Banking Landscape

advertisement

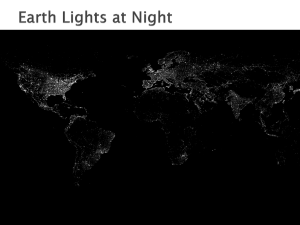

Banking in the NAFTA Region A Practitioners Landscape April 21st, 2013 Aaron Martin Rebecca Mcculloch Ian Graham Payments and Cash Management Senior Sales Manager HSBC Bank Canada Payments and Cash Management Senior Sales Manager HSBC Bank USA Director Treasury & Risk Management Saxon Energy Services INTERNAL - 1 This presentation is provided in part by HSBC Bank Canada and in part by HSBC Bank USA, N.A. (collectively "HSBC"), is for information purposes only and may not be used or relied upon for any other purpose. In addition, these materials may not be disclosed, in whole or in part, or summarized or otherwise referred to except as agreed in writing by HSBC. The information contained herein is derived from sources we believe to be reliable, but which we have not independently verified. To the extent such information includes estimates and forecasts of future financial performance obtained from public sources, we have assumed that such estimates and forecasts have been prepared on bases. HSBC makes no representation or warranty (express or implied) of any nature nor is any responsibility of any kind accepted with respect to the completeness or accuracy of any information, projection, forecast, representation or warranty (expressed or implied) in, or omission from, this document. HSBC expressly disclaims any and all liability that may be based on any information contained herein, errors therein or omissions there from and any obligation to update any of such information. In particular, Nno liability is accepted whatsoever by HSBC for any direct, indirect or consequential loss arising from the use of or reliance on this presentation or any information contained herein by the recipient or any third party. These materials are intended solely for your information and HSBC assumes no obligation to update or otherwise revise these materials. Any examples given are for the purposes of illustration only. The information, analysis and/or opinions in this presentation constitute our present judgment, which is subject to change without notice. This presentation does not constitute an offer or solicitation for, or advice that you should enter into, the purchase or sale of any security, commodity or other investment product or investment agreement, or commitment to provide any financing, or any other contract, agreement or structure whatsoever and is intended for institutional, professional or sophisticated customers and is not intended for the use of private individual or retail customers. Nothing contained herein should be construed as tax, investment, accounting or legal advice. No consideration has been given to the particular service needs, investment objectives, financial situation or particular needs of any recipient. Recipients should not rely on this document in making any investment decision and should make their own independent appraisal of and investigations into the information and any investment, product or transaction described in this presentation. Unless governing law permits otherwise, you must contact a HSBC Group member in your home jurisdiction if you wish to use HSBC Group services in effecting a transaction in any investment or product mentioned in this presentation. This presentation, which is confidential and not for public circulation, must not be copied, transferred or the content disclosed, in whole or in part, to any third party. This presentation should be read in its entirety. No part of this presentation may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC. All the information set out in this presentation is provided on the best of HSBC's current knowledge and understanding of the relevant law, rules, regulations, directions and guidelines governing or otherwise applicable to the subject matter thereof but HSBC makes no guarantee, representation or warranty and accepts no liability as to its accuracy or completeness. If a report or other source is referenced within this presentation, you should read the disclaimers and disclosures which form part of the relevant report or source. The opinions expressed and information provided are as at the date that this presentation was made and HSBC and such opinions and information may change; HSBC is under no obligation to update such opinions or information if they do change. Please note the following with regard to certain products which may be discussed in connection with these materials: HSBC Bank Canada and HSBC Bank USA, N.A are members of the HSBC Group of entities. In the United States, deposit, credit and other banking products are offered by HSBC Bank USA, N.A., Member FDIC., and an Equal Credit Opportunity Lender. In Canada, deposit, credit and other banking products are offered by HSBC Bank Canada, Member CDIC. For all HSBC products, certain terms and restrictions may apply and the products are offered subject to applicable terms and conditions n. Certain products, including, without limitation, loans, are subject to approval. All United States persons (including entities) are subject to U.S. taxation on their worldwide income and may be subject to tax and other filing obligations with respect to the U.S. and non-U.S. accounts. U.S. persons should consult a tax advisor for more information. INTERNAL - 2 Insert GPS number here Disclaimer Insert GPS number here Banking in the NAFTA Region Agenda Learning Objectives NAFTA Overview Saxon Introduction Economic Comparison Banking Landscape Liquidity Clearing Systems Future Payment Trends Key Learnings Q&A INTERNAL - 3 Insert GPS number here Banking in the NAFTA Region Learning Objectives Understand key differences among banking systems across the NAFTA region Understand the strengths of each system in order to enhance the effectiveness of your cross-border treasury operations Recognize the impact of future changes to cross-border banking services Understand best practices and identify opportunities to optimize cross-border operations INTERNAL - 4 NAFTA Overview INTERNAL - 5 Insert GPS number here North American Free Trade Agreement (NAFTA) History and Background Did you know? INTERNAL - 6 NAFTA went into effect on January 1, 1994. NAFTA created the world's largest free trade area. NAFTA links 450 million people producing $17 trillion worth of goods and services. Approximately $462.3 billion in trade between Canada and the USA during the same time frame. This is ahead of China, which is at $389.7 billion and Mexico, with $369.5 billion. Insert GPS number here Canada Facts about Canada Did you know? INTERNAL - 7 Canada is the leading exporter of natural resources, resourcebased technology and knowledge. Home to the second biggest oil reserve and thriving mining sector. Canada is the second-largest country in the world, behind Russia. As of 2013, Toronto is fourthlargest city in N.A. after Mexico City, New York and Los Angeles Canada has the fourth lowest population density in the world, averaging three people per square kilometre. Insert GPS number here Canada Overview of Banking Sector There are currently 49 commercial banks (25 domestic banks and 24 foreign bank subsidiaries) which offer whole sale and retail banking services, 27 branches of foreign banks and 6 federally regulated cooperative credit associations in Canada. Canada's domestic banking sector is dominated by five commercial banks: Royal Bank of Canada (RBC), TD Bank Financial Group (TD), Scotiabank Group, BMO Financial Group and CIBC (Canadian Imperial Bank of Commerce). These banks account for around 90% of the Canadian banking sector's total assets. Many of Canada's leading banks have expanded in the US. Royal Bank of Canada, BMO Financial Group, TD Bank Financial Group and HSBC Bank Canada have banking affiliates among the top 50 US banks. 7 Largest Banks in Canada by asset size (C$ BN as at Oct 2012): o o o o o o o Royal Bank of Canada TD Bank Scotiabank BMO CIBC National Bank of Canada HSBC Bank Canada* $825 $811 $668 $525 $393 $184 $81 (as at Dec, 31, 2012) INTERNAL - 8 Insert GPS number here Mexico Facts about Mexico Did you know? INTERNAL - 9 Mexico is the twelfth-largest economy in the world in terms of GDP and second largest in Latin America (Latam). Mexico’s President is elected every 6 years and cannot be reelected. Mexico is the 2nd most liquid exchange in Latin America, behind Brazil. The Mexican stock exchange is highly concentrated, with the top five stocks accounting for 63% of the market universe and the top 10 for 81% (May 2012). Mexico has hosted the FIFASoccer World Cup in 1970 and 1986 and the Summer Olympics in 1968. Insert GPS number here Mexico Overview of Banking Sector There are currently 26 financial groups, 43 multiple banks, six development banks, 22 financial companies with limited operations and 81 representative offices of foreign banks operating in Mexico. Legislation passed in Dec 1998 allowing foreign investment in Mexico's leading banks. Following extensive privatization and consolidation, approximately 75% of total banking assets, and five of the six largest banks in Mexico are now foreign owned. 7 Largest Banks in Mexico by asset size (USD BN July 2012): o o o o o o o BBVA Bancomer (Spain) Banamex (US) Banorte (Mexico) Santander (Spain) HSBC (UK) Inbursa (Mexico) Scotiabank Inverlat (Canada) $102 $92 $ 67 $ 63 $ 38 $ 25 $ 16 INTERNAL - 10 Saxon Overview INTERNAL - 11 Saxon is a land based drilling and workover service company providing services to oil and gas exploration and production companies Specialized “Fit For Project” rigs Worldwide fleet of drilling and work over rigs – footprint extends across four continents Contracts with National Oil Companies (“NOCs”) and International Oil Companies (“IOCs”) 2012 Forecast % Revenue Breakout by Revenue Geography Fleet Overview Saxon’s fleet includes 94 Drilling and Workover rigs Saxon supports an additional 30+ rigs through various Operational and Technical Services Agreements (TSAs) – all TSA rigs are owned partially or fully by Schlumberger Drilling Rigs (76) Emphasis on modular and highly mobile drilling equipment Focus on drilling intensive, large scale development projects PAK: 5% TSA: 4% OMN: 10% NAM: 14% VEN: 13% PER: 2% ECU: 3% Workover Rigs (18) Small but growing fleet Focus on large scale development projects MEX: 15% COL: 20% INTERNAL - 12 AUS: 14% TSA – Turkey PAK – Pakistan OMN – Oman VEN – Venezuela PER – Peru ECU – Ecuador COL – Colombia MEX – Mexico NAM – North America AUS - Australia Insert GPS number here Saxon Energy Services Company Overview Saxon Direct Operations/Rig Targeted Growth Territories Canada (10) 5 x 700-850 HP Rigs 2 x 660 HP Rigs 3 x 400-450 HP Rigs Technical Services Agreements (TSA) w/ SLB USA (10) Mexico (16) 5 x 1150 HP Rigs 1 x 1000 HP Rigs 4 x 700-750 HP Rigs 3 x 1000 HP Rigs 3 x 800-850 HP Rigs 4 x 600 HP Rigs 4 x 750 HP Rigs 2 x Workover Rigs Australia (16) 4 x ATS 600 HP Rigs 4 x ATS 1250 HP Rigs 3 x ATD 1250 HP Rigs Colombia (14) 1 x 2000 HP Rigs 4 x 1500 HP Rigs 1 x 865 HP Rigs 6 x 750 HP Rigs 1 x 650 HP Rigs 1 x Workover Rig Ecuador (7) 7 x Workover Rigs Peru (2) Pakistan (4) 1 x 2500 HP Rigs 2 x 2000 HP Rigs 1 x 1200 HP Rigs Venezuela (8) 1 x 3000 HP Rigs 2 x 2000 HP Rigs 1 x 1500 HP Rigs 1 x 1000 HP Rigs 3 x Workover Rigs Oman (7) 5 x 2000 HP Rigs 2 x 1000 HP Rigs 2 x 2000 HP Heli Rigs Total of 3,800 employees representing 30+ nationalities INTERNAL - 13 5 x Workover Rigs Insert GPS number here Saxon Energy Services Diverse Geographic Footprint (94 Drilling & Workover Rigs) Saxon Headcount by Region @ OCT-2012 N'AM (CAN-USA-MEX) 851 S'AM (COL-ECU-PER-VEN) 1,447 EH (OMN-PAK-TSA-MEA) 994 AUS 532 CORP 74 CONSOL 3,898 AUS 14% CORP 2% Saxon Headcount by Function @ OCT-2012 Direct Rig 3,222 Field Support 277 G&A 399 CONSOL SAM 37% 3,898 G&A 10% NAM 22% EH 25% Insert GPS number here Saxon Energy Services Global Employee Base w/ International Industry Experience Field Support 7% Employees from 30+ different Nationalities Algeria India Philippines Australia Indonesia Polynesia Canada Jordan Romania Chile Malaysia Russia China Mexico Scotland Colombia New Zealand Spain Ecuador Nigeria Syria Egypt Oman Turkey England Pakistan UAE France Panama USA Germany Peru Venezuela INTERNAL - 14 Direct Rig 83% Insert GPS number here Saxon Energy Services Company Overview Strong, Committed Shareholders Saxon was taken private in Q3-2008 (previously a publicly listed company trading on the TSX) by First Reserve Corporation (FRC) & Schlumberger (SLB) who are equal 49.5% shareholders in Saxon (remaining % held by Saxon Management) Acquisition rationale: Mutual view by shareholders on long term strategic importance and enhanced value of international drilling operations High Quality, Advanced Technology Rigs Approximately 80% of rigs are Tier 1 / Tier 2 Since 2007, Saxon has invested ~$600 MM in acquisitions, new build, and major rig upgrade programs Fit-for-project drilling solutions provided by Saxon’s highly nimble and agile fleet Premier supplier of land-based drilling and workover operations in Shallow to Deep oil and gas reservoirs Strong Financial Outlook Underpinned by Long-Term Contracts Historically, Saxon’s customer base has been comprised of ~60% IOCs and ~20% NOCs Currently ~70% of 2013 revenue is currently contracted with a substantial amount of the remaining revenue projected accruing from probable renewals and extensions 2013 Projections: $650MM + USD in Revenue world-wide; $1.1B+ in Assets INTERNAL - 15 Economic Comparison INTERNAL - 16 USA Mexico Canada Uneven economic recovery Sequestration for fiscal year 2013 resulting in a potential USD 85bn cancelation of resources across the federal government Uneven growth path Moderate growth expected during 1H13, followed by more dynamic growth in 2H13 Incremental economic growth Main concerns are about U.S. fiscal policy, Euro area crisis, and commodity prices Low interest rates expected to continue S&P forecasts the Fed will keep interest rates low through 2014 Fed funds target rate is between 0 and a 25bps Monetary policy : Expect one-time reduction of 50bp in April 2013 to take funding rate to 4.0% Monetary policy: Expect BoC to remain on hold until Q414. Policy rate will eventually move higher but not for a lengthy period. Financial conditions though are extraordinarily accommodative. Canadian Prime rate is currently 3.00% Labor market improving gradually Unemployment still a significant challenge – approx. 7.7% (7.9% expected) at February 2013 Education reform recently approved Fiscal and energy reforms to be sent to Congress during 2H13 Could generate a better outlook for medium and long term condition Job creation remains slack in 2013 Mixed results for corporate profits Weak and disappointing 4Q12 result increase investor caution 55% of the International Petroleum Companies (IPC) did not meet HSBC’s EBITDA estimates and 72% of them did not meet income estimates. Balance sheets are strong. Corporate profits have been squeezed recently, and are likely to be a concern well into 2013 12.15 USD MXN year end forecast, based on relatively sound macroeconomic framework and positive outlook on reforms In the near term, the currency may struggle to make headway given near term constraints of lower MXN yields and heavy INTERNAL - 17 long MXN market positioning In the midst of interest rates holding steady, the Canadian dollar is trending as bearish USD dollar has risen 4%on an index basis and is higher against all other G10 currencies as of January 2013 Insert GPS number here Economic Comparison USA Mexico Canada Growth expected in 2013 because of strong momentum of export and domestic consumption Steady income growth Household debt to disposable income at an all-time high Savings rates at very low levels Currently running 2% YOY/1.9% Central Bank Target (Feb 2013) inflation up from 1.6% as at (Jan 2013) Largest CPI in the US since the credit card in the 2008 Inflation expected to rise during the first months of year and later drop, closing the year at 3.6% Inflation below target but stable Significant and increasing government debt due to stimulus Optimism around the introduction of reform that could lead to higher GDP growth for Mexico. Expect the economy to increase by 3.2% in 2013, below the 3.9% growth in 2012, but in line with the 15 year average growth rate of 3.0% Federal debt to GDP is half the G7 average Housing market is recovering Housing Starts climbed by .8 percent% to 917 000 as at February 2013 Housing Permits rose 4.6% to 946 000 (most since 2008) Longer-term interest rates spark recovery in housing market, boosted purchases of automobiles and other durable goods Home loans in Mexico grew by 10% in 2012 Housing market is cooling due in large part to new mortgage restrictions – weighing on economic growth Slower inventory growth and wider trade deficit Exports up 2.6% in Q412 after falling for three consecutive months. Industrial production improvements in line with US Industry Production (U.S. automotive industry’s large presence in Mexico.) Trade surplus with the U.S., trade deficit with non-U.S. countries Capital spending plans set to grow at a very modest rate Sluggish income growth Disposable household income decreasing High household debt Corporations continue to aggressively reserve cash. INTERNAL - 18 Insert GPS number here Economic Comparison Banking Landscape INTERNAL - 19 USA Mexico Canada Financial Industry > $12.6 trillion in assets Financial Industry >$4.2 trillion in assets Financial Industry > $3.6 trillion in assets Top five financial institutions hold approx. 30% assets Following extensive privatization and consolidation, approximately 90% of total banking assets, and five of the six largest banks in Mexico are now foreign owned Top five financial institutions hold approx. 90% of Assets. Thousands of participants and the Federal Reserve Banco de Mexico (Banxico) is the central bank, in charge of monetary and exchange rate policy Mexico’s high and low value clearing systems owned and operated by Banxico Eleven direct clearers and the Bank of Canada National coverage, but a segmented geographic footprint National coverage, also segmented geographic footprint. Major cities include Mexico City, Monterrey, Guadalajara, Cd. Juarez National coverage Approximately 7,000+ financial institutions Vast majority of Mexico’s banking assets are in non-domestic ownership. 22 Financial groups, 43 multiple banks, 6 development banks, 12 financial companies with limited operations and 58 representative offices of foreign banks 151 deposit-taking institutions FIs may utilize third-party providers and partners for cash management services Banks offer full range of financial services FIs may utilize third-party providers and partners for cash management services INTERNAL - 20 Insert GPS number here Banking Landscape USA Insert GPS number here Banking Landscape Mexico Canada The Federal Reserve has one paper check clearing center and one image check clearing center All checks cleared through CECOBAN Canadian Payments Association utilizes six national clearing points Check 21 image capture and exchange legalized in 2004 Remote check deposit is available No national image exchange in Canada (some FIs exchange images on a proprietary basis) Although consumer checks writing is dropping significantly over 70% of Business to Business payments remain checks. Checks still predominate but declining A large percentage of items cleared are electronic payments A number of options for checks clearing (Federal Reserve and local clearing house arrangements) One central cheque clearing system Centro de Compensacion Bancarios (CECOBAN) images captured and truncated One centralized cheque clearing system (Automated Clearing Settlement System) Multiple days for clearing (one to two is the norm) One or two days depending on the time of the day the checks were deposited Same day value for CAD items deposited across six time zones Defined “business day” clearing times 24 or 48 hours, depending on time deposited Overnight clearing of cheque INTERNAL - 21 USA Mexico Canada National Branch Network Yes Yes Yes Payment Clearing Yes Yes Yes Yes - Electronic Yes - Electronic/Cash Yes - Electronic Yes - ACSS (ACH) Yes - CECOBAN(TEF) Yes - ACSS (EFT) Yes LVTS Yes SPEI Yes LVTS EDI, SAP®, Oracle Yes Yes Yes Cheques/Cheque Imaging Yes Yes Yes Low value 0-2 HP–0 / LP-1 Low value 0-2 Payroll Low Value/Non-Priority Payments High Value/Priority Payments Availability - Electronic Availability - Cheque 0 1-2 0 Controlled Disbursements Yes Yes No Remote Deposit Capture Yes No Yes Lockbox Yes Yes Yes Positive Pay Yes No Yes Backdating No No No Account Analysis Yes Yes Yes Credit Interest Yes No Yes Notional Pooling No Yes Yes Cash Concentration Yes Yes Yes INTERNAL - 22 Insert GPS number here Banking Landscape USA Insert GPS number here Banking Landscape Payment Systems Mexico Canada Fedwire Funds Transfer system Real-time gross settlement for high value/time-critical financial/commercial payments Processes high value USD credit transfers Interbank and third-party transfers SPEI (Sistema de Pagos Electronicos Interbancarios) is Mexico's Real Time Gross Settlement (RTGS) system for high value wire payments Payments routed through SWIFT, settled through accounts held with correspondent banks abroad LVTS (Large-Value Transfer System) Canada's RTGS systems Used for CAD wires – high value, sameday, urgent customer and bank-to-bank transfers 17 direct bank participants Approx. 88% of the total daily transaction value is cleared through LVTS. ACH (Automated Clearing House) Most widely used electronic funds transfer system for ACH credit and debit transactions Two operators: Federal Reserve system (FedACH), Electronic Payments Network (EPN) Used for batches of lower-value credit and debit transfers; payroll, collections, EDI, WEB, TEL, XBR and check conversion (ARC & BOC) payments CECOBAN is Mexico's low value “ACH” system SICAM: Deferred net settlement system owned by Banco de Mexico, operated by CECOBAN SIAC (Sistema de Atencion a Cuentahabientes de Banco de Mexico) Used for transfers and real-time settlement among holders of current accounts ACSS (Automated Clearing Settlement System) Deferred net settlement system Processes CAD cheques, EDI, low value credit and debit transfers, etc. 11 participants 99% of daily transaction volume is cleared through ACSS. These transactions represent just 12% of the total value cleared INTERNAL - 23 Insert GPS number here Banking Landscape Payment Systems USA CHIPS (Clearing House Interbank System) Bilateral/Multilateral netting system for USD FX settlements, financial settlements (loan and interest payments), commercial and treasury payments Principally for Int’l USD credit transfers Clear high value interbank transfers Mexico Bill Pay Managed independently by banks and third party processors Check Clearing Channels On-us/Transit Digitized Image Processing Direct Sends Canada Sistema de Pagos Electrónicos Interbancarios (SPEI) is owned and operated by Banxico and operates via a queuing system. SICAM (Sistema de Cámaras) Deferred net settlement system owned and operated by Banxico. Authorize lines of credit to banks needed to settle their net clearing balances for cheques and electronic credits and debits. Settles all payments processed by CECOBAN. Bill Pay Check Clearing Clearing and settlement managed by CECOBAN except on-us cheques INTERNAL - 24 USBE (US Dollar Bulk Exchange) Next day (ACH-type) settlement of USD items (check and EFT) among Canadian banks Positions are settled through US correspondents Corporate Creditor Identification Number (CCIN) (Bill Payments) Centralized bill payment reporting used by all direct clearers Cheque Clearing Clearing and settlement managed by Canadian Payments Association (CPA), except on-us cheques Cash Management Capabilities INTERNAL - 25 USA Insert GPS number here Cash Management Capabilities Payments and Disbursements Mexico Canada Checking accounts/Zero Balance Accounts (ZBAs) Checking Accounts/Zero Balance Accounts (ZBA) Chequing Accounts/Zero Balance Accounts (ZBAs) Electronic Data Interchange (EDI) Electronic Data Interchange (EDI) Electronic Data Interchange (EDI) Wire Payments Wire Payments Wire Payments Cross-border payments via SWIFT through correspondents Large USD volumes Automated Clearing House Payments (ACH) and check blocks Automated Clearing House (ACH) Electronic Funds Transfer Stop Payments Stop Payments Stop Payments Corporate/Travel and Procurement Cards Not Available Corporate/Travel and Procurement Cards Positive Pay No positive pay but check protection is available Positive pay Controlled disbursement No controlled disbursement No controlled disbursement Tools to balance to zero daily ZBA structures allowed Tools to balance to zero daily INTERNAL - 26 USA Mexico Remote Deposit Capture (RDC) – Image technology RDC is available ,cheque collection services are not common practice except for large corporates Nationwide Deposits Mail Delivery - Once per day US Postal Service recently announced a $15 billion cost savings plan potentially closing more than 200 processing facilities. Mail Delivery – Once per day (not used for checks) Mail Delivery – Once per day Lockbox Service – Core Cash Management service (wholesale B2B/retail C2B) converts paper to image and electronic payment Lockbox Service – not offered in Mexico Lockbox Service USD cheques drawn against US banks settled through “southbound” cash letters Transition to Check Image Exchange (aka US Check 21) demised Automated Clearing House (ACH) – Robust reporting Automated Clearing House (ACH) – Robust reporting Electronic Funds Transfer (EFT) – Limited information Electronic Data Interchange (EDI) Electronic Data Interchange (EDI) Electronic Data Interchange (EDI) – capabilities comparable to that of the US Imaging – Check and lockbox Imaging – Cheque Imaging - Cheque and lockbox Merchant Services – Debit/Credit Cards Merchant Services – Debit/Credit Cards Merchant Services – Debit/Credit Cards/CHIP Check Conversion (ARC) – C2B lockbox only Branch banking is highly used – branch deposits and company payments using special payments/deposit tickets Coast to Coast National Branch System INTERNAL - 27 Canada Insert GPS number here Cash Management Capabilities Collections and Receivables USA Insert GPS number here Cash Management Capabilities Liquidity Management Mexico Canada Earnings credits Interest on credit balances Interest on credit balances Bank account overdrafts (fee) Bank account overdrafts (fee) Bank account overdrafts (fee) Cash Concentration/Zero Balance Accounts (ZBA) Same Day Cash Concentration via SPEI Cash Concentration/Zero Balance Accounts (ZBA) All domestic and most international banks offer cash concentration services Made as either AFT direct debits or LVTS transfers ACH/Debit Wires Zero Balance Accounts permitted and used Domestic Pooling - Most banks offer CAD and USD account structures Daily sweep/Offshore Liquidity Daily Sweep / Notional Pooling is not permitted Sweep not necessary to earn interest on deposits INTERNAL - 28 Trends in the Marketplace INTERNAL - 29 Insert GPS number here Trends in the Marketplace Payment Trends Convergence of business and consumer payments B2B payment alternatives converging with consumer payments Corporate credit cards, travel & entertainment, purchasing, etc. Online payments supported for both corporate and consumers Online bill payments Online tax payment and filing Online consumer debits SWIFT for corporates Migration to electronic payments away from cash and paper methods: Migration to chip technology for cards* Mobile technology taking hold Migration to online payments Move toward real-time payments E-Mail Money Transfer (EMMT) - person to person funds transfers in real-time INTERNAL - 30 Insert GPS number here Trends in the Marketplace Payment Trends CHIP Technology EMV CHIP is currently one of the most secure technologies available to protect payment information and prevent payment card fraud The EMV CHIP can be found in over 65 countries Migration to CHIP affects payment brands, issuers, acquirers, merchants and consumers Training of retail staff is important. The migration requires the upgrade and/or replacement of POS terminals, ABMs/ATMs and payment cards More secure payment infrastructure that bolsters consumer and retailer confidence INTERNAL - 31 Insert GPS number here Trends in the Marketplace Payment Trends USA Mexico Canada New payment alternatives Yes Yes Yes New fraud opportunities Yes Yes Yes CHIP – Credit (credit card chip) No Yes Yes CHIP – Debit (debit card chip) No Yes Yes iDoc Yes Yes Yes Mobile Banking Yes Yes Yes Increased acceptability of EFT/ACH Yes Yes Yes “Cyber” fraud Yes Yes Yes Breach of account information Yes Yes Yes New payment methods/new control risks Yes Yes Yes TECHNOLOGY RISK INTERNAL - 32 A single set of high-quality, understandable and enforceable global accounting standards. Over 100 countries report under IFRS, more countries are adopting it as a local accounting standard. Publically listed entities, including those in finance and insurance sectors, are regulated by the National Banking and Securities Commission (CNBV), which mandated a 2012 adoption of IFRS (early adoption permitted). Mexico: IFRS transition date is January 1, 2011; first reporting date for Mexican public companies (excluding FIs)is December 31, 2012 Canada: IFRS transition by 2011, new standards in IFRS and Canadian GAAP will take effect during the transition period which may cause complications IFRS helps companies increase global reach, provides financial information with enhanced comparability and transparency, and easier access to international capital, funding and investment opportunities INTERNAL - 33 Insert GPS number here Trends in the Marketplace International Financial Reporting Standards (IFRS) Questions/Discussion INTERNAL - 34 2012 Financial Reports Bank of Montreal, Year End Consolidated Financial Statements, Oct 31st, 2012. Accessed March 2013. http://www.bmo.com/ar2012/downloads/bmo_ar12_cfs.pdf Bank of Nova Scotia, Year End Consolidated Financial Statements, Oct 31st, 2012. Accessed March 2013. http://media.scotiabank.com/AR/2012/en/downloads/Scotiabank_AR_2012_FS.pdf Canadian Imperial Bank of Commerce, Year End Consolidated Financial Statements, Oct 31st, 2012. Accessed March 2013. https://www.cibc.com/ca/pdf/investor/ar12-en.pdf Toronto Dominion Bank, Year End Consolidated Financial Statements, Oct 31st, 2012. Accessed March 2013. http://www.td.com/document/PDF/ar2012/AR2012_FS&Notes_E.pdf Royal Bank of Canada (RBC), Year End Consolidated Financial Statements Oct 31st, 2012. Accessed March 2013. 11 direct clearers + Bank of Canada “2012-2013 Economic Outlook – Economy Battles Strong Headwinds: Modest Growth Ahead”, Canadian Chamber of Commerce, December 2011, http://www.chamber.ca/images/uploads/Reports/2011/EconomicOutlook111228.pdf) “Automated Clearing Settlement System” Canadian Payments Association. Accessed March 2013. https://www.cdnpay.ca/imis15/eng/Clearing_Settlement/Automated_Clearing_Settlement_System/eng/sys/Automated_Clearing_Settlement_System.aspx Bain, B and Jonathan, J, Levin. “Mexico Banks Target Wealthy in Booming Home Market: Mortgages”, Bloomberg, Accessed March 2013. http://www.bloomberg.com/news/2012-11-23/mexico-s-banks-target-wealthy-in-booming-home-market-mortgages.html “Bank Operating in Canada” Canadian Bankers Association, November 14, 2012. http://www.cba.ca/en/component/content/category/61-banks-operating-in-canada Bloom, David, Daragh Maher, Paul Mackel et al. “Currency Outlook – USD, Heads I win, tails you lose” HSBC Global Research – Macro Currency Strategy, March, 2013, Accessed March 18, 2013. https://research.uk.hibm.hsbc/midas/Res/RDV?p=pdf&$sessionid$=KcAyac0iBrb2fCW_pE_IlBB&key=lcXeQbArrL&n=364177.PDF “Canada’s Major Payment Systems” Bank of Canada, Accessed March 2013, http://www.bankofcanada.ca/financial-system/payments/canadas-major-payments-systems/ “Canadian Economic Month at a Glance” Conference Board of Canada, May 11, 2012, http://www.conferenceboard.ca/reports/cmaag/2012/cmaag052012.aspx Dhillon, Sunny. “Toronto is the fourth-largest city in North America” Wary Centrists Posing Challenge in Health Care Vote.” The Globe and Mail, March 5, 2013. Accessed March 5, 2013. http://www.theglobeandmail.com/news/toronto/toronto-now-the-fourth-largest-city-in-north-america/article9317612/) “Federally Regulated Financial Institutions” Office of the Superintendent of Financial Institutions Canada, February 23, 2012. http://www.osfibsif.gc.ca/osfi/index_e.aspx?DetailID=568 “Fun facts about Winnie the Pooh and his friend” Accessed from the New York Public Library website March 2013. http://www.nypl.org/locations/tid/36/node/49187 International Financial Reporting Standards website. Accessed March 2013, http://www.ifrs.org/Pages/default.aspx “Large Value Transfer System”, Canadian Payments Association Website. Accessed March 2013. https://www.cdnpay.ca/imis15/eng/Clearing_Settlement/Large_Value_Transfer_System/eng/sys/Large_Value_Transfer_System.aspx Martin, Sergio, and Juan Carlos Mateos. “In the spotlight…Mexico Handbook – Competitive, open and only a truck drive away” HSBC Global Research – Economics and Equity Strategy - Mexico: October 2012. Accessed March 5, 2010. https://research.uk.hibm.hsbc/midas/Res/RDV?p=pdf&$sessionid$=rWYSPhTNh_HCtR9a_lplftb&key=mWEGLYsvGK&n=344846.PDF “North American Free Trade Agreement” Office of the United States Trade Representative, Accessed March 20, 2013, http://www.ustr.gov/trade-agreements/free-tradeagreements/north-american-free-trade-agreement-nafta Watt, David. “Canada – Bank of Canada to keep rates lower for longer” HSBC Global Research – Macro Economics Canada, March 13, 2013, Accessed March 18, 2013. https://research.uk.hibm.hsbc/midas/Res/RDV?p=pdf&$sessionid$=KcAyac0iBrb2fCW_pE_IlBB&key=bqxJLb5yJM&n=363873.PDF Woellert, Lorraine. “Gains in Permits Signal Sustained U.S. Housing Rebound: Economy” Bloomberg, March 19, 2013. INTERNAL - 35 Insert GPS number here References: Banking in the NAFTA Region