Lake Tahoe Basin Prosperity Plan Cluster Meeting PowerPoint

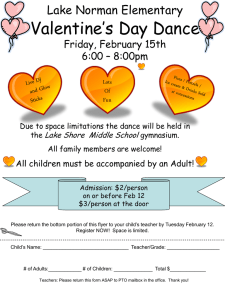

advertisement

Click to edit Master title style Lake Tahoe Basin Prosperity Plan Visitor Services and Tourism Economic Cluster Meeting April 22, 2010 Embassy Suites, South Lake Tahoe Facilitated by Doug Svensson, Trish Kelly, Kathie Studwell and Michael Ward ClickMeeting to edit Master title style Agenda Introductions Overview of Lake Tahoe Basin Prosperity Plan Review of Economic Clusters, Process, Schedule Recap of Environmental Scan – Issues, Opportunities, Barriers Validation of Cluster components Discussion and Identification of Priorities for Action Plan Development Click to editBackground Master title style Project Regional collaboration to develop a Basin-wide economic prosperity strategy Address high rates of unemployment & seasonal employment, income disparities, workforce skills gaps, brain drain, environmental challenges, aging built environment, infrastructure gaps Goal – develop an action plan for a more resilient economy that enhances environmental quality, improves standard of living, grows local businesses and supports entrepreneurs Click toCommittee edit Master Members title style Steering Carson City, Nevada City of South Lake Tahoe, California Douglas County Nevada El Dorado County, California Lake Tahoe Community College Lake Tahoe School Lake Tahoe South Shore Chamber of Commerce North Lake Tahoe Chamber of Commerce Placer County, California Tahoe Regional Planning Agency Washoe County, Nevada Western Nevada Development District Click Master title style What is to anedit Economic Cluster? Leading Industries (core of the cluster) Support Industries (suppliers of components, raw materials, support services) Technology Human Resources Capital Regulatory & Tax Climate Economic Foundations Adv. Physical Infrastructure Quality of Life Click Master title style What is to anedit Economic Cluster? We are here Lake Click Tahoe to edit Resident MasterPopulation title style Lake Tahoe Resident Population (1987-2008) 70,000 62,894 60,000 50,000 46,887 51,086 55,232 53,347 2005 2008 40,000 30,000 20,000 10,000 0 1987 1995 2000 Click to edit MasterEnrollment title style Lake Tahoe School Tahoe Region School Enrollment 12,000 10,000 9,644 9,331 8,972 8,767 8,461 8,000 7,755 7,534 6,985 6,882 2007 2008 6,000 4,000 2,000 0 2000 2001 2002 2003 2004 2005 2006 Lake Tahoe Employment Click to editBasin Master title style 2000-2007, Basin and Larger Region Comparable Data – Non-Farm Payroll Jobs Long-Term Trend, using 2000-2007 change (<= Left axis) Six-County Region Six-County Private Non-Farm Payroll Jobs 600,000 Lake Tahoe Basin (Right axis =>) 120,000 Region: +24% 500,000 100,000 400,000 80,000 300,000 60,000 Tahoe: -6% 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 20,000 1998 100,000 1997 40,000 1996 200,000 Counted at place of work (though workers may live elsewhere) Region may be gaining, but Tahoe Basin is losing jobs South Lake TahoeMaster Gamingtitle Revenues Click to edit style 1990-2009 South Lake Tahoe Real Gaming Revenues 1990-2009 (2009 dollars) 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Click edit Master title style KeytoGeneral Themes Declining population affects workforce, markets for goods and services, sense of community Lack of affordable housing is a drain on young talent and barrier to business growth; middle class families are priced out; high percentage of home owners are non-resident Demographic change, increasing skills gaps Traffic congestion a serious problem Aging existing development contributes to environmental degradation Click to edit Master title style Tourism Trends Tahoe Basin is losing jobs compared to the broader region Gaming revenues are down in both South and North Shore as is employment Hotel occupancy rates have declined and at alltime low for Casino Corridor Sales tax revenue has declined Transient Occupancy Tax revenue has declined Traffic volumes have declined although commuter traffic has increased Workers commute long distances due to high housing costs Click toTrends edit Master style Tourism andtitle Themes The most popular visitor activities are alpine skiing, gaming, sightseeing, fine dining, snowboarding and shopping Tourism generated $1.2 billion in direct spending in South Lake Tahoe (in 2006); almost 27% of jobs were in the leisure and hospitality sector Visitor spending in North Lake Tahoe generates over 60% of earnings and 2/3rds of all employment The population within a 4 hour drive is expected to grow 28% over next 14 years ClickTourism to edit Master title style Context Gaming industry recognizes need for diversification and to “reinvent” itself, taking advantage of the unique amenities of the Lake Tahoe setting – to be an amenity rather than a driver Reno is planning a major “rebrand” of the region – Reno Tahoe USA in 2010 Tahoe Douglas Visitors Authority plans new campaign and strategic plan Click edit Master title style KeytoOverall Themes Build on the foundation of sustainability Create more mobility options (biking, walking, transit, other) Focus on job quality (living wage jobs with career pathways) Continued investment in infrastructure is needed, including technology (broadband) Develop a cohesive regional strategy Diversify, redevelop, revitalize – both the economy and the built environment – the private sector is innovating; shift in role for TRPA ClickCluster to edit Master title style Process Identify key clusters and components Convene participants, validate cluster components Identify key issues, opportunities and barriers Identity key priorities Develop an action plan with key initiatives and strategies, led by champions Engage cluster partners including businesses, non-profits, government and support organizations Click to Evaluation edit Master title style Cluster Criteria Size of contribution to economic base Future job creation prospects Ability to help diversify the economy Ability to enhance environmental quality Short term organizational capability Long term sustainability Unique to the assets of Tahoe Click to in edit Master title style Trends Major Industries Declining Industries 0 -9 -200 -61 -11 -23 -38 -152 -190 -400 -600 -800 -1,000 -1,200 -1,226 -1,400 Estab Emp Nat. Resources/ Utilities Estab Emp Mfg./ Wholesale/ Trucking Estab Emp Information Estab Emp Arts/ Rec./Lodging/ Food Click to edit MasterAnalysis title style Economic Cluster Cluster Visitor Services Outdoor App. / Equip. Research Health Care / Medicine Government 2007 Jobs Job Change 2007 Estabs Estab Change 18,108 (1,273) 672 (28) 316 (72) 52 8 1,789 10 207 (8) 542 115 97 17 Click to edit MasterGroupings title style Preliminary Cluster Visitor Services and Tourism Tourism Hospitality Entertainment/Cultural Resources and Amenities Recreation Historic Preservation Transportation (tours, moving visitors in and out, etc.) Recreational/Outdoor Apparel and Equipment Research and Testing Click to Cluster edit Master title style Draft Findings Visitor Services is the largest cluster but it is declining and needs to restructure to thrive. Outdoor apparel and equipment product development do not appear to produce lots of jobs currently. Health care is also a large cluster. This sector offers opportunities to help rebrand the region as a wellness center and build on recreation amenities. Click to edit Master title style Issues • Fragmentation in marketing • Blighted communities • Need for improved access to public lands • Need to rebrand/reinvent the region • Gaming industry needs to reinvent itself • Coordination across the region for synergies Click to edit Master title style Opportunities Several lodging, resort and casino establishments have major redevelopment plans Leverage Arts and culture Create new venues Become more of a destination with more diverse amenities Focus on environmentally sustainable infill and redevelopment Connect recreation with wellness and healthy lifestyles Improve access to public lands Click to editOpportunities Master title style Regional Connect with food and wine products in West Slope and Nevada Grown – culinary tourism and visitor experiences Specific local targets for Douglas County include outdoor lifestyle manufacturers (surf boards, go-peds, etc.) – look at dual applications for manufacturing and tourism – in the areas of boating, kayaking, climbing, skiing, etc. Collaborate with tribal leaders Click toNext edit Master Steps title style Form cluster work groups and prepare draft action plans – first meeting April 21st to identify priority issues and opportunities; second meeting May 22nd to develop draft action plans Prepare draft prosperity plan summer 2010 for review and input by agencies, the community and partners Launch implementation plan in fall 2010 Click to edit Information Master title style Contact Doug Svensson, ADE President dsvensson@adeusa.com Trish Kelly, ADE Principal tkelly@adeusa.com Kathie Studwell, ADE Senior Associate, kstudwell@adeusa.com Michael Ward, Project Manager mklward@pacbell.net Click to edit Master title style Lake Tahoe Basin Prosperity Plan BUILDING THE KNOWLEDGE AND RESOURCES CLIENTS NEED TO REALIZE THEIR ECONOMIC AND BUSINESS POTENTIAL