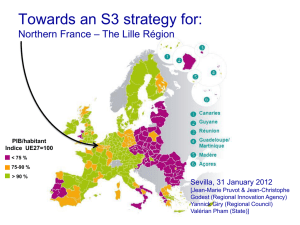

Clusters Policy

advertisement

Brazilian Policies on Cluster Development Institutional background, technical design and some lessons learnt Renato Caporali PhD on Economic Development University of Paris SME’s exports evolution Some figures about SMEs exports • SMEs represent 62% of the Brazilian exporting enterprises; • In 2011, 11.858 SMEs exported US$ 2 billion - less than 1% of the total Brazilian exports; • The average amount of exports per enterprise is US$ 170.000. Some figures about SMEs exports • But exporting SME’s were already 11.800 in 2006; • It means that no real progress has been achieved in total number of SME’s exporting … • … while during the period from 2002 to 2008, the growth rate of SME’s exports surpassed 10% per year. Brazilian concept of Micro and Small enterprises • The Law of Micro and Small Enterprises (2006) defines: – Micro enterprises: annual sales up to US$ 180,000 – Small enterprises: from US$ 180.000 to US$ 1,800,000 Export’s data from SMEs • A quite diversified agenda : 5 main items cover only 14% of the total exported ; • Sectors which export most : – Micro: Precious stones, garment, auto-parts, and furniture. – Small: furniture, shoes, auto-parts, marble and granite, wood. • Latin America is the main destination, corresponding to 25% of SME’s exports. A low level of internationalization • Brazil’s SMEs show a low level of internationalization. • An expression of : – low grade of economic development of most SMEs; – SME’s low level of integration to international value chains; – And the size of the country. The Brazilian policies for SMEs • Brazil has made strong advances in the development of policies for Micro and Small companies; • In 1990: creation of SEBRAE, the Brazilian Support Service for Micro and Small Enterprises, with annual budget of US$ 1,5 billion. • Brazilian law excludes medium enterprises from the public policies for small businesses. The Brazilian policies for clusters: first steps • In its first decade, SEBRAE concentrated on building a network of external consultants, creating methodologies to stimulate entrepreneurship culture, and a toolbox of management skills for small companies. • In 2000, SEBRAE started considering it own self as responsible for structural development initiatives. • Clusters Policy was launched in 2001-2002. – first attempt on Industrial Policy since the 80’s. • In 2004, the Annual Budget Plan established 60% of the annual budget to be spent in collective actions. The brazilian clusters development policy • Policy started studying international experience: mainly Italy, France and Spain. • With support of Interamerican Development Bank basic methodologies for the development of clusters have been created. • By 2006, some evaluations demonstrated impressive results. • The policy then became an economic, political and intellectual fashion. – This “fashion consensus” would charge its price later on. The brazilian clusters development policy • In 2007, more than 300 clusters were receiving resources to support common/joint initiatives. • The Government created the Brazilian Agency for Promotion of Exports –APEX (2002). • APEX stimulated export consortiums, mainly to overcome the scale limit of small companies. • The results were negatively affected by legal constraints and cultural issues. Basic elements of Brazilian clusters policy • The clusters intervention methodology articulates a mix of entrepreneurial education, access to technology and market information, collective interactions and institutional networking for technical services; • Intense access to market fairs, attempts to reduce information gaps on technology and information assimetry in credit solutions. • Resources are mostly spent to subsidize such initiatives. The Brazilian clusters : the origin • Most Brazilian clusters were born from : – (i) strong currency devaluation; – (ii) high level of unemployment of the 80’s Brazilian structural crisis. • A “survival entrepreneurship” productive system. • Almost all of them were consolidating comparative advantages when the economy entered a phase of currency evaluation and declining levels of unemployment (from 2004 until now). Some macroeconomic issues • From 2001 to 2010, wage levels (Unit Cost of Labor) have grown, in dollars, more than 200%; • Just from 2010 to 2013: 17% more ! • The protection effect of a devaluated currency disappeared. • Brazilian Manufacture exports stagnated after the 2008 crisis; • And in the last 2 years they began to decline. • In this context, cooperation networks created could not perform miracles. A first essential lesson • A first important lesson: cooperation networks, in conditions of strong currency overvaluation, are not capable of reversing macroeconomic trends. • Costs on labor force, energy, and industrial inputs remain the basis of economic competitivity for sectors not knowledge based... • … which happens to be the greatest part of SME’s clusters. A first essential lesson • To be totally effective, clusters policies – as industrial policies in general – must be followed by real exchange rate policies • as China and India have shown over the last decades. • If it is not possible to have active exchange rate policies, watching costs evolution closely become decisive. Elements for an evaluation • Nevertheless, a comparison on clusters maturity before and after projects demonstrates impressive results. – Take a look at: www.sigeor.sebrae.com.br • SIGEOR : “Result Oriented Management System” Elements for an evaluation – Business models were modernized ; – Management tools were disseminated ; – Technology evolution was accelerated ; – Entrepreneurial interaction on a higher level. The Brazilian clusters development policy • Unfortunately, a comprehensive evaluation of Brazilian cluster policy, as a modality of industrial policy, has not been pursued. • And a shift towards productive chain approach was induced after the launching of the Industrial Policy of 2006; • Just by when the first clusters projects were being completed. • Abundant data have been produced by evaluating tools, but systematic data analysis has not yet been accomplished. • So, evaluation remains at the level of case by case; • Let’s check a couple of cases. Some results from clusters projects • Cluster of Santa Rita de Sapucaí municipality • Specialization: Electro-electronic products. • Project Objective: to promote the access to international markets to 55 enterprises participating in the project. • Actions: – 130 courses and training activities; – 5 participations in market fairs; – 2 technical missions abroad; Some results from clusters projects • This cluster has structured various clusters projects, over the last 10 years; • Global exports from the cluster of Santa Rita; • • • • 2006 : US$ 5.7 million; 2009 : US$ 7.8 million; 2010 : US$ 7.6 million – the project starts 2012 : US$ 12.4 million – end of the project. Some results from clusters projects • At the end of the project, started with 15 exporting enterprises, 33 out of 55 launched exporting activities. – In 2010, 15 SME’s participating exported US$ 1.4 million; – In 2011, 22 SME’s participating exported US$ 2,7 million; – In 2012, 27 SME’s exported US$ 3.1 million (+ 90% over 2010). Some results from clusters projects • Project: Internationalization of the Productive Chain of Petroleum and Gas • Objective: to promote exports and international business (transference of technology, joint-ventures and partnerships); • 187 SME’s participating Some results from clusters projects • Actions for the Internationalization of SME’s from the petroleum and gas productive – 30 courses and training; – 18 international missions gone abroad; – 12 international missions brought to Brazil; – 180 entrepreneurial diagnosis; – 9.500 hours of consulting services provided; – 2 market studies achieved; Some results from clusters projects • Exports in: – 2008 : US$ 189 million – 2010 : US$ 650 million • Joint-ventures of EU$ 5.0 million established. Elements for an evaluation • Of course, there are many projects with less impressive results… • … but Brazilian experience does suggest that clusters projects produce positive results. • Because knowledge, technical solutions and market information do make the difference. Some lessons learnt (1) • The problematic of “capture by leading groups” remains relevant… – … but working with the avant-garde is inevitable. • Need to overcome excessive anxiety for immediate results. • A definitive lesson: clusters development are medium to long term initiatives: – 5 years to produce irreversible results. Some other lessons learnt (2) • SME’s entrepreneurs are avid for knowledge; • A policy to accelerate entrance to the knowledge economy! Some lessons learnt (3) • It is a huge challenge to make institutions (government, universities, technological centers) to envisage the potentialities of SME’s emerging sectors; – Institutions must understand themselves as an institutional tissue responsible to promote entrepreneurial development. Some lessons learnt (4) • In consequence, one of the hardest challenges is institutional coordination. • Cooperation networks require significant shifts on normal mental models; • But, within the clusters, cooperation must be seen as a result to be produced, not a starting point. Some lessons learnt (5) • The “Eastern lesson”: perseverance ! • Consistent evolution is connected to knowledge and attitudes: more money may not produce more results. • Time management must be closely monitored : there must be a political sensibility for timing issues. • That means: the timetable of actions is one of the problems of the project, something to be managed and not a passive variable. Clusters projects are one of the most democratic forms of industrial policies ! rcaporali.56@gmail.com