Nord-Pas-de-Calais (France)

advertisement

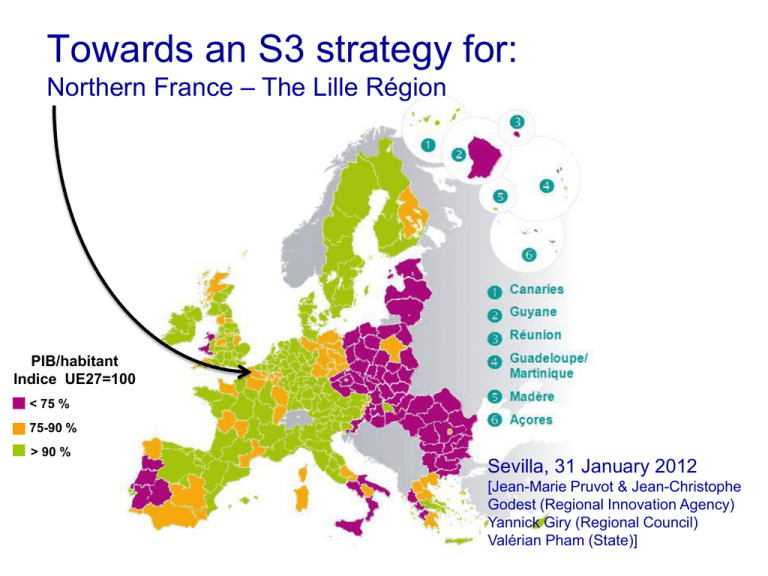

Towards an S3 strategy for: Northern France – The Lille Région PIB/habitant Indice UE27=100 < 75 % 75-90 % > 90 % Sevilla, 31 January 2012 [Jean-Marie Pruvot & Jean-Christophe Godest (Regional Innovation Agency) Yannick Giry (Regional Council) Valérian Pham (State)] Introduction • Nord-Pas de Calais : − 4 million inhabitants, 86 billion € GDP; − 7 Universities, 28 graduate schools (business and engineering); − diversity and youthful of the population; − 3rd purchasing power in the world, in a 300km radius, behind Tokyo (1rst) and Cologne; − 0,7 % of GDP for R&D expenses (2,2% for France); • A Regional Scheme for Economical Development (RSED) driven by regional Council with local communities • A Regional Innovation Strategy (RIS) launched at the end of 2009, in the frame of the RSED Place based dimension of the RIS3 • key challenges and main competitive advantages of your region : − A rural Pas de Calais and an urban Nord (more than 1Million inhabitants in the Lille Community); − A growing population but less than the France average; − 3 big harbours (fish, passengers and freight), channel tunnel − Agriculture 1.1% Industry 25.3% Construction 9.2% Services 64.4%; − Historic strengths : Railway transport, Automotive, Logistics, Wholesale trade; − Under the France average for Knowledge Intensive Business Services • How does the current strategy meet the overall vision for the region’s development, e.g. in terms of sustainability and inclusiveness? Achieving critical mass • Régional priorities selected, after involving interest groups, with the help of consultants, by national and regional authorities : EA = Entrepreneurial activity SA = Scientific activity Railway transport , Health-Nutrition-Food, Commerce of the future Automotive ; EA + SA EA + SA EA + SA EA+SA Buildings and eco-construction; EA Mechanical engineering EA Advanced materials (green chemistry, textiles, composites); Energy and power electronics; EA + SA SA Waste treatment, sediments, polluted sites and soils; EA+SA Images and digital creation; EA+SA SA E-health Prospects for an “entrepreneurial process of discovery” • business community is involved by the way of their representatives : chamber of commerce, employer's organisations.…All clusters's Presidents are (was) SME's managers; • difficulties to involve higher education institutions, ties are not close enough; • Governance, managers networks and working groups may help to facilitate the EPD; • local and regional authorities give the political legitimacy and …the foundings; • regional intermediaries are the regional policies ambassadors and could get the feedback from SME's. Outward-oriented aspects of the RIS • Competitivity clusters are connected with relevant clusters in other regions : − ex UpTEx with TECHTERA (FR), AEI (SP),CLUTEX (CZ), INNTEX (DE), NWTEXNET (UK), POINTEX (Italie), Textile Cluster of Valencia (SP); • NFID is member of : − EURADA, ERRIN, EBN, his director is member of ADARI; • NFID is project partner in : − MKW (benchmark), Know-Hub (S3), InnoMot and Tandem Interreg programs; • During 2012-2013, we plan to develop synergies with : Flanders, Picardie, Champagne & Wallonia Future orientation of the S3 process • Have to involve the local partners at the begining of the design process; • Synergies to be developped with Champagne, Flanders, Picardie & Wallonia; • More focused, less complex, easier to follow; • Score board of actions plans, impact indicators, one steering committee each month, two strategic committee each year. Summary and next steps • Build a retro planning (2014) and meet the others regions; • Involve the local clusters and detect entrepreneurs • Keep a good partnership between regional and national authorities; • What do you think is needed in the medium term to develop a regional innovation strategy for smart specialisation in your region? • Main challenge (for S3 building ?) is to motivate all partners as actual RIS was launched two years ago; • Need review of others regions and support of experts