The Politics of Retirement

A Washington Update

Marcia S. Wagner, Esq.

1

Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Introduction

– Impending Retirement Plan Crisis

• Social Security

• Employer-Sponsored Plans

• Private Savings

– Current Private Pension System

• Half of workers have no plan.

• Plans have low saving rates and hidden costs.

• Fewer than half of workers will have adequate retirement income.

– Role of Policymakers

2

1. Increasing Savings

2. Protecting Returns

3. Decumulation Planning

4. Tax Reform

5. Industry Groups

3

Increasing Savings Thru Automatic Features

– Pension Protection Act of 2006

• Auto-Enrollment

• Auto-Escalation

– Plan Sponsor and Advisor Initiatives

• Re-Enrollment

• Re-Allocation

– Automatic IRAs

4

Automatic Enrollment and Escalation

– Negative Elections

• IRS issued guidance in late 1990’s.

• Pension Protection Act of 2006 expands IRS guidance and offers fiduciary protection.

– Problems

• Most plans set auto-contribution rates at 3%.

• 6% safe harbor rate provides “free pass” from discrimination testing.

• But few plans use safe harbor or auto-escalation.

– Automatic enrollment can significantly increase savings.

5

Emerging Initiatives and Practices

– Re-Enrollment Program

• Auto-enrollment and auto-escalation typically apply to new employees, not incumbent

employees.

• Consider re-enrolling all employees with low contribution rates to default rate (e.g., 6%).

• May be implemented on ad hoc basis.

– Re-Allocation Program

• Consider re-allocating participant accounts and new contributions to QDIA (unless they opt

out).

• May be implemented at re-enrollment or ad hoc basis whenever elections become stale.

6

Automatic IRAs

– Legislative History

• Auto IRAs proposal appears to be partisan.

• But had bi-partisan support in prior years.

• Increasing retirement plan coverage is shared policy goal.

– Three Key Features

• Default contribution rate set at 3%.

• Post-tax Roth IRA would be default, but employee could choose pre-tax Traditional IRA.

• Multiple alternatives available for selecting Auto IRA provider.

7

Prospects for Auto IRAs

– Objections to Auto IRAs

• Burdensome mandate for small businesses with more than ten employees.

• Federal government control overs assets.

• Role of private sector.

– Partisan politics will continue in short term.

• But bipartisanship support typically emerges on retirement issues.

8

Summing Up

– Push for auto investments expected to continue.

– Auto IRA legislation unlikely in current form.

– But some reform can be expected in future.

• Retirement needs of aging middle class will force lawmakers to act.

• $5,000 cap on Auto IRA contributions would not discourage formation of qualified plans.

• Auto IRAs would help close retirement gap.

9

1. Increasing Savings

2. Protecting Returns

3. Decumulation Planning

4. Tax Reform

5. Industry Groups

10

Introduction

– Policymakers focusing on protection for investment returns.

• Disclosing hidden fees.

• Meaningful information for participants.

– Regulatory Agenda

• Improving fee transparency.

• Encouraging participant-level advice.

• Broadening “fiduciary” definition.

11

Fee Transparency

– Policymakers want plans to get fair price for services.

– Plan Sponsor-Level Disclosure Regs

• Effective July 1, 2012.

• Service providers must disclose direct and indirect (“hidden”) compensation.

– Participant-Level Disclosure Regs

• Effective August 30, 2012 (for calendar year plans).

• Must compare investment options and provide quarterly fee disclosures.

– Disclosures are expected to drive down fees.

12

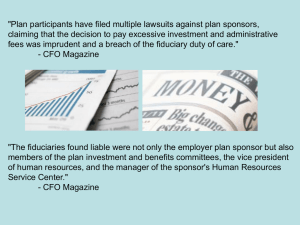

Fee Litigation and Case Law

– 2006 Wave of 401(k) Fee Litigation

• Alleged breach of fiduciary duty to monitor indirect compensation.

• Trial courts cautious and did not dismiss lawsuits.

– Hecker v. Deere

• Case dismissed on “efficient markets” theory.

– 408(b)(2) Fee Disclosures

• May support new theories of 401(k) litigation.

• Monetary settlements to date have been significant.

13

Encouraging Participant Advice

– Many participants unwilling or unable to make investment decisions.

• Advisors receiving variable fees (e.g., 12b-1) generally cannot provide fiduciary advice.

– DOL provides fiduciary relief.

• Advice based on computer model.

• Level fee for affiliate providing advice.

– Fiduciary relieve unhelpful to many advisors.

– DOL expected to work with private sector.

14

Proposal to Broaden “Fiduciary” Definition

– ERISA’s Functional Definition

• If fiduciary advice provided, fiduciary status arises.

• It is fiduciary advice only if it is primary basis for plan decisions and given on regular basis.

• Ellis v. Rycenga Homes

– DOL’s Initial Proposal

• It is fiduciary advice if it may be considered for plan decision.

• One-time, casual advice may trigger fiduciary status.

• Re-proposed definition pending.

15

Emerging Practices and Levelizing Fees

– Fiduciaries must not receive variable fees.

• Non-fiduciary advisors may receive 12b-1 fees.

• DOL proposal to broaden “fiduciary” definition would stop receipt of variable fees.

– Plan Expense Accounts

• Typically, funded by recordkeeper’s indirect compensation for gross-to-net pricing.

• May be used to levelize advisor’s compensation.

16

Summing Up

– Administration has launched initiatives.

• Fee disclosures for plan sponsors and participants.

• Tried to encourage participant-level advice.

• Pushing boundaries of fiduciary status.

– Pressure on Fees

• Interest in levelized fee arrangements.

• Downward pressure on 401(k) pricing .

17

1. Increasing Savings

2. Protecting Returns

3. Decumulation Planning

4. Tax Reform

5. Industry Groups

18

Administration’s Goals

– Help retirees take plan distributions without outliving them.

• Motivate retirees to annuitize accounts.

• Retirement paycheck for life.

– Encourage plan sponsors to voluntarily offer annuity options.

• Permit longevity annuities.

• Remove regulatory hurdles.

• Facilitate default annuities.

• Promote education and disclosures.

19

Longevity Annuities

– IRS proposal would relax required minimum distribution (RMD) rules for plans.

– Longevity annuities provide income stream for later in life.

• But RMD rules mandate start at age 70 ½.

– Proposed Regulations

• Exception from RMD rules for longevity annuity investments.

• Limit investment to $100,000 or 25% of account.

• Must start no later than age 85.

20

New Tax Rules Favoring Annuities

– Rollovers to DB Plans

• Rev. Rul. 2012-4

• 401(k) accounts may be rolled over and converted to DB plan annuity benefits.

• Provides favorable annuity rates for participants.

– Relief for DC Plans With Deferred Annuities

• Rev. Rul. 2012-3

• 401(k) plans typically exempt from onerous death benefit rules.

• Ruling confirms that 401(k) plans with deferred annuities can still avoid them.

21

Default Annuities

– Should annuity option be default for plan?

– Possible Approach: Amend QDIA Rules

• Permit annuity option to qualify as QDIA.

• Critics argue annuities not appropriate for all.

• Default annuity investments not easily reversed.

– Possible Approach: 2-Year Trial Period

• Retirees receive annuity during trial period (unless they opt out).

22

Education and Disclosures for Participants

– GAO Recommendations

• Update DOL’s “investment education” guidance to cover decumulation.

• But DOL is concerned about conflicts.

• Guidance likely to restrict sales pitches.

– Lifetime Income Disclosure Act

• Would require plan to show account balances as if converted into guaranteed monthly

payments.

• Would also encourage participants to think about retirement paycheck for life.

23

Summing Up

– Consensus emerging on lifetime income options.

• Proposal for longevity annuities to be finalized in near future.

• Recent IRS annuity rulings are plan-friendly.

• Guidance on decumulation education expected from DOL.

• But debate on use of annuities as QDIA likely to follow.

24

1. Increasing Savings

2. Protecting Returns

3. Decumulation Planning

4. Tax Reform

5. Industry Groups

25

Tax Reform

– Impact of Plan Contributions on Federal Deficit

• $70.2 Billion Annually.

• $361 Billion 2011 – 2015.

– Plan Limitations That Can Be Reduced to Lessen Deficit

• Annual Additions from All Sources - $50,000.

• Elective Deferrals - $17,000.

• Plan Sponsor Deduction – 25% Compensation of All Participants.

• Compensation Counted to Determine Benefits/Contributions - $250,000.

26

Tax Reform

– National Commission on Fiscal Responsibility (20/20 Cap) – Lesser of $20,000 of 20%

Compensation.

– Brookings Institution

• Make All Employer and Employee Contributions Taxable.

• Refundable Tax Credit Deposited to Retirement Savings Acct.

– Obama Administration – 7% on Employer and Employee Tax Contributions for High

Earners Only.

27

Other Revenue Raisers

– Minimum Required Distributions to be Accelerated.

• Shrink Distribution Period for Inherited 401(k)s and IRAs.

• Administration want to waive MRD for small accounts.

– Limit or Eliminate Roth Conversions.

– Increase PBGC Premiums by $16 billion over 10 years.

28

Republican Reaction to Tax Proposals

– Republican budget does not directly address.

– Romney Campaign favors lower tax rates and broader base but no focus on retirement

plans expenditure.

– Senator Hatch skeptical of changing current limits.

– Summing Up

– Soak the rich schemes may defeat themselves.

– 20/20 Cap may be enacted.

– Consequences of lowered contributions

• Private Retirement Plan System gets smaller

• Reduced Role for Employers.

29

1. Increasing Savings

2. Protecting Returns

3. Decumulation Planning

4. Tax Reform

5. Industry Groups

30

Industry Groups

– Social Policy Advocate

– Plan Services Industry

• ASPPA

• AARP

• Pension Rights Center

• Spark Institute

– Plan Sponsor Groups

• ABC

• ERIC

• Chamber of Commerce

– Investment Providers

• ACLI

• ICI

• IAA

31

– Independent Research Organizations

• EBRI

Thank you.

Marcia S. Wagner, Esq.

99 Summer Street, 13th Floor, Boston, MA 02110

Tel: (617) 357-5200 Fax: (617) 357-5250

Website: www.wagnerlawgroup.com

marcia@wagnerlawgroup.com

Neither Eaton Vance or The Marcia Wagner Law Group, is providing legal or tax advice as to the matters discussed herein. The

discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or

completeness. It is not intended as legal or tax advice and individuals may not rely upon it (including for purposes of avoiding tax

penalties imposed by the IRS or state and local tax authorities). Individuals should consult their own legal and tax counsel as to matters

discussed herein.

This presentation is being distributed with permission from The Wagner Law Group by Eaton Vance Distributors, Inc. 2 International

Place, Boston, MA 02110.

Eaton Vance does not provide tax or legal advice. Investors should consult a tax or legal professional before making investment

decisions.

32

Copyright Marcia S. Wagner, Esq. 2012. Reprinted by permission. All rights reserved.