The Supply Chain Simulation Game

advertisement

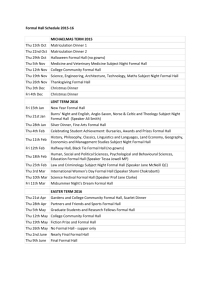

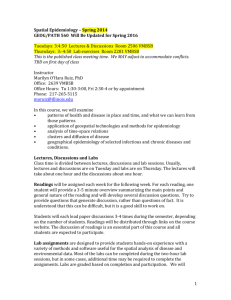

2012 Utah Operations Winter Conference The Supply Chain Simulation Game Gal Raz Darden School of Business, University of Virginia Supply Chain Management Elective Jan 18 (Wed) Jan 19 (Thu) Jan 25 (Wed) Jan 26 (Thu) Introduction to Supply Chain Management Supply Chain Network Design (K&S) Data Rich Management (SEJ) Feb 2 (Thu) Feb 8 (Thu) Feb 15 (Wed) Feb 16 (Thu) Feb 22 (Wed) Sourcing from an Ops / People Perspective (K&S China (B)) No Class Aligning Incentives in Supply Chains (Blockbuster) The Negotiations Exercise (Uncle Coco Magic shop) The Supply Chain Game – Part 1 Feb 23 (Thu) Feb 24 (Fri) Mar 1 (Wed) Mar 8 (Wed) Mar 9 (Thu) The Supply Chain Game – Part 2 The Supply Chain Game – Debrief Recycling and Reverse Logistics (Sandvik) Green ProductService Systems (Netafim) Green ProductService Systems (Better Place) Outsourcing and Offshoring (Timbak2) Feb 1 (Wed) Sourcing from an Ops / People Perspective (K&S China (A)) * The Negotiation Exercise on Thursday February 16th and the Supply Chain Game on Wednesday and Thursday February 22-23 will be from 2:45pm to 4:45pm and thus there will be no class on February 8 The SC Simulation Game Main Learnings Managing a global supply chain that competes by making timely decisions of pricing, ordering, and logistics that impact both the market and competitors The impact of supply chain contracts on supply chain and individual firm performance Negotiation under asymmetric information Supply chain strategy (responsiveness versus efficiency) The SC Simulation Game Procedure The game is played with competing teams of 4–8 players Each team has four roles: a Retailer, Wholesaler, Distributor, and Manufacturer The game is played for up to 96 weeks (2 simulated years) The flow of product and orders Customers Manufacturer Distributor Wholesaler Retailer Manufacturing and transport takes 1 or 2 weeks. Orders are received immediately The Decisions Weekly: Quarterly: Order quantity Mode of transportation (trucks vs planes) Retail Price Half Yearly: Supply Chain Contract Negotiations (Revenue Sharing or Wholesale Pricing Contracts) Information System The SC Game Interface Retailer Screen The SC Game Interface Distributor Screen Contract Screen (RS Contract) 1 2 Quarterly Reports The SC Game Debrief Market Strategy – Pricing and market share Supply Chain Strategy – Ordering, using fast mode of transportation (Responsiveness vs efficiency), coordinated ordering The Supply Chain Contract Wholesale pricing contract Revenue sharing contract Use of Information Sharing Individual vs Supply Chain Profit Market Strategy Retail Price Market Share $300 100% Team 1 Team 1 90% Team 2 $250 Team 2 80% Team 3 Team 4 $200 Team 3 70% Team 4 60% 50% $150 40% 30% $100 20% 10% $50 0% 0 1 2 3 4 Quarter 5 6 7 8 0 1 2 3 4 Quarter 5 6 7 8 Supply Chain Strategy Order Order Customer 150,000 Customer 200,000 Retailer Retailer Wholesaler Wholesaler Distributor 120,000 160,000 Distributor Manufacturer Manufacturer 90,000 120,000 60,000 80,000 30,000 40,000 0 0 0 20 40 60 Quarter Team 1 80 100 0 20 40 60 Quarter Team 3 80 100 The Supply Chain Contract Revenue-Sharing contract versus WholesalePricing contract What is the goal and impact of the revenue sharing contract? What is the optimal revenue sharing contract? What is the impact of the Asymmetric Information? Administrator Interface