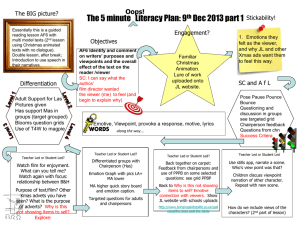

Presentation [PDF:863KB]

advertisement

![Presentation [PDF:863KB]](http://s2.studylib.net/store/data/005548425_1-ead9d4105297a66953ee7241b3c01e6e-768x994.png)

“The development and future of Factory Asia” Richard Baldwin and Rikard Forslid RIETI seminar: Ideas for a research agenda 4 December 2013, Tokyo Overarching question • How to make global value chains (GVC) work for developing nations? • Study Factory Asia = best example. Some background • Globalisation changed • Today’s process should not be studied using only 20th century tools. • KEY change: – “De-nationalisation of comparative advantage” Globalisation changed 20% 0% 0% G7 nations’ share of global GDP, 1820 – 2010. 5% 6 Risers, 9% 3% 1970 10% 1820 1839 1858 1877 1896 1915 1934 1953 1972 1991 2010 10% China, 19% 2010 1820, 22% RoW 30% 2005 20% 40% 2000 30% G7, 47% 50% 1995 2010, 50% 40% 60% 1990 50% 70% 1985 60% 1990, 65% 1980 70% 80% 1975 1988, 67% World manufacturing share 80% Source: unstats.un.org; 6 risers = Korea, India, Indonesia, Thailand, Turkey, Poland G7 nations’ share of global manufacturing, 1970 – 2010. ‘Smile curve’: Distribution of value Share of value added Post-1990 value distribution 1970s & 1980s value distribution Stage Pre-fab Fabrication Post-fab services services Global GDP shares, 1960-2012 80% 67% 70% 60% G7, 48% 50% 40% 30% RoW 10 gainers 27% 20% 10% Post-1990: • G7 share loss goes to 10 developing nations. • RoW see little change. 11% 0% 1990 China, Brazil, Mexico, Poland, India, Turkey, Russia, Korea, Indonesia, Venezuela People in poverty (under $2/day) Millions under $2/day by national income class Lomiddle 1993 HiMiddle Low 1981 1984 1987 1990 1993 1996 1999 2002 2005 2008 2010 1,600 1,400 1,200 1,000 800 600 400 200 - 1990 Post 1993 • Hi-middle poverty plummets. - 650 million fewer poor! • Others’ poverty keeps rising. Globalisation: 3 cascading constraints High High High = Preglobalised world = 1st unbundling = 2nd unbundling Steam revolution High High Low Stage A Stage B Stage C ICT revolution High Low Low Stage A Stage B Stage C 20th century comparative advantage Stage A Stage B Goods crossing borders Stage A Stage C • Goods = ‘bundle’ on national knowhow, labour, capital, institutions, etc. • National economies only connected via competition in goods markets. Stage B Stage C 21st century comparative advantage Stage A Stage C 1) Supply-chain linkages: Cross-border flows of goods, know-how, ideas, capital & people. 2) Doing business abroad: Application of tangible & intangible assets in developing nations. Stage B • Goods = mixture of national knowhow, labour, capital, institutions, etc. (e.g. hi-tech + low wages). • National economies connected via much richer flows: knowhow, goods, services, people, capital, etc. Why it matters • OLD: Study national performance looking at national factors. – ‘Team Japan’ versus ‘Team Germany’ Regress growth/exports/etc on national right-hand side variables. • NEW: Study national performance looking at regional and national factors. – ‘Factory Asia’ versus ‘Factory North America’ Regress growth/exports/etc on national & regional right-hand side variables and/or allow interactions depending upon supply-chain exposure. First steps in study GVC and development • Shifting resources to trade sectors is prodevelopment. • Growth in value added exports is one measure of this. • First axis of investigation: – Is rapid value-added export growth related to supply-chain participation? Value added v. Gross exports Total export growth, 1995-2009 East Asians JPN TWN HKG PHL KOR MYS IDN THA SGP BRN KHM CHN VNM Gross export growth VA export growth Total export growth, 1995-2009 Other EMs in GVCs PRT SVN MEX TUR CZE HUN POL SVK ROU Gross export growth VA export growth Primary exporters ZAF AUS CHL NOR BRN RUS BRA SAU G7 nations FRA ITA CAN USA GBR DEU 0% 500% 1000% 0% 500% 1000% Special interest of VA exports • Indirectly measures growth in domestic resources in trade sector (worldclass). • Close to many development mechanisms: – Technology adoption; – Skill upgrading; – Formation of domestic industrial capacities: • Human, institutional, infrastructure, etc. How measure supply chain participation? • TiVa has several; many more construct-able. – FVA (Foreign Value Added share) – REI (Reexported intermediates) • REI seems to work better. First look at relationship Hope • Faster domestic valueadded export growth correlated with faster REI growth. • Plot vertical axis = Growth in domestic value added in exports • Plot horizontal axis = Growth in REI trade (supplychain participation) Data • Plot all nations, all 18 goods sectors. • Growth from 1995 to 2009. Little correlation REI vs Growth in Domestic VA in exports 2500% 2000% 1500% ? 1000% 500% 0% -200% -100% 0% -500% 100% 200% ? 300% But theory to rescue • The correlation should depend upon: – Nations: • Headquarter v factory economies • Primary-resource exporters v manufactures exporters – Sectors: • GVC sectors (mech & elec machinery, chemicals, etc) • nonGVC sectors Thinking about nation groups VA export growth composition, 1995 to 2009 VA export growth composition, 1995 to 2009 PHL BRN CHN SAU TWN CHL KOR NOR THA IDN VNM MYS AUS SGP CAN JPN RUS VNM ZAF KHM KHM BRN BRA HKG -25% 0% Manufactures 25% 50% Services 75% 100% Primary -20% 0% 20% 40% 60% 80% 100% Manufactures Services Primary Thinking about nation groups VA export growth composition, 1995 to 2009 PRT VA export growth composition, 1995 to 2009 GBR TUR FRA ROU USA MEX DEU POL CZE ITA SVN CAN HUN JPN SVK 0% 25% 50% Manufactures 75% Services 100% 0% 20% Manufactures 40% 60% Services 80% 100% Primary Aside: BRICS asunder VA export growth composition, 1995 to 2009 IND CHN ZAF BRA RUS 0% 25% Manufactures 50% Services 75% 100% Primary Relationship by nation groups? Relationship by sector: Primary 01T05: Agriculture, hunting, forestry and fishing 10T14: Mining and quarrying 2300% 2300% 1800% 1800% IND 1300% 1300% IND VNM VNM 800% 300% -200% -100% TUR PHL RUS BRA ZAFSVK CHN POL HUN MEX CAN USA DEU FRA KOR GBR THA MYS JPN TWN 0% 100% 800% IDN PHL BRA TUR ZAF CHN SVK RUS POL IDN KOR CAN HUN USA DEU MEX THA MYS TWN JPN FRAGBR 300% 200% -200% 300% -100% 0% 100% 15T16: Food products, beverages and tobacco 2300% 1800% VNM 1300% 800% 300% -200% -100% TUR SVK POL PHL IND IDN BRA HUN KOR ZAF RUS CAN USA DEU THA MEX GBR JPN MYS TWN 0% 100% CHN 200% 300% 200% 300% Relationship by sector: Light manuf 17T19: Textiles, textile products, leather and footwear 20T22: Wood, paper, paper products, printing and publishing 2300% 2300% 1800% 1800% 1300% 1300% VNM 800% 300% -200% -100% SVK CHN IDN POL INDMEX HUN BRA KOR DEU RUS FRA GBRZAF THA JPN M YSUSA TWN CAN 0% 800% PHL TUR 100% 300% 200% -200% 300% -100% VNM PHL TUR SVK POL HUN CHNUSA IDN IND BRA ZAF MEX KOR RUS DEU FRA THAGBR MYSTWN JPN CAN 0% 100% 200% 300% Relationship by sector: heavy manuf 23T26: Chemicals and non-metallic mineral products 2300% 27T28: Basic metals and fabricated metal products 2300% VNM 1800% 1800% 1300% 1300% 800% 300% -200% -100% TUR SVK POL IND CHN MEX BRA IDN HUN ZAF KOR USA RUS CAN THA MYS DEU FRAJPN GBR TWN 0% 800% PHL 300% 100% 200% -200% 300% -100% VNM IND PHL SVK POL CHNHUN IDN MEX KOR BRA USA ZAF DEU RUS FRA THA CAN MYS GBR JPN TWN 0% 100% TUR 200% 300% Relationship by sector: GVC manuf 30T33: Electrical and optical equipment 2300% 34T35: Transport equipment IND TUR 1800% 2300% VNM PHL 1800% VNM SVK POL 1300% PHL 1300% CHN HUN POL CHN 800% 300% -200% -100% 800% HUN IDN BRA MEX ZAF KOR THA MYS T WN RUS USA DEU CAN FRA GBR JPN 0% 100% -200% 300% -100% 0% 100% 29: Machinery and equipment, nec 2300% 1800% TUR VNM SVK 1300% 800% 300% -200% -100% CHN POL HUN MEX KORIDN THA BRA MYS USA ZAF RUS DEU FRA TWNJPN GBR CAN 0% 100% IND IDN KOR BRA THA MEX ZAF MYS USA DEU FRA GBR TWN JPN RUS CAN 300% 200% TUR SVK PHL IND 200% 300% 200% 300% Relationship by nation & sector 2300% 15T16: Food products, beverages and tobacco 20T22: Wood, paper, printing&publishing 2300% 1800% 1800% VNM 1300% VNM 1300% 800% 300% CHN 800% CHN THA MYS KOR TWN PHL IDN 300% 2300% -200% -100% 1800% -200% -100% 0% 100% 200% 300% 400% 500% 800% IDNMYS THA 34T35: Transport equipment KOR TWN PHL 0%VNM 100% PHL 17T19: Textiles, leather 1300% & footwear VNM 700% 200% 300% EA EMs CHN 800% 600% G5 IDN KOR THA 500% 300% CHN Oth EM SCTers MYS TWN 400% -200% -100% 300% IDN 200% 100% 0% 0% THA MYS KOR TWN PHL -100% -50% 0% 50% 100% 150% 100% 200% 300% Relationship by nation & sector 23T26: Chemicals & non-metallic mineral prod 2300% 27T28: Basic metals and fabricated metal products 2300% 1800% 1800% 1300% 1300% VNM 800% 800% CHN -200% -100% THA MYS TWN KOR PHL 0% 100% 34T35: TransportCHNequipment 2300% 300% IDN 300% VNM 200% 300% 1800% -200% 1300% -100% IDN MYS TWN VNM PHL PHL 0% THA KOR 100% 200% CHN 300% EA EMs 800% G5 IDN KOR THA 300% -200% -100% Oth EM SCTers MYS TWN 0% 100% 200% 300% Relationship by nation & sector 34T35: Transport equipment 29: Machinery and equipment, nec 2300% 2300% VNM PHL 1800% 1800% 1300% VNM 1300% EA EMs CHN CHN 800% IDN KOR THA 300% -200% -100% MYS TWN 0% 100% 200% 2300% G5 800% IDN Oth EM SCTers 300% PHL THAKOR MYS TWN 2300% -200% -100% 1800% 300% 200% 300% EA EMs CHN G5 IDN KOR THA 300% 1300% -200% -100% PHL 800% VNM 300% 0%VNM 100% 30T33: Electrical and optical 1300% equipment 1800% 800% 34T35: Transport equipment PHL IDN CHN -200% -100% 0% TWN MYS THA KOR 0% 100% 200% Oth EM SCTers MYS TWN 300% 100% 200% 300% Facts to theory • How does unbundling happen? – Fractionalisation of production process; – Geographical dispersion of stages. Production unbundling: Some theory Trade-off: Specialisation vs coordination costs euros (n-1/2) Marginal costs (coordination) Marginal benefits (specialisation) a[n;] 1 n1 Number of stages/occupations Trade-off: Specialisation vs coordination costs euros (n-1/2) Better IT lowers benefit of fragmentation (automation) a[n;] 1 n2 n1 Number of stages/occupations Trade-off: Specialisation vs coordination costs euros (n-1/2) Better CT lowers cost of fragmentation (coordination easier) a[n;] 1 n1 n3 Number of stages/occupations Geographical dispersion • Odd economics: – Clustering/agglomeration – Convex coordination costs euros Total cost of coordinating given number of stages in two locations ns(1- ns) 0 1/2 N 1 Stages Research agenda? • Link between domestic value-added exports and development (industrial production, GDPPC, etc). – Finer look at domestic value added exports and domestic value added, by sector, nation groups, etc. • ‘Dense-ifying’ participation in value network – Not really a ‘chain’; IO matrix, not a IO column. • Does the partner matter? – Does the REI-growth link vary by source of intermediates? • What institutional & policy variables determine supply-chain participation (as measured by REI) Three policy issues • Geography matters – Geography is an important determinant of the ease of participating in Factory Asia. – This is nothing more than an assertion that forward and backward linkages matter at the regional level as well as at the national or industrial district level. – ERGO: Policy to foster participation in Factory Asia should have a geographical dimension as well as the usual income level dimension. – In particular, proximity may be less important for certain sectors and distant nations may be well advised to focus on these. Three policy issues • Size matters. – Nations that have over a billion consumers (the PRC and India) can pursue policies that smaller nations cannot. – In essence the two giants can leverage their local market as a powerful attraction force for supply chain segments. – ERGO: Policy recommendations should not blinding point to China’s success as the right way forward. Costa Rica’s success in supply-chains maybe be more relevant to some small Asian nations. Three policy issues • Regulatory network effects matter. – Factory Asia requires firms’ tangible and intangible assets to be protected inside the participating nations. – Disciplines for these are emerging from megaregionals. – Asian policy should focus on what this means for Factory Asia; one-size may not fit all, but one-size disciplines may foster the development and spread of Factory Asia. END • Thank you for listening. • Please look at: VoxEU.org “Research-based policy analysis and commentary by leading economists”