KPMG Screen template

advertisement

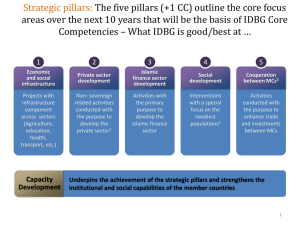

Islamic Finance Creating an enabling framework for Azerbaijan Neil D Miller Global Head of Islamic finance 16 November 2012 Islamic Finance – Why? 2 $bn Global Islamic banking assets are growing… 1.20 $1,000.00 1.00 $800.00 0.80 $600.00 0.60 $400.00 0.40 $200.00 0.20 $0.00 0.00 2007 2008 2009 2010 % $1,200.00 2011 Islamic Banking Assets Source:: Deutsche Bank, company data, Central Banks, The Banker, Reuters % of global banking assets $bn … and forecast to continue growing. $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $0 32.0 31.0 30.0 % 29.0 28.0 27.0 26.0 2010 2011 2012 2013 2014 2015 2016 Islamic Assets As percentage of GDP Source: Deutsche Bank, company data, IMF, Central Banks (The sample group of countries includes Iran, Saudi Arabia, Malaysia, UAE, Kuwait, UAE, Qatar, Bahrain, Turkey, Indonesia, Jordan, Bangladesh and Pakistan), Reuters Islamic finance is spreading across the Islamic world… Number of institutions offering Islamic finance products 200 189 160 138 120 80 32 40 29 22 18 8 Source: Deutsche Bank, CIBAFI, IFSL. Bangladesh Malaysia Iran Pakistan Sudan GCC Rest of World 0 …and across the secular world. Number of institutions offering Islamic finance products 25 22 20 15 9 1 1 1 1 1 1 Luxembourg Russia 3 Ireland 3 Germany 3 Cayman Islands 4 5 Canada 10 Source: Deutsche Bank, CIBAFI, IFSL. Sw it zerland Sout h Af rica France Aust ralia US UK 0 Islamic finance activity centres Developing / interested centres: • Australia • Azerbaijan • Canada • France • Germany • Hong Kong • Indonesia • Ireland • Kazakhstan • Nigeria • Pakistan • Singapore • South Africa • United States Major activity centres: • Bahrain • Dubai • Malaysia • United Kingdom 100 – 70% 69 – 50% 49– 30% 29– 10% 9 – 2% Muslims are approximately 25% of the worlds population… Less than 2% Several Muslim states are investing immense wealth across borders… 1,126 MENA-based SWF account for approximately 43% of the top 10 or $1.7 trillion 1,000 719 572 600 478 405 143 200 85 70 57 Algeria 296 400 Libya $bn 800 Qatar 1,200 Source: Deutsche Bank, Sovereign Wealth Fund Institute. Russia Kuw ait Singapore KSA Norw ay UAE China 0 …and financing through the use of Sukuk Global Sukuk issuances (USD) 100 90 93 90 80 70 60 50 50 37 40 31 30 22 20 20 11 10 2005 2006 2007 2008 Source: Deutsche Bank, Bloomberg Finance LP, Zawya, IIFM, KFH Global Sukuk Report 2009 2010 2011 2012 (to date) The commercial case for Islamic finance Is it worth it? Could it attract capital and funding? Would it makes us internationally competitive? Does it force innovation and up skilling? Is it inclusive for our citizens? Will it create employment? Will it enhance our global reputation? Does it support the vision for our country? Is it ethical and morally right? Does the cost benefit balance work? Is it profitable? It is inevitable in the long term? Azerbaijan Total Population: c. 9.3 million (with c. 93% Muslims) Mode of governance Constitutional Secular Republic Legal system Civil Law GDP * US$ 64.78 billion (AZN 51.16 billion) in 2011 GDP growth rate * c. 20% in 2011 GDP per capita * US$ 7,155.7 (AZN 5,650.8) in 2011 GDP by sector * Production: 68%; Services: 26%; Net taxes on products and import 6% Labour force by occupation * Agriculture 37,9%, Trade; repair of transport means 14,5%; Education 8%; Construction 7,1%; Other 32,5% Unemployment rate * 5.4 % Population below poverty line * 7.6% Major exports Oil & gas (90%) Enabling framework for Islamic finance Development Stage Source: http://www.stat.gov.az/menu/6/statistical_yearbooks/SYA2012 11 Islamic finance in Azerbaijan International Bank of Azerbaijan is leading Islamic Banking in Azerbaijan and opened Islamic Window. International Bank of Azerbaijan provides various Islamic Banking Products, such as wadiah, wakala, mudaraba, etc. Amrah Bank conducted market analysis of Takaful (Islamic Insurance). Creating an enabling framework for Islamic finance Phase 1 Evaluate whether new laws are needed or whether existing framework can be adapted. Identify and make Learn from others’ experience, including Kazakhstan. legal changes to In addition to banking, the framework should also facilitate Sukuk transactions facilitate the establishment of a Financial Shari’a Liquidity Islamic Legal Structure of robust and well accounting governance management Capital and Islamic regulated Islamic and and for Islamic markets supervisory banking banking sector. reporting oversight banks and Sukuk framework institutions Phase 2 Identify and make Once an enabling environment for Islamic banking industry is created and the Islamic banking industry establishes itself it will create demand for other sectors of the economy changes required to be similarly enabled for Islamic financial products. to facilitate other Over time, enabling framework can be created to facilitate all segments of Islamic finance segments of the sector Islamic finance sector Islamic fund management Microfinance Others Takaful 13 Learning from others’ experience Kazakhstan experience Amendments made to the following laws: o Civil Code of Kazakhstan (General Part) dated 27 December 1994 (the “Civil Code - GP”); o Civil Code of Kazakhstan (Special Part) dated 1 July 1999 (the “Civil Code - SP” and, together with the Civil Code – GP, the “Civil Code”); o Tax Code of Kazakhstan dated 10 December 2008 (the “Tax Code”); o Law On Banks and Banking Activity in the Republic of Kazakhstan dated 31 August 1995 (the “Banking Law”); o Law On Partnerships with Limited and Additional Liability dated 22 April 1998; o Law On the Securities Market dated 2 July 2003 (the “Securities Market Law”); o Law On Investment Funds dated 7 July 2004; o Law On Mandatory Guaranteeing of Deposits in the Second-Tier Banks of the Republic of Kazakhstan dated 7 July 2006; o Law On Licensing dated 11 January 2007; and o Law On State Registration of Rights to Immovable Property and Transactions Therewith dated 26 July 2007. 15 Kazakhstan experience (continued) On 14 March 2009 the Prime Minister issued an order (No. 40-r) directing that 11 sets of implementing normative legal acts be adopted including the following: • amendments and changes to certain resolutions on bookkeeping and financial reporting by Islamic special finance companies (the “ISFC” ) (National Bank of Kazakhstan (the “NBK”) Resolution No. 24 dated 20 March 2009); • instruction on bookkeeping by Islamic special finance companies (NBK Resolution No. 25 dated 20 March 2009); • rules governing transfer of property and liabilities under investment deposits of liquidated Islamic banks to another selected Islamic bank (FMSA Resolution No. 51 dated 27 March 2009); • extension of rules for issuance of bank establishment permits and for licensing of banking and other operations to cover Islamic banks (FMSA Resolution No. 53 dated27 March 2009); • requirements for the establishment and operation of ISFCs (FMSA Resolution No. 54 dated 27 March 2009); • rules on voluntary reorganization or liquidation of Islamic special finance companies (FMSA Resolution No. 55 dated 27 March 2009); • requirements for content of an agreement between the issuer and the representative of holders of Islamic securities and the functions and duties of the representative (FMSA Resolution No. 56 dated 27 March 2009); and • instruction on prudential standards for Islamic banks (FMSA Resolution No. 66 dated 27 March 2009). 16 The UK experience Commodity Murabaha transactions executed through the London Metal Exchange since 1980 Islamic finance formally acknowledged in 2003 with changes to stamp duty legislation Changes made to tax laws in almost every Finance Act since 2003 to accommodate additional products The term “Islamic” or “Shari’a” does not appear in any UK statute. However, these terms are used in the guidance notes issued by the regulatory authorities No major change in the regulatory framework – Islamic finance accommodated within the existing framework The FSA is a financial regulator and does not have the mandate to regulate on matters of Shari’a compliance The UK does not mandate the application of AAOIFI or IFSB. 17 Malaysian experience Islamic Banking Act enacted in 1983 Takaful Act introduced in 1984 Amendments made to Government Funding Act of 1983 to facilitate Sukuk issuances by the Malaysian government Between 1983 to 2000, various amendments made to the Banking and Financial Institutions Act of 1989 Between 2001 to 2010, various amendments made to several laws, including: o The Central Bank of Malaysia Act of 1958 to facilitate window operations o Development Financial Institutions Act of 2002 to facilitate Islamic DFIs o Capital Market Services Act 2007 Several amendments made to tax laws to remove tax anomalies and to provide incentives for IFIs Shari’a governance framework and guidelines on corporate governance for Islamic banks issued by the regulator A dedicated high court to facilitate dispute resolution in Islamic finance 18 Next steps for Azerbaijan? – The Market/Industry readiness matrix Government Initiate and germinate Consider creating opportunities – Pension/Sukuk? Location incentives/training subsidies Encourage and facilitate Actively invite and solicit market entrants Help them navigate the system Investigate and regulate Identify road blocks and reform Create supporting regulations and rules Private sector Next steps for Azerbaijan? – The Market/Industry readiness matrix Government Initiate and germinate Encourage and facilitate Investigate and regulate Private sector Evaluate feasibility given potential demand, no roadblocks, clear regulations and facilitative environment and develop strategy Develop products to meet demand given clear tax and legal treatment and supportive regulators, invest in systems, people, training and marketing Evaluate feasibility Develop and execute Deliver local demand, learn, innovate, develop overseas demand, attract capital, become specialist, develop leadership and dominate the region Innovate and grow Next steps for Azerbaijan? – The Market/Industry readiness matrix Government Initiate and germinate POTENTIAL Encourage and facilitate Investigate and regulate Private sector PRESENT STATE Evaluate feasibility Develop and execute Innovate and grow Thank You Neil D. Miller Global Head of Islamic Finance Email: neilmiller@kpmg.com Questions?