The AADF Assessment Mission

advertisement

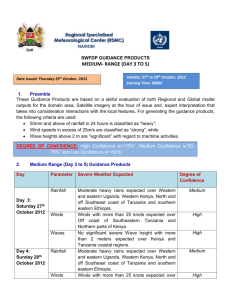

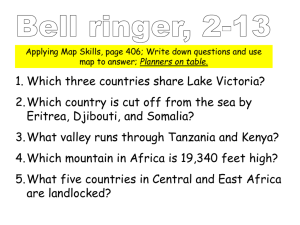

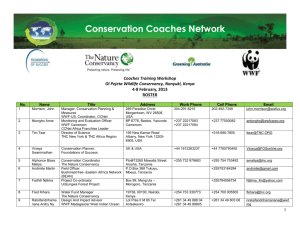

AADF Assessment Mission to Kenya and Tanzania 21-28 April 2012 Tim Roche Enterprise Ireland Participants • Department of Foreign Affairs and Trade – Sean Hoy – Dr. Sizya Lugeye (Irish Embassy Tanzania) • Department of Agriculture, Food and Marine – Colm Hayes • Enterprise Ireland – Dr. Tim Roche Mission objective To Assess: 1. The current investment climate in Kenya & Tanzania 2. Opportunities for possible trade and investment by the Irish Agri-food industry and 3. Options for support from the Africa AgriFood Development Fund (AADF) Irish Food Exports to Africa Kenya 3% Ghana 10% Tanzania 3% South Africa 25% Nigeria 59% Source: 2011 ABR Overview • 26 separate meetings in Kenya & Tanzania – – – – – • Five site visits – – – – • Government sector Private sector International agricultural researchers Public academic and research institutions Irish citizens currently involved in business. Factories, Retail outlets, Food markets Research centres. Morogoro, Tanzania – Being developed for investment incl. FDI. Itinerary Key Meetings 1. 2. 3. 4. 5. Bidco Vegpro Kenyan Ministry for Agriculture Kenya Agricultural Research Institute Canadian International Food Security Research Fund/International Research Development Centre (IRDC) 6. International Livestock Research Institute 7. Kenya Agricultural Productivity and Agribusiness Project (KAPAP) 8. KenInvest 9. Agriculture Enterprise Challenge Fund 10. Syngenta East Africa 11. Tanzanian Ministry of Agriculture Food Security and Cooperatives 12. Tanzanian Ministry of Livestock Development and Fisheries 13. USAID 14. Sokoine University 15. Dakawa Agriculture Research and irrigation trials 16. Financial Sector Deepening Trust (FSDT) 17. Investment Climate Facility for Africa (ICF) 18. SAGCOT centre; public/private sector investment on agriculture 19. Bakhresa & Co. Ltd. (Azam Group) Findings • Discussions confirmed interest in – – – – Expanding output Addressing value chain deficits Diversification Partnership with foreign investors including those from Ireland Findings contd. • Opportunities exist in both countries for investment in the Agri-Food sector – Improved economic performance – Rapid urbanisation – Increased demand for processed food • Very low Agricultural and industrial Productivity and innovation in both countries due to lack of – – – – – – – Scale & integration Expertise Skills Suitable technology Operating capital Market access Under-developed private sector • Evident throughout the value chain from primary producer to processor. • Need and opportunities for relevant technical and business development knowledge transfer in several sectors • International industry partnering and knowledge transfer important to addressing deficits and stimulating trade and investment in the region. Findings contd. • Business-to-business support and development opportunities exist for companies with expertise, technologies and services aligned to production and processing of – Dairy milk – Fruits and vegetables – Beef, Poultry & Fish Potential to beneficially impact the economics of primary production • Expertise/technology relating to – Soil fertility management, – Water management/conservation, – Crop and livestock husbandry, – Fertility management (e.g. Artificial Insemination and semen sexing), – Nutrition-based preventative health management – Postharvest quality management Potential to beneficially impact the economics of the Processing sector • Reduce operating overhead costs arising from underutilisation of capacity – Discontinuity of raw material inputs (supply chain management) – Interruption of power supplies • Technologies, practices & training to – – – – – – Reducing handling and improve processing efficiency Improved shelf-life Improved quality & safety assurance and traceability Improved production and logistics planning, Improved ERP, NPD planning • Commodity risk management instruments and services as a possible lower-cost alternative to vertical integration. – Mitigate domestic and international price volatility – Improve security of supply – Stabilise input prices and operational costs Findings contd. • Significant presence of successful Indian and Arabowned ventures – – – • Independently wealthy – • Diversified business interests across East Africa Maintain links overseas Vertically-integrated to control supply and quality variables Adequate resources to pay for independent expertise and technology to modernise production B2B opportunities e.g. value-added processing, distribution & dairy ingreds. Kenya • Gaps in ability to transform commodity outputs into products for defined markets – Production constraints – Market access constraints • Technology gaps relating to processing and storage – 40% Post harvest losses are common • Competence/investment in risk mitigation across value chain and meeting standards required at the end are critical • Lack of working capital is a general business constraint • Opportunities – – – – – Juices, pastes, sun-dried fruit & Veg. ‘Urban Veg’ for growing middle class Reduced cost chicken protein production Soya bean and yellow maize growing Private sector disease testing/analytical services Tanzania • Very significant agricultural base – – – • But significantly underdeveloped – – – – – • Only growing at 4.2% p.a. 44M ha arable land but only using 20% V. low productivity of commodities (low tech, high input costs) Over-dependence on rain-fed agriculture (<1% irrigated land) High post-harvest losses Young/underdeveloped private sector – • Fragmented businesses; high scaling costs Potentially significant opportunities in – – – – – – • 77.5% population employed in agriculture Produce 95% own food requirement; 33% export earnings Beef/meat processing (1 M cattle slaughtered/yr) Dairy (relatively new to Tanzania) Animal feed quality improvement Fruit and vegetable processing sectors Nutritionally improved horticulture Improving energy security Could position Irish companies as early movers in a manner that does not exist in Kenya (due to its more advanced economy). Some issues • High rates of corporate tax – • • • • • • • 37.5% for foreign business in Kenya; 30% in Tanzania Lack of capital investment and employment grant supports Non-transparent business costs, Ambiguous regulation re foreign ownership of assets, Logistical difficulties Unreliable energy supplies. Visa costs ES&H Compliance requirements Infrastructure Issues • Power Supply • Transport • Urban Vs rural Dried Fruit NPD -Tanzania Conclusions • Currently there are identifiable Irish manufacturing, processing and service companies with expertise, products and solutions that can be brought to bear on these issues and opportunities • The challenge lies in developing propositions which effectively appeal to and engage them in a way that significantly enhances the indigenous value-chain proposition without conferring disproportionate reputational or business risk on the Irish partner(s). • Involvement of relevant Irish private sector expertise is key to effective assessment and development of these opportunities