Liabilities

advertisement

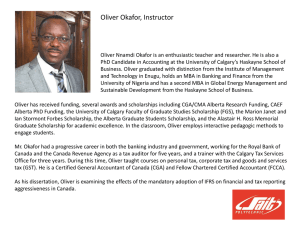

Chapter 1 Accounting and The Business Environment Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 1 of 23 Decision Makers Individuals Businesses Creditors Investors Taxing Authorities Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 2 of 23 Two Fields of Accounting Financial Accounting Managerial Accounting Provides information for external decision makers Focuses on information for internal decision makers – Investors – Creditors – Taxing Authorities Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Managers Business Owners Employees Slide 3 of 23 S1-2: USERS OF FINANCIAL INFORMATION Suppose you are the manager of Greg’s Tunes, Inc. The company needs a bank loan in order to purchase music equipment. In evaluating the loan request, the banker asks about the assets and liabilities of the business. In particular, the banker wants to know the amount of the business’s stockholders’ equity. Requirements: 1.Is the banker considered an internal or external user of financial information? 2.Which financial statement would provide the best information to answer the banker’s questions? Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 4 of 23 The Accounting Profession • Lucrative career with many opportunities • Certified Public Accountants (CPAs) Certified Public Accountants, or CPAs Certified Management Accountants, or CMAs Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 5 of 23 Governing Organizations FASB SEC AICPA GAAP IASB Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 6 of 23 Ethics in Accounting and Business Investors and creditors want reliable financial information Conflict of Interest Companies want to attract investors Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 7 of 23 Audit • SEC requires companies to have financial statements examined by independent accountants – Auditors will provide an opinion on financial statements, if possible • Recent accounting scandals hurt investor confidence – SOX – PCAOB Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 8 of 23 Standards of Professional Conduct AICPA IMA Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 9 of 23 Types of Business Organizations Proprietorship Partnership Corporation LLC and LLP Not-for-profit Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 10 of 23 Comparison of Business Forms Proprietorship Partners Corporation LLC, LLP Not-forProfit Owners Proprietor: One Owner Partners: Two or more Stockholders: usually many Members None Life of Organization Limited by owner's choice or death Limited by owners’ choice or death Indefinite Indefinite Indefinite Liability of owners for business debts Proprietor: Owner is personally liable Partners are personally liable Stockholders not personally liable Members are not personally liable Fiduciary liability of board members Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 11 of 23 Corporate Characteristics Separate Legal Entity Continuous Life/Transferability of Ownership No Mutual Agency Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 12 of 23 Corporate Characteristics (continued) Limited Liability of Stockholders Separation of Ownership and Management Government Regulation Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 13 of 23 Corporate Characteristics (continued) Corporate Taxation Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 14 of 23 Organization of a Corporation • Incorporators obtain charter from the state • Charter authorizes corporation to: Issue stock Conduct business in accordance with state law • Incorporators agreed to a set of bylaws • Corporations begins to exist when stock is issued Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 15 of 23 Structure of a Corporation Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 16 of 23 S1-4: TYPES OF BUSINESS ORGANIZATION Chloe Michaels plans on opening Chloe Michaels’ Floral Designs. She is considering the various types of business organizations and wishes to organize her business with unlimited life and limited liability features. Additionally, Chloe wants the option to raise additional equity easily in the future. Which type of business organization will meet Chloe’s needs best? Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 17 of 23 GAAP • Generally Accepted Accounting Principles Guidelines that govern accounting Based on a conceptual framework Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 18 of 23 Accounting Principles Entity Concept Cost Principle Faithful Representation Principle GoingConcern Concept Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Stable Monetary Unit Concept Slide 19 of 23 Accounting Principles Entity Concept Faithful Representation Principle Cost Principle Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 20 of 23 Accounting Principles (continued) Going-Concern Stable Monetary Unit Concept Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 21 of 23 The Accounting Equation ASSETS Economic Resources LIABILITIES EQUITY Claims to Economic Resources Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 22 of 23 Assets • Economic resources • Benefit the business in the future Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 23 of 23 Claims to Assets Liabilities Equity • Debts payable to outsiders • Owners’ claims to the assets of the business Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 24 of 23 The Accounting Equation Assets Liabilities Equity Liabilities Assets Equity Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 25 of 23 Equity of a Corporation Assets Stockholders’ equity Liabilities Paid-in capital Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Retained earnings Slide 26 of 23 Equity of a Corporation Paid-in capital Stockholders’ equity Common stock + Net income (loss) Retained earnings - Dividends Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 27 of 23 Net Income Retained earnings + Net income (loss) + Revenues - Expenses - Dividends Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 28 of 23 Revenues • Amounts earned by delivering goods or services to customers Sales revenue Service revenue Interest revenue Dividend revenue Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 29 of 23 Expenses • Outflows of assets or increasing liabilities in the course of delivering goods or services to customers Store or rent expense Salary expense Advertising expense Utilities expense Interest expense Property tax expense Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 30 of 23 E1-16: CHARACTERISTICS OF A CORPORATION, ACCOUNTING CONCEPTS, AND USING THE ACCOUNTING EQUATION Select financial information for three corporations follows: Liabilities Equity New Rock Gas Assets $? $74,000 $24,000 $50,000 DJ Video Rentals $75,000 $? $43,000 $32,000 Corner Grocery $100,000 $53,000 $? $47,000 Requirements: 1. Compute the missing amount in the accounting equation for each entity. Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 31 of 23 E1-16: CONTINUED 2. List the seven main characteristics of a corporation. Continuous Life and transferability Corporate taxation Government regulation Limited Liability of Stockholders No Mutual Agency Separate Legal Entity Separation of ownership and managers 3. Which accounting concept tells us that the previous three corporations will continue to exist in the future? Going Concern Concept Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 32 of 23 Transaction • An event that affects the financial position of the business • Can be measured reliably • Every transaction impacts at least two items • The accounting equation balances before and after each transaction Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 33 of 23 E1-21: USING THE ACCOUNTING EQUATION TO ANALYZE TRANSACTIONS Caren Smith opened a medical practice. During July, the first month of operation, the business, titled Caren Smith, M.D., P.C. (Professional Corporation), experienced the following events: 1. Analyze the effects of these events on the accounting equation of the medical practice of Caren Smith, M.D., P.C. Assets Dat e Cash Medical supplies Land Liabilitie s Stockholders’ Equity Accounts payable Commo Retained n stock earnings Jul $ 55,000 6 Bal $ 55,000 9 (46,000) Bal $9,000 $ 55,000 $ 0 $ 0 $ 0 $ 55,000 $ 0 $ 0 $55,000 $ 0 46,000 $ 0 $46,000 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 34 of 23 E1-21: CONTINUED Assets Date Cash Jul 12 Bal Medical supplies Land $1,800 Liabilitie s Stockholders’ Equity Accounts payable Commo Retained n stock earnings $1,800 $9,000 $1,800 $46,000 $1,800 $55,000 $0 Bal $9,000 $1,800 $46,000 $1,800 $55,000 $0 15-31 8,000 Bal $17,00 0 29 (1,600) (900) (100) 15 8,000 $1,800 $46,000 $1,800 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson $55,000 $8,000 (1,600) (900) (100) Slide 35 of 23 E1-21: CONTINUED Assets Date Cash Bal $14,400 30 $1,800 Land $46,000 (700) Bal $14,400 31 Medical supplies $1,100 Stockholders’ Equity Accounts payable Commo Retained n stock earnings $1,800 $55,000 $5,400 $55,000 $5,400 $55,000 $5,400 (700) $46,000 (1,100) Bal $13,300 Liabilitie s $1,100 (1,100) $1,100 $46,000 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson $ 0 Slide 36 of 23 Preparing the Financial Statements Income Statement Balance Sheet Statement of Retained Earnings Statement of Cash Flows Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 37 of 23 Income Statement Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 38 of 23 Statement of Retained Earnings Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 39 of 23 Balance Sheet Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 40 of 23 Statement of Cash Flows Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 41 of 23 P1-36A: PREPARING FINANCIAL STATEMENTS Studio Photography, Inc., works weddings and prom-type parties. The balance of retained earnings was $16,000 at December 31, 2011. At December 31, 2012, the business’s accounting records show these balances: Insurance expense $ 8,000 Accounts receivable $ 8,000 Cash 37,000 Note payable 12,000 Accounts payable 7,000 Retained earnings 47,000 Advertising expense 3,000 Salary expense 25,000 Service revenue 80,000 Equipment 50,000 Dividends 31,000 Common stock 29,000 Prepare the following financial statements for Studio Photography, Inc. for the year ended December 31, 2012: a. Income statement b. Statement of retained earnings c. Balance sheet 42 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 42 of 23 P1-36A: CONTINUED Studio Photography, Inc. Income Statement Year Ended December 31, 2012 Revenue: Service revenue Expenses: Salary expense Insurance expense Advertising expense Total expenses Net income 43 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson $ 80,000 $ 25,000 8,000 3,000 36,000 $ 44,000 Slide 43 of 23 Studio Photography, Inc. Statement of Retained Earnings Year Ended December 31, 2012 Retained earnings, December 31, 2011 Add: Net income Subtotal Less: Dividends Retained earnings, December 31, 2011 44 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson $ 16,000 44,000 $ 60,000 (13,000) $ 47,000 Slide 44 of 23 P1-36A: CONTINUED Studio Photography, Inc. Balance Sheet December 31, 2012 Assets Cash Accounts receivable Equipment Liabilities $37,000 8,000 50,000 Accounts payable $ 7,000 Note payable 12,000 Total liabilities 19,000 Stockholders’ Equity Common stock Retained earnings Total assets $95,000 $29,000 47,000 Total stockholders’ equity 76,000 Total liabilities and stockholders’ equity $95,000 45 Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Slide 45 of 23 Decision Guidelines Income Statement Statement of Retained Earnings Financial & Managerial Accounting by C. Horngren, W. Harrison & M. S. Oliver, 3rd ed. Pearson Balance Sheet Slide 46 of 23