What is Strategy

advertisement

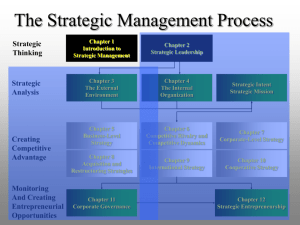

Welcome to Integrative Business Strategy MGS 4999 Dr. Joseph McGill Kean U - Willis 105J 908 737 4166 (O) jmcgill@kean.edu turbo.kean.edu/~jmcgill 1 Business Strategy • Firm-level view – Integrative - crosses internal functions/units – Fit – the firm in its environment – LT performance – LT (~irreversible) resource commitments 2 Learning Objectives • Understand strategy • Understand • Understand • Understand history/context of the goal of strategy strategy content strategy process 3 Business Strategy antecedents • Ancient Greece - military term Στρατηγικός: the army’s leader • von Clausewitz – strategy is emergent • Strategy appears in both business and military fields in mid-19th century America. • West Point graduates implemented what they learned: – in the Civil War (developed the Staff Office) 4 – in business in the 1850s Business Strategy questions – Why is it that some firms perform well over time relative to competitors, while other firms fail? – Who are the stakeholders relative to firm performance (e.g., managers, owners, investors, employees, customers, suppliers, …)? – What drives business performance (value creation)? • We will learn to apply strategic management “toolkits” to identify issues, evaluate 5 alternatives, and choose & implement actions. Business Strategy • 1959 – Ford foundation report on business schools > reform the curriculum! • Apply analytical models, e.g., game theory. • Move beyond neoclassical economics 6 Neoclassical economics Firm MC AC Price per Bushel Price per Bushel LONG-RUN EQUILIBRIUM - FIRM AND INDUSTRY Industry D (2,075 firms) S 2 M m $1.87 D 2 40 Quantity of Corn in Thousands of Bushels (a) $1.87 S 2 D 83 Quantity of Corn in Millions of Bushels (b) 7 The Facts Analysis of 8,000 US businesses 81-97: • 19% sustained high performers. • 20% chronic under-performers. • 41% steady moderate performers. • 10% declining performers. • 10% improving performers. McGahan,California management review, 1999 • NB Recent McKinsey research notes that sustainable success is now rarer than 20%. 8 Industry profitability 1987-1996 Source: Hawawini, Subramanian, & Verdin. Strategic Management Journal (2003) 9 Why are there performance differences among firms? • Concentration of market power, monopoly positions ? (Bain) • Opportunistic innovation? (Schumpeter) • Efficiency through vertical integration? • Efficiency through control of transaction costs? (Williamson) • Capability to learn & adapt continuously 10 Drivers of performance (brief version) • Desire - some firms seek dominance (e.g. Newscorp, WalMart, Canon, Dell, Sony) – National competition - firms may be protected from the forces of competition (‘national champions’ for example) • Ability – To identify a valuable opportunity. – To innovate & protect the innovation (others see it and are attracted by first mover success). – To leverage firm-specific capabilities and resources. 11 12 Alaska Gold Mine (You have 14 days) Option Min Time Max Time Outcome Personal Risk #1 (wait 3-4 weeks) #2 (over top) #3 (valley) #4 (wait 3 days) 13 Alaska Gold Mine (You have 14 days) Option Min Time Max Time Outcome No $$$ #1 Personal Risk None (wait 3-4 weeks) #2 (over top) #3 (valley) #4 (wait 3 days) 14 Alaska Gold Mine (You have 14 days) Option Min Time Max Time Outcome #1 Personal Risk No $$$s None For sure $$$s Life (wait 3-4 weeks) 7 days #2 (over top) 10 days #3 (valley) #4 (wait 3 days) 15 Alaska Gold Mine (You have 14 days) Option Min Time Max Time Outcome #1 Personal Risk No $$$s None For sure $$$s Maybe $$$s Life (wait 3-4 weeks) #2 7 days 10 days 14 days 21 days (over top) #3 (valley) None #4 (wait 3 days) 16 Alaska Gold Mine (You have 14 days) Option Min Time Max Time Outcome No $$$s None #1 (wait 3-4 weeks) #3 #2 Personal Risk (valley) (over top) #4 (wait 3 days) #3 14 days 7 days 21 days 10 days (wait 3 days) None Life Yes, if top 10-13 days 17-24 days $$$s None Lose, if storm to top to valley 14 days 21 days (valley) #4 Maybe For $$$ssure 10-13 days 17-24 days to top to valley Maybe $$$s None Yes, if top Lose, if storm None 17 The Alaska Gold Mine (You have 14 days) Option Personal Min Time Max Time Outcome Risk No $$$s None #1 (wait 3-4 weeks) #2 7 days 10 days 14 days 21 days (over top) #3 (valley) (wait 3 days) #4 to top to valley 10-13 days 17-24 days (wait 3 days) #5 What if walk to for top3 days? to valley For sure Life $$$s Maybe None $$$s Lose, if storm None Yes, if top Lose, if storm None IF STORM Keep walking, same as option #3 #5IFWhat if walkforTurn 3 days? NO STORM back (total 6 days) + over top (7-10 days) 13 - 16 days IF STORM Keep walking, same as option #3 IF NO STORM Turn back (total 6 days) + over top (7-10 days) 13 - 16 days 18 Strategy Formulation The Environment “Threats & Opportunities” GOAL Management’s values & attitude toward risk STRATEGY Organization’s capabilities “Strengths & Weaknesses” 19 Strategic Management Process The Environment “Threats & Opportunities” Management’s values & attitude toward risk Execution/ Implementation GOAL STRATEGY Control Organization’s capabilities “Strengths & Weaknesses” Performance Formulation Implementation 20 More specifically … Strategy consists of organization-wide commitments and actions required for a firm to exploit its competencies, gain competitive advantage, and earn aboveaverage returns *commitments - long term (irreversible) commitments *actions - involving substantial creation, acquisition, or redeployment of resources *competitive advantage(s) – competitors are unable to 21 copy/imitate Terms Average (or “accounting”) returns Returns equal to those an investor expects to earn from other investments with a similar amount of risk Above-Average (or “economic”) returns Returns from firm-specific strategies that competitors are not simultaneously implementing 22 Limited sources of value creation • Strategies • Structures/business models • Products/processes • Resource/capability creation • Resource/capability combination • New markets But …good business ideas are hard to find! 23 The Strategic Management Process 1. Strategic Planning 2. Scenario Planning 3. Strategy as Planned Emergence 24 Strategy as Planning •Top-down rational planning – Define mission/vision/goal (strategic intent) – External analysis: opportunities and threats – Internal analysis: strengths and weaknesses – Create strategic fit through SWOT – Formulate appropriate strategy – Implement chosen strategy – Monitor performance & modify if necessary 25 Strategy as Scenario Planning Envision different "what-if" plans Generate a dominant plan – Must implement the most probable option Keeps other scenarios in the event of changes… • "Arab Spring" impact on the oil industry? • Tablets/mobility impact on the PC industry – Good example of the AFI framework 26 Strategy as Planned Emergence • Strategic Initiative – Google 50% from the "20% rule" – Enron wind investment… • Mintzberg Planned Emergence • Strategy can come from top or bottom – Some intended strategies drop off in the process – Allows for new emerging ideas to become realized – Resource allocation process (RAP) – Serendipity can have dramatic effects 27 Competitive Landscape Dynamics of strategic maneuvering among global and innovative combatants Hypercompetition Fundamental nature of competition is changing Price-quality positioning, new know-how, first mover Protect or invade established product or geographic markets 28 Competitive Landscape Emergence of global economy Hypercompetitive environments Fundamental nature of competition is changing Goods, services, people, skills, and ideas move freely across geographic borders. Spread of economic innovations around the world. Political and cultural adjustments are required. 29 Competitive Landscape Emergence of global economy Rapid technological change Hypercompetitive environments Fundamental nature of competition is changing Increasing rate of technological change and diffusion The information age Increasing knowledge intensity 30 Strategic flexibility? How can a firm develop dynamic capabilities in response to perpetually turbulent and uncertain competitive environments? Can firms change? (i.e., success breeds failure)? 31 Strategic Flexibility Organizational slack Strategic reorientation Strategic Flexibility flexibility Capacity to learn 32 I/O Model of Above-Average Returns 1. External Environments General Global Industry Environment Competitor Environment 1. Strategy dictated by the external environments of the firm (what opportunities exist in these environments?) 2. Firm develops internal skills required by external environment (what can the firm do about the opportunities?) Technological Environment 33 Four Assumptions of the I/O Model 1.External environment creates pressures and constraints that determine the strategies that would result in aboveaverage returns (deterministic) 2.Most firms competing within a particular segment are assumed to control similar strategically relevant resources and to pursue similar strategies in light of those resources 34 Four Assumptions of the I/O Model 3.Resources used to implement strategies are highly mobile across firms 4.Organizational decision makers are assumed to be rational and committed to acting in the firm’s best interests, as shown by their profit-maximizing behaviors 35 I/O Model of Above-Average Returns Industrial Organization Model The External Environment 1. Study the external environment, especially the industry environment • economies of scale • barriers to market entry • diversification • product differentiation • degree of concentration of firms in the industry36 I/O Model of Above-Average Returns Industrial Organization Model The External Environment An Attractive Industry 2. Locate an attractive industry with a high potential for aboveaverage returns Attractive industry: one whose structural characteristics suggest above-average returns 37 I/O Model of Above-Average Returns Industrial Organization Model The External Environment An Attractive Industry Strategy Formulation 3. Identify the strategy called for by the attractive industry to earn above-average returns Strategy formulation: selection of a strategy linked with aboveaverage returns in a particular industry 38 I/O Model of Above-Average Returns Industrial Organization Model The External Environment 4. Develop or acquire assets and skills needed to implement the strategy An Attractive Industry Strategy Formulation Assets and Skills Assets and skills: those assets and skills required to implement a chosen strategy 39 I/O Model of Above-Average Returns Industrial Organization Model The External Environment An Attractive Industry Strategy Formulation Assets and Skills Strategy Implementation 5. Use the firm’s strengths (its developed or acquired assets and skills) to implement the strategy Strategy implementation: select strategic actions linked with effective implementation of the chosen strategy 40 I/O Model of Above-Average Returns Industrial Organization Model The External Environment An Attractive Industry Strategy Formulation Assets and Skills Strategy Implementation Superior returns: earning of aboveaverage returns Superior Returns 41 Resource-based Model of Above Average Returns 1. Firm’s Resources 1.Strategy dictated by unique resources and capabilities of the firm (what can the firm do best?) 2.Find an environment in which to exploit these assets (where are the best opportunities?) 42 Resource-based Process Resource-based Model Resources 1. Identify the firm’s resources-- strengths and weaknesses compared with competitors Resources: assets (tangible or intangible) used in delivering products or services 43 Resource-based Process Resource-based Model Resources Capability 2. Determine the firm’s capabilities--what it can do better than its competitors Capability: how resources are managed and integrated in the delivery of a product or service 44 Valuable Rare Costly to imitate Nonsubstitutable Resources and Capabilities Four Attributes of Resources and Capabilities (Competitive Advantage) allow the firm to exploit opportunities or neutralize threats in its external environment possessed by few, if any, current and potential competitors when other firms cannot obtain them or must obtain them at a much higher cost the firm is organized appropriately to obtain the full benefits of the resources in order to realize a competitive advantage 45 Resources and capabilities Valuable Rare Costly to imitate Nonsubstitutable Resources and Capabilities that meet these four criteria become a source of: Core Competencies 46 Core Competencies are the basis for a firm’s Competitive advantage Strategic competitiveness Core Competencies Ability to earn aboveaverage returns 47 Resource-based Process Resource-based Model Resources Capability Competitive Advantage 3. Determine the potential of the firm’s resources and capabilities in terms of a competitive advantage Competitive advantage: ability of a firm to outperform its rivals in the creation of value. 48 Resource-based Process Resource-based Model 4. Locate an attractive industry Resources Capability Competitive Advantage An Attractive Industry An attractive industry is one with opportunities that can be uniquely exploited by the firm’s resources and 49 capabilities Resource-based Process 5. Select a strategy that best allows the firm to utilize resources and Resources capabilities (that are superior to its rivals) Capability relative to opportunities in the Competitive Advantage external environment An Attractive Industry Strategy formulation Strategy Form/Impl and implementation: strategic actions taken to earn above average50 Resource-based Model Resource-based Model of Above Average Returns Resource-based Model Resources Capability Competitive Advantage An Attractive Industry Strategy Form/Impl Superior returns: earning of aboveaverage returns Superior Returns 51 52 Strategic Intent What is forming strategic intent? • Identifying a desired position in the long term that far exceeds a company's current resources and capabilities • E.g., Sony, Komatsu (encircle Caterpillar) , Canon (beat Xerox) 53 Strategic Intent The resources required to realize the strategy may not be available initially Intent is about seeing the end state and deciding how to leverage internal resources, capabilities, and core competencies in a “staged” approach 54 Mission Fundamental question of Goal Choice: • Profitability (net profits) • Efficiency (low costs) • Market Share • Growth (e.g., ^ in total assets, sales, etc) • Shareholder Wealth (dividends plus stock price appreciation) • Utilization of Resources (e.g., ROE, ROI) • Reputation • Contribution to Stakeholders (e.g., employees, society) • Survival (avoid bankruptcy) 55 Mission Intel Corp. • From product orientation … – To be the pre-eminent building block supplier of the PC industry – To be the pre-eminent building block supplier of the Internet economy • To customer orientation … – Delight our customers, employees, and shareholders by relentlessly delivering the platform and technology advancements that become essential to the way we work and live • But…what links a firm’s mission statement with competitive advantage? 56 Strategy Process • Strategic Planning • Scenario Planning • Strategy as “Planned Emergence” 57 Strategy Process Rational Planning • Define mission, vision, goals (strategic intent) • External analysis - opportunities and threats • Internal analysis of strengths and weaknesses • Create strategic fit through SWOT • Formulate appropriate strategy • Implement chosen strategy • Monitor performance & modify if necessary 58 Strategy Process Scenario planning • Envision different "what-if" plans – Generates a dominant plan • Implement the most probable option – Keep other scenarios in the event of changes… – "Arab Spring" impact on the oil industry? 59 Strategy Process Scenario Planning - The future cannot be known, e.g., • UPS, FedEx, AirTran, Delta … – How to compete if the barrel of oil costs $35 or $200? • Boeing, Harley-Davidson, Caterpillar … – How to compete if 1 euro = $2 or $1 = 75 yen • How to obtain capital when credit markets are frozen? • Tendency however is not to think about pessimistic scenarios 60 Strategy Process Emergent Strategy • Strategy can come from top or bottom • Some intended strategies drop off in the process, new ideas realized • Resource reallocation required • Sometimes deliberate – Real Options • Serendipity can have dramatic effects • Technological innovation |≠| success 61 The Firm and Its Stakeholders Stakeholders Groups The firmwho must aremaintain affected performance by a at firm’s an performance adequate level and in who order have to retain claims theon its wealth participation of key stakeholders 62 Critical dependency: Stakeholders Stakeholders Provide Resources Capital Markets Shareholders (institutional ownership most active) Major suppliers of capital •Banks •Private lenders •Venture 63 capitalists Stakeholders Provide Resources Capital Markets Product Markets Primary customers Suppliers Host communities & regulatory bodies Unions 64 Stakeholders Provide Resources Capital Markets Product Markets Organizational Employees Managers Nonmanagers 65 Stakeholder Involvement Two issues affect the extent of stakeholder involvement in the firm Organizational 1 How do you divide the returns to keep stakeholders involved? E.g., Compensate employees? Increase dividends? Increase product value? Capital Market Product Market 66 Stakeholder Involvement Two issues affect the extent of stakeholder involvement in the firm Organizational 2 How do you increase the returns so everyone has more to share? Capital Market Product Market 67 Some financial metrics Profitability: important to Shareholders and Senior Managers Shareholders: ROE - return on equity Dividend Yield Senior Mgrs: ROA - return on assets ROS - return on sales Expense Ratios Profit Margin Liquidity: Impt to Lenders Current Ratio Debt/Equity Ratio Quick Ratio Efficiency: Internal Usage Accounts Receivable Turnover Inventory Turns 68 Cases • Describe actual situations – Forces you to choose among different options and plan implementation actions • Cases include background events and supporting materials – – – – Financial statements Operational data Product lists Transcripts of interviews with employees 69 Case Skills • Evaluate – multiple aspects of a business situation – differentiate significant factors – deal with uncertainty, missing information • Envision – explanations not readily apparent – outcomes of decisions • Integrate/Synthesize – understand firm-level effects – interdependencies 70 Case Analysis • Put yourself “inside” the case – Strategic decision maker – Board member – Outside consultant • Purpose is to diagnose problems and find solutions. Unravel the case material. – Background/Problem Statement 10-20% – Strategic Analysis/Options 60-75 % – Recommendations/Action Plan 10-20% 71