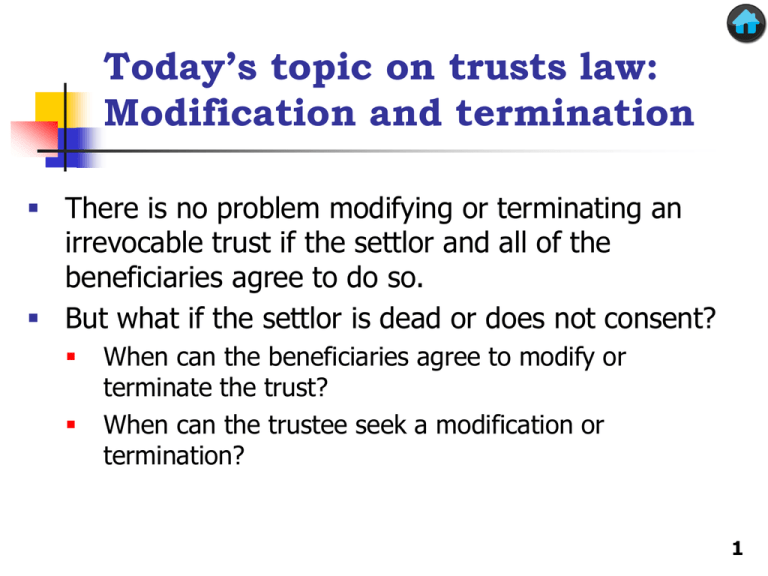

Modification and Termination of Trusts

advertisement

Today’s topic on trusts law: Modification and termination There is no problem modifying or terminating an irrevocable trust if the settlor and all of the beneficiaries agree to do so. But what if the settlor is dead or does not consent? When can the beneficiaries agree to modify or terminate the trust? When can the trustee seek a modification or termination? 1 Modification and termination under traditional law Modification or termination by beneficiaries Claflin doctrine allows modification or termination except when continuation is necessary to carry out a material purpose of the settlor Modification or termination by trustees Doctrine of equitable deviation permits modification or termination of administrative terms on account of unanticipated circumstances When necessary to accomplish the purposes of the trust, but not merely to benefit the beneficiaries 2 In re Trust of Stuchell In re Trust of Stuchell 801 P.2d 852 (Or. App. 1990), p.643 What were the facts? J.W. Stuchell Stuchell died. Will created trust for family: When Edna dies, principal to be distributed to her children or their descendants per stirpes. John Harrell, Edna’s son, is unable to live independently. Can the trust be modified under equitable deviation to provide for continuation as special needs trust and not count as income for by Medicaid? Other life income Edna beneficiaries Harrell John Harrell No. Modification not permitted merely because it is more advantageous to 3 the beneficiaries Modern modification due to unanticipated circumstances Restatement (Third) of Trusts § 66(1) (2003) The court may modify an administrative or distributive provision of a trust … if because of circumstances not anticipated by the settlor the modification or deviation will further the purposes of the trust. Uniform Trust Code § 412(a) (2000) The court may modify the administrative or dispositive terms of a trust or terminate the trust if, because of circumstances not anticipated by the settlor, modification or termination will further the purposes of the trust. To the extent practicable, the modification must be made in accordance with the settlor’s probable intention. 4 In re Riddell In re Riddell 157 P.3d 888 (Wash. App. 2007), p.645 What were the facts? Irene George Ralph Donald Beverly Nancy George and Irene died. Wills created trusts for family: When Ralph and Beverly die, principal to be distributed to their children Nancy is unable to live independently because of psychiatric disease. Can trust be modified to provide for continuation as special needs trust for Nancy’s benefit? 5 What result in Riddell? Under traditional law principles No. The modification was merely for the benefit of the beneficiaries (in this case avoiding payment to the State) (page 646) Under Third Restatement Yes. Nancy’s mental illness was not anticipated, and modification would further the purposes of the trust by preserving the trust’s assets for Nancy’s care (both because Nancy cannot manage them, and the State likely would seize them) (page 648) 6 What result in Riddell? But why is it legitimate for Nancy’s father/trustee to shield the trust assets from the state (page 648)? After all, the funds would be going to pay for her basic needs. Because Congress specifically authorized special needs trusts for families like the Riddells. Modification is appropriate in this case. 7 Question 1, p.649 Did Nancy’s father have a duty to request a modification of her trust? No. The duty to petition applies to administrative terms, and this case involved a distributive term (Restatement § 66(2), page 645) But one of the comments to § 66 suggests that there might be some duty if the trustee has actual knowledge that a purpose of the settlor would be jeopardized by adherence to existing provisions governing distribution. 8 Question 2, p.649 What result under traditional law? Petition fails. It’s not clear we have a qualifying change in circumstances (the examples in the Restatement involve situations with a decline in value), and even if we do, they haven’t changed to the extent that compliance would substantially impair achieving the purposes of the trust. Moreover, the change would affect a dispositive rather than administrative term of the trust. What about termination by beneficiaries? It was a spendthrift trust 9 Question 2, p.649 What result under UTC § 412, page 645? Case for termination is stronger since the UTC only requires that the termination further the purposes of the trust rather than being necessary to avoid frustrating the purposes of the trust (page 642) The Somers court allowed for the distribution to the charity but not to the individuals (it was a spendthrift trust) 10 Anticipating unanticipated circumstances: Trust Protectors, p. 651 Settlor Beneficiaries Trustee Trust Protector Examples of Protector Powers 1) replace trustee; 2) approve modifications to trust provisions; 3) terminate trust; or 4) select a successor trust protector. Other options: trustee power to modify the trust, with a co-trustee rather than trust protector; powers of appointment in beneficiaries; decanting power 11 Modification or termination by beneficiaries: Claflin and material purpose Traditional Claflin doctrine: If continuance of the trust without termination is necessary to carry out a material purpose of the settlor, the beneficiaries cannot compel termination. Examples of material purpose (traditional law): Spendthrift trust Discretionary trust (pure or support) Support trust Postponed enjoyment (e.g., principal distributed when beneficiary reaches age 30) What about terminating a trust with successive beneficiaries? 12 In re Estate of Brown In re Estate of Brown 528 A.2d 752 (Vt. 1987), p.653 What were the facts? (3) The … trust … shall be used to provide an education … for the children of my nephew … . Said trust to continue for said purpose … until … accomplished. At such time as this purpose has been accomplished … [the trust shall continue] for the care, maintenance and welfare of [my nephew and wife] for and during the remainder of their natural lives. [Upon their demise, the residue goes to their children] 1) Has the educational purpose been satisfied? 2) If so, is there any other material purpose preventing termination of the trust and distribution of the assets to nephew and wife? 13 Brown and material purpose The trust cannot be terminated if it is a support trust. Is it? No. The trust provides for the nephew and his wife all of the income and such principal as is necessary to maintain them in the style to which they are accustomed rather than to use income or principal only to the extent necessary to support them (page 654) Is it non-terminable as a spendthrift trust? No. The terms of the trust do not indicate that it is a spendthrift trust. Was there another material purpose preventing termination? Yes. The trust was designed to assure a life-long income to the nephew and his wife (“to live in the style and manner to which they are accustomed, for and during the remainder of their natural lives”) As the court observed, when the trust merely provides for successive gifts, life and remainder beneficiaries can agree to termination. 14 Modification or termination of noncharitable trust by consent Restatement §65 UTC §411 Weakens material purpose Preserves material purpose Authorizes termination Weakens requirement of if reason outweighs beneficiaries’ unanimity material purpose Authorizes termination if Preserves requirement of interests of absent beneficiaries’ unanimity beneficiary will be adequately protected Should really say “nonconsenting” rather than “absent” 15 Removal of a trustee Rules draw a balance between the need to protect the settlor’s interests against beneficiaries who might want to find a trustee more sympathetic to their requests and the need to protect the settlor against an irresponsible trustee Traditionally, removal has been allowed only for cause—serious breach of duty, but not a minor breach. UTC allows beneficiaries greater power to seek a new trustee (§ 706(b)(2)-(4), page 660) Of course, the trust document can override the law’s default rules (e.g., by giving the power of removal to a trust protector or to the beneficiaries) 16 Modification due to unanticipated circumstances Restatement (Third) of Trusts § 66(1) (2003) 1) The court may modify an administrative or distributive provision of a trust … if because of circumstances not anticipated by the settlor the modification or deviation will further the purposes of the trust. 2) If a trustee knows or should know of circumstances that justify judicial action under Subsection (1) with respect to an administrative provision, and of the potential of those circumstances to cause substantial harm to the trust or its beneficiaries, the trustee has a duty to petition the court for appropriate modification of or deviation from the terms of the trust. 17 Modification and termination under traditional law Termination by beneficiaries Claflin doctrine prohibits termination when doing so would be contrary to a material purpose of the settlor Modification or termination by trustees Doctrine of equitable deviation permits modification or termination of administrative terms on account of unanticipated circumstances When necessary to accomplish the purposes of the trust, but not merely to benefit the beneficiaries 18 Trust protectors The trust instrument should make clear whether the protector is subject to fiduciary duties If the answer is no, perhaps there also should be an exculpatory clause to deal with the possibility that a court might hold that the protector’s fiduciary status cannot be waived, though this too might not be enforced. 19 Decanting clause example The independent trustee of any trust hereunder (the “original trust”) shall have the power at any time and from time to time, in such trustee’s sole and absolute discretion, to appoint any portion or all of the principal of any trust held hereunder to the trustee of another trust under any other instrument, by whomever created, provided that the exercise of such power (a) does not reduce any fixed income interest of any beneficiary of the original trust; (b) is in favor of the beneficiaries of the original trust; and (c) does not violate any applicable rule against perpetuities. 20 Removal of a trustee Any trustee may be removed at any time by the Settlor during his competent lifetime upon delivery of written notice to the Trustee being removed; and following the Settlor’s incapacity or death, any corporate Trustee may be removed by the individual Trustee(s), or if no individual Trustee(s) is/are serving, by a majority of the then permissible income beneficiaries of the Trust (with the custodial parent, guardian or other legal representative acting on behalf of a minor or otherwise incapacitated beneficiary). 21