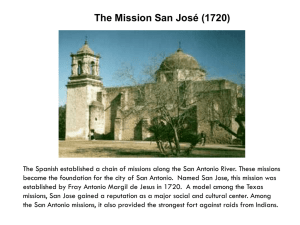

2014 Funding Symposium - San Antonio, TX

advertisement

NEFA 2014 FUNDING SYMPOSIUM September 19, 2014 Compliance Seminar II Protect Yourself! In today's environment, you are expected to comply with the rules. Ignorance of the law is no excuse! Be pro-active, and avoid compliance issues. 60 minutes to protect your bottom line. 2014 Funding Symposium - San Antonio, TX Moderator: Kenneth Peters Licensing Under the California Finance Lenders Law and Related California Usury: What You Need to Know for Successful Equipment Financing (Victor Harris) Other States’ Licensing and Usury Laws: What You Don’t Know Can Hurt You (Barry Marks) Successful &Valid Automatic Renewal Provisions; Retail and Motor Vehicle Installment Acts; Real Estate Mortgages as Additional Collateral (Frank Peretore) Business Person on Panel: (John Rosenlund) 2014 Funding Symposium - San Antonio, TX PRESENTER VICTOR HARRIS LA W OFFICES OF VICTOR HARRIS LICENSING UNDER THE CALIFORNIA FINANCE LENDERS LAW AND RELATED CALIFORNIA USURY: WHAT YOU NEED TO KNOW FOR SUCCESSFUL EQUIPMENT FINANCING 2014 Funding Symposium - San Antonio, TX OVERVIEW OF THE CALIFORNIA FINANCE LENDERS LAW (“CFLL”) • Broadest of all state licensing laws in our industry. It requires licenses and imposes disclosure, documentation and operational requirements. • It trumps conflicts with Division 9 (Article 9) of the California Commercial Code (Cal. Com. Code §9201(b) and (c)). • For those who comply, it creates a usury exemption (Cal. Fin. Code §22002). • Violations can have severe consequences. The expense and lost income of just one violation will exceed the compliance expense. 2014 Funding Symposium - San Antonio, TX PERSONS GOVERNED BY THE CFLL For our purposes, the CFLL governs “finance lenders” and “brokers.” Both must obtain a license under the CFLL (Cal. Fin. Code §22100(a)) • “Finance Lender” includes any person who is engaged in the business of making consumer loans or making commercial loans . . . (Cal. Fin. Code §22009). • “Broker” includes any person who is engaged in the business of negotiating or performing any act as broker in connection with loans made by a finance lender (Cal. Fin. Code §22004). 2014 Funding Symposium - San Antonio, TX EXEMPTIONS FROM THE CFLL The CFLL has many persons and transactions who and which are exempt (Cal. Fin. Code §§22050-22065). Most do not pertain to you. Two of them that may pertain to you are: • Any person doing business under any law of any state or of the United States relating to banks, trust companies, savings and loan associations, insurance premium finance agencies, credit unions, small business investment companies, community advantage lenders, California business and development corporations … or licensed pawn brokers - - (Cal. Fin. Code §22050(a)). (The DBO is proposing a regulation to eliminate the exemption for a “nondepository operating subsidiary, affiliate, or agent” of a national bank or federal savings association.) • Bona fide conditional sale contracts involving the disposition of personal property, when they are not used to avoid the CFLL (Cal. Fin. Code §22054). 2014 Funding Symposium - San Antonio, TX THE CFLL DOES NOT APPLY TO “TRUE LEASES” The definitions of “Finance Lender” and “Broker” show that the CFLL applies only to loans. So does California’s usury law. Therefore, the CFLL does not apply to you if all you do are “true leases.” 2014 Funding Symposium - San Antonio, TX THE CFLL APPLIES TO MOST INTERSTATE TRANSACTIONS California judicial precedents establish that individuals residing in, and entities organized and having their principal office in, other states which are involved in transactions with California residents probably are subject to the CFLL, depending on the facts. My booklet discusses all them. The most important of these cases is Brack v. Omni Loan Co., Ltd. (2008) 164 Cal.App.4th 1312, in which the Court concluded that the CFLL requirements are matters of fundamental California public policy which cannot be waived by a choice-of-law provision in a loan agreement that another state’s law governs. 2014 Funding Symposium - San Antonio, TX PRIMARY CFLL REQUIREMENTS • • • • • Initial Application. Cost. Time. Annual Report and Fees. Branch Offices and Changes of Address and Name. 2014 Funding Symposium - San Antonio, TX CALIFORNIA USURY • California case law holds that a loan, which is usurious at inception, remains usurious in the hands of an assignee who may be exempt from usury. Similarly, a loan which is not usurious at its inception, does not become usurious by assignment to a non-exempt person. • A commercial loan under the CFLL means a loan of a principal amount of $5,000 or more, the proceeds which are intended by the borrower for use primarily for other than personal, family or household purposes. • If the finance lender had the required license at the inception of that commercial transaction, the lease, promissory note, or EFA would be exempt from the usury law regardless of whether the lease is held to be a loan. 2014 Funding Symposium - San Antonio, TX CALIFORNIA USURY, CONT. • The California Constitution sets commercial loan interest at the higher of (a) 10% or (b) 5% plus the San Francisco Federal Reserve Bank discount rate on the 25th day preceding the earlier of (i) the loan commitment, or (ii) loan execution date. As of August 29, 2014, that rate was .75%. Therefore, as of that date an interest rate exceeding 10% would be usurious under California law. • Potential Consequences of Violating California’s Usury Law 2014 Funding Symposium - San Antonio, TX OTHER CONSEQUENCES OF CFLL VIOLATIONS • • DBO cease and desist orders – no willfulness required (Cal. Fin. Code §22712). • DBO and State actions for injunctions and civil penalties of $2,500 per violation (Cal. Fin. Code §22713). • • DBO suspension or revocation of the license (Cal. Fin. Code §22714). • • Criminal actions – willfulness required (Cal. Fin. Code §22780). • Remedies by funders and assignees. 2014 Funding Symposium - San Antonio, TX Victor Harris Law Offices of Victor Harris 1050 Northgate Drive, Suite 360 San Rafael, CA 94903-2541 Phone: (415) 479-8000 Fax: (415) 479-8111 vhlaw@prodigy.net 2014 Funding Symposium - San Antonio, TX 2014 Funding Symposium - San Antonio, TX But Most Of Us Are Like… 2014 Funding Symposium - San Antonio, TX While Our Lawyers Are Always… 2014 Funding Symposium - San Antonio, TX But If you Don’t Pay Attention….Ouch 2014 Funding Symposium - San Antonio, TX Because The State Is … 2014 Funding Symposium - San Antonio, TX Automobile Financings 2014 Funding Symposium - San Antonio, TX “High” Interest Rate Financings 2014 Funding Symposium - San Antonio, TX Micro-ticket Financings 2014 Funding Symposium - San Antonio, TX Vendor Retail Installment Sales Financings 2014 Funding Symposium - San Antonio, TX Broker Loan Statutes 2014 National Equipment Finance Summit, San Antonio, TX Barry S. Marks Marks & Associates, P.C. 505 North 20th Street Financial Center – Suite 1615 Birmingham, AL 35203 Phone: (205) 251-8301 Fax: (205) 251-8305 bmarks@markslegal.com www.leaselawyer.com 2014 National Equipment Finance Summit, San Antonio, TX Tips, Treasures and Traps in Automatic Renewal Provisions, Retail and Motor Vehicle Installment Acts and Real Estate Mortgages As Additional Collateral 2014 Funding Symposium - San Antonio, TX 2014 Funding Symposium - San Antonio, TX Louisiana Automatic Renewal Law New York Automatic Renewal Law Rhode Island Automatic Renewal Law Wisconsin Automatic Renewal Law 2014 Funding Symposium - San Antonio, TX Retail and Motor Vehicle Installment Acts Many states have Retail Installment Sales Acts (“RISA”) that may require, among other things, licensing in connection with entering into, or even taking assignment of, retail installment contracts for small consumer transactions. A number of other states have such requirements only in connection with motor vehicles, to wit, Motor Vehicle Installment Sales Acts (“MVISA”) which may require not only licensing, but also specific Riders with required disclosures and provisions. Finally, some states have such requirements for all installment sales (“All Goods”). 2014 Funding Symposium - San Antonio, TX Real Estate Mortgages As Additional Collateral If a lessor sometimes takes real property mortgages as additional collateral, they may be required to obtain a license even if they only do one such deal in that state and they only take a second or third mortgage. For example, pursuant to New Jersey’s New Jersey Licensed Lenders Act, a license is required even if the lender only takes one qualified mortgage in a year. While the Act excludes loans to corporations it does not exclude limited liability companies (“LLC”). Since LLCs are now ubiquitous, this Act is problematic for any lender taking a junior mortgage on a guarantor’s home, even if for only one odd deal and only just as additional collateral. 2014 Funding Symposium - San Antonio, TX Frank Peretore Peretore & Peretore, P.C. 191 Woodport Road Sparta, NJ 07871 Phone: (973) 729-8991 Fax: (973) 729-8913 Frank@Peretore.com www.peretore.com New York office: 135 Woodbury Road, Suite L-2 Woodbury, NY 11797 Phone: (516) 200-8484 2014 Funding Symposium - San Antonio, TX Kenneth D. Peters Dressler | Peters LLC 111 West Washington Street Suite 1900 Chicago, IL 60602 Phone: 312-602-7362 E-mail: kpeters@dresslerpeters.com Barry S. Marks Marks &Associates, P.C. PO Box 11386 Financial Center-Suite 1615 Birmingham, AL 35203 Telephone: 205-251-8301 E-mail: bmarks@markslegal.com Victor Harris Law Offices of Victor Harris. 1050 Northgate Drive, Suite 360 San Rafael, CA 94903-2541 Phone: 415-479-8000 E-mail: vhlaw@prodigy.net John G. Rosenlund, CLP Director-Risk Management Portfolio Financial Servicing Company 7303 SE Lake Rd Portland, OR 97267 Telephone: 503-721-3211 E-mail: jrosenlund@pfsc.com Frank Peretore Peretore & Peretore, P.C. 191 Woodport Road Sparta, NJ 07871 Phone 973-729-8991 E-mail: frank@peretore.com 2014 Funding Symposium - San Antonio, TX