Cartelisation in global markets for primary commodities

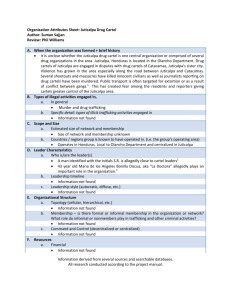

advertisement

CARTELISATION IN GLOBAL MARKETS FOR PRIMARY COMMODITIES, GOVERNANCE CHALLENGES AND WAY FORWARD Pradeep S. Mehta • Aradhna Aggarwal • Natasha Nayak CUTS International Symposium on Trade in Primary Products and Competition Policy 22 September, 2011, Geneva Motivation for the study? Two fold: First, high dependence of developing countries on primary sector exports; yet dominance of some countries in world wide trade of these products Second, steep rise in commodity prices, impacting both the developing and developed world adversely The reasons? Restrictions on the trade in commodities in the form of licensing, quotas, export restrictions, tariffs, packaging regulations and other non tariff barriers Anti-competitive practices of international export cartels We focus on the latter which is often overlooked Export cartels? “hard core” cartels comprise of private producers from at least two countries who collude to fix prices, establish output restrictions or quotas, or share markets private export cartels where producers from one country engage in market allocation in export markets, but not in their domestic market state-run export cartels Is the presence of export cartels in commodities significant? Not exactly known Connor (2006): eight out of 283 known private international cartels in commodities during 1990-2005 This means only 3 percent of the total known international cartels Other studies endorse this finding Do cartels have a role in the primary sector trade? Not really, because: a majority of private cartels never come to light, the number of cartels do not reflect their impact on trade, producers and consumers, cartels in the up/down stream industries can have serious impacts on primary products trade, and there is sporadic evidence of cartels which might have long term effects Can cartels succeed in the primary products sector? Determinants of success ◦ Industry characteristics: concentration and entry barriers ◦ Product characteristics: product elasticity ◦ Frequency of business shocks ◦ Large buyers Success of cartels in the primary sector… Incentives: ◦ concentration of natural resources ◦ extraction skills and infrastructure ◦ low product elasticity etc. De-stabilising factors: ◦ large number of participants, ◦ possibility of entry barriers, ◦ large buyers, ◦ bargaining issues ◦ demand shocks etc. Key role of large multinationals (such as de Beers), trade associations or even national governments INTERNATIONAL AGREEMENTS AND CARTELISATION International Commodity Agreements (ICAs) Interface between global trade rules and cartelisation: export restrictions, anti-dumping, TRIPs Adverse effects on world trade Need to be explored further NATIONAL COMPETITION POLICY and EXPORT CARTELS Implicit or explicit exclusion from action against them by the home authorities Critics: beggar thy neighbour policy ECONOMIC CONSEQUENCES OF EXPORT CARTELS? Ambiguous, both theoretically and empirically, But, anti competitive practices adopted by them can have disastrous impacts (CUTS’ studies on Fertilisers, Coffee, Potash) Need for ◦ case studies, ◦ deeper studies with explicit counterfactual analysis, and ◦ improvement in data quality Effects of CARTEL in DOWNSTREAM INDUSTRIES: Coffee Consumers Retailers Roasters International traders Domestic traders Smallholder/estate 30 grocers = 33% of global market 4 companies (Philip Morris, Nestle, Proctor & Gamble and Sara Lee) = 45% of global coffee market 4 companies (Neumann, Volcafe, ECOM, Dreyfus) = 39% of global market 25 million farmers and workers Effects of cartels in upstream industry: CUTS’ study on fertilisers Fertiliser price rise due to anti-competitive practices in the potash market Only 12 percent of the incremental fertiliser subsidy translated into higher consumption of fertilisers, the rest was due to price rise Governance challenges: Unilateral solutions application of the “effects doctrine”: ◦ private actions for damages but a prisoner’s dilemma (a country prohibiting export cartels can always make itself better off by allowing them and a country that permits export cartels can make itself worse off by prohibiting them) Governance challenges: Few Multilateral solutions ◦ Strict disciplines on export restrictions ◦ WTO Remedies against injury caused by export cartels (Counter measures, reverse antidumping, safeguards) ◦ Formation of Countervailing Buyer Cartels ◦ Multilateral Agreement on Competition (with S&DT) ◦ Creation of an international competition authority The way forward Agreements on information sharing on cartels Capacity building reforms Technical assistance by the WTO International Competition Fund (CUTS has been strongly advocating for such a fund) Diversification of exports Thank you for your attention CUTS International www.cuts-international.org