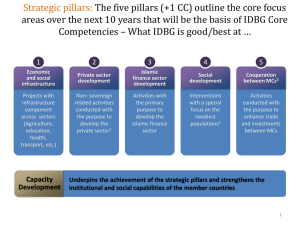

Training in Islamic – The Islamic Development Bank

advertisement

Training in Islamic Finance – The Islamic Development Bank IRTI :Wide Regional Coverage Over the period 1985-2010, IRTI Organized 426 Training Programs These were for benefit of IDB Member Countries and Non-Member Countries 12575 professionals participated in Classification of Training Programs Islamic Finance Islamic Economics Poverty Alleviation Private Sector Development Small and Medium Enterprises & Micro-Finance Project Cycle Framework Information Technology for Development Economic polices Examples of Training Topics In Islamic Finance An Introduction to Islamic Finance Islamic Modes of Financing IDB Modes of Financing Insurance - Takaful from An Islamic Financial System Perspective Sukuk as Sources of Financing Development Projects Islamic Financial Products: Principles and Applications Risk of Financing in Islamic Financial Institutions Governance In Islamic Financial Institutions Shari’ah Standards for Islamic Financial Institutions Accounting and Auditing Standards for Islamic Financial Institutions Illustrative of Some of These Examples Topic: NEW PRODUCT DEVELOPMENT IN ISLAMIC FINANCIAL INSTITUTIONS A. Main Objectives Allow trainees to learn about the nature and characteristics of Islamic finance as a modality that can be used for providing an alternative approach in compliance with Shari'ah rules. Study the main elements of applied Islamic transactions and differences between traditional financial engineering and Islamic financial engineering. Explore the appropriate setting for Islamic financial products and the way and method of structuring them with special Follow….. reference to Murabaha, Musharaka, Mudharaba, Ijarah, Salam, Istisna’, and treasury products. B. Target Population The target group of the Course is the middle-level managers and executives working in financial institutions, especially banks in the IDB Member Countries. C. Admission Requirements University degree in Economics, business Administration, Finance, Laws or equivalent. Be a professional involved in running, launching, and management of banking operations or related Financial institutions in IDB Member Countries. Have a minimum professional experience of three years in one or more of the above fields. Follow….. D. Main Contents Overview of Islamic Banking and Finance Islamic Alternative Modes of Finance to Conventional Financial Theory Design of new Islamic financial Products: Prospects and Challenges Appropriate Setting for Islamic Financial Products Islamic Financial Engineering Structuring Islamic financial products Second Illustrative Example Topic: “Sukuk: Shari’ah and Operational Aspects” Main Objectives Provide the participants with a comprehensive understanding of the burgeoning Sukuk product (its origins and future) within the parameters promulgated by the AAOIFI Shari’ah standards. Make a complete coverage of the salient legal, credit and operational aspects relating to varying Sukuk structures possible under different Shari’ah contracts. Evaluate global trends in the Sukuk market as it continues to unfold in sovereign and corporate sectors. Analyze the benefits, costs and risks of Sukuk both from the issuer as well as investor perspectives. Follow….. Discuss the potential of Sukuk within the context of the overall Islamic finance landscape and its potential for application in varying capacities for raising funding requirements. B. Target Population Course is designed for university researchers, middlelevel officials, executives and bankers working in financial institutions and government corporations. C. Admission Requirements University degree in Economics, business Administration, Finance, Laws or equivalent. Follow….. Be a professional having exposure to finance, banking and other related business activities. Have a minimum professional experience of three years in one or more of the above fields. D. Main Contents Introduction to Islamic finance. Discussion of important Fiqh al-Muamalat principles and Fiqh interpretational issues. Understanding the origin of Shari’ah compatible contracts as well as important principles underlying such contracts. Review of key Islamic finance contracts and practical examples. Follow….. The practical application of Shari’ah compatible contracts in modern day Islamic banking and finance. Definition and Shari’ah basis of Sukuk. Current Sukuk Market Overview. Comparisons with other conventional capital market products (Bonds, shares, derivatives etc). The Sukuk Issuance process. Legal and documentations issues in Sukuk. Regulatory and tax aspects of Sukuk. Sukuk tradability. Sukuk in the context of corporate financing choices. Sukuk structuring perspectives.