FAIS lecture: Daleen Millard

advertisement

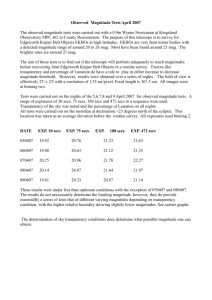

THE FAIS ACT FOR KEY INDIVIDUALS AND REPRESENTATIVES by Daleen Millard 26 January 2011 THE BASICS OF FAIS: REGULATOR CONSUMER/ CLIENT FSP FAIS LEGISLATIVE FRAMEWORK • • • • • • • • • • • • Definitions an application (s 1) Administration (secs 2, 3, 5 and 6) Authorisation of FSPs (secs 7, 8 and 11) Representatives (secs 13 and 14) Duties of FSPs (secs 17 to 19) Codes of Conduct (secs 15 and 16) Supervision of FSPs (s 4) Ombud (secs 20 and 30) Regulatory Action (secs 19 and 14 A) Enforcement (secs 33, 34 and 36) Exemption (secs 44 and 45) Miscellaneous (secs 32, 35, 40-42 and 46) Definitions an application (s 1) ANY ACT IS LIKE A HOUSE: ASK: WHAT IS INSIDE AND WHAT IS OUTSIDE? STARTING POINT IS ALWAYS DEFINITIONS IN THE ACT. -FAIS: all definitions in s 1 -If no definition: look at ordinary meaning of the word, references to other Acts – e.g. long-term insurance business Definitions and application (s 1) • There are certain key concepts that are fundamental to our understanding of the Act, e.g: -advice -complaint -intermediary service -key individual -ombud -product supplier -representative • Concepts determine scope of application of the Act. E.G. “ADVICE” • • • • • • • • • Recommendation Guidance Proposal Financial nature Any medium To client/group of clients MUST PERTAIN TO A FINANCIAL PRODUCT (Exclusions) Possible question: Did a particular individual render advice for purposes of FAIS Act ADMINISTRATION • Delegation of functions to the FSB (FSB cannot act outside this) • Advisory committee (e.g. “Treating Customers Fairly”) • Recognition of representative bodies AUTHORISATION OF FSPs (1) • Licensing requirements -Application -Fit and proper requirements • Approval of Key Individuals • Lapsing of a licence COMPLIANCE WITH FIT AND PROPER REQUIREMENTS FIT AND PROPER REQUIREMENTS KEY INDIVIDUAL PARTNERSHIP, TRUST, CORPORATE Honesty and integrity Person himself KI, any director, member, trustee, partner of provider who is not KI Competency Person himself Key individuals Operational ability Person himself Entity and key individuals Solvency Person himself Entity AUTHORISATION OF FSPs (2) FIT AND PROPER REQUIREMENTS FOR KI’S OPERATIONAL ABILITY HONESTY AND INTEGRITY COMPETENCY Operational ability: Basics: -Fixed business address -Communication -Storage and filing facilities -Account with a registered bank (P91 H & M) HONESTY and INTEGRITY What is the meaning of “honesty”? -What is the meaning of “integrity”? -Which factors constitute prima facie evidence that an FSP, key individual or representative does not qualify? (H & M 94-96) COMPETENCY REQUIREMENTS: Date of authorisation Qualifying criteria Experience Qualifications Regulatory examinations CPD’s REPRESENTATIVES • Again, Fit and Proper Requirements • Debarment • Reinstatement of debarred representatives DUTIES OF FSPs • Approval of compliance officers • Compliance reports • Audit reports • Recordkeeping requirements CODES OF CONDUCT • • • • Purpose of the Codes? See s 16 of FAIS Act- obligations (principles) Codes: Rules! 5 Codes: -General Code of Conduct -Administrative and -Discretionary Code of Conduct -Forex Investment Code of Conduct -Specific Code of Conduct for Short-term Deposit Business RULES V PRINCIPLES: WHAT’S THE STORY? • E.g. s 16(1)(a) of FAIS Act: Must act honestly and fairly, with due skill, care and diligence, in the interests of clients and the integrity of the financial services industrythese are principles! • Rules: See BN 58 of 2010: Conflict of interests E.g. a broker who acts on behalf of various insurance companies in marketing long-term insurance, advises a client to enter into an agreement with company A, wellknowing that company B’s product is better suited to the needs of the client. However, because company A invites the broker along on their annual hunting trips and golf days, the broker is partial to A and would rather send more business their way. • Compliance with rules must serve principles. SUPERVISION OF FSPs (S 4) • Powers of the FSB: -Functions -Departments -Profile changes -On-site visits • Read this together with Regulatory Action (suspension, withdrawal and debarment) and Enforcement Enforcement • 2 Aspects: -FAIS Ombud -Other measures: *Suspensions and withdrawals *Voluntary sequestration, winding up, debarment *Removal of directors *Civil remedies *Undesirable practices DISPUTES: OPTIONS LITIGATION FAIS OMBUD ADVANTAGES√ DISADVANTAGES Creature of statute x Voluntary Jurisdiction? JURISDICTION • Contravention of FAIS Act- has lead to financial prejudice or damage, future prejudice, damage • Willful, negligent rendering of financial service • Treating the complainant unfairly • At a time when the rules were in force • Respondent had failed to address complaint within 6 weeks DETERMINATIONS • • • • Extensive powers Uphold: wholly or partially Financial prejudice, damage Cost order: improper, unreasonable, unreasonable delay • Difference between Ombud and court? REMEMBER: REGULATOR CONSUMER/ CLIENT FSP CONCLUSION “Financial systems were not abstract entities dreamed up by dispassionate architects: they were human working practices caught up in the messy real world. That meant that the psychopathology of those people running such systems would determine the operation of the system…And therein lay the problem: (banks) had been taken over by the wrong types.” -Alexander McCall Smith-