shortfall would ultimately fall on states. – Define Contribution Initiatives. – Fiduciary Implications. • Potential state liability for selection of investment alternatives. • State must ensure that plan avoids prohibited transactions. • Bonding. • Administrative duties allocated between state and employer 28 Harkin Universal Pension Proposal – New retirement system proposed in “report” issued by U.S. Sen. Tom Harkin • Automatic and universal enrollment • Regular stream of income starting at retirement age • Financing through payroll system by employee contributions/government credits • Privately managed by new entities to be called “USA Retirement Funds” • Limited employer involvement and no fiduciary responsibility • Employees could increase/decrease contributions or opt out – Similarities to proposals for state-covered pensions of private-sector workers – Less likely to be enacted than Automatic IRAs 29 Other Revenue Raisers – Minimum Required Distributions to be Accelerated. • Shrink Distribution Period for Inherited 401(k)s and IRAs. • Administration want to waive MRD for small accounts. – Limit or Eliminate Roth Conversions. – Enactment of MAP-21 • PBGC premium increases for defined benefit pension plans under MAP-21 o o o Specific premium increases replace Administration’s proposal to allow PBGC Board to set risk-adjusted rates Flat rate per participant premium increases from current $35 level to $42 in 2013 and $49 in 2014, to be indexed for inflation in subsequent years Varriable rate premium per $1,000 of vested unfunded benefits increases from current $9 level to $13 (plus inflation) for 2014 and $18 (plus inflation) for 2015 • Defined Benefit Plan Funding Relief o o o 30 Abnormally low interest rates increase funding requirements MAP-21 adjusts rates upward if regular rate falls below 25-year average for interest rates, resulting in lower required contributions If interest rates increase, larger plan contributions could be due Republican Reaction to Tax Proposals – Republican budget does not directly address. – Romney Campaign favors lower tax rates and broader base but no focus on retirement plans expenditure. – Senator Hatch skeptical of changing current limits. – Summing Up – Soak the rich schemes may defeat themselves. – 20/20 Cap may be enacted. – Consequences of lowered contributions • Private Retirement Plan System gets smaller • Reduced Role for Employers. 31 1. Increasing Savings 2. Protecting Returns 3. Decumulation Planning 4. Tax Reform 5. Industry Groups 32 Industry Groups – Social Policy Advocate – Plan Services Industry • ASPPA • AARP • Pension Rights Center • Spark Institute – Plan Sponsor Groups • ABC • ERIC • Chamber of Commerce – Investment Providers • ACLI • ICI • IAA 33 – Independent Research Organizations • EBRI Thank you. Marcia S. Wagner, Esq. 99 Summer Street, 13th Floor, Boston, MA 02110 Tel: (617) 357-5200 Fax: (617) 357-5250 Website: www.wagnerlawgroup.com marcia@wagnerlawgroup.com A0083724 34