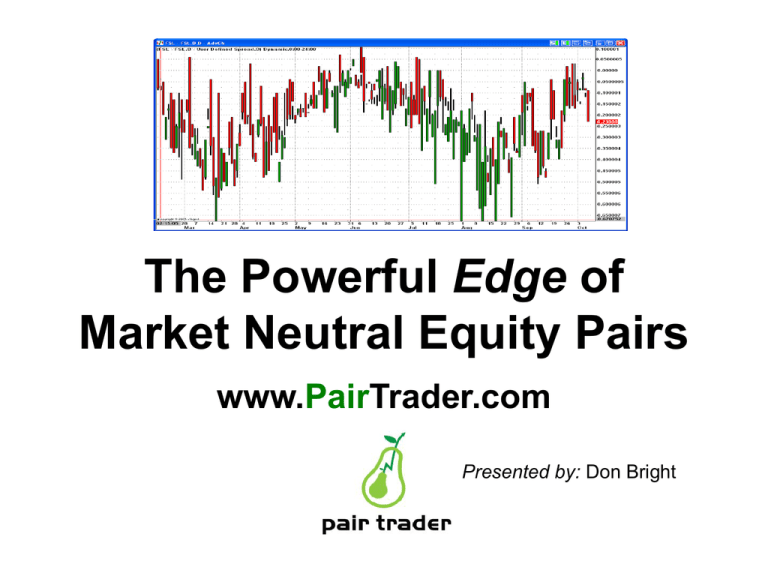

The Powerful Edge of Market Neutral Equity Pairs

advertisement

The Powerful Edge of Market Neutral Equity Pairs www.PairTrader.com Presented by: Don Bright What is a Pair? The combination of two stocks to profit from their relative change in price through divergence or convergence of the spread price. Statistical Arbitrage vs. Risk Arbitrage Created for different purposes traded with many different strategies Creating a Spread Price to Watch Example: Long Alcan vs. Short Alcoa Differential Last Price of AL minus Last Price of AA 48.06 – 30.58 = 17.48 • Factor – (.65 x AL) – AA (.65 x 48.06) – 30.58 = .66 • Ratio Numerator and Denominator AA divided by AL 30.58 / 48.06 = .64 Trading Considerations Goal is Market Neutral Choices are: Dollar Neutral ($1 long to $1 short) Beta Neutral (H.V is substitute) Share Neutral Best Pairs Created From: Same Industry Group Correlated Exhibit Mean Reverting Tendencies Why is there the probability of mean reversion over time? Fundamental Difference Between Stocks Comparing Metrics is Straightforward Overvalued / Undervalued to Peers CnpSrp100 65-Day Chart Metrics used in Fundamental Comparisons Value out performs growth when risk adjusted Compare: Market Cap Price to Book (P/B) Tangible Book Values Price to Earnings (P/E use TTM) Dividend Yield Industry Group Short the overvalued stock Buy the undervalued stock Spread History Compoundable Trades Predictability Intra-day Scalps Market Neutral Swing Trade Relative Strength Pairs Baskets Pair Investing Fundamental Edge Technical Edge PairNomics, LLC. Traders Training Traders A systematic, logical, low stress methodology to making consistent money in Today’s Markets. www.pairnomics.com PairNomics, LLC announces the release of the most advanced, comprehensive 6-month course ever developed for professional and active traders. This Correspondence Course was produced by a group of successful traders, who combined years of experience to create a structured system and a step-by-step disciplined journey into the realm of Equity Pairs Trading and related Market-Neutral Strategies. Online Correspondence Course Course Delivered by Utilizing the Latest in Multi-Media Training Technology 6-Month Course Structured in Weekly Modules Systematic Compoundable Strategies Learn How to Confidently Use Trading Probabilities to Maximize Profitability All Traders MUST be PROFITABLE Before Advancing to the Next Module Required Research, Assignments, Quizzes, Business Plans, and Trading Tasks Learn to Combine Fundamentals & Technical Analysis Additional Comprehensive Strategies & Techniques beyond Pairs Trading Master Critical Risk-to-Reward Relationships Course Includes Monthly LIVE Web Conferences Receive PairNomics PairTrader Certification upon Completion of Course “Go confidently in the direction of your dreams. e-mail within 30-days for Live the life you have imagined.” Expo discount of 10% – Henry David Thoreau e-mail today ! info@pairnomics.com Contact us for: Mentoring & Education Compoundable Profitable Strategies Data, Tools & Resources Automated Trading Programs Need Sponsorship? Want to work with a Productive Team? Use our Capital to Trade With - Apply Today! robfriesen@pairtrader.com www.PairTrader.com E-mail us within 30-Days for EXPO Discounts off PairTrader products & services !