Presentation to cost-recovery public meetings

Joint Border Management System

What it means and how much it costs

New Zealand Customs Service Ministry for Primary Industries

A modern global border system

Why NZ needs JBMS

• Existing aging technology presents an increasing risk of failure

• Inflexible systems that will not be able to meet evolving expectations for border management and international facilitation initiatives

• Current resource-intensive agency processing will struggle to cope with volumes and complexity over time

• Current cargo and craft clearance messages not international standard-compliant and insufficient for border agency needs

• Duplicated processes across Customs and MPI and different approaches for managing border risks

What did you want in 2009?

• Joined up agency requirements and channels

• Greater electronic interface to MPI

• Less cost and effort in providing information to agencies

• System connection options

• XML messaging

• Online client code applications with faster responses 24/7

• Recognition of clients who consistently comply

• Certainty of clearance requirements – before cargo arrival

• International trade facilitation opportunities

What are we building?

Tranche 2

NZCS

MPI:

Biosecurity

Food

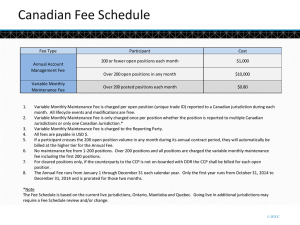

Tranche 1 cost recovery options

• No increases from 2008/09 cost recovery budgets except for adding JBMS Tranche 1 costs

• 3.25-year initial cost recovery period

• Start 1 April 2013

• Fees are first adjusted to reflect changes in transaction volumes

• Four fee options proposed

Tranche 1 cost recovery options

Option 1: JBMS costs on import entries (IETF and biosecurity levy)

Fee $GST excl

Import Entry (IETF)

ICR (air)

ICR (sea)

Export Entry (SES)

Export Entry (non- SES)

OCR (air)

OCR (sea)

Biosecurity levy

Current fee

Adjusted fee for volumes

Option 1 fee top-up

New proposed fee

Change

22.00

26.67

312.89

8.89

12.67

6.67

20.00

11.11

20.67

22.77

358.50

8.58

13.07

7.48

22.53

10.57

6.43

-

-

-

-

-

-

4.76

27.10

22.77

358.50

8.58

13.07

7.48

22.53

15.33

23%

(15%)

15%

(4%)

3%

12%

13%

38%

Tranche 1 cost recovery options

Option 2: JBMS costs on all Customs transaction fees and biosecurity levy – flat fee increases

Fee $GST excl

Import Entry (IETF)

ICR (air)

ICR (sea)

Export Entry (SES)

Export Entry (non- SES)

OCR (air)

OCR (sea)

Biosecurity levy

Current fee

Adjusted fee for volumes

Option 2 fee top-up

New proposed fee

Change

22.00

26.67

312.89

8.89

12.67

6.67

20.00

11.11

20.67

22.77

358.50

8.58

13.07

7.48

22.53

10.57

4.77

4.77

4.77

2.56

2.56

2.56

2.56

4.76

25.44

27.54

363.27

11.14

15.63

10.04

25.09

15.33

16%

3%

16%

25%

23%

51%

26%

38%

Tranche 1 cost recovery options

Option 3: JBMS costs on all Customs transaction fees and biosecurity levy – proportionate fee increases

Fee $GST excl

Import Entry (IETF)

ICR (air)

ICR (sea)

Export Entry (SES)

Export Entry (non- SES)

OCR (air)

OCR (sea)

Biosecurity levy

Current fee

Adjusted fee for volumes

Option 3 fee top-up

New proposed fee

Change

22.00

26.67

312.89

8.89

12.67

6.67

20.00

11.11

20.67

22.77

358.50

8.58

13.07

7.48

22.53

10.57

4.52

4.98

78.48

1.84

2.80

1.60

4.82

4.76

25.19

27.75

436.98

10.42

15.87

9.08

27.35

15.33

15%

4%

40%

17%

25%

36%

37%

38%

Tranche 1 cost recovery options

Option 4: JBMS costs on all Customs transaction fees and biosecurity levy – flat fee increases (Option 2) + food-related fees

Proposed fee increases for options 1, 2 & 3

New proposed fees and comparison with the fee increases proposed in 2009 ($GST excl)

Fee $GST excl Current fee

Option 1: top-up IETF

+ bio levy

Option 2: top-up all flat fee

Option 3: top-up all -

% fee

2009

Import Entry (IETF)

ICR (air)

ICR (sea)

Export Entry (SES)

Export Entry (non- SES)

OCR (air)

OCR (sea)

Biosecurity levy

22.00

26.67

312.89

8.89

12.67

6.67

20.00

11.11

27.10

22.77

358.50

8.58

13.07

7.48

22.53

15.33

25.44

27.54

363.27

11.14

15.63

10.04

25.09

15.33

25.19

27.75

436.98

10.42

15.87

9.08

27.35

15.33

25.90

30.57

316.79

11.49

15.27

9.27

22.60

15.41

Information and feedback

Web: www.jbmsconsultation.govt.nz

Email: jbms@customs.govt.nz

Fax: 04 901 4555

Mail: JBMS Cost Recovery Submissions

NZ Customs Service, PO Box 6140

Wellington

• Submissions close: 16 July 2012

• Policy decisions advised: late September

• Regulations passed: by Feb 2013

• Start date for new fees: 1 April 2013

Questions and comments?

Page 26 of Discussion Document:

• Do you agree that increases to the Customs transaction fees and MPI biosecurity levy are the most practical way to cover industry’s share of costs, rather than through new fees?

• Is the likely scenario for transaction volumes reasonable?

• Any other factors to be taken into account?

• Any further comments on the proposal?