Slide 1 - The ILS Funds

advertisement

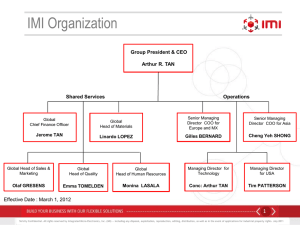

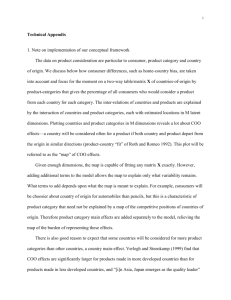

Adding Value as a PE COO • Calling on COO colleagues in Boston and New York, I mapped the typical COO duties, the areas where some COO’s are adding value to the portfolio, and some possible areas for future COO contributions. • At least in the US, the COO’s role is defined to complement the interests and abilities of other team members (more so than the CFO). Even so, the COO role has a typical core of internally focused tasks. There are also some outward facing functions that are allocated to either the CFO or COO. Some “best of breed” firms have COO’s with portfolio enhancing functions. (E.g., Blackstone, Riverside.) • Most of the COO’s future is in creating ways to add value to the firm and the portfolio, and the frontier is using risk management to enhance returns rather than limit opportunities. • Partnering solutions have come and gone, and now come again, with more aggressive and better product offerings. Robertson Stephens was the partner of choice for stock distributions. Citizens Bank has a decade-long history of wrap solutions for PE banking needs, and Wells Fargo is currently considering a PE product wrapping cash management, short term financing and industry expert insurance brokerage, all with portfolio level discounts. Inward facing, administrative duties In firms that have a COO, the core duties relate to the administration of the business. Some of the duties address facilities and IT, some cross between COO and CFO. A third set emerges only if the firm pushes for excellence in its internal operations. Facilities / Shared With IT CFO x x x x x x x x x x x x x x Emerging Best Practices x x x x x x infrastrucure - office space, equipment IT and enterprise systems - standards, strategy and best prices telephony and email solutions disaster recovery insurance program (property casualty and benefits) LP communications administrative systems (e.g., TNR, Investran, et al.) fund raising process benchmarking compensation bank lines (e.g., bridging from funding to calls) FX (transactional and risk management) annual portfolio planning and returns budget management company plans and budgets weekly fund level flash reports digitizing workflow (BPEL implementation) benchmarking operations headcounts benchmarking operational effectiveness returns attribution in compensation orchestrating valuations process and documentation IT and enterprise systems moving specific applications to the cloud Adding Value to the Portfolio Increasingly, VC and PE firms are actively managing portfolio companies. The process seems to ramp through four areas – metrics and monitoring, purchasing programs, cash management, and then active consulting as an extension of management. The COO can participate as a diagnostician, helping with staffing logistics, as part of a consulting team, et al.. The COO’s role becomes a reflection of abilities and bandwidth more than job title. Common Occasional x x x x x Unusual x x x x x x x portfolio planning - KSF's and valuation metrics portfolio planning - automated reporting linked to dashboards purchasing programs - insurance purchasing programs - office equipment purchasing programs - lease financing purchasing programs - shared cloud purchasing programs - shared banking cash management facility venture partners focused on developing opportunities venture partners focused on portfolio operations recurring consulting relationships retainer consulting relationships New Areas and Leading Edge Creative COO’s are moving fund administration into the best practices established for other services companies. Internal x x x x Portfolio Co's LP's x x x x x x x x x x x x x x x connectivity breakthroughs for the technology backbone digitizing processes social networking in the workplace BPO studies, pricing and facilities portfolio company roundtables - CEO's on macro market and planning portfolio company roundtables - CFO's on best practices comprehensive productivity enhancement ("GTD" administrator) pooled cash management facility returns database with valuation transparency and drill down capability mezzanine debt conduits co-investing with parallel public funds A swirl of other issues Several large scale issues are affecting the operations of private investment firms, and will continue to challenge industry COO’s. Some are listed below. • New analyst and associate hiring is down sharply, and the changing staffing profile is forcing process changes at all funds. In general, deal teams are more tightly focused on making investments and exits, and non-deal professionals are working other aspects of portfolio development. • When you can’t exit and valuation multiples don’t increase, you have to get gains from better operations. The pressure for improved margins has many effects, and one is faster development of internal consulting teams. • Increasingly sophisticated outsourcing alternatives can change the COO into to a coordinator of third party providers. The re-configured role emphasizes negotiation and confrontation over analysis, and limits the COO’s use in portfolio company work. • Fund CFO’s and COO’s are willing to share information, but not rewarded for doing so. The previous slides are based on conversations with a handful of well-connected COO’s, but not supported by a statistically valid sample. Appendix – Duties commonly delegated by the General Partners. The COO job starts by facing inward : A long list, but quickly becomes routine…… Operations side of investor communications Review, grammar and fact check all investor information Create and maintain investor information center (Sharepoint, other) Review and assemble financial statements into investor communication Production and distribution of online and hard copy Treasury and banking Review and verify controls over cash and securities (one in finance, one deal partner) 3rd party custody of physical securities (lock box with auditable log) Credit line for funding between capital calls Drive account structures and payment systems to the lowest total net cost for payments, funding, FX, wires, other Cash flow optimization – mechanics of cash collection and disbursements Compliance function Training (welcome to confidentiality and capital market regulations…) Monitoring (brokerage account copies, et al.) Reporting (quarterly internal and/or external) Fund raising process Administrative systems / prospect tracking Document the track record and establish the documents room Structuring to market terms and tax optimization Know Your Customer process Coordinate with counsel to orchestrate [rolling?] closes Subscription review and documentation Kick off meeting? First call and surrounding investor communications Investment process New deal and follow on processes - define it, document it, write it into the DNA of the organization. Checklists for commitments, checklists for funding. Guidelines to pre-empt conflict issues between funds Guidelines to pre-empt conflict issues between parallel equity and debt funds, and shared services operations Role of advisory committee in emerging issues and handling exceptions Operating policies and procedures Facilities manager functions HR Legal IT