VIII International conference

Theory and practice of options trading.

Evolution of market making and algorithmic trading

Christopher Lederer

MD, Orc Software BV

VP Sales Continetal Europe ORC AB

2011-06-04

Who am I and why I am here. . .

1991 – 1998 Studied Medicine at University of Bonn / Germany

1998 – 2001 RTS Realtime Systems AG Frankfurt (Head of

Support and Projects)

2001 – 2005 RTS Sydney Ltd. Founding Member (Head of IT

APAC)

2005 – 2007 Tick-TS AG (Joint Venture of HSBC and Sino

(Brokerage) (Key Accountmanager IT)

2007 - 2008 ORC Software Frankfurt, Found and establish ORC

Office in Amsterdam

2008 – 2009 MD Orc Software BV

2009 – now VP Sales Continental Europe

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 2

Evolution ? Survival of the fittest

1998 Amsterdam Trading Firm

˃ MM on Eurex (Options) / Xetra (Stock)

– 2 Series with 1 Trader and one Assitant (8hours)

– ISDN Lines 64kb/s max 128kB for MM

2004 same Amsterdam Trading Firm

˃ MM on Eurex/Xetra

– 15 Stock all Options Series one Trader (12 – 14 hours)

– 10Mbit

2001 – 2005 Market Makers in Sydney

˃ Initial 24 Market Makers registered (2001)

˃ 14 left (IMC, TH and Optiver dominated the landscape after 24 month)

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 3

Evolution - lead the race?

Latency comes at the price of lower flexibility

Conditions are usualy „same“ for all.

Leading MM companies have a very static approach to markets

˃ Leaving them exposed if conditions change beyond the expectd

˃ Global players educate and train staff themself – very strikt approach towards market

conditions caused by that.

˃ If conditions are as expected 10+ years expiriance are executed on a market

MM has suffered under small spreads, low volume and volatility.

Algo traders suffer under high TCO with lower revenues – investments have

to be justified. 2008 – 2010 have been hard years

There is thirst for new markets – main European markets are already at a

technology level where more is hardly possible..

Quote „Every millisecond we save we see in revenue increase next day“

˃ Developer Amsterdam Market Maker 2009

Quote „We hire Operators not Market Makers“

˃ MD Market Making Company (globally connected)

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 4

OFT Technology Vision (basic requirements)

Segment Independence

˃ Allow Independent Segment Development – deploy to new markets

Redundancy Minimization – one does all.

Open Architecture

˃

˃

˃

˃

Ability for segment solutions to only pick the components they need

Ability to only pick the components they want

Ability to build their own market gateways

Ability to customize different components from parameters to plugin-code

– Market Maker

– Limit Management

– Compliance

Consistently Low Latency

˃ Market Access layer can be accessed directly from customers without

going through service layer (unless enrich functionality is desired or

needed)

˃ Not lowest possible latency whatever the cost

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 5

Automated trading (MM/ARB/gAlgo)

Trader

Trader &

programmer

Algorithmic

trading engine

Financial

markets

Trading ideas are converted to

Computer runs millions of calculations per

A trader gets

a trading

idea.

strategies

understandable

by the

second, reacting to market changes in

computer. LAST POINT FOR

microseconds, implementing strategies

EMOTION!

and sending orders to the exchange

much, much faster than a human could.

© Orc Software AB, All Rights Reserved. Proprietary and Confidential | 6

The Key to Success (Technology)

Possibility to rapidly adapt to changing

requirements

Technology is key in MM and Algo

˃ Well-defined and well-tested connectivity

˃ New product can be as simple as combining a set of

existing building blocks in a new way

Continously strive towards shorter time to market

˃ Remove unnecessary overhead (releasing process time)

˃ Focus on minimal transactions approach

– Fire and Forget (Mifid helps in Europe)

– Better diagnostics for latency and bottelnecks

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 7

Competitive challenges (service a market)

Low-latency: Constant push to be faster and process data more

quickly

Scalability: Increasing competition within markets requires that

underlying technology is highly scalable (handle more exchanges

and more instruments simultaneously) to be able to grow

business and stay ahead.

Quality/up-time: Continuous push to build solutions that have

greater up-time – especially at peak periods like market opening

and closing where maximum trading profits are made

Market access – market connections to worldwide exchanges

Global presence – regional knowledge

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

8

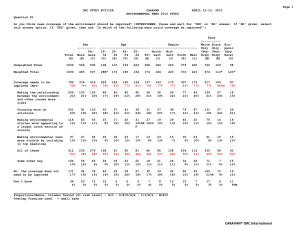

Market Making and Volatility Trading

Aggression level

High

Structured

products MM

Competitive

MM

Strategic

MM

Low

None

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

Market view

9

Significant

Market Making and Volatility Trading

Aggression level

High

Structured

products MM

Competitive

MM

Volatility

trading

Strategic

MM

Volatility

arbitrage

Low

None

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

Market view

10

Significant

High Frequency Trading success factors

Mostly technology

some analysis

µs

Only

technology

Holding period

Technology and

analysis

Some technology

mostly analysis

Only analysis

Days

Complete

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

11

Automation

None

HFT challenges and opportunities

Challenge

Holding

period

Arbitrage

Technology demands

Spread

trading

Opportunities

New liquidity

New instruments types

New regions

New trading strategies

Statistical

arbitrage

Full automation

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

12

Manual

Amsterdam HFT firm – 2008

Amsterdam HFT Firm

London Stock

Exchange

Orders

Trading

desk

Orders

Amsterdam

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

13

Amsterdam HFT firm – 2010

Amsterdam HFT firm

Co-Location site

London Stock

Exchange

Orc Spreader

Orders

Trading

desk

Orders

Amsterdam

TCO +50%, Revenues stay the same – competitive effects

that can change landscape of markets – only the one that

can invest can survive. 2009 MM Amsterdam reported 90%

lees EBITA due to crisis.

© Orc Software AB, All Rights Reserved. Proprietary and Confidential |

14

Outlook for Russian

Regulation?

Exchange competition

Technical Infrastructure (TCO)

˃ When do costs block expansion? – Investments are drastic in

competitive markets. Return of investments have to materilize quickly

before others follow and competitive factors have effects on revenues.

Products –ETF, Strutured Products . . .

Education on Products

Local Economy and Conditions have to there . . .

Russia has show stable grows in all measurable conditions as well

as emotional.

˃ Language and cultural differences will adjust within time

Pragmatic and smart approaches can make the difference!

˃ Being smart is not necessarily linked to measuarble parameters and

therfore can not be ordered, forced or bought.

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 15

Q&A

Thank You!

© Orc Software AB, All Rights Reserved. Proprietary and Confidential . | 16