INDUSTRIAL POLICY - Northeastern University

advertisement

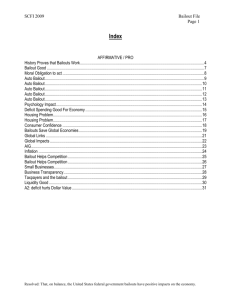

HARD VS. SOFT INDUSTRIAL POLICY: When and How the Government Should Intervene in Markets JOHN KWOKA FINNEGAN PROFESSOR OF ECONOMICS NORTHEASTERN UNIVERSITY 19 SEPTEMBER 2012 Stockholm, 1974 Implications and Applications Privatization and deregulation Less aggressive antitrust policy Weaker public support for infrastructure, R&D Reliance on markets and competition Uncritical embrace of free trade Opposition to industrial policy Long History of Antitrust and Regulation Antitrust and regulation are responses to the difference between “free markets” and “competitive markets” Competitive markets are very good at responding to consumers, harnessing entrepreneurial activity Markets that are not competitive—even if apparently “free”--cannot make same claim Most markets work reasonably well, even if not perfectly competitive, and do not require government intervention Under some circumstances, more is necessary Antitrust sets rules of game: prohibits cartels, big mergers, various anticompetitive practices Regulation supervises utilities and other industries that cannot be competitive due to scale economies Both policies date back to 1800s in US Antitrust as Preventive Industrial Policy Many troubled industries are complacent oligopolies Weak competition breeds inattention to products, costs, technology Leaves them vulnerable to outside forces such as imports Autos, steel, others Stronger competition can improve performance, help sector protect itself Antitrust actions sometimes can help Breakup of AT&T, Standard Oil Prohibit efforts by dominant firms to prevent entry, like Microsoft Antitrust policy has fairly broad political support, in principle More controversial in practice Less support for its use in reforming industries Long History of Direct Industry Involvement US has long provided support to private sector, especially infrastructure Support for roads, canals, railroads in 19th century Local public utilities (water, power) at turn of century Massive public works of 1930s “National Defense Highway Program” of 1950s R&D at national labs and universities US has also intervened to defend and rescue companies and sectors Lockheed in 1970s S&Ls in 1980s Airlines after 9-11 Auto industry in 1979, 1982, 2008-9 Detroit, 1979 Chrysler reports $1.1B loss, in danger of collapse Problems mostly of own making: products, costs, technology, management Similar problems for GM, Ford: “Big 3” Policymakers concerned with spillovers from collapse CBO estimated job losses of 360,000 Effects on suppliers, communities, etc. Others argued Chrysler should be allowed to fail Should bear brunt of own mistakes Avoid “insuring” bad management against bad outcomes Market will shift resources to those better able to manage To Bail or Not To Bail No-bailout is a sound economic prescription, under certain specific conditions Labor markets can absorb released workers into jobs utilizing skills and preserving human capital Physical capital can be put to other good uses reasonably quickly Input or output connections limited: modest spillovers Possible to reorganize with alternative management, financing If conditions do not hold, may be case for assistance Important issues of nature, timing, duration Competition Policy Auto industry had already attracted scrutiny Justice Dept. and FTC both conducted antitrust inquiries into competition problems in 1970-80s Focused on GM’s dominance, various pricing practices in industry, cost issues, lack of innovation, exclusive dealers, etc. Intent was to see if antitrust could help revitalize industry, for benefit of both consumers and companies themselves Efforts did not succeed Antitrust weak policy tool in some circumstances Issues superseded by Chrysler anyway Chrysler Bailout Congress passed Loan Guaranty Act in Dec. 1979 Chrysler got $1.5B in loan guarantees Had to get some concessions from stakeholders But no requirement to revamp operations, products No replacement of management Chrysler emerged intact, but bailout essentially gave company money without remedial actions Problem of moral hazard: failure to penalize certain bad behavior encourages more of it Made it more likely Detroit would return to Washington Detroit, 1982 Japanese car imports doubled from 1976 to 1980 Big 3 production fell from 8.4M to 5.1M Employment declined from 930,000 to 780,000 Big 3 asked for help from Washington, claiming need for “breathing room” to respond to import challenge Reagan administration imposed quotas on imports in 1981 Not a direct subsidy, but allowed Big 3 to raise prices Prices rose, and US companies pocketed money Hope they would use time and money to improve products, operations, management proved vain These experiences give intervention bad reputation They are poor public policy Detroit, 2008-9 “Big 3” sales and production already in long decline Sales truly collapsed during financial crisis Huge financial losses to all three US companies Likelihood that companies would collapse, with spillovers to suppliers, dealers, communities Some argued market should be allowed to work Same arguments as in 1979 against bailout “If General Motors, Ford, and Chrysler get the bailout that their chief executives asked for yesterday, you can kiss the American automotive industry goodbye…The automakers will stay the course—the suicidal course of declining market shares, insurmountable labor and retiree burdens, technological atrophy, product inferiority and never-ending job losses.” “Detroit will need to drastically restructure itself: New labor agreements to align pay and benefits with competitors… Management as is must go. New faces should be recruited from unrelated industries… Sanity in salaries and perks…Get rid of the planes, the executive dining rooms… Investments must be made for future...truly competitive products and innovative technologies--especially fuel-saving designs… Do not give shareholders and bondholders a free pass. They bet on management and they lost.” Others argued for government intervention Loss of jobs in weak economy CEA estimated 1.1M jobs would be lost Loss of competition at supplier level Loss of human capital (skilled workers) Loss of physical capital (factories, infrastructure) Financial losses: local taxes, pensions, unemployment insurance Some had more nuanced view “Sometimes circumstances get in the way of philosophy. […] do it again” Bush and Obama Bush provided interim financing to GM, Chrysler Obama (2009) provided longer-term financing, but with conditions Some conditions familiar: Had to obtain concessions from workers, suppliers, etc. Other conditions were fundamentally different: Chrysler forced to find partner GM required to restructure operations, drop brands Both had to close plants, alter products, reduce dealer network Both CEOs were fired, Board members replaced And both Chrysler and GM forced into “managed bankruptcy” “Hard Bailout” No blank checks Do not simply give out money and hope for best Rather, transform structure and personnel Be sure to change operations and incentives Deal with moral hazard (future reckless behavior) Separate rescue of company from rescue of people responsible for problems Remove CEO, managers, directors; ensure no golden parachutes; institute legal proceedings if actions criminal Next set of executives will know they personally will not benefit from or survive any future crisis of company, and hence deterred This is good industrial policy Detroit, 2012 GM sales up by 4 percent year-over year Ford by 6 percent, Chrysler by 20+ percent Companies reopening plants, investing in facilities, resuming hiring GM building new $500M assembly plant in Hamtramck Auto manufacturing employment up 63,000 since last August All three companies profitable Chrysler has paid off loan, GM about half paid off Should not exaggerate this, but industry has stabilized and is recovering Principles of Government Involvement Limit involvement to companies with three properties Systemic effects, i.e., interconnectedness Widespread and substantial spillovers to other sectors Real effects on upstream suppliers, downstream producers Lack of reasonable alternatives for labor and capital resources Implies risk of long-term diminished prospects, loss of value Lack of plausible private alternatives Take full control, transform companies Never simply grant dollars Must change operations and incentives Hold individuals personally responsible Penalize, change expectations, and deter Get out ASAP Avoid involvement that confuses govt. vs. firm responsibility Wall Street, 2009 Financial crisis left many banks, insurers, mortgage companies in precarious financial condition Problems had multiple causes, many of own making Took imprudent risks Invented assets of uncertain value Ignored internal and external warning signs Lobbied for and secured deregulation Did firms nonetheless meet criteria for government assistance? Most analysts would likely say “yes” Ran the experiment of not doing so, with Lehman Bros. Bailout of banks, financial institutions cost $300B It worked in sense that banks survived Government had ownership stakes in institutions Opportunity for same kind of fundamental reforms as in autos But little effort to change institutions or people No breakup of banks…now larger than before No systematic removal of bad actors No replacement of CEOs or boards Little holding of companies responsible Scant efforts to prosecute companies or individuals Compounded by inadequate regulatory reform Glass-Steagall separation not restored Countless provisions of Dodd-Frank being compromised “Soft Bailout” for Banks One corrosive result is sense of unfairness Banks got relief without responsibility “Banks got bailed out, we got sold out” Bailout supposed to be accompanied by aid to homeowners That part of plan got sidetracked, never to return Second damaging effect is moral hazard Financial institutions now have reason to believe government will bail them out Knowing that, they behave differently toward risk, reward Creates exposure for taxpayers to future problems, failures This is bad industrial policy Why? Why such a soft approach and so little pushback? Relentless counterattack by institutions that benefit Much greater power of financial sector than ever before No longer “What’s good for GM is good for the country” Crucial policy role for advocates of banks, financial institutions Wall Street, Goldman Sachs proteges dominate government Absence of same tough analytical approach that was used for auto industry Conclusions Industrial policies of antitrust and regulation are useful tools Government actions to promote, defend, rescue certain companies can be useful tools Entirely possible to conduct these policies with limiting principles, minimizing adverse effects Failure to adhere to these principles can also do great damage Shifts risk from private actors to public Creates enormous private power with implicit but very real claim on future public resources Some Readings Clyde Prestowitz, The Betrayal of American Prosperity (2010) Neil Barofsky, Bailout (2012) Josh Lerner, Boulevard of Broken Dreams (2009) John Kwoka, “The U.S. Auto Industry Under Duress” Competition Policy International (2009)