Contracting

advertisement

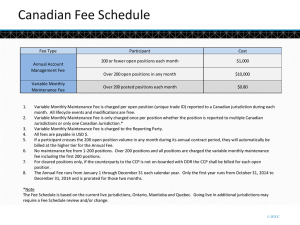

Financial Implications of Contracting for Acquisition Programs Professor Gerry Land CPA, CDFM-A Defense Acquisition University Capital & Northeast Region Fort Belvoir, VA (703) 805-3755; DSN 655-3755 E-mail: gerry.land@dau.mil Workshop #45 2010 PDI – June 2010 1 Workshop Topics • Basic Contracting Information – – – – Contract Families and Types in those Families Characteristics of Contract Types Elements of Contract Types Broad Policies of Contracting • Budgeting for Acquisition Contracts • Special Topics – – – – – Multi-Year Contracts Planning for Contract Award Unique Contract Provisions and Clauses “Contracting” Through use of MIPRs Management of on-going Acquisition Contracts • Summary 2 Two Families of Contracts • Fixed Price Contracts – Provides for firm price or, in appropriate cases, an adjustable price – Contractor’s profit built into price – Use when specific requirements known before award • Cost Reimbursement Contracts – Provides for payment of allowable incurred costs – Contractor’s profit = fee – Use when uncertainties in contract performance prevent sufficiently accurate estimate of costs for fixed-price contract 3 Two Families of Contracts Types Within the Families Fixed Price Family Types Cost Reimbursement Family Types Firm Fixed Price (FFP) Cost Plus Fixed Fee (CPFF) Fixed Price (EPA) Cost Plus Incentive Fee (CPIF) Fixed Price Incentive (FPI) Cost Plus Award Fee (CPAF) 4 Characteristics of Contract Families Cost Reimbursement Fixed Price Contractor’s Promise Best Efforts Deliver specifics Financial Risk to Contractor Low High Financial Risk to Government High ??? Cash Flow to Contractor As Cost Incurred On Delivery Progress Payments Performance Based Payments ----------- % Incurred Milestones (Preferred) Government Administration High Low Fee or Profit ? Fee Profit 5 Elements of Contract Types • Firm Fixed Price (FFP) – Negotiated Price (Includes cost and profit) • Fixed Price Economic Price Adjustment (FP-EPA) – Negotiated Price (Includes cost and profit) – Price Adjustment (+ or - based on stated economic conditions) • Fixed Price Incentive (FPI) – – – – Target Cost Target Profit Share Ratio (Government / Contractor) Ceiling Price 6 Elements of Contract Types (Continued) • Cost Plus Fixed Fee (CPFF) – Estimated Cost – Fixed Fee • Cost Plus Award Fee (CPAF) – Estimated Cost – Base Fee (< 3% of estimated cost) – Award Fee Pool • Cost Plus Incentive Fee (CPIF) – – – – – Target Cost Target Fee Share Ratio (Government / Contractor) Minimum Fee Maximum Fee 7 Schematics Showing Elements of Contract Types FFP FPIF 0/100 Share Target Profit Profit Fee Adjustment Formula (Ratio) (PTA) Ceiling Price Cost Target Cost CPIF CPFF Fixed Fee 100/0 Share Max Fee Target Fee Fee Adjustment Formula (Ratio) Max Fee Award Fee Pool Base Fee Min Fee Estimated Cost CPAF Target Cost Base Fee (0-3%) Estimated Cost 8 Broad Policies Relative to Contracts • Contracting Officers have relatively broad discretion in determining best type contract for a particular requirement • Contract type selected should be based on appropriate criteria • Contract should promote Government’s interests and motivate contractor to achieve objectives • Restrictions on contract types: – “Cost-Plus-Percentage-of-Cost” contracts are not authorized – Fixed Price development contracts > $25M must be approved by USD (AT&L) – Limitations on Fees for Cost Reimbursement Contracts • CPAF – Base Fee may be “0-3%” of the estimated cost • CPFF – Maximum Fixed Fee Percentages R&D Effort: 15% Production: 10% Architectural & Engineering (A&E) : 6% 9 Factors in Selecting Type Contract For Acquisition Programs • Timing on the acquisition continuum • Degree of complexity to satisfy requirement • Risk of successful performance • Shared responsibility of risk involved • Cost, schedule, performance and other incentives • Fair and reasonable prices through competition • Contracting Officer determines “best” contract type for required work effort and “most reasonable” cost to the government 10 Defense Acquisition Management System With Emphasis on Contract Type Appropriate to Phase • The Materiel Development Decision precedes entry into any phase of the acquisition management system • Entrance Criteria met before entering phase User Needs Technology Opportunities & Resources A ICD Materiel Solution Analysis B Technology Development C Engineering and Manufacturing Development CDD Materiel Development Decision AoA PDR Pre-Systems Acquisition CPFF FFP (LOE) • Evolutionary Acquisition or Single Step to Full Capability PDR Production & Deployment CPD Post PDR Assessment CDR or CPFF CPIF IOC Operations & Support FRP Decision Review Post CDR Assessment Sustainment Systems Acquisition CPAF FOC FPI FFP FPI FFP Generally Preferred Contract Type For Different Phases PDR: Preliminary Design Review CDR: Critical Design Review FRP: Full Rate Production IOC: Initial Operational Capability FOC: Full Operational Capability Based on DoDI 5000.02; 8 Dec 08 11 Cost and Pricing • Government policy is to pay a “fair and reasonable” price for goods and services for which a contract is awarded • One responsibility of the contracting officer is to determine the “fair and reasonable” price • Key Question: What is a “fair and reasonable” price and how is it determined? 12 Price Analysis vs. Cost Analysis Performed by Government Contracting Officer Price Analysis Cost Analysis • Fast and “cheap” to perform • Slow and costly to perform • Used to analyze sealed bids, small purchases and competitive proposals • Used to analyze sole source and, occasionally, competitive proposals Used when Purchasing: Used when Purchasing: • Standard, off-the-shelf items • Research and Development efforts • Repeat buys of other items • Purchases < $500,000 • Unique sole source items • Purchases > $500,000 13 Funding Policies for Acquisition - Related Contracts • For Research and Development Efforts • RDT&E Appropriation • Incremental Funding Policy: Budget on basis of cost expected to be incurred during given fiscal year • For Production • Procurement Appropriation • Full Funding Policy: Budget on basis of all cost for specific quantity of militarily usable end items expected to be put on contract during given fiscal year 14 Relationship Between Budgeting and Contracting • Budgeting • Accomplished well in advance of planned contract award • In compliance with funding policies of appropriation to be used • Amount based on “most likely price” of planned work effort • Funds above budgeted amount may be needed for contract modifications, overruns, requests for equitable adjustments, claims and litigation judgments; request funds when known • Contracting • Action during execution phase of the acquisition process • Upon contract award or modification, must have – and obligate – total amount of funds (budget authority) for “price” of work effort appropriate for contract type (i.e., cost reimbursement vs. fixed price) • Contract “price” = contractor’s “cost” plus company profit or fee 15 Budgeting for Different Contract Types General Rule: Budget to Most Likely Price Contract Type Budgeted Amount FFP Negotiated Price FP – EPA Negotiated Price (not including EPA) FPI Target Cost + Target Profit CPFF Estimated Cost + Fixed Fee CPIF Target Cost + Target Fee CPAF Estimated Cost + Base Fee + Maximum Award Fee 16 Budgeting for a CPFF Contract CPFF • Elements of Contract: – Estimated Cost: – Fixed Fee: – Budget Estimate: 2,000 150 Fixed Fee 100/0 Share 2,150 • Step One: Determine Estimated Cost • Step Two: Determine Fixed Fee • Step Three: Determine Budget Estimate Estimated Cost Fixed Fee Limitations: • R&D - 15% • Production - 10% Budget Estimate = Estimated Cost plus Fixed Fee • A&E - 6% 17 Budgeting for a CPIF Contract • Elements of Contract: – – – – – Target Cost: 1,000 Target Fee: 80 Maximum Fee: 100 Minimum Fee: 60 Sharing Arrangement: 80/20 – Target Price: CPIF 100 Slope% 80/20 Target 80 Fee 60 1,080 • Step One: Determine Target Cost • Step Two: Determine Target Fee 1000 Target Cost • Step Three: Determine Other Elements • Step Four: Determine Target Price Target Price = Target Cost + Target Fee • Step Five: Determine Budget Estimate Budget Estimate = Target Price 18 Budgeting for a CPAF Contract CPAF • Elements of Contract: – Estimated Cost: 2,000 – Base Fee: 80 – Maximum Award Fee: 120 – Budget Estimate: Max Fee Award Fee Pool 2,200 Base Fee • Step One: Determine Estimated Cost • Step Two: Determine Base Fee Base Fee (0-3%) Estimated Cost • Step Three: Determine Maximum Award Fee • Step Four: Determine Budget Estimate Budget Estimate = Estimated Cost; Base Fee; and Maximum Award Fee 19 Budgeting for Severable Services Contracts • DoD may budget for and enter into a contract for severable services that begin one fiscal year and ends during the next fiscal year if the contract period does not exceed one year • Funds made available for a given fiscal year may be obligated for the total amount of that contract References: (1) Title 10, U.S. Code, Section 2410a (2) Comptroller General Decision B-259274 (22 May 96) 20 Budgeting for Termination Liability On Incrementally Funded RDT&E Contracts • Unliquidated obligation on incrementally funded contract must be sufficient to cover cost of terminating for convenience (if action required) • Termination costs can not increase total budget needed • If contract terminated, termination costs to be financed from unliquidated obligations without reprogramming • Exceptions (expected to be rarely used): – Statutory Waivers: When exempted by Public Law (then budgeted on a pay-as-you-go basis) – Special Termination Cost Clause: Permitted by DFAR in fixedprice incentive and incrementally funded cost reimbursement contracts; approval requires notification of House and Senate Appropriations Committees 21 Award Fees Background • Cost Plus Award Fee (CPAF) contract most suitable when government wants to incentivize contractor in areas other than just cost (e.g., subjective areas such as timeliness and technical performance) • Total Award Fee consists of two elements: – Base Fee (0 – 3% of estimated cost of contract minus Award Fee) – Award Fee Pool (from which contractor earns fee based on superior performance in satisfying criteria stated in Award Fee Plan) • Amount of fee actually paid is judgment decision made in accordance with criteria in Award Fee Plan • Fee to be paid contractor is a unilateral government decision; generally, decision is not subject to “Disputes” clause • Can be contentious topic for both contractor and government 22 Application of Award Fees • Elements of Award Fee • • • • • Periods 1 2 3 4 5 Award Fee Base (0 – 3 %) Award Fee Pool Award Fee Pool Evaluation Periods Base Fee (0 - 3%) Evaluation Criteria Total Award Fee must be available at contract award • Financial actions re Award Fee • Commitment made before start of award period • Obligation made after end of award period (but before payment) • Payment action may be based on: • Specific milestones • Time periods • Combination of milestones and time periods 23 Determination for Earning Award Fee • Criteria for earning specified in Award Fee Plan • Frequency is important to the process • Time based periods (usually 6, 9 or 12 month periods) • Milestone or event-based periods • Both time-based and milestone/event-based periods • Unearned Award Fee – How can it be used? * • FAR prohibits “rollover” of unearned award fee to future evaluation periods or events • Unearned award fee may be used by PMO or returned to higher command level for other requirements * Paragraph 16.401(e)(4), dated 14 Oct 2009 24 Special Topics 25 Multi-Year Service Contracts Criteria for This Type Service Contract • Must be a continuing requirement for the services • Furnishing of services will require a substantial initial investment in plant or equipment, or the incurrence of substantial contingent liabilities for the assembly, training, or transportation of a specialized work force • Use of such a contract will promote the best interest of the U.S. by encouraging effective competition and promoting economies of operation Chapter 137 of title 10, United States Code, Sec 2306C, Multiyear Services Contracts. (Originated in 2000 Authorization language) 26 Multi-Year Service Contracts Type Services Appropriate for Such Contracts • Operation, maintenance and support of facilities and installations • Maintenance or modification of aircraft, ships, vehicles, and other highly complex military equipment • Specialized training necessitating high quality instructor skills (e.g., Pilot and aircrew members; foreign language training) • Base services (e.g., Ground maintenance; plane refueling; bus transportation; refuse collection and disposal) Chapter 137 of title 10, United States Code, Sec 2306C, Multiyear Services Contracts. (Originated in 2000 Authorization language) 27 Cancellation Ceiling for Multiyear Procurement Contracts • Cancellation Ceiling may cover: – Non-recurring Costs – Recurring Cost (with approval of Agency Head and USD (C)) • Cancellation Ceiling is: – Negotiated along with other provisions of the contract – A decreasing amount each year – Not an additional amount to be budgeted • MYP contracts with Cancellation Ceiling > $100M require 30 day written notice to Congressional Defense Committees prior to award 28 Planning for Contract Awards • Consider contract type and award timing early – Factor this information into cost and budget estimates – Avoid execution issues resulting from planned contract award in first or fourth quarter of fiscal year • Initial planning done as part of obligation plan • Consult contracting officer when preparing obligation plans • Proper planning usually results in better execution 29 Contract Changes • Two formal methods to change a contract: – Preferred is the “Supplemental Agreement”: Fully negotiated agreement on specific work, price and schedule. – Less preferred is the “Undefinitized Change Order”: Tentative agreement on work and schedule but final agreements not yet negotiated; usually has a “not-to-exceed” price. • Constructive change: government action causes contractor to perform work differently than required by written contract • Standard changes clause: allows contracting officers to unilaterally direct changes in specification (what), shipping destination (where) and packing (how packaged); contractor may request equitable adjustment in cost and/or schedule 30 Contract Clauses that Provide Some Control over Unliquidated Obligations • Contractor required to notify government 60 days prior to incurring costs equal to 75% of amount obligated – Incrementally Funded Cost-Reimbursement Contracts • Called “Limitation of Funds Clause (LOF)” – Fully Funded Cost-Reimbursement Contracts • Called “Limitation of Cost Clause (LOC)” • Contractor required to notify government 90 days prior to incurring costs equal to 85% of amount obligated – Incrementally Funded Fixed Price Contracts • Called “Limitation of Government Obligation Clause (LOGO)” • Notification allows termination liability to be covered by unliquidated obligations on that specific contract 31 “Contracting” of Goods and Services through Use of MIPR • Three types of actions by which DoD activities can use Military Interdepartmental Purchase Requests (MIPRs) to obtain goods and services: – Project Orders – Economy Act Orders – Non-Economy Act Orders • A MIPR (DD Form 448) is normally used to transfer budget authority from one DoD activity (requesting agency) to another DoD activity (servicing agency) to provide specific goods or services • The servicing agency signs and returns DD Form 448-2 (MIPR Acceptance) to requesting agency to indicate agreement to provide the goods or services 32 Project Order • MIPR must specifically state the request for goods or services is a Project Order • MIPR is then treated as if it were a contract • Funds identified on MIPR considered obligated when servicing agency signs and returns DD Form 448-2 • Three tests must be satisfied for action to be considered a Project Order: – Request must be for specific, identifiable supply, material, equipment, work or service; – Servicing agency must be capable of performing requested action; – Requested work must be started within 90 days of acceptance or by first of January of following year. References: US Code, Title 41, Section 23 and DoDI 7220.1 33 Economy Act Order • An Economy Act Order is not treated as if it were a contract but, rather, an interagency acquisition agreement • While funds on the MIPR are normally considered obligated when accepted by servicing agency, the servicing agency is simply an extension of requesting agency • Funds on the MIPR retain original period of availability for obligation purposes • Required criteria for requesting agency to use this type order: – Required amount of funding must be available; – Head of requesting agency decides the order is in best interest of the government; – Servicing agency is capable of filling the order or getting by contract the requested goods or services; – Head of requesting agency decides ordered goods or services can not be provided as conveniently or cheaply by contract with a commercial enterprise References: US Code, Title 31, Chapter 15, Section 1535; FMR, Volume 11A, Chapter 3; and FAR at Sub-part 17.5 34 Non-Economy Act Order Highly Controversial Method of DoD “Contracting” • Non-Economy Act Orders are for intra-governmental support where a DoD activity obtains required goods or services from a Non-DoD agency by sending funds to that servicing agency with understanding it will award a contract on its behalf. • There must be specific statutory authority to place an order with a Non-DoD agency for this type action and to pay associated fees (there are limited such statutory authorities) • Required criteria for requesting agency to use this type order: – Proper funding must be available; – The Non-Economy Act Order does not conflict with another agency’s designated responsibilities; – Requesting agency determines order is in best interest of DoD; – Servicing agency is able and authorized to provide requested goods or services • Non-Economy Act Orders are subject to same fiscal limitations as appropriation from which the funds are provided Reference: FMR, Volume 11A, Chapter 18 (new chapter as of Feb 08) 35 Managing On-Going Contracts From Resource Management Perspective • As with other DoD entities, Acquisition Program Offices forecast obligations and expenditures in Obligation and Expenditure Plans • Acquisition Program Offices are responsible for managing obligations and expenditures associated with contracts awarded for their programs • Better (i.e., more realistic) forecasts usually result in better execution of those plans • Deviations from planned obligations and expenditures must be reported and justified to higher headquarters 36 Managing On-Going Contracts From Contract Management Perspective • Vast majority of Program Office funding is obligated against contracts • Proper management of fiscal aspect of contracts requires close coordination with contractors • Contractors provide status reports on many contracts • Government Program Offices receive – and should use – information from contractor–provided reports and other government sources (e.g., DCMA) to help manage fiscal aspects of contracts • Poor execution of contracts usually result in loss of funds 37 Information Available to Improve Management of On-Going Contracts • Many acquisition-related contracts require contractors to provide periodic reports reflecting status of contract work effort and costs • Earned Value Management – IAW DoDI 5000.02 (Enclosure 4, Table 5): • cost or incentive contracts valued at or greater than $20M in thenyear dollars are required to implement EVMS • whenever implementation of EVMS is required on a contract, a Contract Performance Report (CPR) and Integrated Master Schedule (IMS) is a requirement of that contract • EVM related reports not required for firm-fixed price, level of effort or time and materials contracts (use must be approved by MDA) – CPR compares actual work performed on contract and actual cost incurred to planned work and budgeted cost at same point in time – Variances between plans and actuals show potential schedule slips and/or cost overruns – Cost overruns usually impact near term budget requirements 38 DoD EVM Application Thresholds (DoDI 5000.02, Enclosure 4, Table 5) Contracts Cost or Incentive Equal to or Above Threshold Cost or Incentive Less Than Upper Threshold but Equal to or Above Lower Threshold Cost or Incentive Less Than Threshold Thresholds Requirements - Compliance with industry EVM standard > $50M - Formal EVM system validation - Contract Performance Report - Integrated Master Schedule - Integrated Baseline Reviews - Ongoing surveillance < $50M but > $20M - Compliance with industry EVM standard - No formal EVM system validation - Contract Performance Report (tailored) - Integrated Master Schedule (tailored) - Integrated Baseline Reviews - Ongoing surveillance < $20M - EVM optional (risk-based decision) - Cost-benefit analysis required Information Available to Improve Management of On-Going Contracts • Contract Funds Status Report (CFSR) – Applicable for contracts over six months in duration – Normally not required for firm fixed price contracts unless circumstances require specific funding visibility – Generally required quarterly unless contract states otherwise – Contractor-prepared report provides basic fiscal information: • • • • • • • Initial and adjusted contract price Funds obligated to date Accrued expenditures Contract work authorized and forecast Projected total price of contracted work Forecast of billings to the government by period Estimated termination costs by period 40 Summary From Contract Management Perspective • Contracting environment is continually changing • Contracting is a team effort in partnership with contractor to meet mission needs • Fair and realistic prices under competition • Contracting Officers have broad discretion in determining contract type • Contracting requires knowledge of policy and regulations plus business judgment • Actions of contracting personnel are limited to authority delegated for specific purposes 41 Summary From Resource Management Perspective • Acquisition program offices must follow provisions of Financial Management Regulation (DoD 7000.14-R) for fiscal matters and FAR/DFAR for contracting matters • Vast majority of budget authority provided defense acquisition programs is obligated against contracts • Resource management in acquisition program offices requires active management of fiscal aspects of contracts • Government requires some contractors – by terms of the contract – to periodically report on status of work actually accomplished and at what cost and projected data • Government can and should make maximum use of data contained in those reports to better manage execution of the program, to include management of resources 42 Now for the DAU optional “commercial” 43 Briefing for DAU Students Learn. Perform. Succeed. #1 ’02 ’06 ’05 ’06 ’07 ’04 ’06 ’07 ’09 ’03 ’04 Jan 2010 DAU Mission Provide a global learning environment to support a mission-ready Defense Acquisition Workforce that develops, delivers, and sustains effective and affordable warfighting capabilities. Impact acquisition excellence through: Acquisition certification and leadership training Mission assistance to acquisition organizations Online knowledge sharing resources Continuous learning assets Strategic workforce planning AT&L Performance Learning Model Training Courses Classroom & online DAWIA, Core Plus, & Executive Continuous Learning CL Modules - Online, self-paced learning modules Conferences - PEO / SYSCOM, Business Managers, DAU Acquisition Community Symposium Knowledge Sharing DAP - Online portal to Big A & HCI knowledge ACC - DoD's online collaborative communities Virtual Library - Online connection to DAU research collection Formal & informal learning at the point of need Mission Assistance Consulting - Helping organizations solve complex acquisition problems Targeted Training - Tailored organizational training Rapid Deployment Training - On-site & online training on the latest AT&L policies Located with our Customers Region Location Workforce Capital/Northeast Fort Belvoir, VA 31,566 Mid-Atlantic California, MD 23,110 Midwest Kettering, OH 18,604 South Huntsville, AL 28,360 West San Diego, CA 25,465 We are part of the community, not just a place to take classes. Learning assets at www.dau.mil DAU Training & CL Courses http://icatalog.dau.mil/ Defense Acquisition Portal https://dap.dau.mil Mission Assistance http://www.dau.mil/images/Pages/mission_assistance.aspx Acquisition Community Connection https://acc.dau.mil/ Acquisition Best Practices Clearinghouse https://bpch.dau.mil/ DAU Acker Library http://www.dau.mil/Library/ DAU’s iCatalog • Most current resource for information regarding DAU courses and the Certification & Core Plus Development Guides • Accessible from the DAU home page (http://dau.mil) or directly at http://icatalog.dau.mil/ FY10 Training - Financial Management Level I Certification ACQ 101 Level II Certification ACQ 201A Fundamentals of Systems Acquisition Management Intermediate Systems Acquisition, Part A 25 hrs, online 37 hrs, online BCF 102 Fundamentals of Earned Value Management 15 hrs, online BCF 103 Fundamentals of Business Financial Management 26 hrs, online BCF 106 40 hrs, online BCF 203 Intermediate Earned Value Management BCF 205 Contractor Business Strategies 4 days classroom BCF 301 Advanced Financial Management 9 days classroom BCF 211 Intermediate Business Acquisition Management 5 days classroom CLM 017 Risk Management CLM 024 Contracting Overview CLM 013 Work Breakdown Structure CLM 031 Improve Statement of Work Knowledge Based Case Based Case Based Level I “Core Plus” Courses & CL Module Level II “Core Plus” Courses & CL Module Level III “Core Plus” Courses & CL Module (See DAU iCatalog) Vers 10 ACQ 201B Intermediate Systems Acquisition , Part B 5 days classroom 9 days classroom Fundamentals of Cost Analysis Level III Certification (See DAU iCatalog) (See DAU iCatalog) FY10 Training - Cost Estimating Level I Certification ACQ 101 Level II Certification ACQ 201A Fundamentals of Systems Acquisition Management Intermediate Systems Acquisition, Part A 25 hrs, online 37 hrs, online BCF 102 Fundamentals of Earned Value Management 15 hrs, online BCF 106 Fundamentals of Cost Analysis 40 hrs, online BCF 103 Fundamentals of Business Financial Management 26 hours, online BCF 107 Applied Cost Analysis 5 days classroom BCF 204 Intermediate Cost Analysis 10 days classroom BCF 211 (See DAU iCatalog) Vers 10 BCF 206 Cost Risk Analysis BCF 302 Advanced Concepts in Cost Analysis 4 days classroom 5 days classroom BCF 215 Acquisition Business Management Operating and Support Cost Analysis 5 days classroom 5 days classroom CLB 026 Level I “Core Plus” Courses & CL Module ACQ 201B Intermediate Systems Acquisition, Part B 5 days classroom Forecasting Techniques Knowledge Based Level III Certification CLB 030 Cost Data Sources Case Based Level II “Core Plus” Courses & CL Module (See DAU iCatalog) CLB 029 Rates CLB 023 Software Cost Estimating Case Based Level III “Core Plus” Courses & CL Module (See DAU iCatalog) DAU’s Commitment to the Defense Acquisition Workforce •Training - 24 / 7 learning assets: in the classroom and in the workplace •Continuous Learning - Helping you learn in the workplace: what you need to know , when you need to know it •Mission Assistance - Supporting your organization •Knowledge Sharing - Connecting you – the Engaged Learner - with the experts, resources and materials you need to do your job Shaping a culture of engagement and career-long learning 53