Document 13794097

advertisement

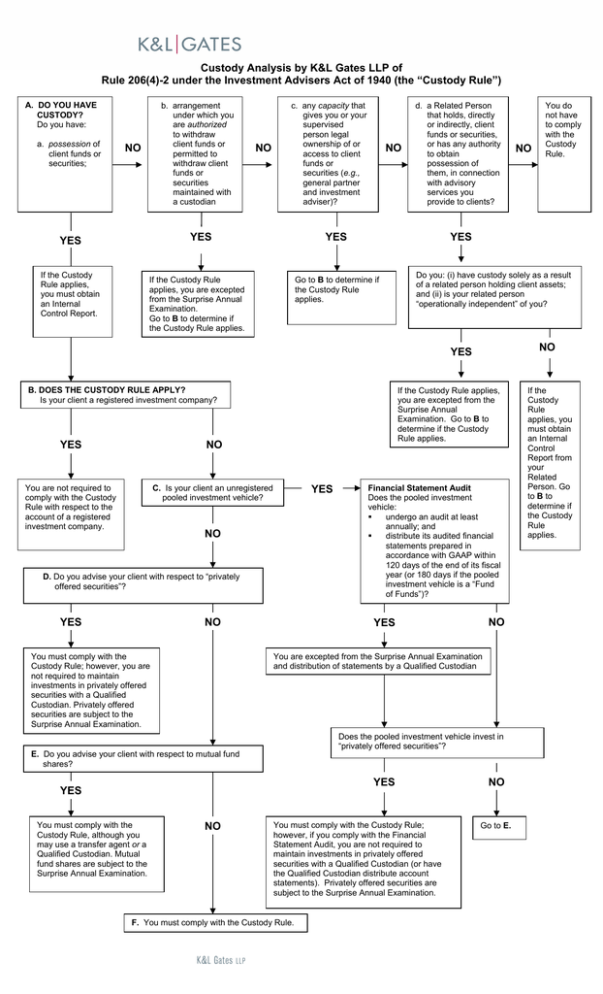

Custody Analysis by K&L Gates LLP of Rule 206(4)-2 under the Investment Advisers Act of 1940 (the “Custody Rule”) A. DO YOU HAVE CUSTODY? Do you have: a. possession of client funds or securities; b. arrangement under which you are authorized to withdraw client funds or permitted to withdraw client funds or securities maintained with a custodian NO NO c. any capacity that gives you or your supervised person legal ownership of or access to client funds or securities (e.g., general partner and investment adviser)? YES YES YES If the Custody Rule applies, you must obtain an Internal Control Report. NO d. a Related Person that holds, directly or indirectly, client funds or securities, or has any authority to obtain possession of them, in connection with advisory services you provide to clients? YES Go to B to determine if the Custody Rule applies. If the Custody Rule applies, you are excepted from the Surprise Annual Examination. Go to B to determine if the Custody Rule applies. Do you: (i) have custody solely as a result of a related person holding client assets; and (ii) is your related person “operationally independent” of you? NO YES B. DOES THE CUSTODY RULE APPLY? Is your client a registered investment company? YES NO You are not required to comply with the Custody Rule with respect to the account of a registered investment company. C. Is your client an unregistered pooled investment vehicle? If the Custody Rule applies, you are excepted from the Surprise Annual Examination. Go to B to determine if the Custody Rule applies. YES NO D. Do you advise your client with respect to “privately offered securities”? YES NO You must comply with the Custody Rule; however, you are not required to maintain investments in privately offered securities with a Qualified Custodian. Privately offered securities are subject to the Surprise Annual Examination. Financial Statement Audit Does the pooled investment vehicle: undergo an audit at least annually; and distribute its audited financial statements prepared in accordance with GAAP within 120 days of the end of its fiscal year (or 180 days if the pooled investment vehicle is a “Fund of Funds”)? NO YES You are excepted from the Surprise Annual Examination and distribution of statements by a Qualified Custodian Does the pooled investment vehicle invest in “privately offered securities”? E. Do you advise your client with respect to mutual fund shares? YES YES You must comply with the Custody Rule, although you may use a transfer agent or a Qualified Custodian. Mutual fund shares are subject to the Surprise Annual Examination. NO You must comply with the Custody Rule; however, if you comply with the Financial Statement Audit, you are not required to maintain investments in privately offered securities with a Qualified Custodian (or have the Qualified Custodian distribute account statements). Privately offered securities are subject to the Surprise Annual Examination. F. You must comply with the Custody Rule. NO You do not have to comply with the Custody Rule. NO Go to E. If the Custody Rule applies, you must obtain an Internal Control Report from your Related Person. Go to B to determine if the Custody Rule applies. APPENDIX: Definitions 1. Financial Statement Audit: Pooled investment vehicle is subject to audit by an independent public accountant registered with the Public Company Accounting Oversight Board at least annually and distributes audited financial statements prepared in accordance with GAAP to all beneficial owners within 120 days of the end of its fiscal year or, in the case of a Fund of Funds, within 180 days of the end of its fiscal year. Additionally, upon liquidation the pooled investment vehicle is subject to audit and distributes audited financial statements prepared in accordance with GAAP to all beneficial owners promptly after the completion of the audit. Non-US based funds may prepare their audited financial statements in accordance with local GAAP, so long as differences to US GAAP are reconciled. 2. Fund of Funds: A limited partnership, limited liability company, or another type of pooled investment vehicle that invests 10% or more of its assets in other pooled investment vehicles that are not, and are not advised by, a related person of the limited partnership, its general partner, or its adviser. 3. Internal Control Report: When an adviser or its related person serves as a Qualified Custodian for advisory client funds or securities, the adviser must obtain, or receive from its related person, no less frequently than once each calendar year, a written report, which includes an opinion from an independent public account with respect to the adviser’s or related person’s controls relating to custody of client assets, such as a Type II SAS 70 report. 4. Operationally Independent: A related person is “operationally independent” of the adviser: if: (i) client assets in the custody of the related person are not subject to claims of the adviser’s creditors; (ii) advisory personnel do not have custody or possession of, or direct or indirect access to, client assets of which the related person has custody, or the power to control the disposition of such client assets to third parties for the benefit of the adviser or its related persons, or otherwise have the opportunity to misappropriate such client assets; (iii) advisory personnel and personnel of the related person who have access to advisory client assets are not under common supervision; and (iv) advisory personnel do not hold any position with the related person or share premises with the related person. 5. Privately Offered Securities: Securities that are: a. Acquired from the issuer in a transaction or chain of transactions not involving any public offering; b. Uncertificated, and ownership thereof is recorded only on the books of the issuer or its transfer agent in the name of the client; and c. Transferable only with the prior consent of the issuer or holders of the outstanding securities of the issuer. 6. Related Person: A related person means any person, directly or indirectly, controlling or controlled by the adviser, and any person that is under common control with the adviser. 7. Surprise Annual Examination: Client funds and securities for which the adviser has custody are verified by actual examination at least once during each calendar year, except as provided below, by an independent public accountant, pursuant to a written agreement, at a time that is chosen by the accountant without prior notice or announcement and that is irregular from year to year. Advisers currently subject to the Custody Rule must have their first surprise annual examination conducted before December 31, 2010. The written agreement must provide for the first examination to occur within six months of becoming subject to the Amended Rule (if you become subject to the Rule after the Effective Date), except that, if client funds or securities are maintained at a qualified custodian, the agreement must provide for the first examination to occur no later than six months after obtaining the internal control report. The written agreement must require the accountant to: (i) file a certificate on Form ADV-E with the Securities and Exchange Commission (“SEC”) within 120 days of the time chosen by the accountant; (ii) upon finding any material discrepancies during the course of the examination, notify the SEC within one business day of the finding; and (iii) upon resignation or dismissal from, or other termination of, the engagement, or upon removing itself or being removed from consideration for being reappointed, file within four business days Form ADV-E accompanied by a statement that includes: (A) the date of such resignation, dismissal, removal, or other termination, and the name, address, and contact information of the accountant; and (B) an explanation of any problems relating to examination scope or procedure that contributed to such resignation, dismissal, removal, or other termination. 8. Qualified Custodian: A qualified custodian means (i) a bank as defined in section 202(a)(2) of the Investment Advisers Act of 1940 or a savings association as defined in section 3(b)(1) of the Federal Deposit Insurance Act that has deposits insured by the Federal Deposit Insurance Corporation under the Federal Deposit Insurance Act ; (ii) a broker-dealer registered under section 15(b)(1) of the Securities Exchange Act of 1934, holding the client assets in customer accounts; (iii) a futures commission merchant registered under section 4f(a) of the Commodity Exchange, holding the client assets in customer accounts, but only with respect to clients’ funds and security futures, or other securities incidental to transactions in contracts for the purchase or sale of a commodity for future delivery and options thereon; and (iv) a foreign financial institution that customarily holds financial assets for its customers, provided that the foreign financial institution keeps the advisory clients’ assets in customer accounts segregated from its proprietary assets.