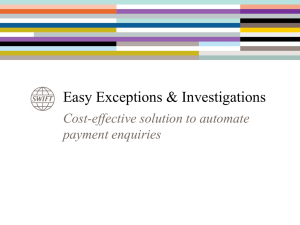

EnI - Generic presentation Q42009

advertisement

On-site or as a service: E&I is easy to implement Payment enquiries challenges Save costs Only 5% automated Labour intensive Comply with regulation Growing volumes due to FAFT SR7 Reduce risk Payments under investigation Improve customer service Long turn-around time No transparency on enquiry status E&I is easy to implement On-site Manual message creation Alliance Messenger Case Management application Case management application Easy E&I from SWIFT Choice from SWIFTReady vendors E&I as a service • Connected via service bureau • No own case management application • Low enquiry volumes => Choice from service bureaux Case Management application Service bureau An E&I solution for everyone E&I application providers 2010 planned : 2011 planned : E&I service bureaus Take the opportunity to visit them at Sibos! 4 Exceptions and Investigations Customer viewpoint • BNY Mellon Mr. Jeremy Phelps, Lead Business Systems Analyst – Global Operations • Abanka Mr. Stefan Volk, Director Interbank Relations • Sloval Guarantee and Development Bank represented by Digital Systems Mr. Peter Hasko, Chief Sales Officer BNY Mellon In –house implementation of E&I Mr. Jeremy Phelps Agenda I. Operational Statistics II. Decision / Project Details III. E&I Process IV. Benefits / Lessons Learned V. Future Initiatives Operational Statistics • Payments and inquiries processed in several locations globally • Over 450 employees dedicated to funds transfer • 165,000+ payments processed daily • 4th largest FED/CHIPS participant by volume • 3,000+ inquiries processed daily • Automation of 10 – 20 % inquiry volume • 6th largest shareholder on SWIFT • Network of 2,000 correspondent banks in 100+ markets Decision / Project Details Built on existing CRM inquiry application • Drivers – Cost – Time – Ease of use – Existing technology Project timeline (1 year duration) • 2 months to establish requirements • 3 months to design • 3 months to build • 4 months to test and implement E&I Process E&I Bank or Corporate SWIFT E&I Message Inbound E&I message • Translates inbound XML into tag-based format • System determines if message (or case) can be automated BNY Mellon XML Message – Converts outbound message if necessary • Message is transformed into user-friendly attachment to case Middleware – XML Translator Translated Message Inbound non-E&I message • System determines appropriate action and checks outbound party for E&I eligibility CRM Application – System uses information from inbound message to automate outbound E&I Outbound E&I Message SWIFT FIN or Other Outbound Message Types Benefits / Lessons Learned • E&I will help increase the amount of qualifying STP cases • STP messages are more concise (less ambiguity) • Overall case processing time is reduced • Reduced staff training time (E&I vs. FIN) • Provides a facility to handle newly defined global compliance standards (FATF SRVII) • Prepare a training program and material before implementation • Utilize the expertise of business partners for “best practice”, testing, and implementation advice – E&I Task Force – www.swiftcommunity.net E&I Future Initiatives • Phase III Completion – Work to automate more difficult E&I workflows • Continue to be active members of the E&I community and Task Force • Work with both clients and partners to encourage industry uptake • Share our experience with others For questions about this presentation please contact: jeremy.phelps@bnymellon.com E&I implementation with Easy E&I Mr. Stefan Volk www.abanka.si About Abanka • 1955: Foundation of Abanka as subsidiary of Jugobanka • 1989: Independent bank – Abanka • 2008: Listed on Ljubljana Stock Exchange • Universal Banking • Network of 41 branches in Slovenia • 3th largest bank in Slovenia with 8.9% market share • Euromoney award 2010 • The Banker award 2009 • 1991: Constitution of the Republic of Slovenia • 2004 : Member of EU • 2007 : Adoption of EUR currency Operational aspects of E&I project Some figures • 250 payment enquiries per month • Processing channels: structured and unstructured MTs (n95,n96,n92, n99), e-mails, fax Challenges & wishes • • • • • Heavy manual processing No dedicated resources No existing investigations system Wish for short time-to-market Bank strategy to remain at forefront of technological modernisation and rationalisation Easy E&I Easy E&I “Extended” Payment application “Off the shelf” Case management application Payments messages SWIFT Alliance Access/Entry • All “off the shelf” features • Integrates with Alliance Access / Entry • Retrieves underlying payment from payment application • Off-the-shelf case management functionalities and embedded intuitive workflows • Multiple BICs and subsidiaries • Handles MT and MX messages Inquiry messages (MT, MX) • Powerful search engine • Secure, role base access • Multi-user Abanka choose for Easy E&I Off-the-shelf E&I project experience & timeline July 2009 Aug. 2009 Sept. 2009 Oct. 2009 Nov. 2009 Dec. 2009 2010 Go live with E&I Decision to participate in Easy E&I pilot Sign-up for Easy E&I (incl. Access to E&I and Expertus application Download of Easy E&I application Start counterparty testing with BNY Mellon Integration with Alliance Access application Set up Pilot Project Group (PPG) within Abanka: 4 staff members headed Ms Natalija Šega, Head of Payments Internal testing End successful counterparty testing Abanka became first Easy E&I adopter, in May 2010! E&I benefits for Abanka • Centralised evidence of investigations, providing a proper audit trail • Increase in operational efficiency – Easy and direct access to full investigation case information instead of time consuming paper document retrieval – Unified way of solving investigations across departments – Possibility of duplicate cases eliminated • Enhanced customer service thanks to faster enquiries resolution • Cost savings – Better use of time of highly qualified workers – Reduction of paper and other communication channels • Environmental benefit – Paper reduction Concluding remarks • Through the pilot experience, Abanka was able to evaluate all parameters of Easy E&I offering – Economical aspect – Response time – User friendliness – Suitability within our business environment • Abanka is an active supporter and promoter of Easy E&I – Presented in SWIFT user communities in Romania, Albania, Macedonia and Bosnia Hercegovina Contact Abanka to learn more about Easy E&I and our experience Contact details E&I pilot team Natalija Šega, team leader tel.: +386 1 47 18 314 e-mail: natalija.sega@abanka.si Nataša Klepec, E&I specialist tel.: +386 1 47 18 309 e -mail: natasa.klepec@abanka.si Grega Zadnik, SWIFT manager tel.: +386 1 47 18 557 e-mail: grega.zadnik@abanka.si Sead Duračković, IT technical expert tel.: +386 1 47 18 507 e-mail: sead-durackovic@abanka.si Interbank Relations Štefan Volk, Director of Interbank Relations tel.: +386 1 47 18 435 e-mail: stefan.volk@abanka..si Žiga Žerjal, Relationship Manager tel.: +386 1 47 18 433 e-mail: ziga.zerjal@abanka.si Slovak Guarantee and Development Bank E&I implementation via a service bureau Mr. Peter Hasko About SZRB and Digital Systems Slovak Guarantee and Development Bank (SZRB) Digital Systems • State-owned bank in Slovakia • Focused on development small and medium sized businesses in Slovakia • Supports towns, municipalities, corporates etc. • A SWIFT Service Bureau providing SWIFT connectivity and SWIFT products and services such as “Software as a Service” to banks and financial institutions • • Provides E&I solution for SZRB via its’ SWIFT Service Bureau A small bank with – ca. 200 payments per month – 2-5 investigations per month • January 2010 started deposit products for their corporate clients expecting increase of investigations • Visit us at our stand A721 to get more information regarding E&I and other solutions running in our SWIFT Service Bureau Investigations profile of SZRB • • • • Small number of investigations Limited resources Expecting increase in investigations from corporates Looking to automate processes in a clear, transparent and cost-effective way • Already connected to SWIFT network via Digital Systems service bureau, which offers E&I service Obvious choice for SZRB to sign-up for the E&I service offered by their service bureau Implementation set-up BIS Payments Service Bureau MX SAP E&I Messaging Interface Case Management System MT Messaging E&I offering of Digital Systems includes access to • • • • Case management system MSIT- EXIN To the bank’s own payments archive To e-mails, faxes, SAP, AML system Any bank information system Benefits of « E&I via Service Bureau » for SZRB • Adopt E&I in very short timeframe – up to 4 weeks • Minimal upfront investment • No maintenance of an own investigation system • Central investigations hub and integration with all the bank’s back-office systems allowing any investigator/ department to easily access all investigation cases and related information in one central point • Very cost effective solution “Our major challenge was to centralise all our payments investigations with one central investigation hub.” Jozef Galis Director of the Accounting and Reporting Section at SZRB Concluding remarks By using E&I SZRB: • Can rapidly respond to customer enquiries • Obtained increased operational efficiency of its staff and procedures • Added a competitive advantage to its offering for corporates • Was able to centralise all investigations to provide a clear audit trail Contact details SRZB Peter Paprskar – Director of information systems Tel: +421 2 572 92 178 E-mail: peter.paprskar@szrb.sk Jozef Galis – Director of the accounting and Reporting Section Tel.: +421 2 572 92 644 E-mail: jozef.galis@szrb.sk Digital Systems (Sibos A721) Radoslav Hromy – Account Manager Tel: +421 2 634 525 37 E-mail: rhromy@digitalsystems.eu Peter Hasko – Head of Sales Tel: +421 2 634 525 37 E-mail: phasko@digitalsystems.eu Questions &Answers