Unit 9

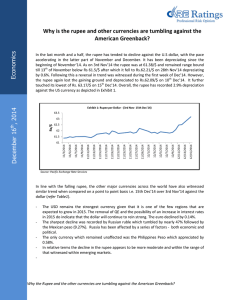

advertisement

“Domestic trade is among us, international is between us and them.” Unit 9 External Sector Dynamics Introduction The scope of managerial economics is not limited to internal trade. Business decision is in a number of ways affected by the competition and prospectus of sale in foreign market. A firm may be producing only for domestic market but it might be using imported raw materials and intermediate goods. Fluctuation in prices of imported raw materials affects the cost of production. Moreover, a firm may have to compete with foreign goods in the domestic market. Thus, foreign trade and foreign trade policies do affect the firms directly or indirectly and also competition in domestic market. Business managers, therefore, must have knowledge of the theory and practice of international trade. INTER-REGIONAL VS. INTERNATIONAL TRADE Interregional trade refers to trade between regions within a country. It is what Ohlin calls inter-local trade. Thus interregional trade is domestic or internal trade. Interregional trade on the other hand, is trade between two nations or countries. A controversy has been going on among economists whether any difference between interregional or domestic trade and international trade is. The classical economists held that there were certain fundamental differences between interregional trade and international trade. Accordingly, they propounded a separate theory of international trade which is known as the theory of comparative costs. But modern economists like Bertil Ohlin and Haberler contest this view and opine that the differences between international and international trade are of degree rather than of kind. JUSTIFICATION FOR INTERNATIONAL TRADE Factor Immobility Differences in Natural Resources Geographical and Climatic Differences Different Markets Different Currencies Change in Currency Value Problem of Balance of Payments Different political Groups Different National Policies CLASSICAL THEORY OF INTERNATIONAL TRADE Adam Smith’s Theory In international trade, a country exports that commodity which is cheaper at home than abroad and vice versa. Thus, differences in the relative prices of goods between different countries is the basis if international trade. Absolute Cost Advantage Adam Smith argued for free trade on the basis of advantages of division of labour. Free trade makes possible a greater degree of specialisation of labour. It arguments the gains from territorial division of labour. BALANCE OF PAYMENTS The balance of payments of a country is systematic record of all its economic transactions with the outside world in a given year. It is a statistical record of the character and dimensions of the country’s economic relationship with the rest of the world. According to Bo Sodersten, “balance of payments is merely a way of listing receipts and payment in international transactions for a country.” It shows the country’s trading position, changes in its net position as foreign lender or borrower and changes in its official reserve holding.” Methods of Removal of Disequilibrium 1. Change in Price-Specie-Flow Mechanism 2. Change in Foreign Exchange Rate (Devaluation) Rise in Foreign Exchange Rates. Foreign Demand and Supply 3. Change in Price Effect of Price Change. Consequence of Devaluation 4. Change in Income (Income Effect) 5. Direct Controls. Physical Controls Financial Controls Inter-relation between National Income and Balance of Payments. A country’s national income and balance of payments are intimately interrelated. Changes in the one cause changes in the other. National income is the total domestic production of final goods and services, broadly classified into consumption and investment or capital goods, during ant given period of time which is ordinarily taken as one year. In money terms, it is the aggregate money expenditure incurred on the production of domestically produced goods and services. Exports. Exports are similar to domestic investment outlay in affecting the national income since each one of these two is like an injection into the aggregate income expenditure flow expanding the stream of aggregate income generated by the purchase of goods and services. Foreign Exchange Rate and Foreign Exchange Market The market in which currencies of various countries are exchanged, traded or converted is called foreign exchange market. Floating (Flexible) and Fixed Exchange Rate System Since exchange rate is a price, its determination can be explained through demand for and supply of currencies. Suppose we consider the transactions between two countries, India and USA. Appreciation and Depreciation of Currencies Let us consider the exchange rate of rupee for dollar. Appreciation of a currency is the increase in its value in terms of another foreign currency. Thus, if the value of a rupee in terms of US dollar increases from Rs.45.50 to Rs. 44 to a dollar, Indian rupee is said to appreciate. This indicates strengthening of the Indian rupee. Note that when Indian rupee in dollar terms appreciates, the dollar would depreciate. On the other hand, if the value of Indian rupee in terms of US dollars falls, say from Rs. 45.5 to Rs. 46 to a dollar, the Indian rupee is said to depreciate which shows the weakening of Indian rupee. Thus, under a flexible exchange system, the exchange value of a currency frequently appreciates or depreciates depending upon the demand for and supply of a currency. DETERMINATION OF EXCHANGE RATE Demand for Foreign Exchange (US Dollars) The demand for dollars by the Indians arises due to the following factors: 1. The Indian individuals, firms or Government who import goods from the USA into India. 2. The Indians traveling and studying in the USA would require dollars to meet their traveling and education expenses. 3. The Indians who want to invest in equity shares and bonds of the US companies and other financial instruments. 4. The Indian firms who want to invest directly in building factories, sales facilities, shops in the USA.