Welcome

Welcome

New Members

Guests

• American Express Advanced

Services Europe Ltd

• Incahoot Ltd

• Transactor Technologies

• Intotheblue.co.uk

• Limonetik

• The Silver Crane Company

Limited

• Ikea

UKGCVA Sales Data

2012

Andrew Johnson

Director General

Year On Year Sales – Members Only

Total Sales £bn

Total Sales £bn

+3%

+12%

2.28

+7%

+14%

+0%

+6%

£bn

+9%

+4%

1.36

1.41

1.54

+2%

1.64

1.64

1.91

2.37

2.04

1.68

Sales reported by UKGCVA members who represent approx 50% total market

2003

2004

2005

2006

2007

Year

2008

2009

2010

2011

2012

Total Market Estimate

Total Sales £bn

5

4.5

4

3.5

£bn 3

2.5

2

1.5

1

0.5

0

Total Sales…

Total market estimate 2012 at £4.74bn

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Year

% Breakdown Consumer v B2B

%

year

Paper v Plastic?

%

Paper v Plastic?

2012

B2B only: 40% paper, 60% plastic

Consumer only: 38% paper, 62% plastic

• In 2011 paper accounted for 51% of B2B sales,

increases in open loop and closed loop cards in B2B

have pushed plastic above paper in B2B for the first

time at 40% paper, 60% plastic

• The consumer sector remains fairly static at 38% paper

and 62% plastic

• The UKGCVA does not currently collate digital voucher

data but it is estimated at single digit %

Billions

Dollars Loaded on Closed-Loop Retail Gift Cards:

In-Store Gift Segment, 2003–2012

$120

$97.3

$100

$92.7

$84.6

$76.9

$80

$68.3

$66.1

$60.5

$60

$51.8

$48.4

$40.0

$40

$20

$0

2003

2004

2005

2006

2007

2008

2009

9

© 2012 Mercator Advisory Group

2010

2011

2012 (f)

% Breakdown of Loads on

Consumer v. B-to-B Closed-Loop Cards

10

© 2011 Mercator Advisory

Group

Plastic is Still the Dominant Form Factor

Form Factor

Average Percent of Loads

Plastic

98%

Virtual

2%

Mobile

0%

This table does not mean no one reporting using virtual or mobile cards, but

the average numbers for those cards are so small as to be negligible. For a

few individual respondents, virtual cards were extremely important. Mobile

cards still remain almost unused.

The Internet Is Still Not An Active Distribution Channel

Distribution Channel

Average % of Total

Sales

Median % of Total Sales

In-Store

50%

56%

Business-to-Business

Sales

23%

16%

Card Malls

17%

18%

Issuer Web Site

5%

2%

Third Party Web Sites

2%

0%

Social Media Sites

0%

0%

•We know there are active programs and companies for third-party online distribution and social

media distribution, but these products are still nascent. These do not total to 100 because of the

independence of the segments across issuers.

Average card load was $42.59, up 28 percent from $33.16

Irish Gift Card & Voucher Association

• Engaged with Retail Ireland

• Following discussions with RI and Exec agreed to put

plans on hold for Irish Association

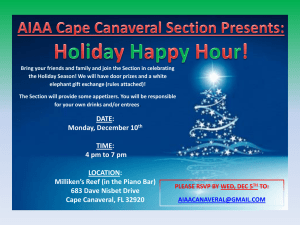

UKGCVA Social

Event

Joanne Peake & Kevin Lake

UKGCVA Exec

UKGCVA Alternative Awards

•

•

•

•

•

Social event planned for July

Follows success of the ‘UKGCVA Legends Dinner’

Informal evening in London restaurant

Opportunity for networking

Short list of nominees will be suggested by the Exec

then members get to vote via online voting

• More details to follow

Gift Card & Voucher Week 2012

10th – 17th November 2012

© Copyright Clareville Communications 2012

Objectives

What did we set out to do?

• To create a focus on gift cards and vouchers in the pre-Christmas period

• To promote awareness of gift cards & vouchers at the key selling and

gifting time

• To promote acceptance of gift cards & vouchers amongst gift givers

• To bring together several brands pooling financial and promotional

resources to make a real impact

© Copyright Clareville Communications 2012

Activity

What we did

• Created a brand – plus logo, website and social media

channels

• invited issuers to become supporters

• selected and agreed media partners

• planned and implemented a consumer survey

• ran a business to business media relations PR campaign

• Ran a consumer PR campaign

• ran a consumer media promotions campaign

supporters

Activity

National survey – 1,000 respondents

• National and regional newspaper coverage

• 49 radio interviews broadcast

• Online media and social media coverage

© Copyright Clareville Communications 2012

Activity

Radio interviews & promotions

• 49 interviews

• Presenter led promotions on 100 local radio stations

offering gift cards and vouchers as prizes

© Copyright Clareville Communications 2012

Activity

National newspaper competitions

•

•

•

•

•

Mirror group as national newspaper media partner

In paper, online

Daily Mirror and Record

Each supporter had an exclusive day

6 days of coverage and over 62,000 unique visitors to the web

site

© Copyright Clareville Communications 2012

Activity

Consumer magazines & TV

• competitions in consumer magazines – print & online

• The Wright Stuff Channel 5

© Copyright Clareville Communications 2012

Activity

Regional newspaper competitions

• competitions placed in 47 regional newspapers

© Copyright Clareville Communications 2012

Business audience

• coverage in key b2b media

© Copyright Clareville Communications 2012

The initiative over indexed against all KPI

measures that we had set. The coverage,

impact and PR value hitting the levels that

they did meant that, through our

participation, we secured the highest ROI of

all campaigns run in 2012; a definite repeat

activity for 2013.”

.

This was probably the

best promotion for gift

cards and vouchers for

many years – definitely

repeating for this year

Supporters

comments

“Gift Card and Voucher Week

presented an ideal opportunity to

highlight both our brand and Gift

Card to the consumer market at the

key trading time in the retail year.

In a relatively crowded marketplace

raising profile and awareness of the

brand and offering is vital”

274 pieces of coverage

•

•

•

•

•

•

•

Business media coverage – print & online

National newspaper coverage –print & online

Regional newspaper coverage – print & online

TV coverage

Radio coverage

Online, social & digital media coverage

Tens of thousands of entries to the competitions

© Copyright Clareville Communications 2012

•

•

•

•

•

•

•

24 pieces of business press coverage

42 pieces of national media coverage

59 pieces of regional coverage

49 radio interviews – live & syndicated

100 radio competitions

62,290 visits to the Mirror competitions online

Website and social media engagement

Summary

Coverage & value

Total impacts

52,290,284

Total advertising equivalent

£263,627

PR value

£527,254

9th – 16th November 2012

© Copyright Clareville Communications 2012

•

•

•

•

•

Maximum 10 supporters

National and regional media coverage

New survey

Mix of editorial and promotional PR activity

Online and social media

Keeping Us On Our Toes!

• The British Media spent 2012 ‘exposing’

expiry dates..........

• ………and 2013 trashing gift cards when a

retailer goes into administration

Press Coverage – Printed and

Broadcast Media

UKGCVA Plan

Crisis Management

Reputation Management

Negative

Positive

Reactive

Proactive

Strategy

Crisis Management:

What we are dealing with

How the media drive crises

• Intense competition to get story first and best

• Copy and out-do each other

• Rush to judgement

• Desire to pin blame

• Quote critics

• Keep story running

• Reluctant correction, if any

PROPOSAL

Strategy

Crisis Management:

Always available for

comment

Crisis communication strategy

• Preparation is everything: silence and confusion are unforgiven

• Company is judged not on the crisis but by how it communicates

• No hiding place: 24/7 Internet/ twitter

• A small crisis can rapidly escalate

PROPOSAL

The cost of crisis

Reputation Management

‘It takes 20 years to build a reputation and 5 minutes

to ruin it.’

‘If you lose money for the firm I will be understanding.

If you lose reputation I will be ruthless.’

By: Warren Buffett, renowned

businessman and philanthropist

PROPOSAL

UKGCVA

Plan

Reputation Management

• White Paper – Administrators, benefits of gift

cards & vouchers

• White Paper – Guidance for consumers

• White Paper – Guidance for retailers/issuers

facing potential administration

• White Paper – Best Practice Guidelines for

Members

• Engage with retailer CEO’s

• Proactive Activity through the year

UKGCVA

Plan

Reputation Management

Proactive Activity through the year

• Gift Card & Voucher Week

– Build on the success of 2012

• Gift Card & Voucher Redemption Weekend

– Success in USA in 2011 & 2012

– January weekend

– Added value for redeeming your gift card over the weekend

• Christmas Gift Card Campaign

– Sponsored by SVS

UKGCVA

Plan

Reputation Management

Proactive Activity through the year

• Gift Card & Voucher Week

– Build on the success of 2012

• Gift Card & Voucher Redemption Weekend

– Success in USA in 2011 & 2012

– January weekend

– Added value for redeeming your gift card over the weekend

• Christmas Gift Card Campaign

– Sponsored by SVS

Proactive Activity will require financial support from members.

What can be achieved in your own stores as well as working together?

Government Intervention

• The recent administrations have not just

sparked the press

• Department for Business, Innovation & Skills

(BIS)

• Potential for self-regulation/’Code of Conduct’

• Imposed regulation unlikely, but possible

• Across the whole industry – from local hair

salons to multi-national retailers

• Ring-fenced funds

Government Discussions

• Education on the industry

• ‘Code of Conduct’ backed by OFT

• Is this a problem big enough for government

to be concerned?

• Level playing field within Europe

After the break we are joined by BIS representatives:

Julie McLynchy & Stephen Childerstone

Followed by panel discussion and questions from members to panel & BIS

The Government’s

View and Options

Julie McLynchy & Stephen Childerstone

Department for Business, Innovation & Skills

Julie McLynchy

Deputy Director

Consumers and Markets

Consumer and Competition Policy Directorate

46

Gift Cards & Gift Vouchers

• Here to learn more about the industry – e.g. value;

participants; structure & relationships

• Particularly interested to hear views on:

– Ways to protect consumers’ funds in the event of

insolvency:

• e.g. bonds; ring-fencing; voluntary codes of practice?

– Expiry dates on gift vouchers:

• why do some issuers include these and others not?

The Panel

Richard Gyselynck

Acorne Plc

Arun Glendinning

CashStar

Stuart Lawrence

B&Q

Tony Rich

Halfords

Robert Courtneidge

Locke Lord

VAT

Jim Wilkinson

PWC

www.pwc.com

Taxation of vouchers

March 2013

Reminder

• EU proposal for Council Directive on vouchers

• To be implemented from 1 January 2015

• Aim to harmonise VAT treatment of vouchers across EU

• Compromise text to be agreed by mid-2013

• Domestic legislation required in 2014

PwC

March 2013

Slide 50

Main Proposals

• Single Purpose Vouchers – tax due on issue

• Multi Purpose Vouchers – tax due on redemption

• Discounts through the supply chain treated as “distribution services”

• Discount Vouchers – third party reimbursements to be treated as

taxable services

PwC

March 2013

Slide 51

Developments since June 2012

• Meeting with Treasury in July 2012 and HMRC

• Examples of voucher treatment produced by European Commission

• Meeting with Treasury and Arthur Kerrigan (DG Tax UD) in

September 2012

• UKGCVA meeting and workshops in November 2012

• UKGCVA meeting with Treasury/HMRC – 27 March 2013

PwC

March 2013

Slide 52

Issues to discuss

• Meaning of “Nominal Value”

• SPV’s – Breakage

• MPV’s – Impact on margins when sold via intermediaries

• MPV’s – impact on Corporate sales

• Discount vouchers – over-turning Elida Gibbs ECJ ruling – major

issue for retailers selling zero-rated goods

• Cash-flow: tax on distribution service paid on issue rather than

redemption of voucher

• Place of supply – possible requirement for overseas VAT registrations

• Administrative burden – invoices for distribution services

PwC

March 2013

Slide 53

This publication has been prepared for general guidance on matters of interest only, and does not

constitute professional advice. You should not act upon the information contained in this publication

without obtaining specific professional advice. No representation or warranty (express or implied) is

given as to the accuracy or completeness of the information contained in this publication, and, to the

extent permitted by law, PricewaterhouseCoopers LLP, its members, employees and agents do not

accept or assume any liability, responsibility or duty of care for any consequences of you or anyone

else acting, or refraining to act, in reliance on the information contained in this publication or for any

decision based on it.

© 2012 PricewaterhouseCoopers LLP. All rights reserved. In this document, “PwC” refers to

PricewaterhouseCoopers LLP (a limited liability partnership in the United Kingdom) which is a

member firm of PricewaterhouseCoopers International Limited, each member firm of which is a

separate legal entity.

New Digital World

John Weaver

Giftango

Arun Glendinning

CashStar

Clive Williams

SVM Digital

Christophe Bourbier

Limonetik

Next Meeting: Wednesday 12th June 2012