Business Policy & Strategy

… an introduction to the COBE BBA degree

capstone foundations course . . .

MGNT428 – Spring 2006

Dr. Tom Lachowicz, Instructor

1

Instructional techniques …

• Hitt Text Chapter

readings + lectures +

Supplemental

readings …

• Five Harvard

Business School

Case Studies

–

–

–

–

–

Meg Whitman & E-Bay

The Walt Disney Company

Apple Computer

Airborne Express

Husky Injection Molding

Systems

2

Course Overview

•

Learning objectives:

1. To apply tools for

analyzing the financial

and competitive

positioning of firms and

industries.

2. To comprehend the

complexities facing

managers in

implementing strategic

plans.

3. To comprehend methods

used for matching a firm’s

internal capabilities with

the demands of

competitive constraints.

4. To examine methods

used to determine where,

how, and for how long a

firm can create its

competitive advantage.

3

Learning objectives (cont’d.)

5. To develop useful

administrative and

individual and

group

communication

skills required for

achieving successful

outcomes for your

firm in the BSG.

4

Any questions?

5

The Hitt Text:

Chapter 1 Notes

MGNT428 – Business Policy

& Strategy

Dr. Tom Lachowicz, Instructor

6

When we have completed this chapter

you should be able to:

– Define strategic

competitiveness competitive

advantage, and aboveaverage returns.

– Describe the 21st-century

competitive landscape and

explain how globalization

and technological changes

shape it.

– Use the industrial

organization (I/O) model to

explain how firms can earn

above-average returns.

– Use the resource-based

model to explain how

firms can earn aboveaverage returns.

– Describe strategic intent

and strategic mission

and discuss their value.

– Describe strategic intent

and strategic mission

and discuss their value.

– Define stakeholders and

describe their ability to

influence organizations.

7

Learning Objectives (cont’d)

- Use the resource-based model to explain how

firms can earn above-average returns.

- Describe the work of strategic leaders.

- Explain the strategic management process.

8

Let’s start by asking … some key questions!

1. What is a management

strategy course all

about?

5. What is the resourcebased model?

2. Just what is strategy?

6. Who are a firm’s key

stakeholders?

3. What is happening in

the business strategic

environment?

7. What affects do firm

stakeholders have on

strategy?

4. What is the industrial

organization (IO)

model?

8. Who is it who creates

“strategy” in

organizations?

9

Some Important Definitions

• Strategic Competitiveness

– When a firm successfully formulates and implements a

value-creating strategy.

• Sustainable Competitive Advantage

– When competitors are unable to duplicate a

company’s value-creating strategy.

• Strategic Management Process

– The full set of commitments, decisions, and actions

required for a firm to achieve strategic competitiveness

and earn above-average returns.

10

Definitions (cont’d)

• Risk

– An investor’s uncertainty about the economic gains

or losses that will result from a particular investment.

• Average Returns

– Returns equal to those an investor expects to earn

from other investments with a similar amount of risk.

• Above-average Returns

– Returns in excess of what an investor expects to

earn from other investments with a similar amount of

risk.

11

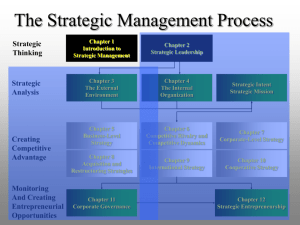

Hitt’s Strategic

Management

Process

Figure 1.1

Copyright © 2004 South-Western. All rights reserved.

12

Current Competitive Landscape

• It’s a “tough” world out there! A Perilous Business

World for the “faint hearted” . . .

– Investments required to compete on a global scale are

enormous.

– Consequences of failure are severe/

• Important Elements of Success

– Developing an effective strategy [game plan!]

– Implementing that strategy [executing the plan!]

13

Competitive Landscape

Global

economy

Strategic

maneuvering among

global and innovative

combatants

Rapid

technological

change

14

Competitive Landscape: Hypercompetition

Hypercompetition . . . A condition of rapidly

escalating competition based on:

• Price-quality positioning.

Hypercompetition

• Competition to create new

know-how and establish

first-mover advantage.

• Competition to protect or

invade established product

or geographic markets.

15

Our Global Economy

• The Global Economy is …

– Goods, people, skills, and ideas move freely

across geographic borders.

– Movement is relatively unfettered by artificial

constraints.

– Expansion into global arena complicates a

firm’s competitive environment.

16

The Global Economy (cont’d.)

• Globalization provides:

– Increased economic interdependence among

countries as reflected in the flow of goods and

services, financial capital, and knowledge

across country borders.

– Increased range of opportunities for

companies competing in the 21st-century

competitive landscape.

17

Technology and

Technological Changes

• Rate of change of technology and speed

at which new technologies become

available

– Perpetual innovation—how rapidly and

consistently new, information-intensive

technologies replace older ones.

– The development of disruptive technologies

that destroy the value of existing technology

and create new markets.

19

Technological Change

• The Information Age

– The ability to effectively and efficiently access

and use information has become an important

source of competitive advantage.

– Technology includes personal computers,

cellular phones, artificial intelligence, virtual

reality, massive databases, electronic

networks, internet trade.

20

Technological Changes

• Increasing Knowledge Intensity

– Strategic flexibility: set of capabilities used to

respond to various demands and

opportunities in dynamic and uncertain

competitive environments

– Organizational slack: slack resources that

allow the firm flexibility to respond to

environmental changes

– Capacity to learn

21

Two Approaches to

Above-Average Returns . . .

• Hitt’s I/O Model of

strategic planning . . .

• The Resource-Based

Model of strategic

planning . . .

22

Hitt’s I/O Model of

Above-Average Returns

• The industry in which a firm competes has a

stronger influence on the firm’s performance than

do the choices managers make inside their

organizations.

– Industry properties include:

•

•

•

•

•

economies of scale

barriers to market entry

diversification

product differentiation

degree of concentration of firms in the industry

23

Four Assumptions of the I/O Model

1

External environment imposes pressures and

constraints that determine strategies leading to aboveaverage returns.

2

Most firms competing in an industry control similar

strategically relevant resources and pursue similar

strategies.

3

Resources used to implement strategies are

highly mobile across firms.

4

Organizational decision makers are assumed to be

rational and committed to acting in the firm’s best

interests (profit-maximizing.).

24

I/O Model of Above-Average Returns

External Environments

General

Environment

1. Strategy is dictated by

the external

environment of the

firm (what

opportunities exist in

these environments?)

2. Firm develops

internal skills required

by external

environment (what

can the firm do about

the opportunities?)

25

The External

Environment

The I/O Model of

Above-Average Returns

1. Study the external

environment, especially

the industry environment.

• The general environment

• The industry environment

• The competitor environment

Adapted from Figure 1.2

26

The External

Environment

An Attractive

Industry

The I/O Model of

Above-Average Returns

2. Locate an attractive

industry with a high

potential for aboveaverage returns.

• An industry whose

structural characteristics

suggest above-average

returns.

Adapted from Figure 1.2

27

The External

Environment

An Attractive

Industry

Strategy

Formulation

The I/O Model of

Above-Average Returns

3. Identify the strategy called

for by the attractive

industry to earn aboveaverage returns.

• Selection of a strategy

linked with aboveaverage returns in a

particular industry.

Adapted from Figure 1.2

28

The External

Environment

An Attractive

Industry

Strategy

Formulation

Assets and Skills

The I/O Model of

Above-Average Returns

4. Develop or acquire

assets and skills

needed to implement

the strategy.

• Assets and skills

required to implement a

chosen strategy.

Adapted from Figure 1.2

29

The External

Environment

An Attractive

Industry

Strategy

Formulation

Assets and Skills

Strategy

Implementation

The I/O Model of

Above-Average Returns

5. Use the firm’s strengths

(its developed or

acquired assets and

skills) to implement the

strategy.

• Selection of strategic

actions linked with

effective implementation

of the chosen strategy.

Adapted from Figure 1.2

30

The External

Environment

The I/O Model of

Above-Average Returns

An Attractive

Industry

Strategy

Formulation

Assets and Skills

Strategy

Implementation

Superior Returns

• Superior returns: earning

of above-average

returns.

Adapted from Figure 1.2

31

Michael Porter’s Five Forces Model

of Competition

• An industry’s profitability results from

interaction among:

– Suppliers

– Buyers

– Competitive rivalry among firms currently in

the industry

– Product substitutes

– Potential entrants to the industry

32

Porter’s Five Forces Model of Competition (cont’d.)

• Firms earn above average returns by:

– Producing standardized products or services.

– Manufacturing differentiated products for

which customers are willing to pay a price

premium.

33

The Resource-Based Model

of Above-Average Returns

• Each organization is a collection of unique

resources and capabilities that provides the

basis for its strategy and that is the primary

source of its returns.

• Capabilities evolve and must be managed

dynamically.

34

Resource-Based Model of Above-Average

Returns (cont’d.)

• Differences in firms’ performances are due

primarily to their unique resources and

capabilities rather than structural

characteristics of the industry.

• Firms acquire different resources and

develop unique capabilities.

35

Resource-Based Model

of Above-Average Returns (cont’d.)

Firm’s Resources

1. Strategy is dictated by

the firm’s unique

resources and

capabilities.

2. Find an environment in

which to exploit these

assets (where are the

best opportunities?)

36

Resources and Capabilities

• Resources

– Inputs into a firm’s

production process:

• Capital equipment

• Skills of individual

employees

• Patents

• Finances

• Talented managers

• Capabilities

– Capacity of a set of

resources to

perform in an

integrative manner.

– A capability should

not be:

• So simple that it is

highly imitable

• So complex that it

defies internal

steering and

control

37

The Resource-Based Model

of Above-Average Returns

Resources

1. Identify the firm’s

resources. Study its

strengths and weaknesses

compared with those of

competitors.

• Inputs into a firm’s

production process

Adapted from Figure 1.3

38

The Resource-Based Model

of Above-Average Returns

Resources

Capability

2. Determine the firm’s

capabilities. What do the

capabilities allow the firm to

do better than its

competitors.

• Capacity of an integrated

set of resources to

integratively perform a

task or activity.

Adapted from Figure 1.3

39

The Resource-Based Model

of Above-Average Returns

Resources

Capability

Competitive

Advantage

3. Determine the potential of

the firm’s resources and

capabilities in terms of a

competitive advantage.

• Ability of a firm to

outperform its rivals.

Adapted from Figure 1.3

40

The Resource-Based Model

of Above-Average Returns

Resources

Capability

Competitive

Advantage

An Attractive

Industry

4. Locate an attractive

industry.

• An industry with

opportunities that can

be exploited by the

firm’s resources and

capabilities.

Adapted from Figure 1.3

41

The Resource-Based Model

of Above-Average Returns

Resources

Capability

Competitive

Advantage

An Attractive

Industry

Strategy

Implementation

5. Select a strategy that

best allow the firm to

utilize its resources and

capabilities relative to

opportunities in the

external environment.

• Strategic actions taken to

earn above-average

returns.

Adapted from Figure 1.3

42

The Resource-Based Model

of Above-Average Returns

Resources

Capability

Competitive

Advantage

An Attractive

Industry

Strategy

Implementation

Superior Returns

• Superior returns: earning

of above-average returns

Adapted from Figure 1.3

43

Key Criteria of Resources and

Capabilities . . .

Valuable

– Resources and capabilities are valuable when

they allow a firm to take advantage of

opportunities or neutralize threats in external

environment.

• Rare

– Resources and capabilities are rare when

possessed by few, if any, current and potential

competitors.

44

Key Criteria of Resources and Capabilities [con’t.]

• Costly to Imitate

– Resources and capabilities are costly to

imitate when other firms either cannot obtain

them or are at a cost disadvantage in obtaining

them.

• Nonsubstitutable

– Resources and capabilities are

nonsubstitutable when they have no structural

equivalents.

45

The all-important Core Competencies

• When the four key criteria of resources and

capabilities are met, they become core

competencies.

• Core competencies serve as a source of

competitive advantage.

• Managerial competencies are especially

important.

46

How Resources and Capabilities Provide

Competitive Advantage . . .

Valuable Allow the firm to exploit opportunities or

neutralize threats in its external environment.

Rare Possessed by few, if any, current and

potential competitors.

Costly to imitate When other firms cannot obtain them or

must obtain them at a much higher cost.

Nonsubstitutable The firm is organized appropriately to obtain

the full benefits of the resources in order to

realize a competitive advantage.

47

Resources and Capabilities, Core

Competencies, and Outcomes

Valuable

Core

Competencies

Rare

Competitive

Advantage

Costly to Imitate

Value Creation

Nonsubstitutable

Above Average

Returns

48

Strategic Intent

• Its internally focused.

• It requires the leveraging of a firm’s resources,

capabilities and core competencies to accomplish

the firm’s goals.

• It only exists when all employees and levels of a

firm are committed to the pursuit of a specific,

significant performance criterion.

49

Strategic Mission

• Is externally focused.

• Is a statement of a firm’s unique purpose

and the scope of its operations in product

and market terms.

– It establishes a firm’s individuality and is

inspiring and relevant to all stakeholders.

– It provides general descriptions of the firm’s

intended products and its markets.

50

Stakeholders

• Are all those individuals, groups and

entities who can affect, and are affected by,

the strategic outcomes achieved and who

have enforceable claims on a firm’s

performance.

• Stakeholder claims are enforced by their

ability to withhold essential participation.

51

The Three

Stakeholder

Groups

Figure 1.4

52

Capital Market Stakeholders

• Shareholders and lenders expect the firm

to preserve and enhance the wealth they

have entrusted to it.

• Returns should be commensurate with the

degree of risk to the shareholder.

53

Product Market Stakeholders

• Customers

– Demand reliable products at low prices.

• Suppliers

– Seek loyal customers willing to pay highest

sustainable prices for goods and services.

• Host communities

– Want companies willing to be long-term employers

and providers of tax revenues while minimizing

demands on public support services.

• Union officials and their members

– Want secure jobs and desirable working conditions.

54

Organizational Stakeholders

Employees [The “worker-bees!”]

– Expect a dynamic, stimulating and rewarding

work environment.

– Are satisfied by a company that is growing

and actively developing their skills.

55

Stakeholder Involvement

• Two issues affect the extent of stakeholder

involvement in the firm

How to divide returns

to keep stakeholders

involved?

Organizational

How to increase

returns so everyone

has more to share?

Capital

Market

Product

Market

56

Strategic Leaders

• People in the enterprise who are

responsible for the design and execution of

strategic management processes.

• Decisions they make include:

– How resources will be developed or acquired.

– At what price resources will be obtained.

– How resources will be used.

57

Organizational Culture

• The complex set of

– Ideologies

– Symbols

– Core values

that are shared throughout the firm,

that influence how the firm conducts

business.

58

Mapping an Industry’s Profit Pools

• Define the pool’s boundaries.

• Estimate the pool’s overall size.

• Estimate the size of the value-chain activity

in the pool.

• Reconcile the calculations.

59

The Strategic Management Process

1. Study the external and internal environments.

2. Identify marketplace opportunities and threats.

3. Determine how to use core competencies.

4. Use strategic intent to leverage resources,

capabilities and core competencies and win

competitive battles.

5. Integrate formulation and implementation of

strategies.

6. Seek feedback to improve strategies.

60