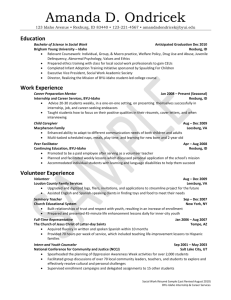

Accounting - Brigham Young University

advertisement

Accounting BYU-Idaho Accounting Department College of Business and Communication What Can I Do With An Accounting Degree? • • • • • • • • • • • Audit Services Tax Compliance and Consulting Information Systems Management & Consulting Management Advisory Services General Corporate & Financial Accounting Cost Accounting Governmental Accounting Forensic Accounting Financial Consulting Expert Witness and Litigation Support Services Run your own business BYU-Idaho Accounting Department Who Can I Work For? • Public Accounting Firms (Certified Public Accountant Track) – Local, Regional, National, International • Consulting Firms • Business and Industry – Manufacturing, Retail, Service, Banking, Insurance, Health Care, Natural Resources, Non-profit, etc. • Government • Self-Employed • Education – College, High School BYU-Idaho Accounting Department The Public Accounting Profession (CPA Track) Following graduation, you will be qualified for employment with the following sample of firms: • Big-4 Firms – – – – • Regional Firms – – • PricewaterhouseCoopers Deloitte Ernst & Young KPMG, LLP Grant Thornton BDO Seidman Local CPA Firms – Rudd & Company • Private Practice – It is recommend that you have at least 6 – 7 years of professional experience with a CPA firm before attempting to begin your own practice! WHY? Lack of experience and reputation = no clients. No clients = No income. No income = bankruptcy. Bankruptcy = unhappy accountant. Unhappy accountant = Back to college for a degree in marketing. Be wise and plan your career. BYU-Idaho Accounting Department Sample of Business and Industry Employers If you decide not to pursue a career in public accounting, you can work in industry for companies like these: BYU-Idaho Accounting Department Sample of Government Employers or for institutions like these: • • • • • • • Federal Bureau of Investigation US General Accounting Office Defense Contract Auditors Internal Revenue Service State of Idaho Idaho State Tax Commission City of Boise BYU-Idaho Accounting Department What Skills Should I Possess? If you pursue a career in accounting, you should 1. become familiar with accounting terminology; 2. become proficient with the tools of the trade; 3. learn the concepts and principles that govern accounting and how to apply them; 4. develop advanced computer skills; 5. develop analytical and people skills; 6. possess written and oral communication skills; and 7. understand legal and ethical conduct within the accounting profession. BYU-Idaho Accounting Department How Do I Become a Certified Public Accountant? If you want a long-term career in public accounting, you must become a licensed CPA. In order to become licensed, most states require 30 credits of advanced education beyond the bachelors degree, a minimum number of accounting credits, 1 – 2 years of qualifying experience, and a passing grade (75%) on the CPA Exam. If this is your career goal, you should plan on earning a Masters of Accountancy degree (MAcc) or your MBA from an accredited university. BYU-Idaho Accounting Department What Salary Can I Expect? Employer Jr. Level (0 - 3 yrs.) Sr. Level (4 - 6 yrs.) Public Accounting (large firm) $50,000-$71,500 $68,500-$88,750 Public Accounting (medium firm) $44,000-$64,250 $62,000-$81,750 Public Accounting (small firm) $41,500-$58,000 $55,250-$71,500 Corporate Accounting (large co.) $38,500-$59,500 $58,250-$76,250 Corporate Accounting (medium co.) $36,500-$55,500 $52,750-$68,500 Corporate Accounting (small co.) $34,000-$50,500 $47,750-$61,250 Note: Add 5 to 10 % additional for one who attains their CPA. BYU-Idaho Accounting Department What Salary Can I Expect? Position Large Co. Small to Medium Co. Chief Financial Officer $187,750-$395,500 $94,250-$182,250 Corporate Controller $125,000-$190,000 $81,750-$138,750 Tax Manager $97,750-$136,000 $77,000-$106,000 BYU-Idaho Accounting Department The Integrated Accounting Degree In order to graduate from BYU-Idaho with an accounting degree, you must fulfill the University’s Graduation Requirements which includes earning a minimum of 120 credit hours within specified areas of study shown below: Foundations 40 Credits Accounting Major 56 Credits Minor OR 2 Clusters Total 24 Credits BYU-Idaho Accounting Department 120 Credits Accounting Major Course Requirements Required Courses Accounting Options (any 3) Business Acct 201 Acct 202 Acct 301 Acct 302 Acct 321 Acct 333 Acct 344 Acct 356 Acct 398 Acct 402 Acct 312 Acct 322 Acct 401 Acct 403 B 275 B 401 Other NOTE: Those planning on entering the CPA profession or planning on going to graduate school are advised to take Acctg 312, 322, and 403 as options. FDMath 221 Econ 150 Econ 151 Electives--2 credits In order to graduate with a bachelor’s degree in accounting, you must complete each of the preceding courses with a C- or better. BYU-Idaho Accounting Department Minor or Clusters AND, in addition to completing the Foundation and Major requirements, you are required to: complete a Minor of your choosing consisting of 24-25 credits, OR complete two clusters of 12 credits each of your choosing within appropriate disciplines. Typical minors or clusters for Accounting include: Business Management Computer Information Technology Communication Economics BYU-Idaho Accounting Department The Accounting Internship • You are required to register for Accounting 398. • Your internship qualifies for 3 credits and consists of at least 270 hours of accounting-related work. Additionally, you will be requested to complete assignments during your internship. A grade will be given based on satisfactory completion of the internship and assignments. • Generally, prior work-related experience will not satisfy the internship. • The busiest time for accountants in business tends to be January – April. Accordingly, it is recommended, but not necessary, that your internship be completed during the Winter Semester of your junior or senior year. Accounting 301 and Accounting 321 are prerequisites. BYU-Idaho Accounting Department BYU-Idaho Accounting Department