Cost Accounting - Society for Academic Emergency Medicine

advertisement

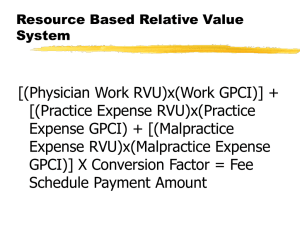

SAEM Bootcamp COST ACCOUNTING Jim Bihun, MBA Vice Chair for Finance & Administration Vanderbilt Department of Emergency Medicine Disclosure of Commercial Relationships None No Off-Label Disclosures Goals Overview of concepts Understanding of different perspectives Better management of your department and leadership in your organization Objectives Understand “costs” in light of health care reform Appreciate elements, system needs, multiple perspectives on cost accounting Prepare and understand financial proposals, monthly reports, budgets, impact studies Why is this Important? Understand what data is needed for best decision making Don’t be mislead Applied knowledge is needed to gain resources Speak fluently with the CFO and your funding sources! My Background MBA and Health Services BA from the University of Michigan 14 years with Vanderbilt EM 2 years in national practice management consulting with HCA 10 years in finance and operations with Henry Ford Health System The Power of Data… “In God we trust, all others must bring data.” The Power of Data… “In God we trust, all others must bring data.” - W. Edwards Deming Cost Accounting The study of costs, including methods for classifying, allocating, and assembling costs to determine “product” costs Purpose is to provide information to manage costs, set charges, analyze profitability, choose among alternatives Cost Accounting Includes the area of managerial accounting, and it overlaps with financial accounting Information used for effective decision making, as well as planning and control of operations Importance has grown with fixed reimbursement The Realm of Accounting Managerial Accounting Financial Accounting Cost Accounting Accounting Financial Accounting Purpose is to provide historic accounting information to external users Prepared according to prescribed AICPA and GAAP formats Managerial Accounting Purpose is to provide accounting information to internal users in order to support planning and control functions Data is generally current or prospective in nature No prescribed format; varies among organizations Costing Methods Methods to Arrive at the Cost of a Product/Service Classify costs Allocate costs Assemble costs Methods to Classify Costs By By By By function traceability behavior relevance to decision making Costs Classified by Function Operating costs are associated with producing the product/service Non-operating costs are associated with supporting the production of a product or service Costs by Traceability Direct costs can be traced directly to a department, product, or service Indirect costs (aka overhead) cannot be traced directly to a product/service Full costs include directs + indirects Average cost = full cost / number of services produced Costs by Behavior In relation to volume or over time Variable costs change directly and proportionately with changes in volume Fixed costs remain constant in relation to volume changes Costs by Behavior Semi-fixed costs are fixed in the short term and can vary when a longer time horizon is considered Marginal costs are the changes in costs related to incremental changes in volume Costs by Relevance to Decision Making Sunk costs have already been incurred and will not be affected by future decisions Opportunity costs represent the opportunities foregone when rejecting an alternative choice Methods of Allocating Costs The process of allocating indirect costs, and some directs, to departments which generate charges Requires determination of revenue and expense by cost center Requires workload statistics that best reflect the department’s activity Cost Allocation Methods Direct allocation from non-revenue centers to revenue centers (driven by share of workload statistics) In step-down apportionment, nonrevenue centers allocate to each other first, then to the revenue centers In multiple apportionment, revenue centers can also reallocate Methods of Assembling Costs Assemble costs by responsibility center to hold managers accountable for their controllable costs Full costing allocates directs and indirects to a product/service to determine profitability Differential costing only looks at incremental costs and revenues in making decisions Methods of Assembling Product Costs Standard Costing Ratio of cost to charges (RCC) Activity-based costing (ABC) Standard Costing Method of identifying expected benchmark costs for producing your goods/services Used in budgeting and for comparison with actual results Ratio of Cost to Charges (RCC) Calculated by dividing departmental charges by departmental expenses and applying that ratio to each product’s charge to determine its cost Flawed, as it assumes a consistent relationship among all products in the group Activity-Based Costing (ABC) Uses cost drivers to assign direct and indirect costs to products Ideal cost drivers are activities that pertain to each product in varying amounts Drivers should have a high correlation to the consumption of the overhead ABC for EDs ABC focuses on the difference between volume-driven costs (eg, ED visits) and activity-driven costs (eg, specific nursing duties and time) Without ABC, overhead may be overallocated to high-volume products ABC can be used to differentiate patient cost by acuity level An Example of ABC in the ED Determine average ED nursing cost by patient group Use for comparison with contracted rates ABC in the ED Define patient groups (eg, ESI level) Determine RN time (and salary) spent in direct and indirect patient care Build RN activity list and time needed for each task Allocate RN activities by patient group and determine total RN time by group Apply RN cost by patient group Visit Counts by Patient Category Patient Category ESI 1 ESI 2 ESI 3 ESI 4 ESI 5 TOTAL Annual Counts 1,000 10,000 25,000 12,000 2,000 50,000 ABC Cost & Time Elements RN hours for 1.0 FTE = 2,080/yr Salary & benefits cost of $50,000/FTE Estimated that 75% of RN time is spent in direct care, 25% is indirect For this example, total cost of 50 FTEs is $3,000,000/yr RN Activity List & Times Take vitals Give medication Patient education Charting 2 min each 4 min 10 min 5 min # of RN Activities by Patient ESI 1 2 3 4 5 Vitals 24 20 16 10 6 Meds 20 15 10 3 0 Pt Ed 3.5 4 3 2 1 Chart 6 6 3 2 1 Avg Hrs & Avg Cost/Patient ESI Avg 1 2 3 4 5 Total Hrs/Pt 4.29 3.78 2.60 1.38 0.60 2.50 Avg RN Cost/Pt $103.10 $ 90.81 $ 62.50 $ 33.12 $ 14.42 $ 60.00 ($3m/50,000 pts) ABC in the ED Comments Look at patient time spent by each job category (eg, RNs, paramedics, techs) Cost is driven by number and type of staff interventions Also include costs of non-chargeable supplies and non-productive staff costs when spreading costs across patient groups Contribution Margin & Cost Volume Profit Analysis Contribution Margin CM= Marginal revenue – marginal cost for an incremental volume of activity Break even (BE) point occurs where contribution margin/visit x activity level = fixed costs BE quantity = total fixed costs / (revenue per unit – variable cost per unit) Cost Volume Profit (CVP) Examples ED Daily Revenues and Expenses 120,000 $534 rev/vst $ Amount 100,000 Staffing (fixed) Cost 80,000 89 Visits to BE $50 exp/vst 60,000 Other Direct (Variable) Costs Total Direct Expenses 40,000 Revenue 20,000 0 33 66 99 Daily Visits 132 164 197 Daily CVP Graph Notes Fixed Costs = $43,200 / day Break even point occurs at 89 visits/day (2,715/month) Contribution Margin (CM) = variable revenue – variable expense ($534 $50 = $484) BE of 89 = $43,200 fixed / $484 CM Add in Indirects for the Month… Monthly CVP Graph Notes Full costs = directs + indirects Break even point is pushed further out to 3,500 visits; 42,000/yr (vs 2,715/mo without indirects) Indirects are typically applied on a monthly allocation basis And Now Consider SemiFixed Costs Over the Year Annual CVP Notes “Fixed” costs can jump when volume warrants it Break even point moves further to the right (eg, to 4750/mo; 57,000/yr) Typically coincides with an increase in staffing levels (labor costs) CVP Observations Variable costs are linear with volume Fixed costs can be modified over an extended time horizon or volume range “Relevant Range” concept: the relationships between fixed and variable costs only hold true within a relevant range of activity or over a “limited” time period CVP Observations Different time horizons allow costs to be viewed and reported differently “Profit” depends on allocation of overhead “Profit” is not perfectly correlated with volume Capitated CVP Example Capitated CVP Notes In a capitated environment, the revenue line is typically horizontal (based on $ pmpm amount x number of lives enrolled) “Profits” occur when costs are lowest Low cost may be seen as skimping on care Costing for Decision Making Costing Scenarios for Non- Routine Decisions Adding a new service, or dropping an old service Expanding or cutting back a program Make vs. buy decisions Establishing charges for services to managed care companies Costing Methodology for Non-Routine Decisions Identify alternatives Define relevant costs Consider nonfinancial issues Applied Costing Studies “The Financial Consequences of Lost Demand and Reducing Boarding”, J. Pines, Annals of Emergency Medicine, Vol xx, 2011 “The Cost of an ED Visit and Its Relationship to ED Volume”, A. Bamezai, G. Melnick, A. Nawathe, AEM, May 2005 New Business Pro Forma VA Staffing Proposal for 1.5 MD FTEs Indiv Avg Cost Revenue - Expense = Margin $414k $462k ($ 48k) Dept’s Marginal Cost $414k $372k $ 42k Marginal cost is based on a new MD starting salary (that’s typically what the Dept will hire for backfill); Avg cost is based on who actually goes to the VA The Cost of Expanded MD Coverage Determine the cost of starting a physician-in-triage program Staffed 24 hrs/wk (Mon & Tue, 12 hrs daily) Identification of marginal costs Prepare revenue forecast (marginal, not average) Annual Budgeting Salary budget Non-salary budget Forecasting visits and collections Rate and volume variance analysis Rate Volume Variance Analysis Problem What’s going on? Where’s the problem? What to do? Example of Monthly Rate & Volume Variances Item Actual Visits 5,500 RVUs 20,000 Collected $ 750k Budget 5,000 18,000 $ 700k Variance +10.0% +11.1% + 7.1% These are volume variances, with the second two caused by rate variances Rate Variances Item RVU/Visit Coll/RVU Coll/Visit Actual 3.64 $37.50 $136.36 Budget 3.60 $38.89 $140.00 Variance +1.1% -3.6% -2.6% Unfavorable Coll/RVU rate variance may be due to changed payor mix, delayed payments, or increased denials Management Controls Allow managers to monitor performance and take appropriate corrective action when needed Benchmarking of Costs & Productivity ED cost per visit Faculty salaries (by rank, longevity) Faculty RVU productivity (per year, per hour, or per visit) Physician visits (per hour or per year) Physician clinical hours (per year, per week, or per day) My Benchmarking Sources SAEM Salary Survey (for total MD compensation, annual clinical hours by job title, starting pay) AAMC salary survey (by faculty rank, school type, geographic area) AAAEM annual survey (for clinical hours, visits, coding, payer mix, RVUs) Others such as UHC (RVUs) and Academic MGMA (salaries, RVUs) Use Cost Data to Negotiate: Rates with payers, or your internal share of bundled payments Amount of hospital support Faculty salary increases, staffing ratios Budgets, approval of new programs Savings from initiatives Costs on the National Radar Cost Accounting and Quality Management Total Quality Management (TQM) philosophy is that prevention is cheaper than cure Focus on doing things right the first time, avoiding rework High quality is the key to low cost Take Time for Planning Consider the costs of improving quality Consider the potential savings resulting from quality improvement The organization must design a system to prevent failures Focus on those costs which directly affect the quality of patient care; “value-added costs” Total Cost Management Cost accounting must change from being reactive to being proactive Focus on sharing cost information with all levels of employees Focus on improving the quality in the value-added areas Selectively reduce non-value-added costs National Perspectives on Cost Payers Employers Individuals Providers Economists / government / society Costs in Light of Health Care Reform Cost reduction, shared savings Cost shifting (pushing costs or payment expectations from one group to another) Cost per member per month Cost sharing – Patient perspective – Provider perspective – Insurance plan / employer perspective Should We Be Worried? Cost Reforms Bending the “cost curve” Value-based purchasing Case rates, bundled payments Sustainable growth rate (SGR) reform ACOs Accountable Care Organizations (ACOs) Local health care organizations that can be held accountable for the quality and cost of care for a defined group of patients Involves investment in systems of care and provider integration, taking financial risk Cost Reduction Fallacies From what baseline? Savings are NOT equal to average cost per case x number of cases avoided, or number of days of reduced LOS x avg cost per day Typically, just a fraction of variable costs Questions for Designing Cost Information Systems What information is needed When is information needed How much detail is needed Has a broad group been surveyed for their input? Widespread organizational access? How complicated is it to use? Cost Accounting System Needs Ability to identify and track the cost of activities Method to link and allocate activities and their costs to “products/services” produced Methods to rationally allocate supporting resources “People” System Needs Need to audit and ensure the quality of your cost data Focus on responsiveness to customers Teamwork is essential Health care needs us to take up the challenge and apply these concepts Cost Accounting Summary What is cost accounting How costing is done Contribution Margin and Cost Volume Profit concepts Costing for business planning and analysis Cost accounting & health care reform System needs Thank You! Jim.Bihun@vanderbilt.edu 615-936-1323