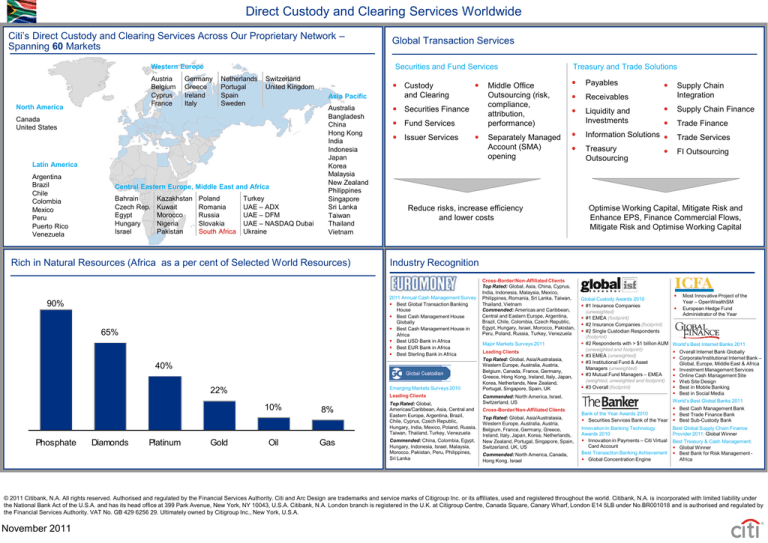

Direct Custody and Clearing Services Worldwide

Citi’s Direct Custody and Clearing Services Across Our Proprietary Network –

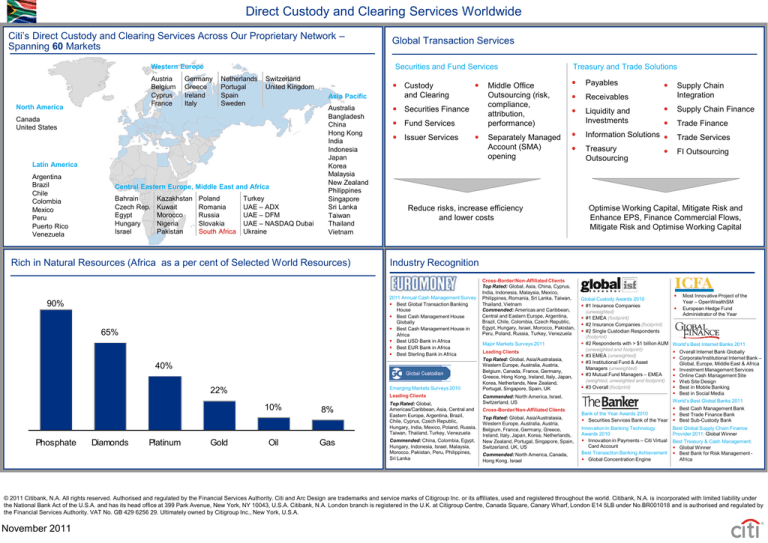

Spanning 60 Markets

Securities and Fund Services

Western Europe

Austria

Belgium

Cyprus

France

North America

Germany

Greece

Ireland

Italy

Netherlands

Portugal

Spain

Sweden

Switzerland

United Kingdom

Asia Pacific

Canada

United States

Latin America

Argentina

Brazil

Chile

Colombia

Mexico

Peru

Puerto Rico

Venezuela

Central Eastern Europe, Middle East and Africa

Bahrain

Czech Rep.

Egypt

Hungary

Israel

Kazakhstan

Kuwait

Morocco

Nigeria

Pakistan

Global Transaction Services

Poland

Romania

Russia

Slovakia

South Africa

Turkey

UAE – ADX

UAE – DFM

UAE – NASDAQ Dubai

Ukraine

Australia

Bangladesh

China

Hong Kong

India

Indonesia

Japan

Korea

Malaysia

New Zealand

Philippines

Singapore

Sri Lanka

Taiwan

Thailand

Vietnam

Rich in Natural Resources (Africa as a per cent of Selected World Resources)

Custody

and Clearing

Securities Finance

Fund Services

Issuer Services

65%

Emerging Markets Surveys 2010

Leading Clients

10%

Phosphate

Diamonds

Platinum

Gold

Oil

8%

Gas

Payables

Receivables

Liquidity and

Investments

Supply Chain

Integration

Supply Chain Finance

Information Solutions

Treasury

Outsourcing

Trade Finance

Trade Services

FI Outsourcing

Optimise Working Capital, Mitigate Risk and

Enhance EPS, Finance Commercial Flows,

Mitigate Risk and Optimise Working Capital

Industry Recognition

40%

22%

Separately Managed

Account (SMA)

opening

Reduce risks, increase efficiency

and lower costs

2011 Annual Cash Management Survey

Best Global Transaction Banking

House

Best Cash Management House

Globally

Best Cash Management House in

Africa

Best USD Bank in Africa

Best EUR Bank in Africa

Best Sterling Bank in Africa

90%

Middle Office

Outsourcing (risk,

compliance,

attribution,

performance)

Treasury and Trade Solutions

Top Rated: Global,

Americas/Caribbean, Asia, Central and

Eastern Europe, Argentina, Brazil,

Chile, Cyprus, Czech Republic,

Hungary, India, Mexico, Poland, Russia,

Taiwan, Thailand, Turkey, Venezuela

Commended: China, Colombia, Egypt,

Hungary, Indonesia, Israel, Malaysia,

Morocco, Pakistan, Peru, Philippines,

Sri Lanka

Cross-Border/Non-Affiliated Clients

Top Rated: Global, Asia, China, Cyprus,

India, Indonesia, Malaysia, Mexico,

Philippines, Romania, Sri Lanka, Taiwan,

Thailand, Vietnam

Commended: Americas and Caribbean,

Central and Eastern Europe, Argentina,

Brazil, Chile, Colombia, Czech Republic,

Egypt, Hungary, Israel, Morocco, Pakistan,

Peru, Poland, Russia, Turkey, Venezuela

Major Markets Surveys 2011

Leading Clients

Top Rated: Global, Asia/Australasia,

Western Europe, Australia, Austria,

Belgium, Canada, France, Germany,

Greece, Hong Kong, Ireland, Italy, Japan,

Korea, Netherlands, New Zealand,

Portugal, Singapore, Spain, UK

Global Custody Awards 2010

#1 Insurance Companies

(unweighted)

#1 EMEA (footprint)

#2 Insurance Companies (footprint)

#2 Single Custodian Respondents

(footprint)

#2 Respondents with > $1 billion AUM

(unweighted and footprint)

#3 EMEA (unweighted)

#3 Institutional Fund & Asset

Managers (unweighted)

#3 Mutual Fund Managers – EMEA

(weighted, unweighted and footprint)

#3 Overall (footprint)

Commended: North America, Israel,

Switzerland, US

Cross-Border/Non-Affiliated Clients

Top Rated: Global, Asia/Australasia,

Western Europe, Australia, Austria,

Belgium, France, Germany, Greece,

Ireland, Italy, Japan, Korea, Netherlands,

New Zealand, Portugal, Singapore, Spain,

Switzerland, UK, US

Commended: North America, Canada,

Hong Kong, Israel

Most Innovative Project of the

Year – OpenWealthSM

European Hedge Fund

Administrator of the Year

World’s Best Internet Banks 2011

Overall Internet Bank Globally

Corporate/Institutional Internet Bank –

Global, Europe, Middle East & Africa

Investment Management Services

Online Cash Management Site

Web Site Design

Best in Mobile Banking

Best in Social Media

World’s Best Global Banks 2011

Best Cash Management Bank

Bank of the Year Awards 2010

Best Trade Finance Bank

Securities Services Bank of the Year Best Sub-Custody Bank

Innovation In Banking Technology

Awards 2010

Innovation in Payments – Citi Virtual

Card Account

Best Transaction Banking Achievement

Global Concentration Engine

Best Global Supply Chain Finance

Provider 2011: Global Winner

Best Treasury & Cash Management:

Global Winner

Best Bank for Risk Management Africa

© 2011 Citibank, N.A. All rights reserved. Authorised and regulated by the Financial Services Authority. Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates, used and registered throughout the world. Citibank, N.A. is incorporated with limited liability under

the National Bank Act of the U.S.A. and has its head office at 399 Park Avenue, New York, NY 10043, U.S.A. Citibank, N.A. London branch is registered in the U.K. at Citigroup Centre, Canada Square, Canary Wharf, London E14 5LB under No.BR001018 and is authorised and regulated by

the Financial Services Authority. VAT No. GB 429 6256 29. Ultimately owned by Citigroup Inc., New York, U.S.A.

November 2011

Direct Custody and Clearing Services in South Africa

Key Services in South Africa

Safekeeping

Securities Settlement

Why Choose Citi in South Africa?

Comprehensive Reporting

– SWIFT and Web-based Reporting

– Detailed MIS Reporting

Assets Servicing

– Custody Information

– Corporate Actions

Positions

– Income Collection

Transaction Status

– Proxy Services

Cash Management and Foreign

Exchange

Portfolio Valuation

Market Information Services

On the ground expertise

South Africa – Key Market Indicators

USD 870.6 MM

Main Indices:

FTSE/JSE All Share Index

No. of Listed Companies:

409 (end October 2011)

Average Daily Trading Value:

USD 349.02 MM

Nominal GDP:

USD 357.27 bn

GDP Per Capita (at PPP):

USD 7.274

GDP Real Growth:

3.5 per cent (end October 2011)

Inflation:

5.7 per cent (end September 2011)

November 2011

Full suite of transaction services,

including Securities and Fund Services,

Treasury and Trade Solutions

Existing global documentation set to

ensure efficient account opening

Global consistency and electronic access

through our CitiDirect® for Securities

technology platform

A dedicated local client service and

operations team with extensive

market knowledge

Timely and accurate securities market

information services via Market Guide

The only global custodian in South Africa

that is a participant in all three markets,

equities, bonds and money market

Proactive engagement with local

regulators and market infrastructures to

drive market improvements

Contact Details

Market Capitalisation (equities):

* Source: JSE Market Profile Nov 2011

Global expertise with the world’s largest

proprietary network spanning 60 markets

Irma Calitz

Securities Country Manager, South Africa

Tel: +2711 944 0310

Email: irma.calitz@citi.com

Jacqui Sambhu

Market Specialist

Tel: +2711 944 0148

Email: jacqueline.sambhu@citi.com

Bianca Smith

Head: Securities and Fund Services

Operations

Tel: : +2711 944 0729

Email: bianca.smith@citi.com

Citibank N.A. South Africa Branch

145 West Street

Sandown, Sandton

P.O. Box 1800

Saxonwold, 2132, South Africa

Tel: +2711 944 1000

Fax: +2711 944 1010

SWIFT Address: CITIZAJX