July 2014

advertisement

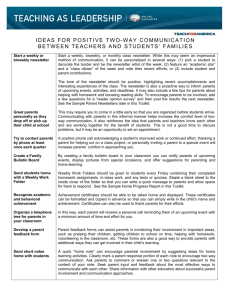

TM We are dependable and trustworthy knowledge processing partner. Although we are a separate entity, we are an integrated part of your organization, like a slice of a wholesome pie. NEWSLETTER –JULY 2014 TM INDEX • Direct Taxation • Indirect Taxation • Corporate and Other Laws • International Taxation • Statutory Due Dates for July 2014 Newsletter –July 2014 TM DIRECT TAXATION Index •CII for the FY 2014-15 Cost Inflation Index i.e. CII for the FY 2014-15 is notified by CBDT on 11th June 2014. It will be “1024”. •Government may hike tax exemption limit from 2L to 5L and deduction u/s 80C may increase to 2L Government may provide a major relief in coming budget to the tax-payers, by increasing the Income Tax slab limit for exemption from Rs.2 lakh to Rs.5 lakh. Further, the government is also considering raising the tax exemption limit on home loans and health insurance premium. Finance ministry also considering the proposal to increase deduction limit under section 80C of the Income Tax Act, 1961 to two Lakh from existing limit of Rs. one Lakh. The Limit of deduction U/s. 80C of Rs. one lakh was fixed wef Financial Year 2005-06 by replacing the section 88 of Income Tax Act,1961. Since then Deduction limit remains un-changed. Newsletter - July 2014 TM DIRECT TAXATION Index •India to implement US foreign tax compliance act RBI has said India and the US have agreed to implement a foreign tax compliance law and asked banks and financial institutions to register by this year-end to report accounts and assets held by US citizens. India and the US have agreed to implement Foreign Accounts Tax Compliance Act (FATCA), a US law that targets tax noncompliance by US taxpayers with foreign accounts. The Inter-Governmental Agreement (IGA) on FATCA, which came into effect on April 11, will be signed only after Cabinet approval. Newsletter - July 2014 TM INDIRECT TAXATION Index •Excise duty cut for Auto, capital good and consumer durables extended till 31st December 2014 In the Interim Union Budget 2014 on 17th February, 2014, the Government had reduced the Excise duty on: Small cars, motorcycles, scooters, three wheelers and commercial vehicles from 12% to 8%; Mid-segment cars from 24% to 20%; Large cars from 27% to 24%; and SUVs from 30% to 24%. Further, to stimulate growth in the Capital goods and Consumer durable sectors, Excise duty was reduced from 12% to 10% on all goods falling within the Chapters 84 & 85 of the Central Excise Tariff Act, 1985. The concessional Excise duty cut for above mentioned goods was set to expire on June 30, 2014, will now be available till December 31, 2014. Newsletter – July 2014 TM CORPORATE AND OTHER LAWS Index •Due date for filing DTP-4 extended to 31st August 2014 MCA has vide General Circular N0. 27/2014- Dated 30.06.2014 extended the due date for Filing DPT-4 with Registrar of Companies in respect of Deposits standing on 01.04.2014 i.e. the date of Commencement of Companies Act, 2013 from 30.06.2014 to 30.08.2014 without any additional fee. Companies are required to file a statement regarding deposits existing as on date of commencement of the Act within a period of 3 months from such commencement. •Old Formats and forms to continue for annual return applicable for FY 2013-14 Clarification with regard to format of annual return applicable for Financial Year 2013-14 and fees to be charged by companies for allowing inspection of records. It is, clarified that Form MGT-7 shall not apply to annual returns in respect of companies whose financial year ended on or before 1st April, 2014 and for annual returns pertaining to earlier years. These companies may file their returns in the relevant Form applicable under the Companies Act, 1956. It is clarified that until the requisite fee is specified by companies, inspections could be allowed without levy of fee. Newsletter – July 2014 TM CORPORATE AND OTHER LAWS Index • Liberalized Remittance Scheme for resident individuals RBI vide circular No. RBI/2013-14/624 dated 3rd June 2014 indicated that existing limit of remittance by resident individual is USD 75000/- per financial year which is been increased to USD 125000/- per year , under the scheme for any permitted current or capital account transaction or a combined of both. • EVOTING not mandatory for shareholders meeting till 31st December 2014 Section 108 of the Companies Act, 2013 read with rule 20 of the Companies (Management and Administration) Rules, 2014 deal with the exercise of right to vote by members by electronic means (e-means). The provisions seek to ensure wider shareholders participation in the decision making process in companies. Corporates and other stakeholders while appreciating the new approach have drawn attention to some practical difficulties in respect of general meetings to be held in the next few months. It is noticed by MCA that compliance with procedural requirements, engagement of Depository Agencies and the need for clarity on matter like demand for poll/ postal ballot etc will take some more time. Accordingly, it has been decided not to treat the relevant provisions as mandatory till 31St December, 2014. Newsletter – July 2014 TM INTERNATIONAL TAXATION Index •MNC tax woes likely to end In a move aimed at avoiding litigation in thousands of transfer-pricing cases, the finance ministry is likely to allow in the Union Budget rollback of advance-pricing agreements (APAs) to past years . This is seen as good news for large multinational companies like Shell, Vodafone and Microsoft, which have received draft tax orders in recent years for purportedly suppressing incomes, as these cases could be resolved under APAs. Newsletter – July 2014 TM STATUTORY DUE DATES FOR JULY 2014 Index •Statutory Due Dates Calendar for July 2014 Due Date Statutory Compliance 5th July 2014 Payment of Service Tax/ Excise duty 7th July 2014 Payment of TDS 15th July 2014 Payment of Provident Fund contribution/ Profession Tax 21st July 2014 Payment of ESIC/ MVAT 31st July 2014 Income Tax Return for Individuals and other to whom Tax Audit is not applicable Newsletter – July 2014 Get in Touch www.nyaasa.com +91.98228 70043 +91.98231 18326 +91.20.3234 1738 +91.20.6500 8738 contact@nyaasa.com TM THANK YOU ! Newsletter –July 2014