Internet Opportunities in Africa

advertisement

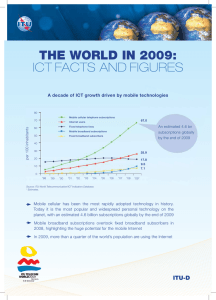

Internet Opportunities in Africa -- or some of the many places I’d recommend people put money and time if they want to take advantage of the coming growth Andrew Mack Principal AMGlobal Consulting iWeek, September 2012 1 Increased Access a fact, but not enough • Bandwidth exploding with the landing of major undersea cables • Costs going down across the board – and more is expected – especially in smaller markets, but Nigeria + $600M/year • Better service and connectivity, wireless is the vector – but… everything needs to be taken to scale 2 Internet Penetration Can you be in the modern economy without internet? 3 New technologies are increasing access and the reach of the web • Making it easier to get higher bandwidth in remoter areas (WiMax, lower cost satellite, others) • Permitting things like true telemedicine, e-gov, post conflict; Q: is a real partnership with government possible? • Traditional infrastructure – especially electricity – remains a really significant limiting factor – Is there a role for localized energy like small solar? – How can low-power computing factor in? 4 The World in 2011 — ICT Facts and Figu Bandwidth, up and up – but not keeping up Growth in bandwidth facilitates broadband uptake International Internet bandwidth, GBit/s 90’000 80’000 World World 70’000 Developed Developed 60’000 Developing Developing 50’000 40’000 30’000 20’000 10’000 0 2001 2002 2003 2004 2005 Note: * Estimate Source: ITU World Telecommunication/ICT Indicators database 5 2006 2007 2008 2009 2010 2011* Broadband here and there 6 More Broadband 40 Active mobile-broadband subscriptions per 100 inhabitants, 2011 36.50 35 31.33 29.70 30 25 20 15.68 15 11.73 10.75 10 3.26 5 0 Europe CIS* The Americas World Arab States *Commonwealth of Independent States Regions are based on the ITU BDT Regions, see: http://www.itu.int/ITU-D/ict/definitions/regions/index.html Source: ITU World Telecommunication /ICT Indicators database 7 Asia & Pacific Africa Growth opportunities that need addressing • Still very focused on the major cities – how to reach the secondary markets, and with what model? • Still very focused on the office (few people connected at home) • Still limited culture of email, e-gov – though this is changing • Broadband still very limited, too limited given opportunities • Still unclear how the mobile web will play out • Internet still an elite phenomenon in most places… 8 Internet – there’s no place like home And why internet at home is crucial 9 Demand is picking up from all sides • As workers and employers – investment in ICT is a part of nearly every company, CSR and development project – seen as the key leverage point, the key multiplier • As consumers – estimated nearly 70% of cellphones in Africa will be web-enabled by 2014 – people are moving in the direction of mobile web • As citizens – anecdotal evidence suggests people like using egov, as it saves time and is more transparent, fits a changing dynamic across the continent of service ethic in government – part of wave of good governance and democracy 10 Q: Are Africans in large numbers making money off the internet? A: Obviously it varies, with hubs in places like Kenya and Ghana and SA, but • in terms of creating the software industries that nearly every government says it wants, not there yet • In e-commerce, Africa is less than one percent of global totals • In banking, outsourcing, call centers some progress but in terms of jobs, nothing like what is hoped for 11 Where is Africa – in terms of access? • African governments and companies are working together to a meaningful extent to provide service. Some real impressive levels of cooperation between biz and government in countries like Kenya. • Financing to improve access still appears to be largely coming from outside the continent. • Legacy PTTs still an issue. Basic infrastructure still a big issue. Opportunities here – but will African be participants or just takers? Hard to say. • Q: Can we create – and maintain – the necessary national coalitions around access? 12 Where is Africa – in terms of training? • A lot of talk, but very few of the programs we see in nearly every country reach anything like scale. Aid and government-based programs have generally failed. • Real concerns about the newness of netizens around the continent and their vulnerability to scams, abuse – and the impact on the broader internet ecosystem – there is danger for new users! • Especially since there are few if any programs aimed at teaching for a mobile web audience. • Q: Can we create new business model here that get us to scale 13 Where is Africa – in terms of content? •Africa’s presence on the web very limited – globally 94 domains/10,000 people but in Africa only 1/10,000 people! •Precious little African content on the web. The numbers are shocking. One seventh of humanity has less than 1% of total internet content based on estimates we’ve seen. •True for content from Africans for Africans. Also true from Africans for the to the broader world – and often (as in the case of Amharic content), the bulk of content is actually coming from the diaspora. •Q: Assuming there’s a much broader audience, how to reach it? 14 What will the tipping points/opportunities be? • Invest in payment options – we need desperately to enable more business on and through the web – need to make more business online business – this is a business opportunity that needs to go to scale… creating true cross border model • Invest in increasing access to low cost laptops and tablets – since there’s only so much you can do with a phone-sized keyboard – the vast majority of Africans don’t have access to computers – the cheap computer is a friend to business and builds familiarity, capacity – the chance to tinker… 15 What will the tipping points/opportunities be? • Invest in entrepreneurship platforms • The culture of business and provide investment opportunities -incubators and programs aimed at young entrepreneurs • Including legislation around the continent that makes it easier to start businesses and raise small capital, including across borders • Desperately need to establish a regional VC culture that promotes fastgrowing businesses and “positive, entrepreneurial tech-recklessness” • Invest in infrastructure, especially light infrastructure • WiMax, broadband and distributed power • Need to create models to bring franchised access to smaller areas – find a way to enable local players to more effectively be partners, share risk 16 What will the tipping points/opportunities be? • Invest in smart IP protection • Perhaps less of an investment than a partnership between government, legal establishments across borders and the investing community • Demand regional thinking and pro-growth policies, and support the legal infrastructure to make business viable longer term • Invest in African content and market it worldwide • For the outside world, Graceland isn’t a fluke – African content is interesting to a world audience • The Diaspora is real – be there • MOST IMPORTANT – Africans are still largely takers of outside content • Africa as the small apps continent? 17 South Africa can play a special role… • You have the technical capacity and organization which is crucial • You have good rights and IP infrastructure • You have a largely functional businessgovernment relationship, which can be a model for other countries 18 South Africa can play a special role… • The rest of Africa may be ready, after flirtations with China and others to see SA as partners… if you’re ready to partner • Given the size of the market and its diversity, it still makes sense for outside players to partner to reach Africa 19 Go for it! 20