Indian Gaming Audit Issues and Challenges

advertisement

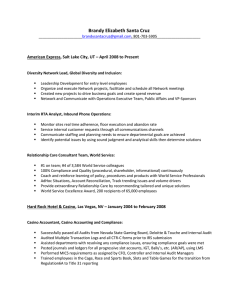

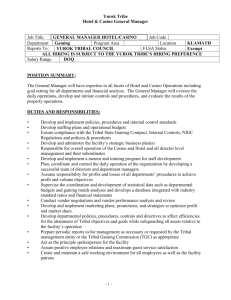

Indian Gaming Audit Issues and Challenges Presented by: Craig L. Greene McGovern & Greene LLP Richard Ross California Gambling Control Commission Current Economy & Risks • Increase in Employee Theft – Is this being Addressed in Indian Country? • Downsizing Often Results in: – Loss of Significant Internal Controls – Removal of Non Revenue Producing Elements May Result in Loss of Revenue Protecting Elements – Loss of Key Employees Current Economy & Risks • Overall Trend Observed by NIGC of Deteriorating Financial Condition – Many New Properties have Large Debt Load • Risk of Default by Major Gaming Operations – Large Casino Management Companies, i.e. Stations Casino Bankruptcy Petition – Gaming Vendors – What is the Level of Due Diligence Improved Corporate Governance • Many Tribes have Developed into the Equivalent of Large Corporations • Is there a Need to Implement Improved Corporate Governance Policies, such as: – – – – – Audit Committees Codes of Business Conduct Fraud Policies Risk Assessment Programs Management Certifications of Financial Statements Role of Tribal Gaming Regulators • What is TGR’s Role? – Is there a Blur between Management and TGR? – Often we have found Management and TGR are at Odds – is this an Issue? – If so, how can we Bridge that Gap? • Understanding the Evolving Electronic Gaming Technology. – Reliance on Industry Manufacturers & Testing Labs Lack of Adequate Review of IT Department • Technology continues to drive Gaming Operations Which Leads to Significant Risks – – – – Access Controls Application Controls Disaster Recovery Archival Issues • Is the MICS Testing Enough? • Should there be a Required Security Audit of IT? – Who are the Right Kind of People? No Required MICS Review of Financial Controls • MICS Emphasizes Gaming Operations, but does not Adequately Address Financial Controls. • Thus, we have Found Significant Deficiencies that Provide Opportunities for Fraud & Abuse. Inability to Attract Adequate & Competent Internal Auditors • Locations of Employment • Demand for Internal Auditors in Other Parts of the Economy • Salary Issues • Internal Auditors as Trusted Business Consultants Lack of Training of Accounting Staff & Internal Audit • Adequate Educational Background • Technology Challenges • Changes in Generally Accepted Accounting Standards & Practices – AICPA Proposed Audit & Accounting Guide for Casinos – International Financial Reporting Standards (IFRS) Lack of Adequate Due Diligence • Numerous Instances of Tribal Investment in Business Ventures with Unethical Business Partners • Issue Seems to be a Lack of Due Diligence on the Part of the Tribes Potpourri • • • • Familial Relationships Resentment of External Criticism Tribal Politics and Issues Audience Concerns Final Questions/Comments Craig L. Greene McGovern & Greene LLP Chicago & Las Vegas 312.692.1000 Richard Ross California Gambling Control Commission Sacramento 916.263.0700